Form 1120 RIC U S Income Tax Return for Regulated 2024-2026

Understanding the Form 1120 RIC U.S. Income Tax Return for Regulated Investment Companies

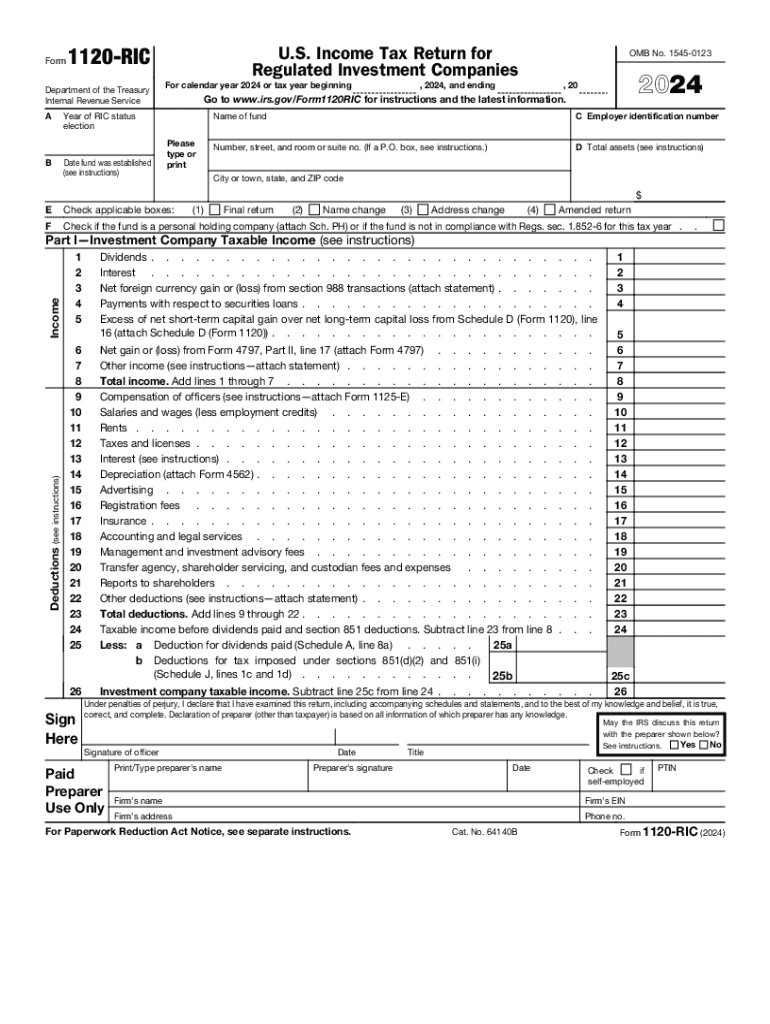

The Form 1120 RIC is specifically designed for regulated investment companies (RICs) to report their income, deductions, gains, losses, and tax liability. This form is essential for RICs to maintain their tax status under the Internal Revenue Code, allowing them to avoid double taxation on income distributed to shareholders. The form captures various financial details, including dividends, interest income, and capital gains, ensuring compliance with IRS regulations.

Steps to Complete the Form 1120 RIC

Completing the Form 1120 RIC involves several steps to ensure accurate reporting. Initially, gather all necessary financial documents, including income statements and balance sheets. Next, fill out the form by entering income and deductions in the appropriate sections. Pay attention to specific lines for capital gains and losses, as these can significantly affect tax liability. After completing the form, review it for accuracy before submission. Finally, ensure that all required signatures are included to validate the filing.

Filing Deadlines and Important Dates

Timely filing of the Form 1120 RIC is crucial to avoid penalties. Generally, the form is due on the fifteenth day of the third month following the close of the tax year. For calendar year filers, this typically falls on March 15. If additional time is needed, RICs can file for an extension, but it is essential to pay any taxes owed by the original deadline to avoid interest and penalties.

IRS Guidelines for Regulated Investment Companies

The IRS provides specific guidelines for regulated investment companies to ensure compliance with tax laws. RICs must adhere to the distribution requirements, which stipulate that at least ninety percent of taxable income must be distributed to shareholders. Additionally, RICs must maintain a diversified portfolio and meet asset tests to qualify for favorable tax treatment. Familiarizing oneself with these guidelines is crucial for maintaining compliance and avoiding potential issues with the IRS.

Required Documents for Filing Form 1120 RIC

When preparing to file the Form 1120 RIC, several documents are necessary to ensure accurate reporting. These include financial statements, records of income and expenses, and any documentation supporting deductions claimed on the form. Additionally, RICs should have records of distributions made to shareholders, as this information is critical for completing the tax return accurately. Proper documentation helps streamline the filing process and supports compliance with IRS regulations.

Penalties for Non-Compliance

Failure to comply with the filing requirements for Form 1120 RIC can result in significant penalties. The IRS may impose fines for late filings, which can accumulate over time. Additionally, if a RIC fails to meet the distribution requirements, it risks losing its tax status, leading to double taxation on income. Understanding these penalties emphasizes the importance of timely and accurate filing to maintain compliance and protect the financial interests of the company and its shareholders.

Create this form in 5 minutes or less

Find and fill out the correct form 1120 ric u s income tax return for regulated

Create this form in 5 minutes!

How to create an eSignature for the form 1120 ric u s income tax return for regulated

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a registered investment company?

A registered investment company is a company that is registered with the Securities and Exchange Commission (SEC) and is subject to specific regulations. These companies pool money from investors to purchase securities and are required to provide transparency and regular reporting. Understanding the role of a registered investment company is crucial for investors looking to diversify their portfolios.

-

How does airSlate SignNow benefit registered investment companies?

airSlate SignNow offers registered investment companies an efficient way to manage document workflows. With features like eSigning and document tracking, these companies can streamline their operations and ensure compliance with regulatory requirements. This cost-effective solution enhances productivity and reduces the time spent on paperwork.

-

What features does airSlate SignNow provide for registered investment companies?

airSlate SignNow provides features such as customizable templates, secure eSigning, and real-time document tracking, which are essential for registered investment companies. These tools help ensure that all documents are signed and stored securely, facilitating smoother transactions. Additionally, the platform supports integrations with various financial software to enhance functionality.

-

Is airSlate SignNow affordable for registered investment companies?

Yes, airSlate SignNow is designed to be a cost-effective solution for registered investment companies. With flexible pricing plans, businesses can choose a package that fits their budget while still accessing powerful features. This affordability allows companies to invest more in their core operations rather than on administrative tasks.

-

Can airSlate SignNow integrate with other tools used by registered investment companies?

Absolutely! airSlate SignNow offers seamless integrations with various tools commonly used by registered investment companies, such as CRM systems and financial software. This interoperability allows for a more cohesive workflow, enabling companies to manage their documents and client interactions more effectively.

-

How secure is airSlate SignNow for registered investment companies?

Security is a top priority for airSlate SignNow, especially for registered investment companies that handle sensitive financial information. The platform employs advanced encryption and complies with industry standards to protect user data. This commitment to security ensures that all documents are safe and secure throughout the signing process.

-

What support does airSlate SignNow offer to registered investment companies?

airSlate SignNow provides comprehensive support for registered investment companies, including live chat, email support, and a robust knowledge base. This ensures that users can quickly resolve any issues or questions they may have. The dedicated support team is knowledgeable about the specific needs of registered investment companies, making it easier to get tailored assistance.

Get more for Form 1120 RIC U S Income Tax Return For Regulated

Find out other Form 1120 RIC U S Income Tax Return For Regulated

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT