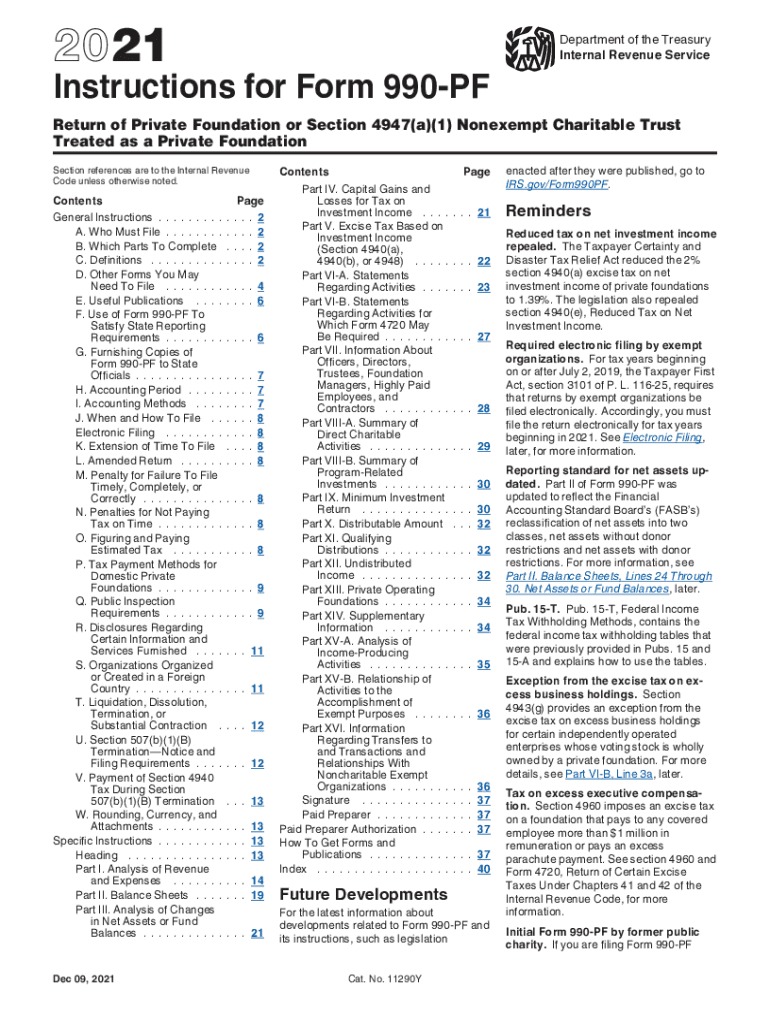

Www Irs Govpubirs SoiInternal Revenue Service Instructions for Form 990 PF 2021

What is the IRS Instructions for Form 990-PF?

The IRS Instructions for Form 990-PF provide detailed guidance for private foundations on how to complete and file their annual tax return. This form is essential for reporting financial activities, including income, expenses, and distributions to charitable organizations. The instructions outline the specific requirements for filling out each section of the form, ensuring compliance with federal tax laws. Understanding these instructions is crucial for maintaining the foundation's tax-exempt status and fulfilling legal obligations.

Steps to Complete the IRS Instructions for Form 990-PF

Completing the IRS Instructions for Form 990-PF involves several key steps:

- Gather necessary financial records, including income statements and expense reports.

- Review the specific sections of the form, including Part I, which details the foundation's financial information.

- Complete Part II, which outlines the foundation's charitable distributions.

- Ensure accuracy by cross-referencing with the IRS guidelines to avoid common errors.

- Sign and date the form before submission to validate the information provided.

Legal Use of the IRS Instructions for Form 990-PF

The legal use of the IRS Instructions for Form 990-PF is essential for private foundations to ensure compliance with federal regulations. These instructions serve as an authoritative source for understanding the legal requirements associated with filing the form. Accurate completion of the form, as guided by these instructions, helps foundations avoid penalties and maintain their tax-exempt status. It is also important to retain copies of the submitted forms and related documentation for record-keeping purposes.

Filing Deadlines / Important Dates

Filing deadlines for Form 990-PF are critical for private foundations to adhere to in order to avoid penalties. Generally, the form is due on the fifteenth day of the fifth month after the end of the foundation's fiscal year. For foundations operating on a calendar year, this means the form is typically due by May 15. If the deadline falls on a weekend or holiday, the due date may be extended to the next business day. It is advisable to file early to ensure all information is accurate and complete.

Required Documents for Form 990-PF

When preparing to file Form 990-PF, several documents are required to ensure a complete submission:

- Financial statements, including balance sheets and income statements.

- Records of charitable distributions made during the reporting period.

- Documentation of any grants awarded and their purposes.

- Prior year’s Form 990-PF, if applicable, for reference.

Form Submission Methods

Private foundations can submit Form 990-PF through various methods, including:

- Online filing through the IRS e-file system, which allows for quicker processing.

- Mailing a paper copy of the form to the appropriate IRS address, ensuring it is postmarked by the due date.

- In-person submission at designated IRS offices, if necessary.

Penalties for Non-Compliance

Non-compliance with the IRS Instructions for Form 990-PF can result in significant penalties for private foundations. These may include fines for late filing, inaccuracies, or failure to disclose required information. The IRS may impose a penalty of up to $20 per day for each day the form is late, with a maximum penalty cap. Additionally, failure to comply with distribution requirements can jeopardize the foundation's tax-exempt status, leading to further legal and financial consequences.

Quick guide on how to complete wwwirsgovpubirs soiinternal revenue service instructions for form 990 pf

Effortlessly Prepare Www irs govpubirs soiInternal Revenue Service Instructions For Form 990 PF on Any Device

Digital document management has become increasingly favored by organizations and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Manage Www irs govpubirs soiInternal Revenue Service Instructions For Form 990 PF on any device using airSlate SignNow's Android or iOS applications and streamline any document-focused task today.

How to Modify and Electronically Sign Www irs govpubirs soiInternal Revenue Service Instructions For Form 990 PF with Ease

- Locate Www irs govpubirs soiInternal Revenue Service Instructions For Form 990 PF and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or redact sensitive information using specific tools provided by airSlate SignNow.

- Generate your signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional ink signature.

- Review all details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require printing additional document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Www irs govpubirs soiInternal Revenue Service Instructions For Form 990 PF and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwirsgovpubirs soiinternal revenue service instructions for form 990 pf

Create this form in 5 minutes!

How to create an eSignature for the wwwirsgovpubirs soiinternal revenue service instructions for form 990 pf

The way to make an e-signature for your PDF document in the online mode

The way to make an e-signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature straight from your mobile device

The way to make an electronic signature for a PDF document on iOS devices

How to make an electronic signature for a PDF document on Android devices

People also ask

-

What are the key features of the 2020 Form 990 PF instructions?

The 2020 Form 990 PF instructions provide comprehensive guidance on reporting requirements and eligibility criteria for private foundations. Key features include detailed explanations of income sources, expense categorizations, and the format for presenting financial data. Understanding these instructions is crucial for accurate tax reporting and compliance.

-

How can airSlate SignNow help with completing the 2020 form 990 PF?

AirSlate SignNow streamlines the process of completing the 2020 form 990 PF by allowing users to eSign and send documents securely. Its user-friendly interface helps you manage all related documents efficiently, reducing the risk of errors. This simplifies the filing process, ensuring adherence to the 2020 form 990 PF instructions.

-

Is there a cost associated with obtaining the 2020 Form 990 PF instructions?

The 2020 Form 990 PF instructions can typically be accessed for free through the IRS website. However, using airSlate SignNow to manage and eSign your tax documents may involve a subscription fee. This investment can save time and enhance accuracy when following the 2020 form 990 PF instructions.

-

What benefits does airSlate SignNow offer for organizations dealing with the 2020 Form 990 PF?

AirSlate SignNow offers several benefits, including the ability to quickly secure electronic signatures and manage document workflows. It ensures that all parties can review and sign documents from any device, facilitating easy compliance with the 2020 form 990 PF instructions. As a cost-effective solution, it contributes to better organizational efficiency.

-

How does airSlate SignNow integrate with other systems for the 2020 Form 990 PF?

AirSlate SignNow seamlessly integrates with multiple software applications, making it easier to import data related to the 2020 Form 990 PF. This integration helps eliminate manual entry errors and saves time when gathering necessary information. Users can ensure their submissions are compliant with the 2020 form 990 PF instructions.

-

Can airSlate SignNow help with compliance regarding the 2020 form 990 PF instructions?

Yes, airSlate SignNow is designed to help organizations maintain compliance with the 2020 form 990 PF instructions. By providing audit trails and secure storage of signed documents, it ensures that all documentation is readily available for review or audit. This attention to compliance signNowly reduces the chances of penalties.

-

What types of organizations can benefit from the 2020 Form 990 PF instructions?

Nonprofit organizations, especially private foundations, can greatly benefit from understanding the 2020 Form 990 PF instructions. These instructions are tailored for entities that must report their income, expenses, and activities for tax purposes. Utilizing airSlate SignNow can enhance the efficiency of managing these requirements.

Get more for Www irs govpubirs soiInternal Revenue Service Instructions For Form 990 PF

- Revocation of medical durable power of attorney colorado form

- Beneficiary agreement colorado form

- Aging parent package colorado form

- Sale of a business package colorado form

- Legal documents for the guardian of a minor package colorado form

- New state resident package colorado form

- Health declaration form

- Commercial property sales package colorado form

Find out other Www irs govpubirs soiInternal Revenue Service Instructions For Form 990 PF

- Help Me With eSign Kansas Business Operations PPT

- How Can I eSign Mississippi Car Dealer Form

- Can I eSign Nebraska Car Dealer Document

- Help Me With eSign Ohio Car Dealer Document

- How To eSign Ohio Car Dealer Document

- How Do I eSign Oregon Car Dealer Document

- Can I eSign Oklahoma Car Dealer PDF

- How Can I eSign Oklahoma Car Dealer PPT

- Help Me With eSign South Carolina Car Dealer Document

- How To eSign Texas Car Dealer Document

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation