Instructions for Form 1120 RIC, U S Income Tax Return for IRS Gov 2014

What is the Instructions For Form 1120 RIC, U S Income Tax Return For IRS gov

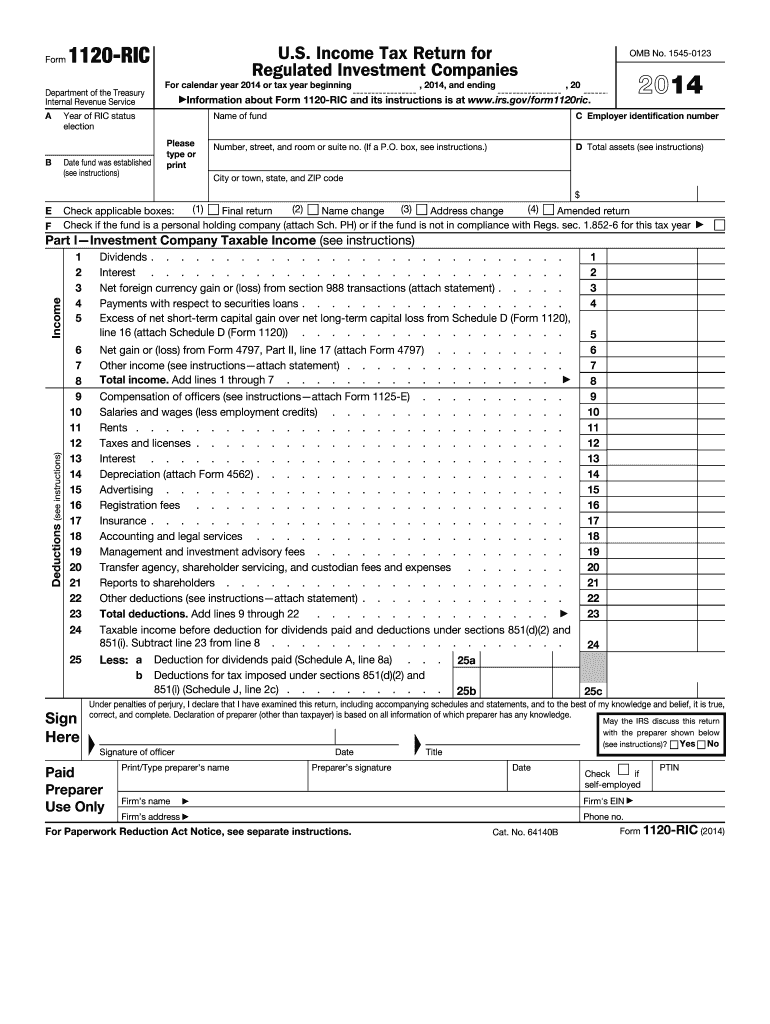

The Instructions For Form 1120 RIC, U S Income Tax Return For IRS gov provide detailed guidance for regulated investment companies (RICs) in the United States. This form is essential for RICs to report their income, deductions, and credits, ensuring compliance with federal tax regulations. Understanding these instructions is crucial for accurate filing and to avoid potential penalties.

Steps to complete the Instructions For Form 1120 RIC, U S Income Tax Return For IRS gov

Completing the Instructions For Form 1120 RIC involves several critical steps:

- Gather necessary financial documents, including income statements, balance sheets, and previous tax returns.

- Review the specific instructions for each section of the form to ensure all required information is included.

- Fill out the form accurately, paying attention to details such as numerical entries and required attachments.

- Double-check calculations and ensure that all figures align with supporting documents.

- Submit the completed form by the specified deadline, either electronically or via mail.

Legal use of the Instructions For Form 1120 RIC, U S Income Tax Return For IRS gov

The legal use of the Instructions For Form 1120 RIC requires adherence to IRS guidelines. RICs must ensure that they are using the most current version of the form and its instructions. Filing outdated or incorrect forms can lead to compliance issues and potential penalties. It is essential to understand the legal implications of the information reported on the form, as inaccuracies can affect tax liabilities and regulatory standing.

Filing Deadlines / Important Dates

Filing deadlines for the Instructions For Form 1120 RIC are critical for compliance. Typically, RICs must file their tax returns by the fifteenth day of the third month following the end of their tax year. For calendar year filers, this means the deadline is March 15. It is important to stay informed about any changes to these deadlines, as late filings can result in penalties and interest on unpaid taxes.

Required Documents

When completing the Instructions For Form 1120 RIC, certain documents are required to support the information provided on the form. These may include:

- Financial statements, including profit and loss statements and balance sheets.

- Documentation of any deductions or credits claimed.

- Previous tax returns, if applicable, for reference and consistency.

Having these documents ready will facilitate a smoother filing process and help ensure accuracy.

Form Submission Methods (Online / Mail / In-Person)

The Instructions For Form 1120 RIC can be submitted through various methods. RICs have the option to file electronically, which is often faster and more secure. Alternatively, forms can be mailed to the appropriate IRS address, depending on the entity's location and filing status. In-person submissions are generally not recommended for tax forms but may be possible in certain circumstances. It is advisable to check the IRS guidelines for the most current submission methods and requirements.

Quick guide on how to complete instructions for form 1120 ric us income tax return for irsgov

Discover the easiest method to complete and sign your Instructions For Form 1120 RIC, U S Income Tax Return For IRS gov

Are you still spending time creating your official paperwork on paper instead of utilizing online options? airSlate SignNow offers a superior approach to complete and sign your Instructions For Form 1120 RIC, U S Income Tax Return For IRS gov and comparable forms for public services. Our intelligent e-signature solution equips you with all necessary tools to manage documents swiftly and in accordance with formal standards - comprehensive PDF editing, organizing, safeguarding, signing, and sharing features are all accessible through a user-friendly interface.

There are just a few steps needed to accomplish filling out and signing your Instructions For Form 1120 RIC, U S Income Tax Return For IRS gov:

- Add the editable template to the editor using the Get Form button.

- Review the information you must supply in your Instructions For Form 1120 RIC, U S Income Tax Return For IRS gov.

- Navigate through the fields using the Next option to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to input your information into the blanks.

- Enhance the content with Text boxes or Images from the top toolbar.

- Emphasize what is crucial or Obscure sections that are no longer necessary.

- Click on Sign to produce a legally valid electronic signature using any method you prefer.

- Insert the Date beside your signature and finalize your task with the Done button.

Store your finalized Instructions For Form 1120 RIC, U S Income Tax Return For IRS gov in the Documents folder within your account, download it, or transfer it to your chosen cloud storage. Our solution also offers adaptable file sharing. There's no requirement to print your forms when you need to submit them to the relevant public office - accomplish it via email, fax, or by requesting a USPS "snail mail" delivery from your account. Give it a try now!

Create this form in 5 minutes or less

Find and fill out the correct instructions for form 1120 ric us income tax return for irsgov

FAQs

-

How can I deduct on my Federal income taxes massage therapy for my chronic migraines? Is there some form to fill out to the IRS for permission?

As long as your doctor prescribed this, it is tax deductible under the category for medical expenses. There is no IRS form for permission.

-

How to fill the apple U.S tax form (W8BEN iTunes Connect) for indie developers?

This article was most helpful: Itunes Connect Tax Information

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

If I don't earn enough money on social security to file income taxes, will I still need an income tax return to fill out a FAFSA, and other financial aid forms for my daughter?

No. Just provide the information requested on the form. If you later need proof you didn't file, you can get that from the IRS BY requesting transcripts.

-

For a resident alien individual having farm income in the home country, India, how to report the agricultural income in US income tax return? Does the form 1040 schedule F needs to be filled?

The answer is yes, it should be. Remember that you will receive a credit for any Indian taxes you pay.

-

For the amended tax return, the only thing I needed to correct was the filing status. Do I still need to fill out the rest of the form involving income, etc.?

Yes, it depends what kind of income. For social security incomes, there is a different threshold amount for single and Married Filing joint. Different filing status have a certain treatment and that tax rates are different for every filing status. The filing status change goes on the very top of the 1040X. When I was a Tax Auditor for the IRS, the 1040X was one of the hardest thing to calculate. Just a few years ago, the IRS decided to change but with disastrous results- people were more confused than the original. So IRS changed the 1040X to its original. Follow your program’s instruction or go to an Enrolled Agent. I found out throughout my career that a good majority of CPA’s do not know the mechanics of the 1040X. Chances are you may need to send the returns by mail.

-

I’m on a H1B visa, single and have been in the U.S. for less than 5 years. Are the forms 1040A and 1040EZ the only ones that I need to fill for my tax return? Should I just use a software like TurboTax or hire an accountant?

It’s tax time.Taxation of immigrants by the United States is signNowly affected by the immigration status of such immigrants. Although the immigration laws of the United States refer to aliens as immigrants, nonimmigrants, and undocumented (illegal) aliens, the tax laws of the United States refer only to “resident aliens” and “nonresident aliens”.In general, the controlling principle is that resident aliens are taxed in the same manner as U.S. citizens on their worldwide income, and nonresident aliens are taxed according to special rules contained in certain parts of the Internal Revenue Code.Holders of nonimmigrant visas or temporary visas may or may not have to report income and pay taxes to the United States Government. Holders of nonimmigrant visas only become tax residents if they spend at least 183 days of the current year within the United States. If you have spent more than 183 days of the current year in the U.S., you are considered a “resident alien.”A nonresident alien/nonimmigrant visa holder (with certain narrowly defined exceptions) is subject to federal income tax only on income which is derived from sources within the United States and or income that is effectively connected with a U.S. trade or business.Nonresident aliens who are required to file an income tax return must use:Form 1040NR, U.S. Nonresident Alien Income Tax Return or,Form 1040NR-EZ, U.S. Income Tax Return for Certain Nonresident Aliens With No Dependents, if qualified.Resident aliens who are required to file an income tax return must use:Form 1040, U.S. Individual Income Tax Return,Form 1040A, U.S. Individual Income Tax Return, orForm 1040EZ, Income Tax Return for Single and Joint Filers With No Dependents.According to TurboTax, its software does not support the filing of Form 1040NR. However, it has a partnership with Sprintax that does support such filings. I would recommend that you also consult with a certified public accountant because depending on your circumstances, s/he may be able to identify other IRS forms and or deductions that may be applicable to you.For more information on the intersection of US taxation and immigration, go here.For more information on immigration, please visit here.

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 1120 ric us income tax return for irsgov

How to generate an eSignature for the Instructions For Form 1120 Ric Us Income Tax Return For Irsgov in the online mode

How to create an electronic signature for the Instructions For Form 1120 Ric Us Income Tax Return For Irsgov in Chrome

How to create an eSignature for signing the Instructions For Form 1120 Ric Us Income Tax Return For Irsgov in Gmail

How to make an electronic signature for the Instructions For Form 1120 Ric Us Income Tax Return For Irsgov straight from your mobile device

How to make an electronic signature for the Instructions For Form 1120 Ric Us Income Tax Return For Irsgov on iOS devices

How to create an electronic signature for the Instructions For Form 1120 Ric Us Income Tax Return For Irsgov on Android

People also ask

-

What are the Instructions For Form 1120 RIC, U S Income Tax Return For IRS gov?

The Instructions For Form 1120 RIC, U S Income Tax Return For IRS gov provide detailed guidance on how to complete and file the form, which is essential for regulated investment companies. This includes information on reporting income, deductions, and tax liabilities. Following these instructions accurately ensures compliance with IRS regulations and helps avoid potential penalties.

-

How can airSlate SignNow assist with filing the Instructions For Form 1120 RIC, U S Income Tax Return For IRS gov?

AirSlate SignNow streamlines the process of filing the Instructions For Form 1120 RIC, U S Income Tax Return For IRS gov by allowing you to eSign documents securely and efficiently. Our platform enables easy collaboration with stakeholders and ensures that all necessary signatures are collected promptly. This reduces the time and effort required to complete your tax return.

-

What features does airSlate SignNow offer for tax document management?

AirSlate SignNow offers robust features for tax document management, including eSignature capabilities, templates for frequently used documents, and cloud storage for easy access. These features help users efficiently manage the paperwork associated with Instructions For Form 1120 RIC, U S Income Tax Return For IRS gov. This makes the process of filing taxes smoother and more organized.

-

Is airSlate SignNow cost-effective for businesses needing to file taxes?

Yes, airSlate SignNow provides a cost-effective solution for businesses needing to handle tax documents like the Instructions For Form 1120 RIC, U S Income Tax Return For IRS gov. Our pricing plans are designed to suit various business sizes and needs, ensuring that you get the best value for your investment. This affordability makes it easier for businesses to comply with tax regulations without breaking the bank.

-

Can I integrate airSlate SignNow with other accounting software?

Absolutely! AirSlate SignNow easily integrates with various accounting software systems, enhancing your workflow when dealing with tax documents like the Instructions For Form 1120 RIC, U S Income Tax Return For IRS gov. This integration allows for seamless data transfer and reduces the chances of errors, ensuring that your tax filings are accurate and timely.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including the Instructions For Form 1120 RIC, U S Income Tax Return For IRS gov, offers several benefits such as enhanced security, faster processing times, and improved collaboration. Our platform ensures that sensitive information is protected while allowing multiple parties to work on documents simultaneously. This efficiency can lead to quicker tax filing and compliance.

-

How secure is airSlate SignNow for handling sensitive tax information?

AirSlate SignNow employs industry-leading security measures to protect sensitive tax information, including data related to the Instructions For Form 1120 RIC, U S Income Tax Return For IRS gov. Our platform utilizes encryption, secure servers, and user authentication to safeguard your documents against unauthorized access. You can trust that your financial data is in safe hands.

Get more for Instructions For Form 1120 RIC, U S Income Tax Return For IRS gov

Find out other Instructions For Form 1120 RIC, U S Income Tax Return For IRS gov

- How To Sign Maine Legal Warranty Deed

- Sign Maine Legal Last Will And Testament Fast

- How To Sign Maine Legal Quitclaim Deed

- Sign Mississippi Legal Business Plan Template Easy

- How Do I Sign Minnesota Legal Residential Lease Agreement

- Sign South Carolina Insurance Lease Agreement Template Computer

- Sign Missouri Legal Last Will And Testament Online

- Sign Montana Legal Resignation Letter Easy

- How Do I Sign Montana Legal IOU

- How Do I Sign Montana Legal Quitclaim Deed

- Sign Missouri Legal Separation Agreement Myself

- How Do I Sign Nevada Legal Contract

- Sign New Jersey Legal Memorandum Of Understanding Online

- How To Sign New Jersey Legal Stock Certificate

- Sign New Mexico Legal Cease And Desist Letter Mobile

- Sign Texas Insurance Business Plan Template Later

- Sign Ohio Legal Last Will And Testament Mobile

- Sign Ohio Legal LLC Operating Agreement Mobile

- Sign Oklahoma Legal Cease And Desist Letter Fast

- Sign Oregon Legal LLC Operating Agreement Computer