PDF Form 1120 RIC Internal Revenue Service 2021

What is the PDF Form 1120 RIC Internal Revenue Service

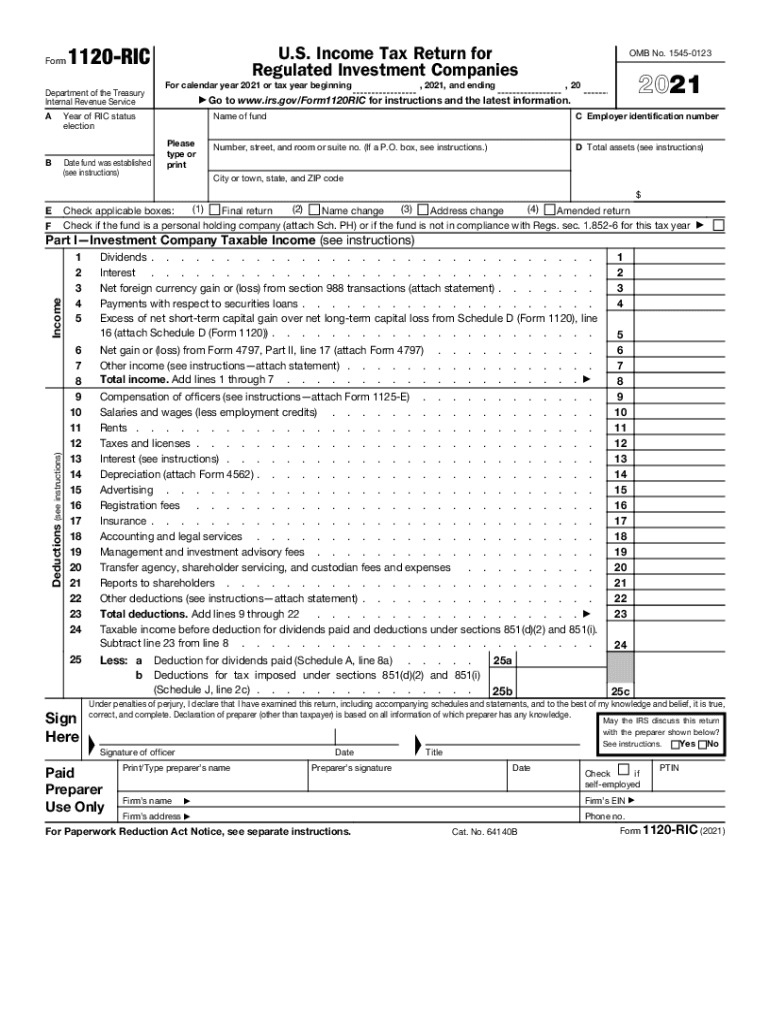

The PDF Form 1120 RIC is a tax form used by registered investment companies (RICs) to report their income, gains, losses, deductions, and credits to the Internal Revenue Service (IRS). This form is essential for RICs to comply with federal tax regulations and to maintain their status as investment companies under the Internal Revenue Code. The form captures various financial details, including the company's income from investments and any distributions made to shareholders. Proper completion of the form ensures that RICs can benefit from favorable tax treatment, provided they meet specific criteria outlined by the IRS.

Steps to complete the PDF Form 1120 RIC Internal Revenue Service

Completing the PDF Form 1120 RIC involves several steps to ensure accuracy and compliance with IRS regulations. Here are the key steps:

- Gather necessary financial information, including income statements, balance sheets, and details of distributions.

- Begin filling out the form by entering the company's name, address, and employer identification number (EIN).

- Report income from various sources, including dividends, interest, and capital gains, in the designated sections.

- Detail any deductions that the RIC is eligible for, such as operating expenses and management fees.

- Calculate the taxable income and any tax liability, ensuring all figures are accurate and supported by documentation.

- Review the completed form for errors or omissions before submission.

Legal use of the PDF Form 1120 RIC Internal Revenue Service

The legal use of the PDF Form 1120 RIC is crucial for registered investment companies to maintain their tax-exempt status. To be considered valid, the form must be completed accurately and submitted by the appropriate deadlines. The IRS requires RICs to adhere to specific regulations regarding income distribution and taxation. Failure to comply with these regulations can result in penalties, including loss of RIC status and increased tax liabilities. Therefore, it is essential for RICs to ensure that their forms are not only complete but also in compliance with all applicable laws and regulations.

Filing Deadlines / Important Dates

Filing deadlines for the PDF Form 1120 RIC are critical for compliance. Generally, the form must be submitted by the fifteenth day of the third month following the end of the RIC's tax year. For RICs operating on a calendar year basis, this typically means the deadline is March 15. If the deadline falls on a weekend or holiday, the due date is extended to the next business day. It is important for RICs to mark these dates on their calendars to avoid penalties for late filing.

Required Documents

When preparing to complete the PDF Form 1120 RIC, several documents are required to ensure accurate reporting. These documents typically include:

- Financial statements, including balance sheets and income statements.

- Records of all income sources, such as dividends, interest, and capital gains.

- Documentation of expenses, including management fees and other operational costs.

- Details of distributions made to shareholders during the tax year.

Having these documents readily available will facilitate a smoother completion process and help ensure compliance with IRS regulations.

Form Submission Methods (Online / Mail / In-Person)

The PDF Form 1120 RIC can be submitted through various methods, providing flexibility for registered investment companies. RICs may choose to file electronically using IRS e-file services, which can expedite processing times and reduce the likelihood of errors. Alternatively, the form can be printed and mailed to the appropriate IRS address, ensuring that it is postmarked by the filing deadline. In-person submissions are generally not common for this form but may be possible in certain circumstances. It is essential for RICs to choose the method that best suits their operational needs while ensuring compliance with IRS requirements.

Quick guide on how to complete pdf 2021 form 1120 ric internal revenue service

Effortlessly Prepare PDF Form 1120 RIC Internal Revenue Service on Any Device

Digital document management has gained traction among organizations and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, adjust, and eSign your documents swiftly without complications. Manage PDF Form 1120 RIC Internal Revenue Service on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

Easily Edit and eSign PDF Form 1120 RIC Internal Revenue Service Without Difficulty

- Locate PDF Form 1120 RIC Internal Revenue Service and then click Get Form to commence.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or conceal sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature with the Sign tool, which takes just seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to record your alterations.

- Choose how you wish to send your form: via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choosing. Modify and eSign PDF Form 1120 RIC Internal Revenue Service while ensuring excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pdf 2021 form 1120 ric internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the pdf 2021 form 1120 ric internal revenue service

The way to generate an e-signature for a PDF document in the online mode

The way to generate an e-signature for a PDF document in Chrome

How to generate an e-signature for putting it on PDFs in Gmail

The best way to generate an e-signature from your mobile device

The way to create an e-signature for a PDF document on iOS devices

The best way to generate an e-signature for a PDF file on Android devices

People also ask

-

What is a registered investment company?

A registered investment company is an investment vehicle that has registered with the U.S. Securities and Exchange Commission (SEC) to offer shares to the public. This type of company includes mutual funds, closed-end funds, and exchange-traded funds (ETFs) that pool money from investors to invest in diversified portfolios. By being a registered investment company, they adhere to strict regulatory standards ensuring transparency and investor protection.

-

How does airSlate SignNow benefit registered investment companies?

airSlate SignNow provides registered investment companies with an efficient and secure way to send and eSign documents seamlessly. The platform allows these companies to streamline their paperwork processes, ensuring compliance with regulatory requirements while saving time and reducing operational costs. With user-friendly features, registered investment companies can improve their client interactions and overall service delivery.

-

What features does airSlate SignNow offer for registered investment companies?

airSlate SignNow offers features such as customizable templates, automated workflows, and advanced security measures tailored for registered investment companies. These features facilitate the smooth generation and signing of critical documents like contracts and compliance forms. Additionally, the built-in audit trail helps maintain accountability and transparency, essential for the regulatory environment of registered investment companies.

-

Can airSlate SignNow integrate with my existing systems as a registered investment company?

Yes, airSlate SignNow can seamlessly integrate with various CRM and document management systems typically used by registered investment companies. Integration capabilities allow for automated workflows, reducing manual entry and potential errors. This ensures that your team can work efficiently without disrupting current operations.

-

Is airSlate SignNow cost-effective for registered investment companies?

Absolutely. airSlate SignNow offers competitive pricing tailored for registered investment companies, making it a cost-effective solution for their eSigning needs. The platform provides various plans to suit diverse budgets, ensuring you only pay for the features that benefit your firm the most, ultimately leading to signNow cost savings.

-

What security measures are in place for registered investment companies using airSlate SignNow?

airSlate SignNow employs industry-leading security protocols, including end-to-end encryption, ensuring the safety of sensitive documents for registered investment companies. Compliance with standards such as GDPR and HIPAA enhances trust, while robust user authentication methods can help prevent unauthorized access. Ultimately, airSlate SignNow prioritizes the confidentiality and integrity of data.

-

How can airSlate SignNow help improve customer satisfaction for registered investment companies?

By utilizing airSlate SignNow, registered investment companies can signNowly enhance their client experience through faster document processing and a more convenient eSignature process. Quick turnaround times on documents allow for timely responses to client needs, fostering trust and satisfaction. Improved customer engagement contributes positively to the overall reputation of registered investment companies.

Get more for PDF Form 1120 RIC Internal Revenue Service

- Non marital cohabitation living together agreement delaware form

- Paternity law and procedure handbook delaware form

- Bill of sale in connection with sale of business by individual or corporate seller delaware form

- Motion interim relief form

- Motion interim relief 497302224 form

- De child support form

- Delaware custody form

- Motion form basic delaware

Find out other PDF Form 1120 RIC Internal Revenue Service

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy