Taxable Refunds, Credits, or Offsets of Local U 2012

What is the Taxable Refunds, Credits, Or Offsets Of Local U

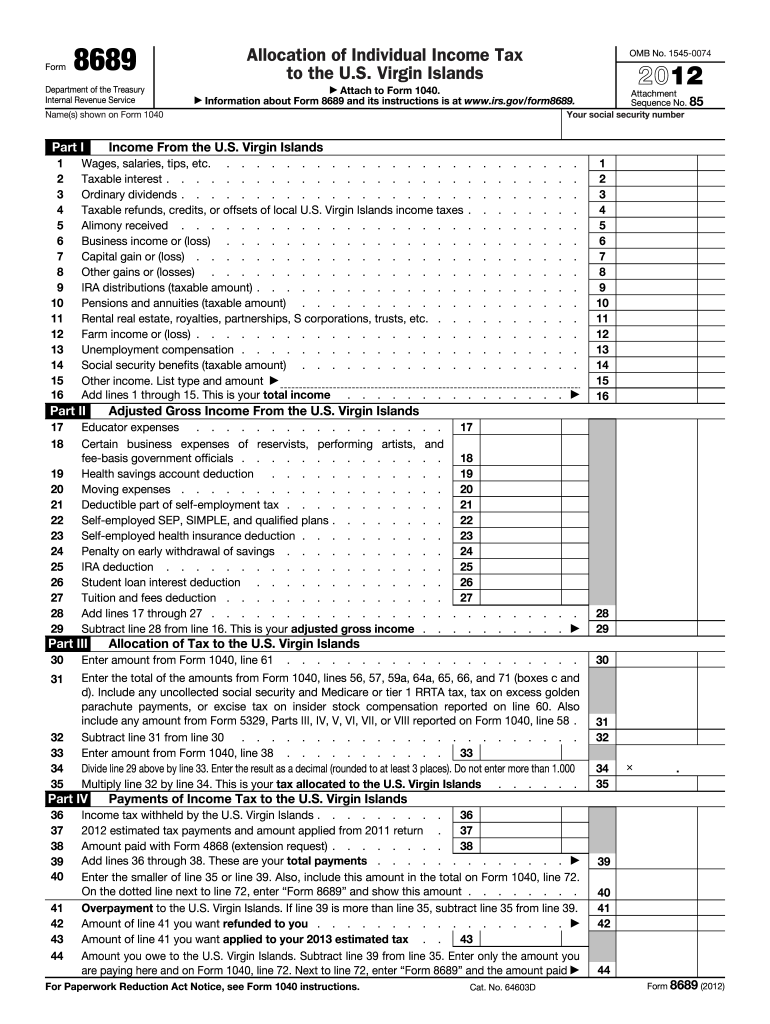

The Taxable Refunds, Credits, or Offsets of Local U form is a document used to report certain types of refunds, credits, or offsets received by taxpayers from local government entities. These financial adjustments may arise from overpayments, tax credits, or other forms of financial relief that can impact a taxpayer's overall tax liability. Understanding this form is crucial for accurate tax reporting and compliance with local tax regulations.

Steps to complete the Taxable Refunds, Credits, Or Offsets Of Local U

Completing the Taxable Refunds, Credits, or Offsets of Local U form involves several key steps:

- Gather all relevant financial documents, including receipts and statements related to the refunds or credits.

- Clearly identify the amounts received and categorize them as refunds, credits, or offsets.

- Fill out the form accurately, ensuring that all required fields are completed.

- Double-check the information for accuracy and completeness before submission.

Legal use of the Taxable Refunds, Credits, Or Offsets Of Local U

The legal use of the Taxable Refunds, Credits, or Offsets of Local U form is governed by local tax laws and regulations. It is essential to ensure that the information provided is truthful and accurate, as any discrepancies could lead to penalties or audits. This form serves as a formal declaration of financial adjustments that affect tax obligations, making it a critical document for compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Taxable Refunds, Credits, or Offsets of Local U form can vary based on local jurisdiction and specific tax regulations. It is vital to be aware of these deadlines to avoid late penalties. Typically, local tax authorities will provide a calendar of important dates, including the due date for submission and any related tax payment deadlines.

Required Documents

To successfully complete the Taxable Refunds, Credits, or Offsets of Local U form, certain documents are required. These may include:

- Copies of any refund checks or credit notifications received.

- Bank statements reflecting the deposits of refunds or credits.

- Any correspondence from local tax authorities regarding adjustments.

Examples of using the Taxable Refunds, Credits, Or Offsets Of Local U

Examples of situations where the Taxable Refunds, Credits, or Offsets of Local U form may be applicable include:

- Receiving a refund from a local tax authority due to an overpayment.

- Claiming a credit for local property taxes that were reduced.

- Offsetting local taxes due to a prior year’s tax credit.

Eligibility Criteria

To utilize the Taxable Refunds, Credits, or Offsets of Local U form, taxpayers must meet specific eligibility criteria. Generally, this includes being a resident of the local jurisdiction and having received a qualifying refund, credit, or offset. It is essential to review local tax regulations to confirm eligibility and ensure compliance with all requirements.

Quick guide on how to complete taxable refunds credits or offsets of local u

Complete Taxable Refunds, Credits, Or Offsets Of Local U effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal environmentally-friendly alternative to traditional printed and signed documents, enabling you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents swiftly and without delays. Handle Taxable Refunds, Credits, Or Offsets Of Local U on any platform with the airSlate SignNow Android or iOS applications and streamline any document-related task today.

The easiest way to modify and eSign Taxable Refunds, Credits, Or Offsets Of Local U with ease

- Obtain Taxable Refunds, Credits, Or Offsets Of Local U and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Select important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and holds the same legal significance as a conventional wet ink signature.

- Verify all the details and then click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tiring form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign Taxable Refunds, Credits, Or Offsets Of Local U and guarantee excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct taxable refunds credits or offsets of local u

Create this form in 5 minutes!

How to create an eSignature for the taxable refunds credits or offsets of local u

The way to generate an eSignature for your PDF online

The way to generate an eSignature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The best way to generate an eSignature straight from your smartphone

The way to create an electronic signature for a PDF on iOS

The best way to generate an eSignature for a PDF document on Android

People also ask

-

What are Taxable Refunds, Credits, Or Offsets Of Local U. and how do they affect my taxes?

Taxable Refunds, Credits, Or Offsets Of Local U. refer to amounts that may be subject to taxation based on local laws. These can impact your tax return, as they may increase your taxable income. It's important to understand the specifics of how these are processed to ensure compliance and accurate reporting.

-

How can airSlate SignNow help in managing Taxable Refunds, Credits, Or Offsets Of Local U. documentation?

airSlate SignNow streamlines the process of sending and eSigning necessary documents related to Taxable Refunds, Credits, Or Offsets Of Local U. Our solution allows you to securely manage these documents, ensuring that they are signed and stored efficiently for tax reporting purposes.

-

What pricing options does airSlate SignNow offer for dealing with Taxable Refunds, Credits, Or Offsets Of Local U.?

We offer flexible pricing plans to accommodate various business needs, including those specifically related to handling Taxable Refunds, Credits, Or Offsets Of Local U. Our cost-effective solution ensures you have access to all necessary features without breaking the bank.

-

Are there any specific features in airSlate SignNow that cater to Taxable Refunds, Credits, Or Offsets Of Local U.?

Yes, airSlate SignNow includes features that cater specifically to Taxable Refunds, Credits, Or Offsets Of Local U., such as customizable templates for frequently used forms and automated workflows for document processing. These tools make it easier for businesses to handle their documentation efficiently.

-

Can I integrate airSlate SignNow with other accounting software for Taxable Refunds, Credits, Or Offsets Of Local U.?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, enabling you to manage Taxable Refunds, Credits, Or Offsets Of Local U. more effectively. This integration helps streamline workflows and keeps your documentation synchronized across platforms.

-

Is airSlate SignNow secure for handling sensitive documents related to Taxable Refunds, Credits, Or Offsets Of Local U.?

Yes, security is a top priority for airSlate SignNow. We utilize advanced encryption and security measures to protect sensitive documents, including those related to Taxable Refunds, Credits, Or Offsets Of Local U. This ensures that your information remains confidential and secure at all times.

-

What support options are available if I have questions about Taxable Refunds, Credits, Or Offsets Of Local U.?

airSlate SignNow offers comprehensive support options, including live chat, email support, and a detailed knowledge base. Our team is ready to assist you with any queries regarding Taxable Refunds, Credits, Or Offsets Of Local U. to ensure you have a smooth experience with our product.

Get more for Taxable Refunds, Credits, Or Offsets Of Local U

- Legal last will and testament form for single person with no children indiana

- Legal last will and testament form for a single person with minor children indiana

- Legal last will and testament form for single person with adult and minor children indiana

- Legal last will and testament form for single person with adult children indiana

- Legal last will and testament for married person with minor children from prior marriage indiana form

- Legal last will and testament form for married person with adult children from prior marriage indiana

- Legal last will and testament form for divorced person not remarried with adult children indiana

- Indiana last will testament template form

Find out other Taxable Refunds, Credits, Or Offsets Of Local U

- How Do I Install Electronic signature in Word

- Help Me With Install Electronic signature in Word

- How Can I Install Electronic signature in Word

- How To Use Electronic signature in Google Drive

- How To Install Electronic signature in Zapier

- Can I Install Electronic signature in Word

- Help Me With Install Electronic signature in Zapier

- How Do I Use Electronic signature in Google Drive

- Can I Install Electronic signature in Zapier

- Help Me With Use Electronic signature in Google Drive

- How Do I Use Electronic signature in WorkDay

- How Can I Use Electronic signature in Google Drive

- How To Use Electronic signature in WorkDay

- Help Me With Use Electronic signature in WorkDay

- How Can I Use Electronic signature in WorkDay

- Can I Use Electronic signature in WorkDay

- How Do I Implement eSignature in Zapier

- How Can I Implement eSignature in Zapier

- How To Install Electronic signature in 1Password

- How Do I Install Electronic signature in Jitterbit