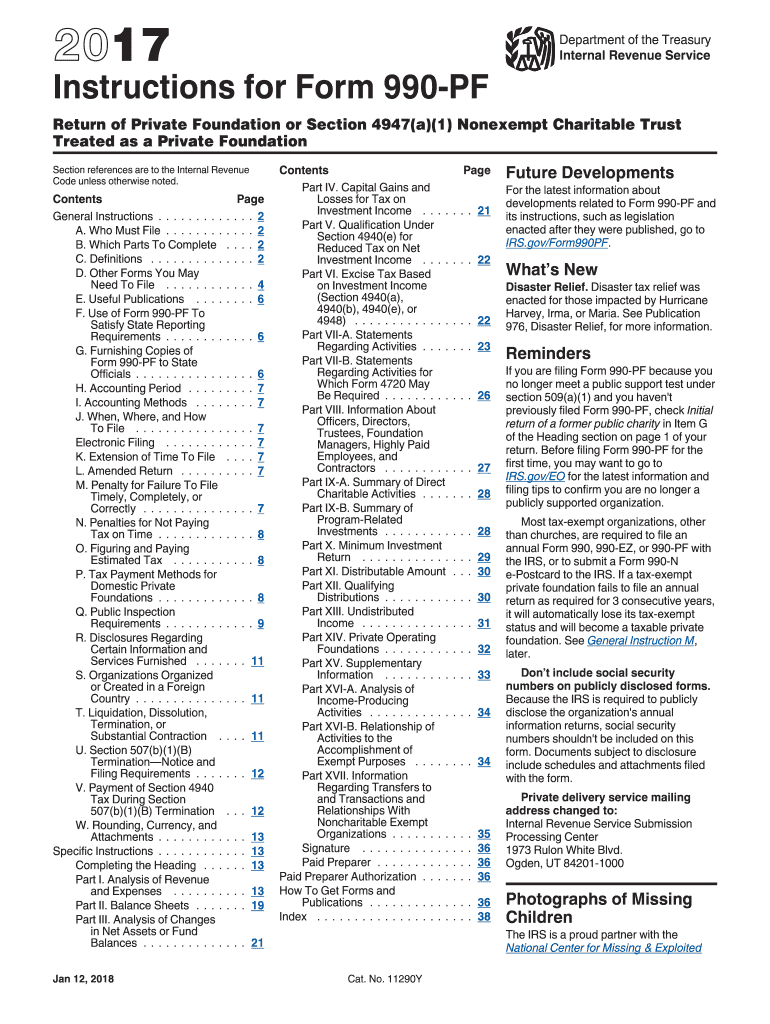

Irs 990 Pf Instructions Form 2017

What is the IRS 990 PF Instructions Form

The IRS 990 PF Instructions Form is a crucial document used by private foundations in the United States to report their financial activities to the Internal Revenue Service (IRS). This form provides detailed information about the foundation's income, expenditures, and investments, ensuring transparency and compliance with federal tax regulations. It is essential for maintaining the foundation's tax-exempt status and must be filed annually.

Steps to Complete the IRS 990 PF Instructions Form

Completing the IRS 990 PF Instructions Form involves several key steps:

- Gather necessary financial documents, including income statements, balance sheets, and records of grants and contributions.

- Review the form's sections to understand the required information, such as revenue sources and program expenses.

- Fill out the form accurately, ensuring all figures are correct and reflect the foundation's financial activities for the reporting year.

- Attach any required schedules and additional documentation that support the information provided on the form.

- Double-check the completed form for accuracy before submission to avoid penalties or delays.

How to Obtain the IRS 990 PF Instructions Form

The IRS 990 PF Instructions Form can be obtained directly from the IRS website. It is available as a downloadable PDF file, which can be printed and filled out manually. Alternatively, organizations may choose to complete the form electronically using tax preparation software that supports IRS forms. Ensure that you are using the most current version of the form to comply with the latest regulations.

Legal Use of the IRS 990 PF Instructions Form

The IRS 990 PF Instructions Form must be used in accordance with federal tax laws. It is legally required for private foundations to file this form annually, providing a comprehensive overview of their financial activities. Failure to file or inaccuracies in the form can lead to penalties, including loss of tax-exempt status. It is crucial to adhere to the guidelines outlined by the IRS to maintain compliance.

Filing Deadlines / Important Dates

The filing deadline for the IRS 990 PF Instructions Form is typically the fifteenth day of the fifth month after the end of the foundation's fiscal year. For organizations operating on a calendar year, this means the form is due by May fifteenth. Extensions may be requested, but it is important to file the necessary forms to avoid late penalties.

Form Submission Methods (Online / Mail / In-Person)

The IRS 990 PF Instructions Form can be submitted in several ways:

- Electronically through approved tax preparation software that allows for e-filing with the IRS.

- By mail, sending the completed form to the appropriate IRS address based on the foundation's location and filing status.

- In-person submission is generally not available, as the IRS encourages electronic filing for faster processing.

Quick guide on how to complete irs 990 pf instructions 2017 form

Uncover the most efficient method to complete and endorse your Irs 990 Pf Instructions Form

Are you still spending time preparing your official documents on paper instead of utilizing online options? airSlate SignNow offers a superior approach to fill out and endorse your Irs 990 Pf Instructions Form and associated forms for public services. Our intelligent electronic signature solution equips you with everything necessary to handle paperwork swiftly and in accordance with formal guidelines - robust PDF editing, management, protection, signing, and sharing capabilities all integrated within an intuitive interface.

Only a few steps are needed to fill out and endorse your Irs 990 Pf Instructions Form:

- Upload the fillable template to the editor by clicking the Get Form button.

- Review the information required in your Irs 990 Pf Instructions Form.

- Move between the fields using the Next option to ensure nothing is missed.

- Utilize Text, Check, and Cross tools to complete the fields with your information.

- Update the content with Text boxes or Images from the top toolbar.

- Emphasize the important parts or Blackout fields that are no longer relevant.

- Click on Sign to create a legally valid electronic signature using your preferred method.

- Add the Date next to your signature and finalize your task with the Done button.

Store your completed Irs 990 Pf Instructions Form in the Documents section of your profile, download it, or export it to your chosen cloud storage. Our solution also offers adaptable file sharing options. There’s no need to print your templates when you are required to submit them to the suitable public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Try it out today!

Create this form in 5 minutes or less

Find and fill out the correct irs 990 pf instructions 2017 form

FAQs

-

What is a good way to learn how to read an IRS form 990?

You may find the instructions to prepare Form 990 at the website below: https://www.irs.gov/pub/irs-pdf/...Hope this is helpful.

-

How can I fill out an IRS form 8379?

Form 8379, the Injured Spouse declaration, is used to ensure that a spouse’s share of a refund from a joint tax return is not used by the IRS as an offset to pay a tax obligation of the other spouse.Before you file this, make sure that you know the difference between this and the Innocent Spouse declaration, Form 8857. You use Form 8379 when your spouse owes money for a legally enforeceable tax debt (such as a student loan which is in default) for which you are not jointly liable. You use Form 8857 when you want to be released from tax liability for an understatement of tax that resulted from actions taken by your spouse of which you had no knowledge, and had no reason to know.As the other answers have specified, you follow the Instructions for Form 8379 (11/2016) on the IRS Web site to actually fill it out.

-

How can I fill out my PF form when I am currently working abroad?

Try to withdraw onlineMore info comment or check contacts info

-

Is it necessary to fill out form 15G to withdraw PF?

Greeting !!!Below are basic details for Form 15G or form 15HForm 15G or form 15H is submitted to request income provider for not deducting TDS for prescribed income. In that form, declaration maker declares that his estimated taxable income for the same year is Nil.If you fulfill following conditions, submit form 15G / form 15H:1. Your estimated tax liability for the current year is NIL and2. Your interest for financial year does not exceed basic exemption limit + relief under section 87A.Only resident Indian can submit form 15G / form 15H. NRI cannot submit those forms. Also note that individual and person can submit form 15G/ H and company and firm cannot submit those forms. However, AOP and HUF can submit those forms.Consequences of wrongly submitting form 15G or form 15H:If your estimated income from all the sources is more than thebasic exemption limit ( + relief under section 87A if applicable), don’t submitform 15G or form 15H to income provider. Wrongly submission of form 15G / form15H will attract section 277 of income tax act.Be Peaceful !!!

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

For taxes, does one have to fill out a federal IRS form and a state IRS form?

No, taxes are handled separately between state and federal governments in the United States.The IRS (Internal Revenue Service) is a federal, not state agency.You will be required to fill out the the necessary tax documentation for your federal income annually and submit them to the IRS by April 15th of that year. You can receive extensions for this; but you have to apply for those extensions.As far as state taxes go, 41 states require you to fill out an income tax return annually. They can either mail you those forms or they be downloaded from online. They are also available for free at various locations around the state.Nine states have no tax on personal income, so there is no need to fill out a state tax return unless you are a business owner.Reference:www.irs.gov

Create this form in 5 minutes!

How to create an eSignature for the irs 990 pf instructions 2017 form

How to make an eSignature for your Irs 990 Pf Instructions 2017 Form in the online mode

How to make an eSignature for the Irs 990 Pf Instructions 2017 Form in Chrome

How to create an eSignature for putting it on the Irs 990 Pf Instructions 2017 Form in Gmail

How to make an eSignature for the Irs 990 Pf Instructions 2017 Form right from your mobile device

How to generate an eSignature for the Irs 990 Pf Instructions 2017 Form on iOS

How to generate an electronic signature for the Irs 990 Pf Instructions 2017 Form on Android OS

People also ask

-

What are the Irs 990 Pf Instructions Form requirements?

The Irs 990 Pf Instructions Form outlines the necessary guidelines for private foundations when filing their annual return. It includes specific requirements for reporting income, expenses, and distributions. Understanding these instructions is crucial for compliance and to avoid penalties.

-

How can airSlate SignNow help with the Irs 990 Pf Instructions Form?

AirSlate SignNow simplifies the process of preparing and signing the Irs 990 Pf Instructions Form by offering an intuitive eSignature solution. With our platform, you can easily upload, fill out, and send documents securely, ensuring that your forms are completed accurately and efficiently.

-

Is airSlate SignNow compliant with IRS regulations for the Irs 990 Pf Instructions Form?

Yes, airSlate SignNow ensures compliance with IRS regulations for the Irs 990 Pf Instructions Form. Our platform is designed to meet the legal standards for electronic signatures, making it a reliable choice for nonprofits and private foundations needing to file their forms.

-

What features does airSlate SignNow offer for managing the Irs 990 Pf Instructions Form?

AirSlate SignNow offers features such as customizable templates, real-time tracking, and secure document storage specifically designed for handling the Irs 990 Pf Instructions Form. These tools streamline the filing process and enhance collaboration among team members.

-

How much does it cost to use airSlate SignNow for the Irs 990 Pf Instructions Form?

AirSlate SignNow offers flexible pricing plans that cater to various needs when managing the Irs 990 Pf Instructions Form. With affordable monthly and annual subscriptions, you can choose a plan that fits your budget while accessing all essential features.

-

Can I integrate airSlate SignNow with other tools for the Irs 990 Pf Instructions Form?

Absolutely! AirSlate SignNow seamlessly integrates with various applications and tools, allowing you to manage your Irs 990 Pf Instructions Form alongside your existing workflows. This integration enhances productivity and ensures that your documents are connected across platforms.

-

What are the benefits of using airSlate SignNow for the Irs 990 Pf Instructions Form?

Using airSlate SignNow for the Irs 990 Pf Instructions Form offers numerous benefits, including increased efficiency, reduced paperwork, and improved accuracy. Our platform allows for quick document turnaround, helping organizations meet their filing deadlines effortlessly.

Get more for Irs 990 Pf Instructions Form

Find out other Irs 990 Pf Instructions Form

- eSignature New York Fundraising Registration Form Simple

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors