1120 Tax Form 2023

What is the 1120 Tax Form

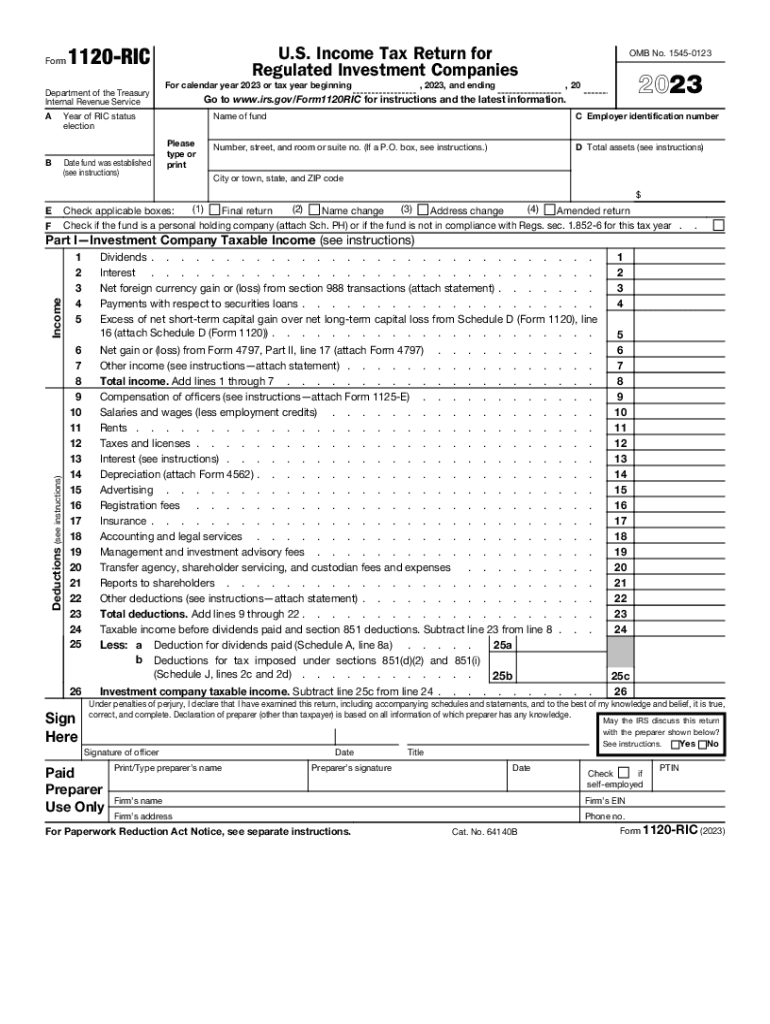

The 1120 tax form is a crucial document used by corporations to report their income, gains, losses, deductions, and credits to the Internal Revenue Service (IRS). This form is essential for corporations operating in the United States, as it provides a comprehensive overview of their financial performance over the tax year. The 1120 form is specifically designed for C corporations, which are separate legal entities from their owners, and it allows them to calculate their corporate tax liability accurately.

Steps to Complete the 1120 Tax Form

Completing the 1120 tax form involves several key steps to ensure accuracy and compliance with IRS regulations. First, gather all necessary financial documents, including income statements, balance sheets, and any relevant deductions. Next, fill out the form by entering the corporation's income, deductions, and credits in the appropriate sections. Pay close attention to the details, as errors can lead to penalties. After completing the form, review it thoroughly to ensure all information is accurate before submission.

Filing Deadlines / Important Dates

The filing deadline for the 1120 tax form is typically the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is due by April 15. If the deadline falls on a weekend or holiday, it is extended to the next business day. Corporations can apply for an automatic six-month extension, but they must file Form 7004 to request this extension before the original due date.

Required Documents

To complete the 1120 tax form accurately, several documents are required. These include financial statements such as income statements and balance sheets, records of all income received, and documentation of any deductions or credits claimed. Additionally, corporations should have records of any dividends paid to shareholders and details of any capital gains or losses. Having these documents organized and readily available simplifies the filing process and helps ensure compliance with IRS regulations.

IRS Guidelines

The IRS provides specific guidelines for completing and filing the 1120 tax form. These guidelines include instructions on how to report various types of income, allowable deductions, and the calculation of tax credits. Corporations must adhere to these guidelines to avoid errors that could result in audits or penalties. It is advisable to consult the IRS instructions for Form 1120 or seek professional tax advice to ensure compliance with all regulations.

Penalties for Non-Compliance

Failure to file the 1120 tax form on time or inaccuracies in the submitted information can result in significant penalties. The IRS may impose a penalty for late filing, which is typically a percentage of the unpaid tax amount for each month the return is late. Additionally, inaccuracies can lead to further penalties and interest on any unpaid taxes. Corporations should prioritize timely and accurate filing to avoid these financial repercussions.

Quick guide on how to complete 1120 tax form

Complete 1120 Tax Form effortlessly on any device

Online document management has become increasingly prevalent among businesses and individuals. It offers an ideal sustainable alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow supplies you with all the tools you need to create, edit, and eSign your documents swiftly without delays. Handle 1120 Tax Form on any device using the airSlate SignNow Android or iOS applications and simplify any document-related workflow today.

How to edit and eSign 1120 Tax Form easily

- Locate 1120 Tax Form and click Get Form to initiate.

- Utilize the tools we offer to complete your document.

- Select important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you would like to send your form, whether by email, text message (SMS), an invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, laborious form searches, or mistakes that require new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign 1120 Tax Form and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1120 tax form

Create this form in 5 minutes!

How to create an eSignature for the 1120 tax form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2012 ric feature in airSlate SignNow?

The 2012 ric feature in airSlate SignNow refers to our robust document signing capabilities, which allow users to send and eSign documents seamlessly. This functionality is designed to enhance efficiency in handling contracts and agreements, meeting the specific needs of businesses looking for reliability.

-

How much does it cost to use airSlate SignNow with the 2012 ric functionality?

AirSlate SignNow offers competitive pricing plans that include the 2012 ric features. Customers can choose from several subscription tiers based on their requirements, ensuring they get the best value while enjoying the advantages of easy document management and electronic signatures.

-

What are the main benefits of using the 2012 ric capabilities of airSlate SignNow?

The primary benefits of the 2012 ric capabilities include improved workflow efficiency, reduced turnaround time for document execution, and enhanced security for sensitive information. These advantages empower businesses to streamline their processes while maintaining compliance.

-

Can I integrate airSlate SignNow with other tools using the 2012 ric function?

Yes, airSlate SignNow supports various integrations that leverage the 2012 ric functionality, allowing users to connect with popular tools like CRM systems, project management software, and more. This interoperability helps businesses enhance their workflows and improve overall productivity.

-

Is there a mobile app for using the 2012 ric features of airSlate SignNow?

Absolutely! AirSlate SignNow offers a mobile app that allows users to utilize the 2012 ric features on the go. This ensures that you can send, sign, and manage documents from your mobile device, providing flexibility and convenience.

-

How secure is the 2012 ric document signing process in airSlate SignNow?

The 2012 ric document signing process in airSlate SignNow is highly secure, employing industry-standard encryption and compliance measures. Our platform is designed to keep your sensitive data safe, giving you peace of mind while conducting important business transactions.

-

What types of documents can I sign using the 2012 ric features?

The 2012 ric features of airSlate SignNow can be used to sign a variety of document types, including contracts, agreements, and forms. This versatility makes it suitable for various industries and business needs, enabling users to handle diverse documentation efficiently.

Get more for 1120 Tax Form

- Novo nordisk home monitoring diary form

- I scream for ice cream lactase persistence in humans form

- Market research contract template form

- Form bgs do 21a

- Beans flour production pdf form

- Haccp product description example form

- Employment application please complete entire togos form

- Security agreement for direct loans including motor vehicles denvergov form

Find out other 1120 Tax Form

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF

- Can I Sign Michigan Banking PDF

- Help Me With Sign Minnesota Banking Word

- How To Sign Missouri Banking Form

- Help Me With Sign New Jersey Banking PDF

- How Can I Sign New Jersey Banking Document

- Help Me With Sign New Mexico Banking Word

- Help Me With Sign New Mexico Banking Document