Form 8689 2015

What is the Form 8689

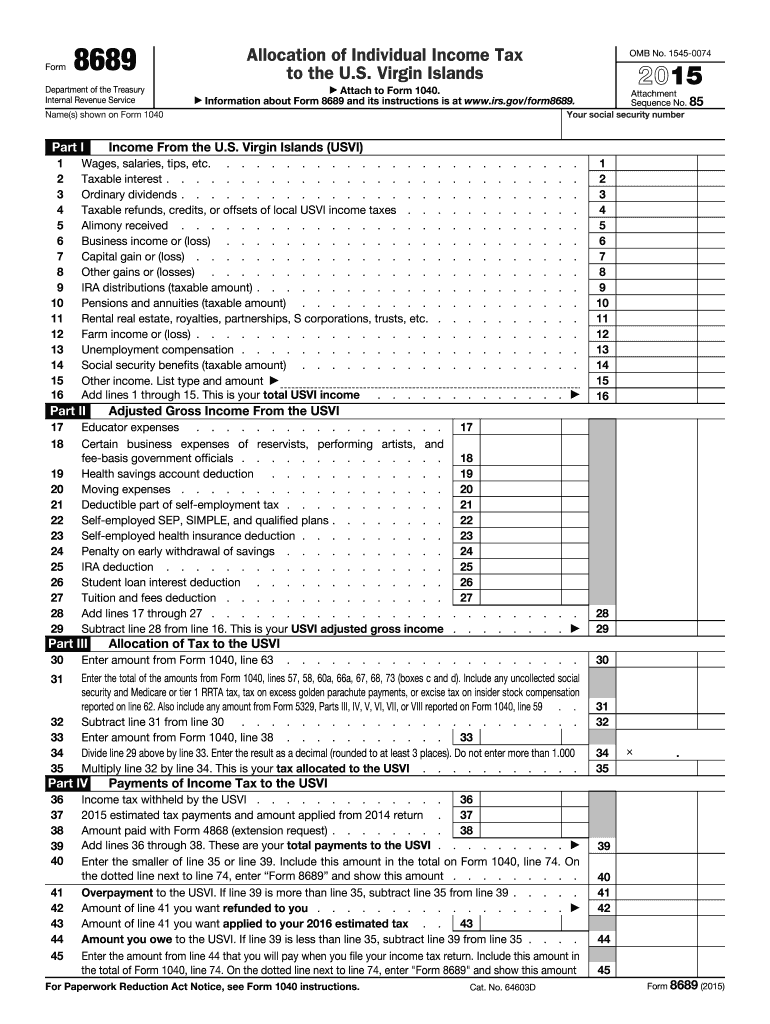

The Form 8689, officially known as the "Allocation of Individual Income Tax to the U.S. Virgin Islands," is a tax form used by U.S. taxpayers to allocate their income tax between the United States and the U.S. Virgin Islands. This form is primarily relevant for individuals who have income sourced from both locations and need to ensure compliance with tax obligations in both jurisdictions. The form helps in determining the correct amount of tax to be paid to each entity, preventing double taxation and ensuring that taxpayers fulfill their legal responsibilities.

How to use the Form 8689

Using the Form 8689 involves several steps to ensure accurate completion and submission. Taxpayers must first gather all relevant income information, including wages, interest, dividends, and any other sources of income. Once the information is collected, individuals can fill out the form by following the instructions provided by the IRS. The form requires details about total income, deductions, and credits applicable to both the U.S. and the U.S. Virgin Islands. After completing the form, taxpayers should review it for accuracy before filing it along with their federal tax return.

Steps to complete the Form 8689

Completing the Form 8689 requires careful attention to detail. Here are the essential steps:

- Gather all income documents, including W-2s and 1099s.

- Determine the total income earned from both the U.S. and the U.S. Virgin Islands.

- Fill out the form by entering the total income, deductions, and credits in the appropriate sections.

- Calculate the tax owed to each jurisdiction based on the allocated income.

- Review the completed form for any errors or omissions.

- Submit the form with your federal tax return by the designated deadline.

Legal use of the Form 8689

The legal use of the Form 8689 is essential for ensuring compliance with both U.S. federal tax laws and the tax laws of the U.S. Virgin Islands. Properly completing and filing this form helps prevent issues such as audits or penalties for underreporting income. The form must be filed by individuals who have income sourced from both the U.S. and the U.S. Virgin Islands to allocate their tax responsibilities correctly. Failure to use the form appropriately may result in legal consequences, including fines or additional tax liabilities.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the Form 8689 to avoid late penalties. Generally, the form should be submitted by the same deadline as the federal tax return, which is typically April fifteenth of each year. If taxpayers require additional time, they may file for an extension, but they must still pay any taxes owed by the original deadline to avoid interest and penalties. Keeping track of these important dates is crucial for maintaining compliance.

Required Documents

To accurately complete the Form 8689, taxpayers need to gather several key documents:

- W-2 forms from employers for wages earned.

- 1099 forms for any additional income, such as freelance work or interest.

- Records of any deductions or credits applicable to both jurisdictions.

- Previous year’s tax returns for reference.

Having these documents on hand will facilitate a smoother and more accurate completion of the form.

Quick guide on how to complete 2015 form 8689

Complete Form 8689 effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed papers, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without obstacles. Handle Form 8689 on any device with airSlate SignNow Android or iOS applications and enhance any document-related process today.

The best way to modify and eSign Form 8689 effortlessly

- Obtain Form 8689 and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose your delivery method for the form, whether by email, text (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors necessitating new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 8689 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 form 8689

Create this form in 5 minutes!

How to create an eSignature for the 2015 form 8689

The best way to make an electronic signature for a PDF document online

The best way to make an electronic signature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

The way to create an electronic signature straight from your smart phone

How to generate an eSignature for a PDF document on iOS

The way to create an electronic signature for a PDF document on Android OS

People also ask

-

What is Form 8689 and what is its purpose?

Form 8689 is used to determine the amount of tax refund or balance due for individuals who have resided in more than one state during the tax year. This form helps taxpayers account for income earned in multiple states and ensures accurate tax reporting.

-

How can airSlate SignNow assist with Form 8689?

airSlate SignNow simplifies the completion and submission of Form 8689 by allowing users to easily eSign and send documents securely. Our platform streamlines the process, making it cost-effective and efficient for tax professionals and individuals alike.

-

What features of airSlate SignNow are beneficial for handling Form 8689?

With airSlate SignNow, you can access advanced features such as template creation, real-time collaboration, and document tracking that enhance the management of Form 8689. These features help ensure all necessary signatures are obtained promptly, reducing delays.

-

Is there a pricing plan specifically for users needing to manage Form 8689?

Yes, airSlate SignNow offers various pricing plans that cater to the needs of users who require efficient document management, including those dealing with Form 8689. Our plans are designed to be cost-effective, ensuring you get the best value for your investment.

-

Can I integrate airSlate SignNow with other software for filing Form 8689?

Absolutely! airSlate SignNow seamlessly integrates with popular accounting and tax software, making it easier to prepare and file Form 8689. This integration helps streamline your workflow by allowing data to flow between applications without manual entry.

-

What are the benefits of using airSlate SignNow for eSigning Form 8689?

Using airSlate SignNow for eSigning Form 8689 offers signNow benefits such as enhanced security, ease of use, and expedited processing times. Our secure platform ensures that your sensitive information is protected while making it effortless to obtain necessary signatures.

-

How does airSlate SignNow ensure compliance when using Form 8689?

airSlate SignNow is designed with compliance in mind, ensuring that all eSignatures and document handling adhere to legal standards. This is especially important for Form 8689 as it involves state tax laws that require accurate and compliant documentation.

Get more for Form 8689

- Refrigeration contractor package hawaii form

- Drainage contractor package hawaii form

- Tax free exchange package hawaii form

- Landlord tenant sublease package hawaii form

- Buy sell agreement package hawaii form

- Option to purchase package hawaii form

- Amendment of lease package hawaii form

- Annual financial checkup package hawaii form

Find out other Form 8689

- eSign Delaware Consulting Agreement Template Now

- eSignature Missouri Hold Harmless (Indemnity) Agreement Later

- eSignature Ohio Hold Harmless (Indemnity) Agreement Mobile

- eSignature California Letter of Intent Free

- Can I eSign Louisiana General Power of Attorney Template

- eSign Mississippi General Power of Attorney Template Free

- How Can I eSignature New Mexico Letter of Intent

- Can I eSign Colorado Startup Business Plan Template

- eSign Massachusetts Startup Business Plan Template Online

- eSign New Hampshire Startup Business Plan Template Online

- How To eSign New Jersey Startup Business Plan Template

- eSign New York Startup Business Plan Template Online

- eSign Colorado Income Statement Quarterly Mobile

- eSignature Nebraska Photo Licensing Agreement Online

- How To eSign Arizona Profit and Loss Statement

- How To eSign Hawaii Profit and Loss Statement

- How To eSign Illinois Profit and Loss Statement

- How To eSign New York Profit and Loss Statement

- How To eSign Ohio Profit and Loss Statement

- How Do I eSign Ohio Non-Compete Agreement