Ric 2018

What is the Ric

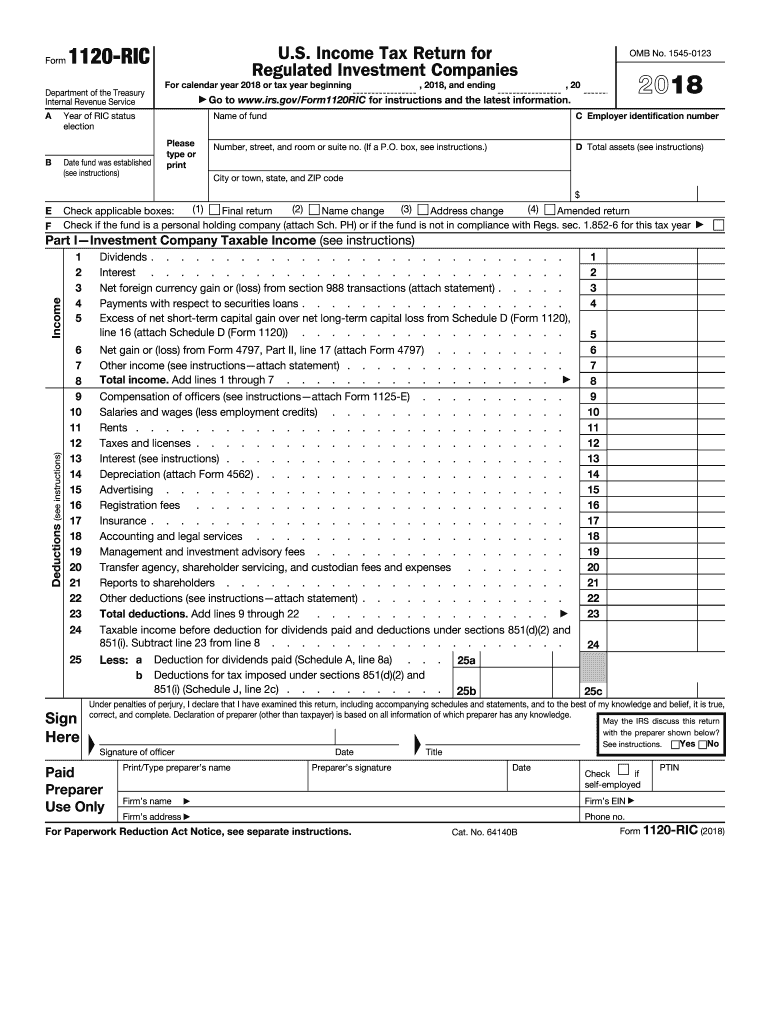

The Ric 2015 is a specific form used primarily for tax reporting purposes in the United States. It is part of the IRS documentation that helps taxpayers report their income and calculate their tax obligations accurately. This form is crucial for ensuring compliance with federal tax laws and provides a standardized way to present financial information to the IRS.

How to use the Ric

Using the Ric 2015 involves several key steps. First, gather all necessary financial documents, including income statements and expense receipts. Next, carefully complete the form, ensuring that all required fields are filled out accurately. After completing the form, review it for any errors or omissions. Finally, submit the Ric to the IRS by the designated deadline, either electronically or via mail, depending on your preference and the IRS guidelines.

Steps to complete the Ric

Completing the Ric 2015 requires attention to detail. Follow these steps:

- Collect all relevant financial documents, such as W-2s and 1099s.

- Fill out the form, ensuring that you provide accurate information in each section.

- Double-check your entries for accuracy and completeness.

- Sign and date the form where required.

- Submit the completed Ric to the IRS by the specified deadline.

Legal use of the Ric

The Ric 2015 must be used in accordance with IRS regulations to ensure its legal validity. It is essential to use the most current version of the form, as outdated forms may not be accepted. Additionally, all information provided must be truthful and accurate to avoid penalties or legal repercussions. Familiarizing yourself with IRS guidelines can help ensure that you are using the Ric correctly and legally.

Filing Deadlines / Important Dates

Filing deadlines for the Ric 2015 are critical to avoid penalties. Typically, the form must be submitted by April 15 of the following tax year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about any changes to deadlines or specific filing requirements that may arise each tax year.

Required Documents

To complete the Ric 2015, you will need several supporting documents. These typically include:

- W-2 forms from employers.

- 1099 forms for other income sources.

- Receipts for deductible expenses.

- Previous tax returns for reference.

Having these documents ready will streamline the process of completing the Ric and ensure accuracy.

Quick guide on how to complete 852 b 4 2018 2019 form

Discover the most efficient method to complete and endorse your Ric

Are you still spending time preparing your official documents on paper rather than online? airSlate SignNow offers a superior approach to complete and endorse your Ric and similar forms for public services. Our advanced electronic signature solution equips you with all the tools necessary to handle documents swiftly and comply with formal standards - comprehensive PDF editing, managing, securing, signing, and sharing features all accessible through a user-friendly interface.

Only a few steps are needed to finish filling out and signing your Ric:

- Load the editable template into the editor using the Get Form button.

- Review the information you need to input in your Ric.

- Move between the fields with the Next option to ensure nothing is missed.

- Utilize Text, Check, and Cross tools to fill in the fields with your details.

- Update the content with Text boxes or Images from the top toolbar.

- Emphasize what is crucial or Redact fields that are no longer relevant.

- Select Sign to create a legally binding electronic signature using your chosen method.

- Include the Date next to your signature and finalize your task by clicking the Done button.

Store your completed Ric in the Documents folder within your account, download it, or transfer it to your preferred cloud storage. Our solution also facilitates convenient file sharing. There’s no need to print your forms when you need to submit them to the appropriate public office - you can do so via email, fax, or by requesting a USPS “snail mail” delivery right from your account. Try it out now!

Create this form in 5 minutes or less

Find and fill out the correct 852 b 4 2018 2019 form

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How do I fill out the BHU's form of B.Com in 2018 and crack it?

you can fill from to go through bhu portal and read all those instruction and download previous year question paper . that u will get at the portal and solve more and more question paper and read some basics from your study level .focus on study save ur time and energy .do best to achieve your goal .for more detail discus with gajendra ta mtech in iit bhu .AND PKN .good luck .

-

How can I fill out the BITSAT Application Form 2019?

BITSAT 2019 Application Forms are available online. Students who are eligible for the admission test can apply online before 20 March 2018, 5 pm.Click here to apply for BITSAT 2019Step 1: Follow the link given aboveStep 2: Fill online application formPersonal Details12th Examination DetailsTest Centre PreferencesStep 3: Upload scanned photograph (4 kb to 50 kb) and signature ( 1 kb to 30 kb).Step 4: Pay application fee either through online payment mode or through e-challan (ICICI Bank)BITSAT-2019 Application FeeMale Candidates - Rs. 3150/-Female Candidates - Rs. 2650/-Thanks!

Create this form in 5 minutes!

How to create an eSignature for the 852 b 4 2018 2019 form

How to create an electronic signature for the 852 B 4 2018 2019 Form online

How to generate an electronic signature for your 852 B 4 2018 2019 Form in Google Chrome

How to generate an eSignature for signing the 852 B 4 2018 2019 Form in Gmail

How to make an electronic signature for the 852 B 4 2018 2019 Form straight from your mobile device

How to generate an electronic signature for the 852 B 4 2018 2019 Form on iOS

How to generate an eSignature for the 852 B 4 2018 2019 Form on Android OS

People also ask

-

What is Ric in the context of airSlate SignNow?

Ric is a key feature of airSlate SignNow that enhances the document signing and management process. It allows users to quickly and efficiently send documents for eSignature, streamlining workflows and improving productivity. By leveraging Ric, businesses can ensure that their document processes are secure, compliant, and user-friendly.

-

How does Ric improve document security in airSlate SignNow?

Ric incorporates advanced security features that protect sensitive information during the eSignature process. With encryption and secure access controls, Ric ensures that only authorized users can view and sign documents. This level of security is crucial for businesses looking to maintain confidentiality and compliance.

-

What pricing options are available for using Ric in airSlate SignNow?

airSlate SignNow offers several pricing plans that include access to the Ric feature. Depending on the size of your organization and your specific needs, you can choose a plan that fits your budget while still providing robust eSignature capabilities. For detailed pricing information, visit our pricing page.

-

Can Ric integrate with other software solutions?

Yes, Ric is designed to seamlessly integrate with various software applications, enhancing your existing workflows. Whether you use CRM systems, cloud storage solutions, or project management tools, Ric can connect with these platforms to streamline document management. This integration capability makes airSlate SignNow a versatile choice for businesses.

-

What are the benefits of using Ric for eSignatures?

Utilizing Ric for eSignatures in airSlate SignNow offers numerous benefits, including increased efficiency, reduced turnaround times, and improved tracking of document statuses. Businesses can expect a smoother signing process, leading to faster contract closures and enhanced customer satisfaction. Ric simplifies the entire experience for both senders and signers.

-

Is Ric suitable for businesses of all sizes?

Absolutely! Ric is designed to cater to businesses of all sizes, from startups to large enterprises. The flexibility and scalability of airSlate SignNow ensure that all organizations can benefit from streamlined document signing and management processes, regardless of their size.

-

How can I get started with Ric in airSlate SignNow?

Getting started with Ric in airSlate SignNow is simple. You can sign up for a free trial on our website, allowing you to explore the features and benefits that Ric offers. After the trial, you can choose a pricing plan that fits your needs and start optimizing your document workflows.

Get more for Ric

- A trip through our solar system an internet scavenger hunt form

- Supply order form cml healthcare

- Govdeals generic inspection form purchasing department

- Traditional 401k and roth401k enrollmentelection form

- Affirmation of isolation department of health form

- Application for extension for filing individual income tax return form

- Sunday school publishing board form

- Space agreement template form

Find out other Ric

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple