990 Pf Instruction Form 2015

What is the 990 Pf Instruction Form

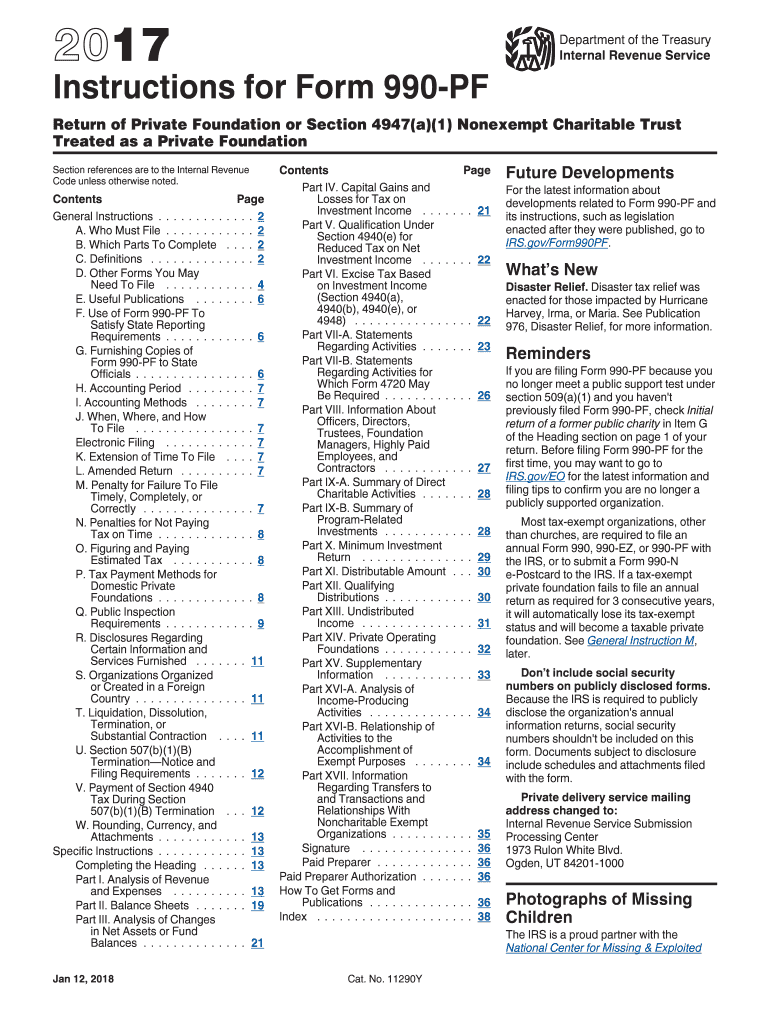

The 990 Pf Instruction Form is a crucial document used primarily by private foundations in the United States to report their financial activities to the Internal Revenue Service (IRS). This form provides detailed information about the foundation's income, expenses, and distributions, ensuring compliance with federal regulations. It is essential for maintaining transparency and accountability in the management of charitable funds.

How to use the 990 Pf Instruction Form

Using the 990 Pf Instruction Form involves several steps that ensure accurate reporting of a foundation's financial activities. First, gather all necessary financial documents, including income statements and expense reports. Next, follow the instructions provided on the form carefully, filling out each section with precise information. It is important to review the completed form for accuracy before submission, as errors can lead to compliance issues.

Steps to complete the 990 Pf Instruction Form

Completing the 990 Pf Instruction Form requires a systematic approach. Start by entering the foundation's basic information, such as name, address, and Employer Identification Number (EIN). Then, proceed to report income sources, including donations and investment income. Document expenses related to operations, grants, and administrative costs. Finally, ensure that all required signatures are obtained before submitting the form to the IRS.

Filing Deadlines / Important Dates

The filing deadline for the 990 Pf Instruction Form is typically the fifteenth day of the fifth month after the end of the foundation's fiscal year. For example, if the fiscal year ends on December thirty-first, the form is due by May fifteenth of the following year. It is essential to adhere to these deadlines to avoid penalties and maintain good standing with the IRS.

Legal use of the 990 Pf Instruction Form

The legal use of the 990 Pf Instruction Form is governed by IRS regulations that require private foundations to disclose their financial activities annually. This form serves as a public record, allowing stakeholders, including donors and beneficiaries, to assess the foundation's financial health and compliance with tax laws. Accurate completion and timely submission are vital to uphold the legal obligations of the foundation.

Key elements of the 990 Pf Instruction Form

Key elements of the 990 Pf Instruction Form include sections for reporting income, expenses, and distributions. The form requires detailed financial statements, including a balance sheet and statement of activities. Additionally, it includes questions regarding governance, compliance with public support tests, and information about investments and grants made during the reporting period. These elements collectively provide a comprehensive overview of the foundation's financial operations.

Quick guide on how to complete 990 pf instruction 2015 form

Effortlessly Prepare 990 Pf Instruction Form on Any Device

Digital document management has become increasingly popular among organizations and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly, eliminating delays. Manage 990 Pf Instruction Form on any platform with the airSlate SignNow apps for Android or iOS and simplify any document-based tasks today.

How to Modify and eSign 990 Pf Instruction Form Effortlessly

- Obtain 990 Pf Instruction Form and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that require the printing of new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign 990 Pf Instruction Form to ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 990 pf instruction 2015 form

Create this form in 5 minutes!

How to create an eSignature for the 990 pf instruction 2015 form

How to make an electronic signature for your 990 Pf Instruction 2015 Form online

How to generate an eSignature for the 990 Pf Instruction 2015 Form in Google Chrome

How to generate an eSignature for putting it on the 990 Pf Instruction 2015 Form in Gmail

How to make an electronic signature for the 990 Pf Instruction 2015 Form from your mobile device

How to make an eSignature for the 990 Pf Instruction 2015 Form on iOS

How to make an electronic signature for the 990 Pf Instruction 2015 Form on Android devices

People also ask

-

What is the 990 Pf Instruction Form and how does it work with airSlate SignNow?

The 990 Pf Instruction Form is a crucial document for organizations that need to provide their financial information to the IRS. With airSlate SignNow, you can easily fill out, sign, and send the 990 Pf Instruction Form electronically, ensuring compliance and accuracy in your submissions.

-

How can airSlate SignNow simplify the process of filling out the 990 Pf Instruction Form?

airSlate SignNow streamlines the process of completing the 990 Pf Instruction Form by providing a user-friendly interface that allows you to fill in fields quickly and efficiently. You can save templates for recurring use, ensuring that your form is always ready for submission without the hassle of starting from scratch.

-

Is there a cost associated with using airSlate SignNow for the 990 Pf Instruction Form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, making it a cost-effective solution for managing the 990 Pf Instruction Form. You can choose a plan that fits your budget while still enjoying features like unlimited document signing and secure cloud storage.

-

What features does airSlate SignNow offer for the 990 Pf Instruction Form?

With airSlate SignNow, you can benefit from features such as eSignature capabilities, document templates, and real-time tracking of your 990 Pf Instruction Form. Additionally, you can collaborate with team members and clients seamlessly, ensuring that all necessary signatures are obtained quickly.

-

Can I integrate airSlate SignNow with other software to manage the 990 Pf Instruction Form?

Absolutely! airSlate SignNow offers integrations with popular software like Google Drive, Salesforce, and Dropbox, allowing you to manage the 990 Pf Instruction Form within your existing workflows. This integration capability enhances productivity by enabling easy access to your documents across platforms.

-

What are the benefits of using airSlate SignNow for the 990 Pf Instruction Form compared to traditional methods?

Using airSlate SignNow for the 990 Pf Instruction Form eliminates the need for paper, printing, and mailing, which saves time and money. Additionally, electronic signatures are legally binding, ensuring that your submissions are secure and compliant with regulatory standards.

-

How secure is my data when using airSlate SignNow for the 990 Pf Instruction Form?

airSlate SignNow prioritizes your data security, employing advanced encryption standards and regular security audits to protect your information. When you use the platform for the 990 Pf Instruction Form, you can trust that your sensitive financial data is safe and secure.

Get more for 990 Pf Instruction Form

- A w 9 form university of rhode island urifoundation

- Updates to business account information pdf 2010

- Certificate doing form

- Application to change a name or add a dba on a dopl utah form

- Sample of parental consent for sports form

- 719a form

- Credit card authorization form

- Oshkosh police department records form

Find out other 990 Pf Instruction Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors