Federal Form 1120 RIC U S Income Tax Return for Regulated InvestmFederal Form 1120 RIC U S Income Tax Return for Regulated Inves 2022

Understanding the Federal Form 1120 RIC

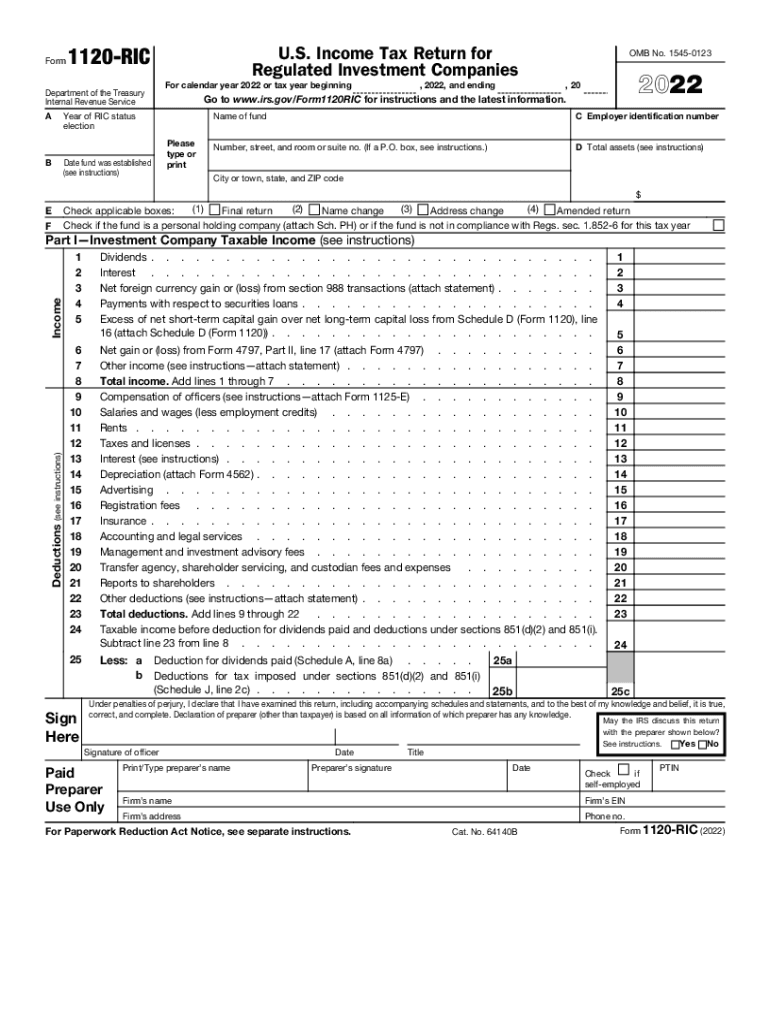

The Federal Form 1120 RIC is a crucial document for regulated investment companies (RICs) in the United States. This form is used to report income, gains, losses, deductions, and credits, and it ensures compliance with the tax obligations specific to RICs. The form is designed to facilitate the taxation process for these entities, which are structured to provide tax benefits to investors. By adhering to IRC Section 851, RICs can avoid double taxation on income distributed to shareholders, making it essential for these companies to accurately complete and file the form.

Steps to Complete the Federal Form 1120 RIC

Completing the Federal Form 1120 RIC requires careful attention to detail to ensure compliance with IRS regulations. Here are the key steps involved:

- Gather all necessary financial documents, including income statements and balance sheets.

- Fill out the identification section, including the name, address, and Employer Identification Number (EIN) of the RIC.

- Report income from various sources, including dividends, interest, and capital gains.

- Calculate allowable deductions, such as expenses directly related to the operation of the RIC.

- Complete the tax computation section to determine the tax liability.

- Ensure all required schedules are attached, including Schedule C and Schedule G, if applicable.

- Review the form for accuracy before submission.

Legal Use of the Federal Form 1120 RIC

The legal use of the Federal Form 1120 RIC is governed by the Internal Revenue Code, particularly IRC Section 851. This section outlines the requirements for RICs to qualify for favorable tax treatment. To legally utilize this form, a RIC must meet specific criteria, including the distribution of at least ninety percent of its taxable income to shareholders. Failure to comply with these regulations can result in penalties and loss of RIC status, which can significantly impact the tax obligations of the company.

Filing Deadlines for the Federal Form 1120 RIC

Filing deadlines for the Federal Form 1120 RIC are critical for compliance. Typically, the form is due on the fifteenth day of the third month after the end of the RIC's tax year. For RICs operating on a calendar year, this means the form is due by March 15. It is essential for RICs to adhere to these deadlines to avoid late filing penalties and interest charges on any unpaid taxes.

Required Documents for Filing the Federal Form 1120 RIC

When preparing to file the Federal Form 1120 RIC, several documents are necessary to ensure accurate reporting. These include:

- Financial statements, including balance sheets and income statements.

- Records of all income received, including dividends and interest.

- Documentation of expenses and deductions claimed.

- Any prior year tax returns that may be relevant for reference.

IRS Guidelines for the Federal Form 1120 RIC

The IRS provides specific guidelines for completing the Federal Form 1120 RIC. These guidelines detail the information required, the format for reporting income and deductions, and the necessary schedules to include. It is essential for RICs to review these guidelines thoroughly to ensure compliance and avoid errors that could lead to audits or penalties. Additionally, understanding these guidelines can help RICs maximize their tax benefits under the applicable tax laws.

Quick guide on how to complete federal form 1120 ric us income tax return for regulated investmfederal form 1120 ric us income tax return for regulated

Complete Federal Form 1120 RIC U S Income Tax Return For Regulated InvestmFederal Form 1120 RIC U S Income Tax Return For Regulated Inves effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow provides you with all the resources required to create, edit, and eSign your documents quickly without any delays. Manage Federal Form 1120 RIC U S Income Tax Return For Regulated InvestmFederal Form 1120 RIC U S Income Tax Return For Regulated Inves on any device with airSlate SignNow Android or iOS applications and enhance any document-based process today.

The simplest way to modify and eSign Federal Form 1120 RIC U S Income Tax Return For Regulated InvestmFederal Form 1120 RIC U S Income Tax Return For Regulated Inves seamlessly

- Obtain Federal Form 1120 RIC U S Income Tax Return For Regulated InvestmFederal Form 1120 RIC U S Income Tax Return For Regulated Inves and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that function.

- Create your signature using the Sign tool, which takes seconds and has the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choosing. Edit and eSign Federal Form 1120 RIC U S Income Tax Return For Regulated InvestmFederal Form 1120 RIC U S Income Tax Return For Regulated Inves while ensuring excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct federal form 1120 ric us income tax return for regulated investmfederal form 1120 ric us income tax return for regulated

Create this form in 5 minutes!

People also ask

-

What is IRC Section 851?

IRC Section 851 is a provision under the Internal Revenue Code that outlines the tax treatment of regulated investment companies. Understanding this section is crucial for investors and financial professionals as it provides insights into taxation and compliance requirements for investment funds.

-

How does airSlate SignNow help with IRC Section 851 compliance?

airSlate SignNow offers streamlined document management features that can aid businesses in maintaining compliance with IRC Section 851. By using our platform, users can easily access, sign, and store important compliance documents securely.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow provides flexible pricing plans tailored to meet various business needs, whether you're a small startup or a large enterprise. Each plan includes features that facilitate compliance with IRC Section 851, ensuring your documents are managed efficiently.

-

What key features does airSlate SignNow offer for document management?

Key features of airSlate SignNow include electronic signatures, document templates, and automated workflows. These tools make it easier to handle documents related to IRC Section 851, ensuring you can focus on compliance without excessive paperwork.

-

Can airSlate SignNow integrate with other software tools?

Yes, airSlate SignNow seamlessly integrates with several popular software applications, enhancing your workflow efficiency. This means you can easily connect with accounting or compliance tools relevant to IRC Section 851 without disrupting your existing processes.

-

What benefits does airSlate SignNow provide for businesses?

Using airSlate SignNow offers numerous benefits, including improved document turnaround times and enhanced security for sensitive information. These advantages are especially important for businesses dealing with IRC Section 851-related documentation and compliance.

-

Is airSlate SignNow suitable for small businesses and startups?

Absolutely! airSlate SignNow is designed to be user-friendly for businesses of all sizes, including small businesses and startups. Our service provides a cost-effective way to manage IRC Section 851 documentation, making it accessible for companies with limited resources.

Get more for Federal Form 1120 RIC U S Income Tax Return For Regulated InvestmFederal Form 1120 RIC U S Income Tax Return For Regulated Inves

- Letter tenant landlord 497321310 form

- Tenant notice increase 497321311 form

- Notice rent increase lease form

- Letter from landlord to tenant about intent to increase rent and effective date of rental increase new york form

- Letter from landlord to tenant as notice to tenant to repair damage caused by tenant new york form

- Letter tenant increase sample form

- Letter landlord services form

- Temporary lease agreement to prospective buyer of residence prior to closing new york form

Find out other Federal Form 1120 RIC U S Income Tax Return For Regulated InvestmFederal Form 1120 RIC U S Income Tax Return For Regulated Inves

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile