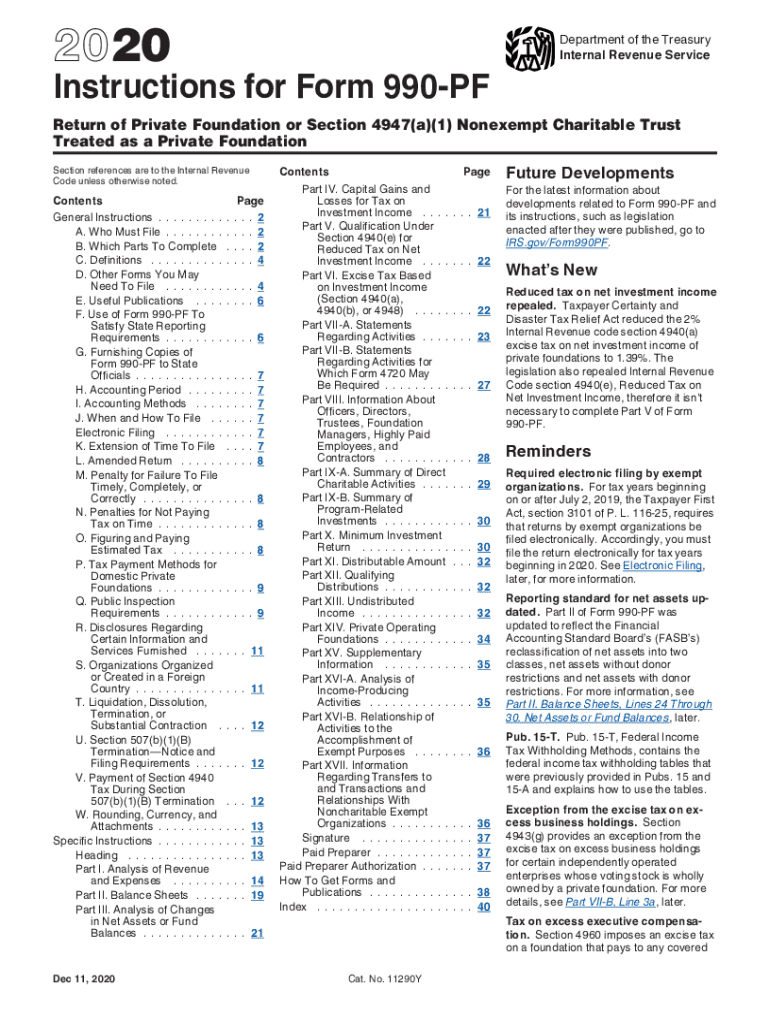

Instructions for Form 990 PF Instructions for Form 990 PF, Return of Private Foundation or Section 4947a1 Nonexempt Charitable T 2020

Understanding Form 990-PF Instructions

The 2017 IRS Form 990-PF is designed for private foundations and certain nonexempt charitable trusts. This form provides a comprehensive overview of the foundation’s financial activities, including income, expenses, and distributions. It is essential for ensuring compliance with federal tax regulations. The instructions guide users through the necessary steps to complete the form accurately, ensuring that all required information is reported correctly.

Steps to Complete the 2017 IRS Form 990-PF

Completing Form 990-PF involves several key steps:

- Gather necessary financial documents, including balance sheets and income statements.

- Fill out the basic information section, including the foundation's name, address, and employer identification number (EIN).

- Report revenue, expenses, and net assets in the appropriate sections, ensuring accuracy to avoid penalties.

- Detail the foundation's charitable distributions, including qualifying expenditures.

- Complete any additional schedules that may be required based on the foundation's activities.

Each section of the form must be reviewed carefully to ensure compliance with IRS regulations.

Legal Use of Form 990-PF Instructions

The 2017 IRS 990-PF instructions serve as a legal guideline for private foundations to report their financial activities accurately. Adhering to these instructions is crucial for maintaining tax-exempt status and avoiding penalties. The instructions outline the legal obligations of foundations, including the requirements for reporting income, expenses, and distributions. Failure to comply can result in significant legal repercussions, including fines or loss of tax-exempt status.

Filing Deadlines for Form 990-PF

Timely filing of Form 990-PF is essential for compliance. The form is due on the fifteenth day of the fifth month after the end of the foundation's accounting period. For most foundations operating on a calendar year, this means the form is due on May 15. Extensions may be available, but they must be requested properly to avoid penalties.

Required Documents for Form 990-PF

When preparing to file Form 990-PF, certain documents are required to ensure accurate reporting:

- Financial statements, including balance sheets and income statements.

- Records of charitable distributions made during the year.

- Documentation of any grants awarded.

- Previous years' Form 990-PF filings for reference.

Having these documents ready will facilitate a smoother filing process.

Form Submission Methods

Form 990-PF can be submitted in several ways, including:

- Electronically through the IRS e-file system, which is often the fastest method.

- By mail, sending the completed form to the appropriate IRS address based on the foundation's location.

- In-person delivery at designated IRS offices, although this method is less common.

Choosing the right submission method can help ensure that the form is processed promptly.

Quick guide on how to complete 2020 instructions for form 990 pf instructions for form 990 pf return of private foundation or section 4947a1 nonexempt

Manage Instructions For Form 990 PF Instructions For Form 990 PF, Return Of Private Foundation Or Section 4947a1 Nonexempt Charitable T smoothly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without interruptions. Handle Instructions For Form 990 PF Instructions For Form 990 PF, Return Of Private Foundation Or Section 4947a1 Nonexempt Charitable T on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and eSign Instructions For Form 990 PF Instructions For Form 990 PF, Return Of Private Foundation Or Section 4947a1 Nonexempt Charitable T effortlessly

- Find Instructions For Form 990 PF Instructions For Form 990 PF, Return Of Private Foundation Or Section 4947a1 Nonexempt Charitable T and click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Select important sections of your documents or redact sensitive information using the tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to submit your form, whether by email, text message (SMS), invitation link, or download it to your PC.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and eSign Instructions For Form 990 PF Instructions For Form 990 PF, Return Of Private Foundation Or Section 4947a1 Nonexempt Charitable T and guarantee effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 instructions for form 990 pf instructions for form 990 pf return of private foundation or section 4947a1 nonexempt

Create this form in 5 minutes!

How to create an eSignature for the 2020 instructions for form 990 pf instructions for form 990 pf return of private foundation or section 4947a1 nonexempt

The best way to generate an eSignature for your PDF document online

The best way to generate an eSignature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The best way to create an electronic signature right from your smart phone

How to create an electronic signature for a PDF document on iOS

The best way to create an electronic signature for a PDF on Android OS

People also ask

-

What are the 2017 IRS 990 PF instructions for completing the form?

The 2017 IRS 990 PF instructions provide detailed guidance on how private foundations should complete their annual tax return. It includes information on reporting financial activities, listing board members, and disclosing grants. Following the 2017 IRS 990 PF instructions ensures compliance with IRS requirements, maximizing transparency and accountability.

-

How can airSlate SignNow assist with the 2017 IRS 990 PF filing process?

airSlate SignNow simplifies the document signing process, making it easier for organizations to gather necessary signatures on their 2017 IRS 990 PF forms. With a user-friendly interface, you can securely send and eSign documents, streamlining the filing experience. This efficiency can help you adhere to crucial deadlines and stay organized.

-

What features does airSlate SignNow offer for managing IRS forms like the 2017 IRS 990 PF?

AirSlate SignNow offers features like customizable templates, team collaboration tools, and secure cloud storage for managing IRS forms, including the 2017 IRS 990 PF. You can track document statuses in real time and ensure that all necessary information is accurately captured. These features enhance overall efficiency and accuracy when filing.

-

Is airSlate SignNow a cost-effective solution for handling the 2017 IRS 990 PF instructions?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes looking to manage their documentation, including IRS forms like the 2017 IRS 990 PF instructions. With competitive pricing options and a focus on reducing paper usage, SignNow helps organizations save on costs while maintaining compliance.

-

Can I integrate airSlate SignNow with other software for managing 2017 IRS 990 PF documents?

Absolutely! AirSlate SignNow offers seamless integrations with popular software to help manage documents related to the 2017 IRS 990 PF instructions. This allows you to sync data across platforms, automate workflows, and enhance overall productivity while preparing your forms.

-

What benefits can I expect when using airSlate SignNow for IRS 990 PF filings?

Using airSlate SignNow for IRS 990 PF filings offers numerous benefits, including enhanced security, faster turnaround times, and ease of use. The platform allows you to track changes, send reminders, and confirm when recipients have signed, making compliance with the 2017 IRS 990 PF instructions much simpler.

-

How can airSlate SignNow improve collaboration on completing the 2017 IRS 990 PF?

AirSlate SignNow improves collaboration by enabling multiple users to work on the 2017 IRS 990 PF documents simultaneously. You can assign roles, leave comments, and track changes to ensure everyone's input is considered. This collaborative approach can lead to more accurate and comprehensive filings.

Get more for Instructions For Form 990 PF Instructions For Form 990 PF, Return Of Private Foundation Or Section 4947a1 Nonexempt Charitable T

- Special or limited power of attorney for real estate purchase transaction by purchaser wyoming form

- Limited power of attorney where you specify powers with sample powers included wyoming form

- Limited power of attorney for stock transactions and corporate powers wyoming form

- Special durable power of attorney for bank account matters wyoming form

- Wyoming startup form

- Wyoming property management package wyoming form

- New resident guide wyoming form

- Satisfaction release or cancellation of mortgage by corporation wyoming form

Find out other Instructions For Form 990 PF Instructions For Form 990 PF, Return Of Private Foundation Or Section 4947a1 Nonexempt Charitable T

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word