149 SalesUse Tax Exemption Certificate Kotulas 2024

What is the 149 SalesUse Tax Exemption Certificate Kotulas

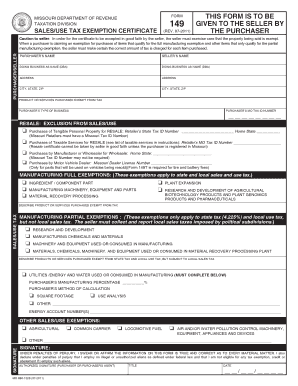

The 149 SalesUse Tax Exemption Certificate Kotulas is a specific form used in the United States that allows businesses to purchase goods without paying sales tax. This exemption is typically granted to organizations that qualify under state tax laws, such as non-profit entities or government agencies. By using this certificate, eligible buyers can save on costs associated with sales tax, thereby enhancing their purchasing power.

How to use the 149 SalesUse Tax Exemption Certificate Kotulas

To utilize the 149 SalesUse Tax Exemption Certificate Kotulas, the buyer must present the completed form to the seller at the time of purchase. This certificate serves as proof of the buyer's tax-exempt status. It is essential to ensure that the form is filled out accurately, including all required information, to avoid any complications or disputes during the transaction.

Steps to complete the 149 SalesUse Tax Exemption Certificate Kotulas

Completing the 149 SalesUse Tax Exemption Certificate Kotulas involves a few straightforward steps:

- Obtain the form from a reliable source, ensuring it is the most current version.

- Fill in the required fields, including the buyer's name, address, and the reason for the tax exemption.

- Include the seller's information and the specific items being purchased.

- Sign and date the certificate to validate it.

Legal use of the 149 SalesUse Tax Exemption Certificate Kotulas

The legal use of the 149 SalesUse Tax Exemption Certificate Kotulas is governed by state tax regulations. It is crucial for users to understand the specific eligibility criteria in their state to ensure compliance. Misuse of the certificate, such as using it for ineligible purchases, can lead to penalties, including fines or back taxes owed.

Eligibility Criteria

Eligibility for using the 149 SalesUse Tax Exemption Certificate Kotulas typically includes being a non-profit organization, a government entity, or a business that qualifies under specific state guidelines. Each state may have different requirements, so it is important to verify the criteria applicable in your jurisdiction. Documentation proving your exempt status may also be required.

Examples of using the 149 SalesUse Tax Exemption Certificate Kotulas

Common examples of using the 149 SalesUse Tax Exemption Certificate Kotulas include:

- A non-profit organization purchasing office supplies for community programs.

- A government agency acquiring equipment for public services.

- A school district buying educational materials for students.

Form Submission Methods (Online / Mail / In-Person)

The 149 SalesUse Tax Exemption Certificate Kotulas can typically be submitted in various ways, depending on the seller's policies. Common submission methods include:

- Presenting the completed form in person at the point of sale.

- Sending the form via email if the seller accepts electronic submissions.

- Mailing the certificate to the seller if required.

Create this form in 5 minutes or less

Find and fill out the correct 149 salesuse tax exemption certificate kotulas

Create this form in 5 minutes!

How to create an eSignature for the 149 salesuse tax exemption certificate kotulas

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 149 SalesUse Tax Exemption Certificate Kotulas?

The 149 SalesUse Tax Exemption Certificate Kotulas is a document that allows eligible businesses to make tax-exempt purchases. This certificate is essential for companies looking to save on sales tax when buying goods for resale or other qualifying purposes. Understanding how to properly use this certificate can lead to signNow savings.

-

How can airSlate SignNow help with the 149 SalesUse Tax Exemption Certificate Kotulas?

airSlate SignNow provides a streamlined platform for businesses to create, send, and eSign the 149 SalesUse Tax Exemption Certificate Kotulas. With its user-friendly interface, you can easily manage your documents and ensure compliance with tax regulations. This simplifies the process of obtaining and using the exemption certificate.

-

What are the pricing options for using airSlate SignNow for the 149 SalesUse Tax Exemption Certificate Kotulas?

airSlate SignNow offers various pricing plans tailored to meet the needs of different businesses. Whether you are a small business or a large enterprise, you can find a plan that fits your budget while allowing you to efficiently manage the 149 SalesUse Tax Exemption Certificate Kotulas. Check our website for detailed pricing information.

-

What features does airSlate SignNow offer for managing the 149 SalesUse Tax Exemption Certificate Kotulas?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all of which are beneficial for managing the 149 SalesUse Tax Exemption Certificate Kotulas. These features enhance efficiency and ensure that your documents are processed quickly and securely. Additionally, you can integrate with other tools to streamline your workflow.

-

What are the benefits of using airSlate SignNow for the 149 SalesUse Tax Exemption Certificate Kotulas?

Using airSlate SignNow for the 149 SalesUse Tax Exemption Certificate Kotulas offers numerous benefits, including time savings and improved accuracy. The platform reduces the risk of errors associated with manual processing and helps you maintain compliance with tax laws. Furthermore, it enhances collaboration among team members when handling important documents.

-

Can I integrate airSlate SignNow with other software for the 149 SalesUse Tax Exemption Certificate Kotulas?

Yes, airSlate SignNow supports integration with various software applications, making it easy to manage the 149 SalesUse Tax Exemption Certificate Kotulas alongside your existing tools. This integration capability allows for seamless data transfer and improved workflow efficiency. Check our integration options to find the best fit for your business.

-

Is airSlate SignNow secure for handling the 149 SalesUse Tax Exemption Certificate Kotulas?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that your 149 SalesUse Tax Exemption Certificate Kotulas and other sensitive documents are protected. The platform employs advanced encryption and security protocols to safeguard your data. You can trust that your information is safe while using our services.

Get more for 149 SalesUse Tax Exemption Certificate Kotulas

- I5 delivery address line postal explorer uspscom form

- In the county court of form

- Enclosed herewith please find the original complaint for claim and delivery which we form

- Enclosed herewith please find a copy of the order setting a hearing on the original form

- State of idaho idaho legislature form

- Enclosed herewith please find a letter which i received from the attorney representing form

- Enclosed please find a letter which i received today from the attorney representing form

- Health care info for your state ampamp zip code legalconsumercom form

Find out other 149 SalesUse Tax Exemption Certificate Kotulas

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer