Preparing an Individual Income Tax Return with U S Virgin 2014

What is the Preparing An Individual Income Tax Return With U S Virgin

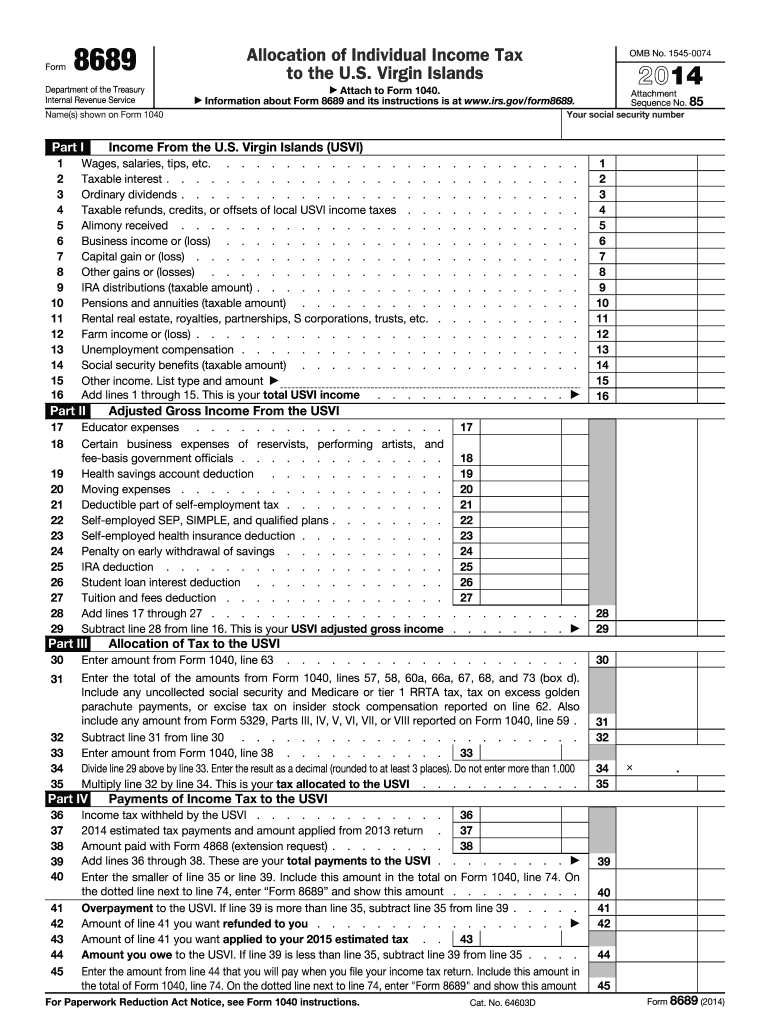

The Preparing An Individual Income Tax Return With U S Virgin is a specific form used by residents of the U.S. Virgin Islands to report their income and calculate their tax obligations. This form is essential for ensuring compliance with local tax laws and regulations. It serves as a declaration of income earned during the tax year and includes various sections for detailing sources of income, deductions, and credits. Understanding this form is crucial for accurate reporting and to avoid potential penalties.

Steps to complete the Preparing An Individual Income Tax Return With U S Virgin

Completing the Preparing An Individual Income Tax Return With U S Virgin involves several key steps:

- Gather necessary documents, including W-2 forms, 1099s, and records of other income.

- Review the instructions specific to the form to understand the requirements and sections.

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income accurately, ensuring to include any applicable deductions.

- Calculate your total tax liability based on the provided guidelines.

- Review the completed form for accuracy before submission.

- Submit the form electronically or via mail, ensuring to keep a copy for your records.

Legal use of the Preparing An Individual Income Tax Return With U S Virgin

The legal use of the Preparing An Individual Income Tax Return With U S Virgin is governed by local tax laws. Proper completion and submission of this form are required to fulfill your tax obligations. An eSignature can be used to validate the submission electronically, provided it complies with the Electronic Signatures in Global and National Commerce Act (ESIGN) and other relevant regulations. This ensures that your submission is legally binding and recognized by tax authorities.

Required Documents

To complete the Preparing An Individual Income Tax Return With U S Virgin, several documents are necessary:

- W-2 forms from employers detailing wages earned.

- 1099 forms for any freelance or contract work.

- Records of additional income, such as dividends or interest.

- Documentation for deductions, including receipts for business expenses and charitable contributions.

- Any previous tax returns for reference.

Filing Deadlines / Important Dates

Filing deadlines for the Preparing An Individual Income Tax Return With U S Virgin typically align with federal tax deadlines. It is important to be aware of these dates to avoid penalties:

- Annual tax returns are generally due on April 15.

- If the due date falls on a weekend or holiday, the deadline may be extended to the next business day.

- Extensions may be requested, but any taxes owed must still be paid by the original due date to avoid interest and penalties.

Form Submission Methods (Online / Mail / In-Person)

The Preparing An Individual Income Tax Return With U S Virgin can be submitted through various methods:

- Online submission via authorized e-filing services that comply with local regulations.

- Mailing a physical copy of the form to the appropriate tax authority address.

- In-person submission at designated tax offices, if available.

Quick guide on how to complete preparing an individual income tax return with us virgin

Effortlessly Complete Preparing An Individual Income Tax Return With U S Virgin on Any Device

Managing documents online has gained popularity among both businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed papers, allowing you to locate the correct template and securely save it online. airSlate SignNow provides you with all the tools needed to create, modify, and electronically sign your documents quickly without delays. Handle Preparing An Individual Income Tax Return With U S Virgin on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to Modify and Electronically Sign Preparing An Individual Income Tax Return With U S Virgin with Ease

- Obtain Preparing An Individual Income Tax Return With U S Virgin and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of your documents or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which takes just moments and carries the same legal validity as a traditional ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you wish to send your document, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Preparing An Individual Income Tax Return With U S Virgin and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct preparing an individual income tax return with us virgin

Create this form in 5 minutes!

How to create an eSignature for the preparing an individual income tax return with us virgin

The best way to make an eSignature for a PDF document in the online mode

The best way to make an eSignature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

The way to generate an electronic signature right from your mobile device

How to make an eSignature for a PDF document on iOS devices

The way to generate an electronic signature for a PDF on Android devices

People also ask

-

What steps should I follow when Preparing An Individual Income Tax Return With U S Virgin using airSlate SignNow?

When preparing your Individual Income Tax Return With U S Virgin, start by gathering all necessary documents such as W-2s, 1099s, and previous tax returns. Once you have your documents organized, upload them to airSlate SignNow's platform to electronically sign and submit. This streamlined process saves time and provides you with a secure way to manage your tax documents.

-

What features does airSlate SignNow offer for Preparing An Individual Income Tax Return With U S Virgin?

airSlate SignNow provides several features tailored for Preparing An Individual Income Tax Return With U S Virgin, including eSignature capabilities, document templates, and secure cloud storage. These features simplify document management and ensure you can sign and send your tax returns quickly and securely. Additionally, the user-friendly interface makes the process efficient, even for those unfamiliar with electronic signing.

-

Is airSlate SignNow cost-effective for Preparing An Individual Income Tax Return With U S Virgin?

Yes, airSlate SignNow is a cost-effective solution for Preparing An Individual Income Tax Return With U S Virgin. With competitive pricing plans, businesses and individuals can choose a package that fits their needs without overspending. The ability to streamline the eSigning process also saves time, ultimately reducing costs related to tax preparation.

-

Can I integrate airSlate SignNow with other accounting software for Preparing An Individual Income Tax Return With U S Virgin?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and tax preparation software, enhancing your experience when Preparing An Individual Income Tax Return With U S Virgin. This integration means you can import documents directly from your accounting software and manage your tax documents more efficiently.

-

What benefits can I expect when Preparing An Individual Income Tax Return With U S Virgin using airSlate SignNow?

Using airSlate SignNow to prepare your Individual Income Tax Return With U S Virgin offers several benefits, including enhanced security, ease of use, and faster turnaround times. You can sign documents from anywhere, reducing the hassle of in-person meetings and ensuring a smooth tax filing process. Plus, the platform's tracking feature keeps you updated on your document’s status.

-

How does airSlate SignNow ensure security when Preparing An Individual Income Tax Return With U S Virgin?

airSlate SignNow prioritizes your security while Preparing An Individual Income Tax Return With U S Virgin by employing industry-leading encryption and secure cloud storage practices. All documents and signatures are protected, ensuring sensitive information remains confidential throughout the process. You can have peace of mind knowing your tax documents are secure.

-

Is there customer support available for questions about Preparing An Individual Income Tax Return With U S Virgin?

Yes, airSlate SignNow offers robust customer support for users preparing their Individual Income Tax Return With U S Virgin. You can access a comprehensive knowledge base, tutorials, and direct assistance from customer service representatives. Whether you have questions about features or need help with the eSigning process, support is readily available.

Get more for Preparing An Individual Income Tax Return With U S Virgin

- Warranty deed from husband and wife to llc iowa form

- Iowa satisfaction 497304925 form

- Ia corporation llc 497304926 form

- Notice to primary contractor of furnishing individual iowa form

- Ia landlord notice form

- Iowa landlord tenant form

- Letter from tenant to landlord containing notice that premises in uninhabitable in violation of law and demand immediate repair 497304931 form

- Letter from tenant to landlord containing notice that premises leaks during rain and demand for repair iowa form

Find out other Preparing An Individual Income Tax Return With U S Virgin

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now

- eSignature Missouri Hold Harmless (Indemnity) Agreement Later

- eSignature Ohio Hold Harmless (Indemnity) Agreement Mobile

- eSignature California Letter of Intent Free

- Can I eSign Louisiana General Power of Attorney Template

- eSign Mississippi General Power of Attorney Template Free

- How Can I eSignature New Mexico Letter of Intent

- Can I eSign Colorado Startup Business Plan Template

- eSign Massachusetts Startup Business Plan Template Online

- eSign New Hampshire Startup Business Plan Template Online

- How To eSign New Jersey Startup Business Plan Template

- eSign New York Startup Business Plan Template Online

- eSign Colorado Income Statement Quarterly Mobile