Form 8689pdffillercom 2016

What is the Form 8689pdffillercom

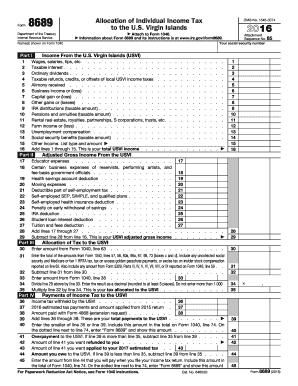

The Form 8689pdffillercom is a specific document used for tax purposes, particularly for individuals who need to claim a refund for overpayment of taxes. This form is essential for taxpayers who have made estimated tax payments throughout the year and are seeking to reconcile those payments with their actual tax liability. Understanding the purpose of this form is crucial for ensuring accurate tax filings and avoiding potential penalties.

How to use the Form 8689pdffillercom

Using the Form 8689pdffillercom involves several key steps. First, gather all necessary financial documents, including income statements and previous tax returns. Next, fill out the form accurately, ensuring that all sections are completed. After filling out the form, review it for any errors before submitting. It is important to keep a copy of the completed form for your records, as it may be needed for future reference or in case of an audit.

Steps to complete the Form 8689pdffillercom

Completing the Form 8689pdffillercom requires careful attention to detail. Begin by entering your personal information, including your name, address, and Social Security number. Next, input your income details and any deductions you are eligible for. Be sure to calculate your total tax liability accurately. Finally, sign and date the form, and ensure that you submit it by the deadline to avoid any late fees or penalties.

Legal use of the Form 8689pdffillercom

The legal use of the Form 8689pdffillercom is governed by IRS regulations. To be considered valid, the form must be filled out completely and accurately. Additionally, it must be submitted within the designated time frame. Compliance with these legal requirements ensures that the form is accepted by tax authorities and that any claims for refunds are processed without issues.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8689pdffillercom are critical to ensure compliance with tax regulations. Typically, the form must be submitted by the tax filing deadline, which is usually April 15 for most taxpayers. However, if you are filing for an extension, be aware of the extended deadline to ensure timely submission. Keeping track of these important dates helps avoid penalties and ensures that your tax matters are handled efficiently.

Required Documents

To complete the Form 8689pdffillercom, several documents are required. These include your previous year's tax return, W-2 forms from employers, 1099 forms for any additional income, and records of estimated tax payments made during the year. Having these documents on hand will facilitate the accurate completion of the form and support your claims for any refunds.

Form Submission Methods (Online / Mail / In-Person)

The Form 8689pdffillercom can be submitted through various methods. Taxpayers have the option to file online using IRS-approved e-filing software, which often simplifies the process and provides immediate confirmation of submission. Alternatively, you can print and mail the completed form to the appropriate IRS address. In-person submission is also an option at designated IRS offices, though this may require an appointment. Choosing the right submission method can enhance the efficiency of your tax filing process.

Quick guide on how to complete form 8689pdffillercom 2016

Complete Form 8689pdffillercom effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to obtain the required form and securely save it online. airSlate SignNow provides you with all the resources needed to create, modify, and eSign your documents promptly without any hold-ups. Manage Form 8689pdffillercom on any platform using the airSlate SignNow Android or iOS applications and simplify any document-based process today.

The easiest method to modify and eSign Form 8689pdffillercom without hassle

- Find Form 8689pdffillercom and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Select important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Decide how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require reprinting document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choosing. Edit and eSign Form 8689pdffillercom and maintain excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8689pdffillercom 2016

Create this form in 5 minutes!

How to create an eSignature for the form 8689pdffillercom 2016

How to create an eSignature for your Form 8689pdffillercom 2016 online

How to generate an eSignature for your Form 8689pdffillercom 2016 in Google Chrome

How to create an electronic signature for signing the Form 8689pdffillercom 2016 in Gmail

How to generate an electronic signature for the Form 8689pdffillercom 2016 right from your smartphone

How to generate an eSignature for the Form 8689pdffillercom 2016 on iOS devices

How to make an electronic signature for the Form 8689pdffillercom 2016 on Android

People also ask

-

What is Form 8689signNowcom and how does it work?

Form 8689signNowcom is a user-friendly online tool provided by airSlate SignNow that allows you to easily fill out, sign, and manage Form 8689. With its intuitive interface, you can complete the form quickly and efficiently, ensuring that all necessary information is accurately captured. This makes it an essential tool for anyone needing to handle this form without the hassle of manual processes.

-

Is there a cost associated with using Form 8689signNowcom?

Yes, using Form 8689signNowcom through airSlate SignNow comes with a pricing structure that is both affordable and transparent. Various subscription plans are available to suit different business needs, allowing you to choose a plan that fits your budget while providing full access to all features related to Form 8689. You can start with a free trial to evaluate the service before committing.

-

What features does Form 8689signNowcom offer?

Form 8689signNowcom includes a range of features designed to enhance your document management experience. You can easily fill, edit, and eSign documents, as well as store them securely in the cloud. Additionally, you can track document status and send reminders, ensuring you never miss a deadline.

-

How can Form 8689signNowcom benefit my business?

Using Form 8689signNowcom can signNowly streamline your document processes, saving you time and reducing errors. By automating form filling and signing, your business can enhance productivity and maintain compliance more effectively. Furthermore, the cost-effective nature of airSlate SignNow allows you to allocate resources more efficiently.

-

Can I integrate Form 8689signNowcom with my existing software?

Yes, Form 8689signNowcom is designed to integrate seamlessly with various software systems, enhancing your overall workflow. Whether you use CRM platforms, accounting software, or other business applications, airSlate SignNow provides integration options that help you connect your tools effortlessly. This ensures a smooth transition and efficient management of your documents.

-

Is it secure to use Form 8689signNowcom for sensitive documents?

Absolutely! Form 8689signNowcom prioritizes the security of your documents with advanced encryption and compliance with industry standards. airSlate SignNow implements robust security measures to protect your data, ensuring that your sensitive information remains confidential and secure during the entire signing process.

-

What support is available for users of Form 8689signNowcom?

airSlate SignNow offers comprehensive support for users of Form 8689signNowcom, including tutorials, FAQs, and customer service representatives ready to assist you. If you have any questions or encounter issues, you can easily access support resources to get the help you need. This ensures that your experience with Form 8689 is as smooth as possible.

Get more for Form 8689pdffillercom

- Intent to lien form florida

- Arizona agreement or contract for deed for sale and purchase of real estate aka land or executory contract form

- Standard contract sale house nj form

- Lien release form oklahoma

- Bill of sale form ky

- Florida lienor statement pdf form

- Virginia commercial building or space lease form

- South carolina warranty deed to child reserving a life estate in the parents form

Find out other Form 8689pdffillercom

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document