Form 8689 2019

What is the Form 8689

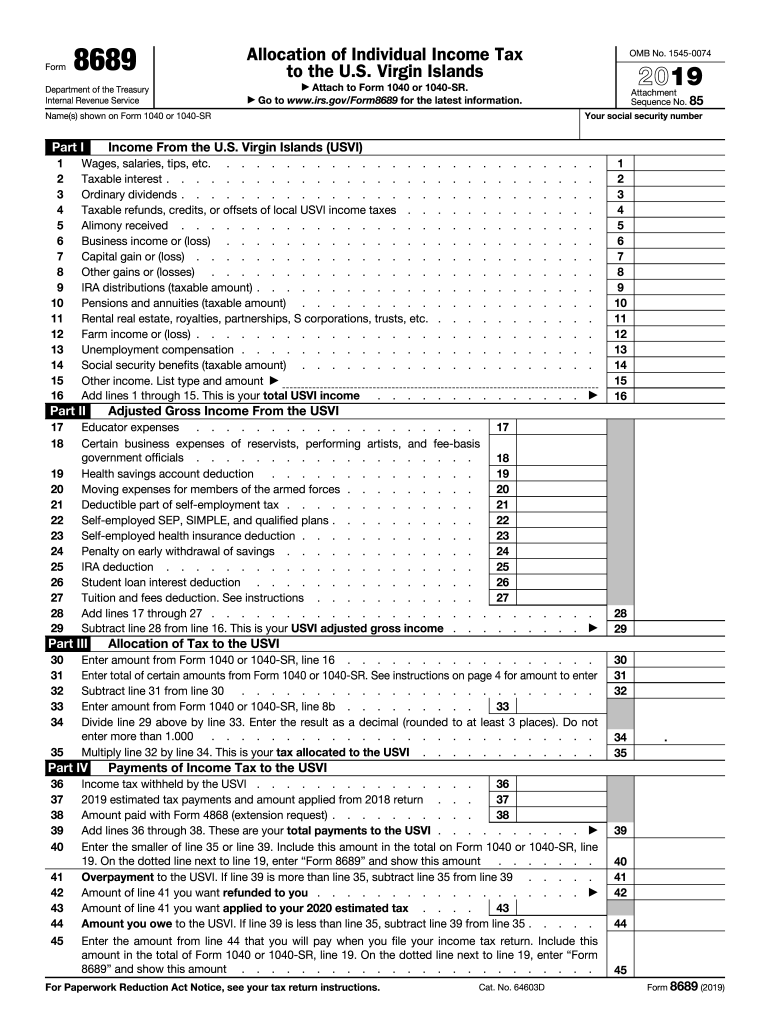

The Form 8689 is a tax form used by individuals who are residents of the U.S. Virgin Islands or Puerto Rico to claim a refund of overpaid taxes. Specifically, it is utilized to calculate the amount of tax owed or the refund due for the tax year. This form is particularly relevant for those who have income from sources outside the U.S. Virgin Islands or Puerto Rico and need to reconcile their tax obligations with the Internal Revenue Service (IRS). Understanding the purpose and function of the Form 8689 is crucial for ensuring compliance with tax regulations.

How to use the Form 8689

Using the Form 8689 involves several steps to ensure accurate completion and submission. First, taxpayers must gather all necessary financial documents, including income statements and previous tax returns. Next, individuals should fill out the form with accurate information regarding their income, deductions, and credits. It is essential to follow the instructions provided by the IRS closely to avoid errors. Once completed, the form can be submitted electronically or via mail, depending on the taxpayer's preference and eligibility. Utilizing digital tools can simplify this process, making it easier to track and manage submissions.

Steps to complete the Form 8689

Completing the Form 8689 requires careful attention to detail. Here are the steps to follow:

- Gather all relevant financial documents, including W-2s and 1099s.

- Download the latest version of the Form 8689 from the IRS website or a trusted source.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income, including wages, dividends, and any other sources.

- Calculate your deductions and credits as applicable.

- Determine the total tax owed or refund due based on the calculations.

- Review the completed form for accuracy before submission.

Legal use of the Form 8689

The legal use of the Form 8689 is governed by IRS regulations, ensuring that the form is used correctly to claim refunds or report taxes owed. To be considered valid, the form must be filled out accurately and submitted within the designated filing period. Electronic signatures are acceptable, provided they comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act. It is important to retain copies of the submitted form and any supporting documents for your records, as these may be required in case of an audit or review by the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8689 are crucial for compliance. Typically, the form must be filed by the tax deadline, which is usually April 15 for most taxpayers. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day. Taxpayers should also be aware of any extensions that may apply, particularly for those living in U.S. territories. Keeping track of these important dates can help avoid penalties and ensure timely processing of refunds or payments.

Required Documents

To complete the Form 8689 accurately, several documents are required. These include:

- W-2 forms from employers detailing wages and tax withheld.

- 1099 forms for any additional income sources, such as freelance work or investments.

- Previous tax returns for reference and consistency in reporting.

- Documentation for any deductions or credits claimed, such as receipts or statements.

Having these documents readily available can streamline the process and reduce the likelihood of errors.

Quick guide on how to complete f8689 form 8689 department of the treasury internal

Easily set up Form 8689 on any device

The management of documents online has become increasingly favored by businesses and individuals. It offers a fantastic eco-friendly option to conventional printed and signed documents, as you can obtain the necessary form and securely save it online. airSlate SignNow provides all the resources you need to generate, modify, and electronically sign your documents swiftly without interruptions. Handle Form 8689 on any device with the airSlate SignNow apps for Android or iOS and simplify any document-related process today.

The simplest way to alter and electronically sign Form 8689 effortlessly

- Find Form 8689 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or errors that necessitate printing new copies of documents. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form 8689 and ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct f8689 form 8689 department of the treasury internal

Create this form in 5 minutes!

How to create an eSignature for the f8689 form 8689 department of the treasury internal

How to generate an electronic signature for the F8689 Form 8689 Department Of The Treasury Internal online

How to generate an electronic signature for your F8689 Form 8689 Department Of The Treasury Internal in Chrome

How to create an electronic signature for signing the F8689 Form 8689 Department Of The Treasury Internal in Gmail

How to make an electronic signature for the F8689 Form 8689 Department Of The Treasury Internal right from your smart phone

How to make an electronic signature for the F8689 Form 8689 Department Of The Treasury Internal on iOS devices

How to generate an electronic signature for the F8689 Form 8689 Department Of The Treasury Internal on Android OS

People also ask

-

What is the form 8689 2016, and why is it important?

The form 8689 2016 is used to calculate the amount of tax withheld from payments for certain types of transactions. Understanding how to fill out this form correctly is essential for ensuring compliance with IRS regulations and facilitating accurate tax reporting.

-

How can airSlate SignNow help with the form 8689 2016?

airSlate SignNow provides an efficient platform to eSign and send the form 8689 2016 securely. With our easy-to-use interface, users can complete and sign the form electronically, streamlining the submission process while maintaining compliance.

-

Is there a cost associated with using airSlate SignNow for the form 8689 2016?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs. Our plans are cost-effective, enabling users to complete the form 8689 2016 and other documents without breaking the bank.

-

What features does airSlate SignNow offer for handling the form 8689 2016?

airSlate SignNow includes features such as custom fields, templates, and real-time tracking for managing the form 8689 2016. These functionalities make it easier to organize, send, and monitor document workflows effectively.

-

Are there integrations available for airSlate SignNow when working with the form 8689 2016?

Absolutely! airSlate SignNow integrates seamlessly with various third-party applications and services to enhance your document management experience with the form 8689 2016. This ensures that you can work efficiently with your existing tools.

-

Can I create a template for the form 8689 2016 within airSlate SignNow?

Yes, you can easily create a reusable template for the form 8689 2016 in airSlate SignNow. This feature allows you to save time and maintain consistency whenever you need to complete this form.

-

How secure is airSlate SignNow when handling sensitive documents like the form 8689 2016?

Security is a top priority for airSlate SignNow. We employ advanced encryption and compliance measures to protect sensitive information contained in documents like the form 8689 2016, ensuring your data is safe.

Get more for Form 8689

Find out other Form 8689

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form