About Form 8689, Allocation of Individual Income Tax to the U S 2020

Understanding Form 8689: Allocation of Individual Income Tax to the U.S.

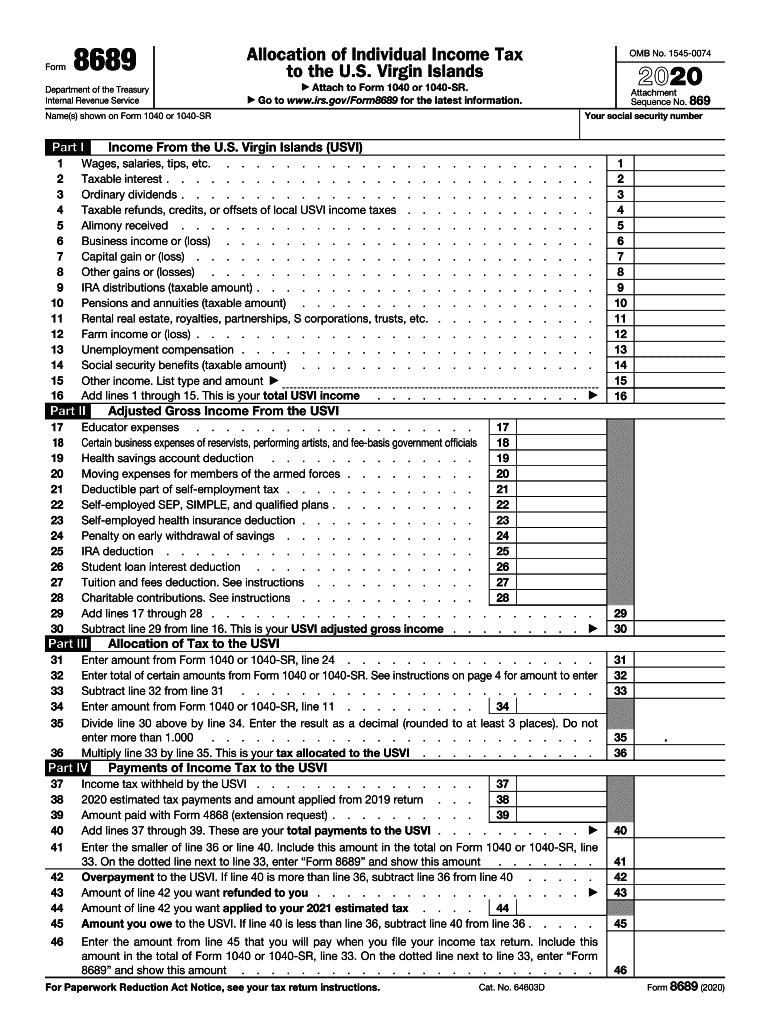

The Form 8689 is used by U.S. citizens and residents to allocate their individual income tax between the United States and the U.S. Virgin Islands. This form is essential for individuals who earn income in both jurisdictions and need to report their tax obligations accurately. It helps ensure compliance with U.S. tax laws while allowing taxpayers to claim any applicable credits for taxes paid to the U.S. Virgin Islands. Understanding the purpose and requirements of this form is crucial for accurate tax reporting.

Steps to Complete Form 8689

Completing Form 8689 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and records of taxes paid to the U.S. Virgin Islands. Next, fill out the form by providing your personal information, including your name, address, and Social Security number. Then, report your total income from both the U.S. and the U.S. Virgin Islands. Afterward, calculate the allocation of income tax, ensuring that you apply the correct rates and deductions. Finally, review the completed form for accuracy before submission.

Filing Deadlines for Form 8689

It is important to be aware of the filing deadlines associated with Form 8689 to avoid penalties. Typically, the form must be filed by the due date of your federal income tax return. For most taxpayers, this is April fifteenth of each year, unless an extension is granted. If you are unable to meet this deadline, consider applying for an extension to ensure that you have ample time to complete the form accurately. Always check the IRS website for any updates regarding deadlines or changes to filing requirements.

Legal Use of Form 8689

Form 8689 serves a legal purpose in the realm of tax compliance. It is recognized by the IRS as a valid method for allocating income tax between the U.S. and the U.S. Virgin Islands. To ensure that your form is legally binding, it is essential to follow all instructions carefully and provide accurate information. Additionally, using a reliable electronic signature tool can further enhance the legal standing of your form, as it ensures compliance with eSignature laws and provides a secure method for submission.

Required Documents for Form 8689

When preparing to complete Form 8689, certain documents are required to support your claims. Gather your W-2 forms, 1099 forms, and any other income statements that reflect earnings from both the U.S. and the U.S. Virgin Islands. Additionally, keep records of any taxes paid to the U.S. Virgin Islands, as this information is necessary for accurate reporting. Having these documents organized and readily available will facilitate a smoother completion process.

IRS Guidelines for Form 8689

The IRS provides specific guidelines for completing Form 8689, which are essential for ensuring compliance. These guidelines outline how to report income, allocate taxes, and claim credits. It is important to review these instructions thoroughly before filling out the form. Adhering to IRS guidelines not only helps avoid errors but also minimizes the risk of audits or penalties related to improper filing.

Quick guide on how to complete about form 8689 allocation of individual income tax to the us

Complete About Form 8689, Allocation Of Individual Income Tax To The U S effortlessly on any gadget

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely save it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents quickly and without delays. Manage About Form 8689, Allocation Of Individual Income Tax To The U S on any device with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign About Form 8689, Allocation Of Individual Income Tax To The U S with ease

- Locate About Form 8689, Allocation Of Individual Income Tax To The U S and then click Get Form to begin.

- Utilize the features we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your choice. Edit and eSign About Form 8689, Allocation Of Individual Income Tax To The U S and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 8689 allocation of individual income tax to the us

Create this form in 5 minutes!

How to create an eSignature for the about form 8689 allocation of individual income tax to the us

How to make an electronic signature for your PDF file online

How to make an electronic signature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

The best way to create an eSignature right from your mobile device

The best way to generate an electronic signature for a PDF file on iOS

The best way to create an eSignature for a PDF on Android devices

People also ask

-

What are the key features of airSlate SignNow regarding 8689 IRS instructions?

airSlate SignNow offers features tailored for efficiently managing documents related to 8689 IRS instructions. These include easy document templates, customizable workflows, and secure eSigning capabilities that ensure compliance with IRS requirements. With our platform, you can streamline your document management process, saving time and reducing errors.

-

How can I use airSlate SignNow to comply with 8689 IRS instructions?

Using airSlate SignNow, you can create, send, and eSign documents that adhere to 8689 IRS instructions. Our user-friendly interface allows you to input necessary information and submit compliance documents without hassle, ensuring you meet all IRS guidelines. Our detailed templates also help simplify the process signNowly.

-

Is airSlate SignNow a cost-effective solution for managing 8689 IRS instructions?

Yes, airSlate SignNow is designed to be a cost-effective solution for managing 8689 IRS instructions. Our pricing plans are competitive and cater to businesses of all sizes, allowing you to access essential eSigning features without breaking the bank. This affordability combined with our features makes us an excellent choice for your document needs.

-

Can airSlate SignNow integrate with other software for 8689 IRS instructions?

Absolutely! airSlate SignNow seamlessly integrates with various software solutions, enhancing the ease with which you can manage 8689 IRS instructions. Whether you use CRM systems or document management tools, our integrations facilitate a smooth workflow, enabling you to keep all your processes aligned and efficient.

-

What benefits does eSigning provide in relation to 8689 IRS instructions?

eSigning through airSlate SignNow offers multiple benefits for 8689 IRS instructions, such as faster processing times and enhanced security. With the digital signature solution, you eliminate the need for printing and mailing documents, which streamlines operations. Additionally, our platform provides tracking features that ensure you can follow every step of the signing process.

-

How does airSlate SignNow ensure the security of documents related to 8689 IRS instructions?

Security is a top priority for airSlate SignNow, especially for documents relating to 8689 IRS instructions. Our platform utilizes advanced encryption technology to protect your data from unauthorized access, ensuring that all signed documents are safe and secure. Compliance with industry standards further enhances your peace of mind.

-

Is customer support available for help with 8689 IRS instructions?

Yes, airSlate SignNow provides robust customer support that can assist you with any inquiries about 8689 IRS instructions. Our dedicated support team is available via chat, email, or phone, ensuring you get the help you need promptly. Whether it's troubleshooting or guidance on using our features for IRS documents, we are here for you.

Get more for About Form 8689, Allocation Of Individual Income Tax To The U S

- Wfp p11 form

- English year 5 exam paper 2021 form

- Form 2 mathematics exam paper with answer

- J k police spo form pdf

- Seahawks schedule 2022 printable form

- Power of attorney declaration de 48 rev 12 4 24 form

- Stonebridge country club leadership scholarship award form

- State of hawaii department of education mckinley community school for form

Find out other About Form 8689, Allocation Of Individual Income Tax To The U S

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe