Ftb 540 Form 2024

What is the Ftb 540 Form

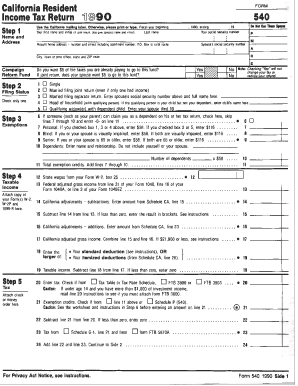

The Ftb 540 Form is a California state income tax return form used by residents to report their income and calculate their tax liability. This form is essential for individuals who earn income in California and need to comply with state tax regulations. It is designed to capture various income sources, deductions, and credits that may apply to the taxpayer's situation. By accurately completing the Ftb 540 Form, individuals ensure they fulfill their legal obligations while potentially maximizing their tax refunds.

How to obtain the Ftb 540 Form

Individuals can obtain the Ftb 540 Form through several methods. The most straightforward way is to visit the California Franchise Tax Board's official website, where the form is available for download in PDF format. Additionally, taxpayers can request a physical copy by contacting the Franchise Tax Board directly. Many local libraries and post offices also provide printed copies of the form. It is advisable to ensure that the most current version of the form is used to avoid any compliance issues.

Steps to complete the Ftb 540 Form

Completing the Ftb 540 Form involves several key steps:

- Gather all necessary documentation, including W-2s, 1099s, and other income statements.

- Fill out personal information, such as your name, address, and Social Security number.

- Report your total income from all sources on the form.

- Claim any applicable deductions and credits to reduce your taxable income.

- Calculate your total tax liability based on the income reported.

- Review the form for accuracy and completeness before submission.

Following these steps ensures that the form is filled out correctly, reducing the risk of errors that could lead to penalties or delays in processing.

Key elements of the Ftb 540 Form

The Ftb 540 Form includes several key elements that are crucial for accurate tax reporting. These elements consist of:

- Personal Information: This section requires basic details such as name, address, and Social Security number.

- Income Reporting: Taxpayers must report all sources of income, including wages, interest, and dividends.

- Deductions and Credits: This section allows taxpayers to claim deductions for expenses like mortgage interest and medical costs, as well as tax credits that reduce overall tax liability.

- Tax Calculation: The form includes a section for calculating the total tax owed based on the reported income and applicable deductions.

Filing Deadlines / Important Dates

Filing deadlines for the Ftb 540 Form are critical to avoid penalties. Typically, the deadline for filing the form is April 15 of each year. If this date falls on a weekend or holiday, the deadline is extended to the next business day. Taxpayers may also request an extension to file, but any taxes owed must still be paid by the original deadline to avoid interest and penalties. It is important to stay informed about these dates to ensure timely compliance.

Form Submission Methods

The Ftb 540 Form can be submitted through various methods, providing flexibility for taxpayers. The available submission methods include:

- Online Submission: Taxpayers can file their Ftb 540 Form electronically using approved tax software, which often simplifies the process and reduces errors.

- Mail Submission: Individuals may choose to print the completed form and mail it to the appropriate address provided by the California Franchise Tax Board.

- In-Person Submission: Some taxpayers may opt to deliver their forms in person at designated Franchise Tax Board offices, which can provide immediate confirmation of receipt.

Create this form in 5 minutes or less

Find and fill out the correct ftb 540 form

Create this form in 5 minutes!

How to create an eSignature for the ftb 540 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ftb 540 Form?

The Ftb 540 Form is a California state income tax return form used by residents to report their income and calculate their tax liability. It is essential for individuals to accurately complete this form to ensure compliance with state tax laws. Using airSlate SignNow, you can easily eSign and send your Ftb 540 Form securely.

-

How can airSlate SignNow help with the Ftb 540 Form?

airSlate SignNow simplifies the process of completing and submitting the Ftb 540 Form by allowing users to eSign documents electronically. This not only saves time but also enhances the security of your sensitive information. With our user-friendly interface, you can manage your tax documents efficiently.

-

Is there a cost associated with using airSlate SignNow for the Ftb 540 Form?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our plans are designed to be cost-effective, ensuring that you can manage your Ftb 540 Form and other documents without breaking the bank. You can choose a plan that best fits your requirements.

-

What features does airSlate SignNow offer for the Ftb 540 Form?

airSlate SignNow provides features such as electronic signatures, document templates, and secure cloud storage, all of which are beneficial for managing the Ftb 540 Form. These features streamline the process, making it easier to fill out and submit your tax documents. Additionally, you can track the status of your documents in real-time.

-

Can I integrate airSlate SignNow with other software for the Ftb 540 Form?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to seamlessly manage your Ftb 540 Form alongside other tools you use. This integration capability enhances your workflow and ensures that all your documents are in one place, making tax season less stressful.

-

What are the benefits of using airSlate SignNow for the Ftb 540 Form?

Using airSlate SignNow for the Ftb 540 Form provides numerous benefits, including increased efficiency, enhanced security, and reduced paper usage. By eSigning your tax documents, you can expedite the submission process and minimize the risk of errors. Our platform is designed to make your tax filing experience as smooth as possible.

-

Is airSlate SignNow secure for handling the Ftb 540 Form?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your Ftb 540 Form and other documents are protected. We use advanced encryption and secure storage solutions to safeguard your sensitive information. You can trust that your data is safe while using our platform.

Get more for Ftb 540 Form

- Dependents in column b enter ampquot dor ms form

- Nmra form 902 rev nmra

- 6 41 l form eighteen month permanency attachment

- Pindot series silhouette order form mobility base invacare

- Herbert wertheim college of engineering egn 4912 syllabus and registration form

- Federal law enforcement training center graduation speech form

- Nationwide distributionrollover application form national

- Written confined space entry program form

Find out other Ftb 540 Form

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now