Instructions for Form 990 PF Instructions for Form 990 PF, Return of Private Foundation or Section 4947a1 Nonexempt Charitable T 2011

Understanding Form 990-PF Instructions

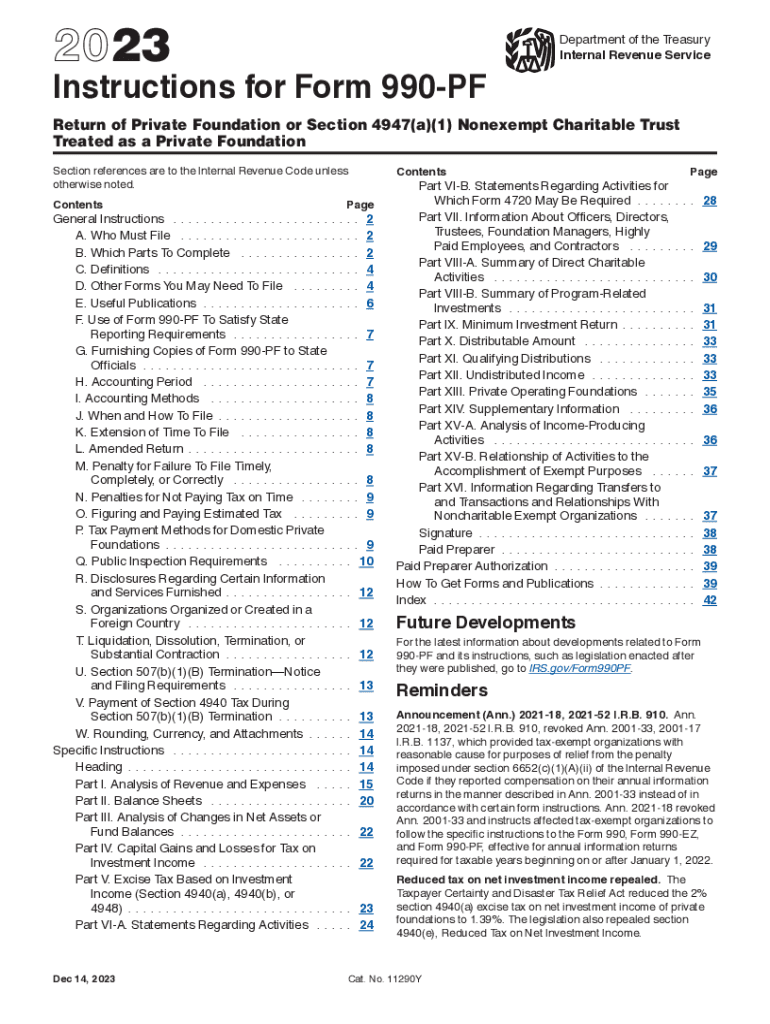

The Instructions for Form 990-PF provide essential guidelines for private foundations and certain nonexempt charitable trusts. This form is crucial for reporting financial information to the IRS, ensuring compliance with tax regulations. It outlines the requirements for disclosing income, expenses, and charitable distributions. Understanding these instructions helps organizations maintain their tax-exempt status and fulfill their legal obligations.

Steps to Complete Form 990-PF Instructions

Completing Form 990-PF involves several key steps:

- Gather financial records, including income statements, balance sheets, and details of charitable distributions.

- Review the specific sections of the form that apply to your foundation, noting any unique requirements for your organization.

- Fill out the form accurately, ensuring all numbers are precise and all required fields are completed.

- Double-check your entries against the instructions to avoid errors that could lead to penalties.

- Submit the completed form to the IRS by the designated deadline, either electronically or via mail.

Key Elements of Form 990-PF Instructions

The key elements of the Instructions for Form 990-PF include:

- A detailed explanation of the reporting requirements for private foundations.

- Instructions on how to calculate the minimum distribution requirement.

- Guidelines for reporting investment income and expenses.

- Information on the penalties for non-compliance and the importance of timely filing.

- Clarification on the types of activities that qualify as charitable distributions.

Filing Deadlines for Form 990-PF

Filing deadlines for Form 990-PF are critical for compliance. Typically, the form is due on the fifteenth day of the fifth month after the end of the foundation's tax year. If the foundation operates on a calendar year, the due date would be May 15. Extensions may be available, but it is essential to file for an extension before the original deadline to avoid penalties.

Obtaining Form 990-PF Instructions

Organizations can obtain the Instructions for Form 990-PF from the IRS website or by contacting the IRS directly. These instructions are available in PDF format for easy downloading and printing. It is advisable to use the most current version to ensure compliance with any recent changes in tax regulations.

Legal Use of Form 990-PF Instructions

The legal use of Form 990-PF Instructions is vital for maintaining compliance with federal tax laws. Foundations must adhere to the guidelines provided to avoid legal repercussions. Understanding these instructions ensures that organizations report accurately and fulfill their obligations to the IRS, thereby protecting their tax-exempt status.

Quick guide on how to complete instructions for form 990 pf instructions for form 990 pf return of private foundation or section 4947a1 nonexempt charitable

Effortlessly Prepare Instructions For Form 990 PF Instructions For Form 990 PF, Return Of Private Foundation Or Section 4947a1 Nonexempt Charitable T on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and eSign your documents quickly and without interruption. Manage Instructions For Form 990 PF Instructions For Form 990 PF, Return Of Private Foundation Or Section 4947a1 Nonexempt Charitable T on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Edit and eSign Instructions For Form 990 PF Instructions For Form 990 PF, Return Of Private Foundation Or Section 4947a1 Nonexempt Charitable T With Ease

- Locate Instructions For Form 990 PF Instructions For Form 990 PF, Return Of Private Foundation Or Section 4947a1 Nonexempt Charitable T and select Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign feature, which takes just seconds and carries the same legal authority as a traditional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Select how you wish to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and eSign Instructions For Form 990 PF Instructions For Form 990 PF, Return Of Private Foundation Or Section 4947a1 Nonexempt Charitable T and ensure outstanding communication throughout your form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form 990 pf instructions for form 990 pf return of private foundation or section 4947a1 nonexempt charitable

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 990 pf instructions for form 990 pf return of private foundation or section 4947a1 nonexempt charitable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the benefits of using airSlate SignNow for 990 pf instructions?

Using airSlate SignNow for 990 pf instructions offers numerous benefits, including streamlined document management and e-signature capabilities. It simplifies the process of submitting and signing tax forms, ensuring compliance with IRS requirements. Additionally, its user-friendly interface enhances productivity and saves time.

-

How does airSlate SignNow integrate with accounting software for 990 pf instructions?

airSlate SignNow seamlessly integrates with popular accounting software, allowing users to manage 990 pf instructions within their existing workflows. This integration enables automatic data transfer, reducing manual entry errors and enhancing efficiency. It's a perfect solution for businesses looking to maintain compliance easily.

-

Is there a free trial available for airSlate SignNow when handling 990 pf instructions?

Yes, airSlate SignNow offers a free trial period that allows users to explore its features while handling 990 pf instructions. This trial provides access to essential tools for document signing and management without commitment. It's a great way to assess the platform's suitability for your business needs.

-

What is the pricing structure for airSlate SignNow regarding 990 pf instructions?

airSlate SignNow features a flexible pricing structure that caters to various business sizes and needs. For those focusing on 990 pf instructions, affordable plans are available with essential features included. This ensures you can efficiently manage your documents without overspending.

-

How secure is airSlate SignNow for handling sensitive 990 pf instructions?

Security is a top priority for airSlate SignNow when managing sensitive 990 pf instructions. The platform employs advanced encryption protocols and complies with industry standards to protect your data. Users can confidently e-sign and store documents with peace of mind.

-

Can I access airSlate SignNow for 990 pf instructions from mobile devices?

Yes, airSlate SignNow is accessible on mobile devices, allowing you to manage 990 pf instructions on-the-go. The platform's mobile app provides all the necessary features for e-signing and document management. This flexibility ensures you can handle your important paperwork anytime, anywhere.

-

What types of documents can I manage with airSlate SignNow along with 990 pf instructions?

In addition to 990 pf instructions, airSlate SignNow supports a wide array of document types, including contracts, agreements, and forms. This versatility allows businesses to streamline all their document processes in one platform. Users can enhance their operational efficiency by managing multiple document types conveniently.

Get more for Instructions For Form 990 PF Instructions For Form 990 PF, Return Of Private Foundation Or Section 4947a1 Nonexempt Charitable T

Find out other Instructions For Form 990 PF Instructions For Form 990 PF, Return Of Private Foundation Or Section 4947a1 Nonexempt Charitable T

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later

- Sign California Healthcare / Medical Arbitration Agreement Free