Form 1120 RIC U S Income Tax Return for Regulated Investment Companies 2015

What is the Form 1120 RIC U S Income Tax Return For Regulated Investment Companies

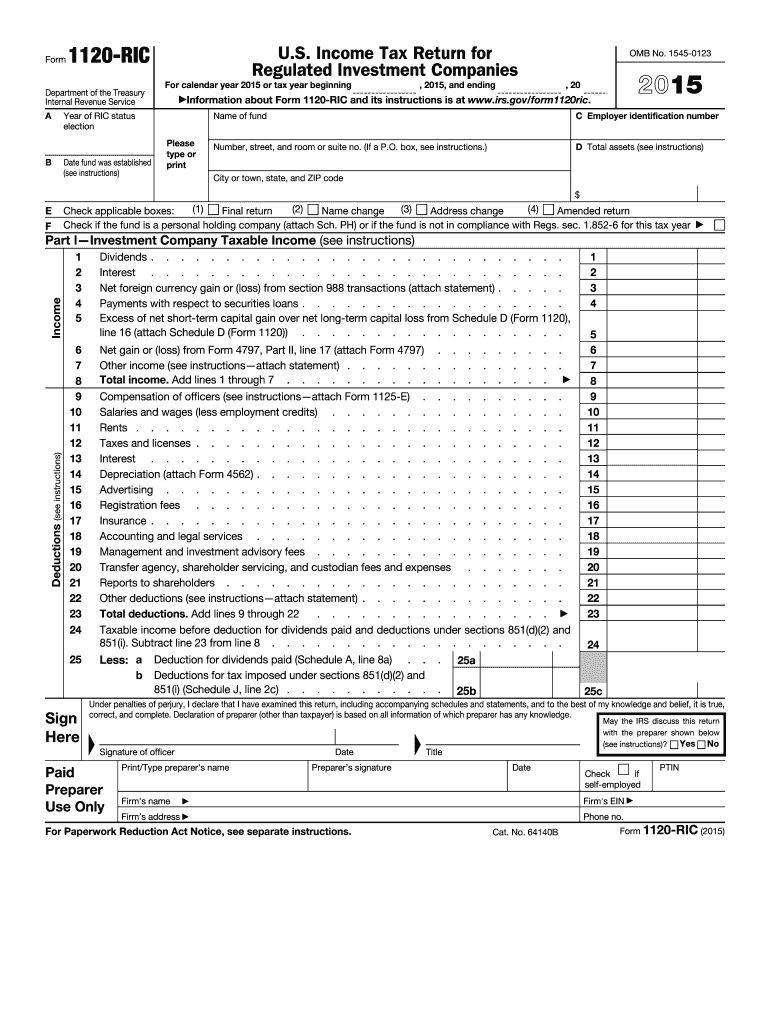

The Form 1120 RIC U S Income Tax Return For Regulated Investment Companies is a specific tax return used by regulated investment companies (RICs) to report their income, gains, losses, deductions, and credits. This form is essential for RICs to comply with U.S. tax laws and to ensure they meet the requirements for special tax treatment under the Internal Revenue Code. By filing this form, RICs can avoid double taxation on income that is distributed to shareholders, provided they adhere to the distribution requirements set by the IRS.

Steps to complete the Form 1120 RIC U S Income Tax Return For Regulated Investment Companies

Completing the Form 1120 RIC involves several key steps:

- Gather all necessary financial documents, including income statements, balance sheets, and records of distributions made to shareholders.

- Fill out the form accurately, ensuring that all required fields are completed, including income, deductions, and credits.

- Attach any necessary schedules and additional documentation as required by the IRS.

- Review the completed form for accuracy and completeness to avoid potential errors that could lead to penalties.

- Submit the form by the specified deadline, ensuring that you follow the appropriate submission methods.

Filing Deadlines / Important Dates

It is crucial for RICs to be aware of the filing deadlines associated with the Form 1120 RIC. Generally, the form is due on the fifteenth day of the third month following the end of the RIC's tax year. For RICs operating on a calendar year basis, this means the form is typically due by March 15. Extensions may be available, but it is important to file for an extension before the original deadline to avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

RICs have several options for submitting the Form 1120 RIC. They can file electronically through the IRS e-file system, which is often the fastest and most efficient method. Alternatively, RICs may choose to mail the completed form to the appropriate IRS address based on their location. In-person submission is generally not available for tax returns. It is important to follow the IRS guidelines for each submission method to ensure proper processing.

Legal use of the Form 1120 RIC U S Income Tax Return For Regulated Investment Companies

The legal use of Form 1120 RIC is essential for compliance with federal tax regulations. RICs must ensure that they meet specific criteria to qualify for the tax benefits associated with this form. This includes adhering to the distribution requirements and maintaining the necessary structure as defined by the IRS. Failure to comply with these regulations can result in penalties or loss of RIC status, which would subject the company to standard corporate taxation.

Key elements of the Form 1120 RIC U S Income Tax Return For Regulated Investment Companies

Key elements of the Form 1120 RIC include sections for reporting income, deductions, and tax credits. The form also requires information on the RIC's distributions to shareholders, which is critical for determining eligibility for tax benefits. Additionally, RICs must provide details about their investment activities and any relevant schedules that support their reported figures. Accurate reporting of these elements is vital for compliance and for minimizing tax liabilities.

Quick guide on how to complete 2015 form 1120 ric us income tax return for regulated investment companies

Discover the easiest method to complete and endorse your Form 1120 RIC U S Income Tax Return For Regulated Investment Companies

Are you still spending time creating your official paperwork on physical copies instead of doing it digitally? airSlate SignNow offers a superior approach to finalize and endorse your Form 1120 RIC U S Income Tax Return For Regulated Investment Companies and related forms for public services. Our advanced electronic signature solution equips you with everything necessary to handle documents efficiently while adhering to official standards - robust PDF editing, managing, securing, signing, and sharing tools are all available within a user-friendly interface.

Only a few steps are necessary to fill out and endorse your Form 1120 RIC U S Income Tax Return For Regulated Investment Companies:

- Insert the editable template into the editor using the Get Form button.

- Verify what details you need to include in your Form 1120 RIC U S Income Tax Return For Regulated Investment Companies.

- Move between the fields using the Next button to ensure you don’t overlook anything.

- Utilize Text, Check, and Cross tools to fill in the blanks with your information.

- Update the content with Text boxes or Images from the top toolbar.

- Highlight important sections or Blackout areas that are no longer relevant.

- Select Sign to create a legally binding electronic signature using any method you choose.

- Insert the Date beside your signature and finish your task with the Done button.

Store your completed Form 1120 RIC U S Income Tax Return For Regulated Investment Companies in the Documents folder within your account, download it, or transfer it to your preferred cloud storage. Our solution also supports easy file sharing. There’s no need to print your forms when you have to submit them to the relevant public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Try it out today!

Create this form in 5 minutes or less

Find and fill out the correct 2015 form 1120 ric us income tax return for regulated investment companies

Create this form in 5 minutes!

How to create an eSignature for the 2015 form 1120 ric us income tax return for regulated investment companies

How to create an electronic signature for your 2015 Form 1120 Ric Us Income Tax Return For Regulated Investment Companies online

How to make an electronic signature for the 2015 Form 1120 Ric Us Income Tax Return For Regulated Investment Companies in Google Chrome

How to create an electronic signature for signing the 2015 Form 1120 Ric Us Income Tax Return For Regulated Investment Companies in Gmail

How to generate an electronic signature for the 2015 Form 1120 Ric Us Income Tax Return For Regulated Investment Companies right from your smart phone

How to generate an eSignature for the 2015 Form 1120 Ric Us Income Tax Return For Regulated Investment Companies on iOS

How to generate an electronic signature for the 2015 Form 1120 Ric Us Income Tax Return For Regulated Investment Companies on Android OS

People also ask

-

What is the Form 1120 RIC U S Income Tax Return For Regulated Investment Companies?

The Form 1120 RIC U S Income Tax Return For Regulated Investment Companies is a tax return specifically designed for regulated investment companies (RICs). It allows these entities to report their income, gains, losses, deductions, and the tax payments made throughout the year. Understanding this form is essential for compliance and accurate filing.

-

How can airSlate SignNow help with filing the Form 1120 RIC U S Income Tax Return?

airSlate SignNow simplifies the process of filing the Form 1120 RIC U S Income Tax Return For Regulated Investment Companies by providing a user-friendly platform for e-signing and sending documents. Businesses can efficiently prepare their forms, ensure they're signed, and submit them on time with minimal hassle.

-

What features does airSlate SignNow offer for eSigning tax forms like Form 1120 RIC?

airSlate SignNow offers a variety of features tailored for eSigning tax documents, including customizable templates, audit trails, and secure cloud storage. These features ensure that your Form 1120 RIC U S Income Tax Return For Regulated Investment Companies is not only easy to sign but also compliant with legal requirements.

-

Is airSlate SignNow cost-effective for businesses needing to file Form 1120 RIC?

Yes, airSlate SignNow is a cost-effective solution for businesses looking to file the Form 1120 RIC U S Income Tax Return For Regulated Investment Companies. The platform offers flexible pricing plans that can accommodate the needs of organizations of all sizes, allowing for signNow savings in time and resources.

-

Can I integrate airSlate SignNow with accounting software for filing Form 1120 RIC?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, making it easier to manage financial documents. This integration ensures that your Form 1120 RIC U S Income Tax Return For Regulated Investment Companies aligns with your accounting data, streamlining the entire filing process.

-

What are the benefits of using airSlate SignNow for tax return documents?

Using airSlate SignNow for tax return documents like the Form 1120 RIC U S Income Tax Return For Regulated Investment Companies provides numerous benefits, including improved efficiency, enhanced security, and better compliance. The platform ensures that all signatures are legally binding and that your documents are stored securely in the cloud.

-

How does airSlate SignNow ensure the security of my Form 1120 RIC submissions?

airSlate SignNow prioritizes the security of your documents by employing advanced encryption technologies and robust access controls. This ensures that the Form 1120 RIC U S Income Tax Return For Regulated Investment Companies and other sensitive files are secure from unauthorized access and data bsignNowes.

Get more for Form 1120 RIC U S Income Tax Return For Regulated Investment Companies

- Tvp charity family fun run sponsorship form twyfordvillagepartnership co

- Texas dps temporary paper id texas dps temporary paper id form

- Weekly independent reading log non fiction edgewaterschools form

- Hospital morgue release form

- 04 gyn asu discharge order form 9 09 3doc chsbuffalo

- 0001 800 222 2062 nationalbenefitlife com form

- Legally exempt child care provider training record form

- Publication 4263 a rev november form

Find out other Form 1120 RIC U S Income Tax Return For Regulated Investment Companies

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document