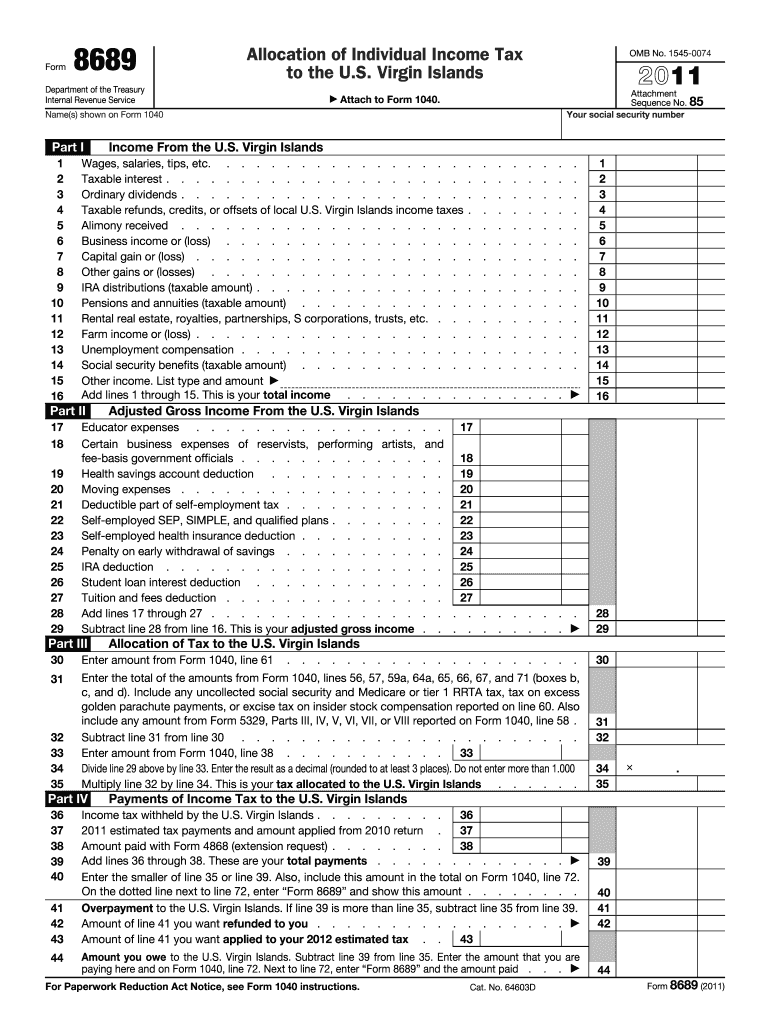

Form 8689 2011

What is the Form 8689

The Form 8689 is a tax form used by individuals to claim a refund of excess state income tax withheld. It is primarily utilized by taxpayers who have moved between states during the tax year or who have had taxes withheld for multiple states. This form helps in reconciling the amount of state income tax that has been withheld versus what is actually owed based on the taxpayer's residency and income situation.

How to use the Form 8689

Using the Form 8689 involves several steps to ensure accurate completion and submission. Taxpayers must first gather their W-2 forms and any other relevant income documents. Next, they should fill out the form by providing personal information, including their name, address, and Social Security number. The form requires details about the states where income was earned and the corresponding tax withheld. After completing the form, taxpayers must review it for accuracy before filing it with their state tax authority.

Steps to complete the Form 8689

Completing the Form 8689 involves a systematic approach:

- Gather all necessary documents, including W-2s and 1099s.

- Fill in your personal information accurately.

- List all states where income was earned and the respective amounts withheld.

- Calculate the total amount of state tax owed versus the amount withheld.

- Sign and date the form to certify its accuracy.

Legal use of the Form 8689

The legal use of the Form 8689 is governed by state tax laws. It serves as an official document that taxpayers can use to claim refunds for overpaid state taxes. To ensure its legal validity, it must be completed accurately and submitted within the designated filing period. Compliance with IRS regulations is also essential, as improper use of the form can lead to penalties or delays in processing refunds.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8689 can vary based on state regulations. Generally, taxpayers should file the form by the tax return deadline, which is typically April 15 for most individuals. If an extension is granted for the federal tax return, it may also apply to state filings. It is crucial to check specific state requirements to avoid missing any important dates.

Who Issues the Form

The Form 8689 is issued by the Internal Revenue Service (IRS) and is available for download on their official website. Taxpayers can also obtain the form through various tax preparation software that complies with IRS guidelines. It is essential to ensure that the correct version of the form is used, as updates may occur annually.

Quick guide on how to complete 2011 form 8689

Complete Form 8689 smoothly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, adjust, and eSign your documents swiftly without any holdups. Handle Form 8689 on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign Form 8689 effortlessly

- Obtain Form 8689 and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether via email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from your chosen device. Modify and eSign Form 8689 and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2011 form 8689

Create this form in 5 minutes!

How to create an eSignature for the 2011 form 8689

The way to generate an eSignature for your PDF in the online mode

The way to generate an eSignature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The best way to generate an eSignature straight from your smart phone

The way to create an electronic signature for a PDF on iOS devices

The best way to generate an eSignature for a PDF document on Android OS

People also ask

-

What is Form 8689, and who needs it?

Form 8689 is a crucial tax form used by taxpayers to calculate and claim their foreign tax credit. It's essential for individuals and businesses who earn income in foreign countries and want to avoid double taxation. Completing Form 8689 correctly ensures you maximize your tax benefits.

-

How can airSlate SignNow help with Form 8689?

airSlate SignNow streamlines the process of eSigning and sending Form 8689 digitally. By using our platform, you can securely store, share, and manage your tax documents with ease. Our user-friendly interface simplifies the signing process, making it easy to stay compliant with tax filing requirements.

-

Is there a cost associated with using airSlate SignNow for Form 8689?

airSlate SignNow offers a variety of pricing plans that cater to different business needs. Whether you are a freelancer or a large enterprise, our packages are designed to be cost-effective. This means you can confidently manage and eSign your Form 8689 without overspending.

-

What features does airSlate SignNow provide for handling Form 8689?

airSlate SignNow includes key features such as customizable templates, real-time tracking, and secure storage specifically for documents like Form 8689. You can easily create a template for Form 8689, making future filings quicker. Our platform also ensures data integrity with advanced encryption.

-

Can I integrate airSlate SignNow with my accounting software for Form 8689?

Yes, airSlate SignNow seamlessly integrates with various accounting and tax software. This integration enhances your workflow by enabling you to manage Form 8689 alongside your financial records. Compatibility with popular tools means you can eSign and share your Form 8689 directly within your existing systems.

-

What benefits does eSigning Form 8689 provide?

eSigning Form 8689 offers several advantages, including faster processing times and improved accuracy. By using airSlate SignNow, you eliminate the postal delays associated with traditional signing methods. Additionally, electronic signatures are legally binding, giving you peace of mind during tax season.

-

How secure is my data when using airSlate SignNow for Form 8689?

Security is a top priority at airSlate SignNow. We employ bank-level encryption and adhere to strict compliance standards to protect your sensitive data, including Form 8689. Your information is safeguarded throughout the signing process, ensuring confidentiality and integrity.

Get more for Form 8689

- Essential legal life documents for baby boomers indiana form

- General durable power of attorney for property and finances or financial effective immediately indiana form

- Revocation of general durable power of attorney indiana form

- Essential legal life documents for newlyweds indiana form

- Essential legal life documents for military personnel indiana form

- Essential legal life documents for new parents indiana form

- In attorney form

- Small business accounting package indiana form

Find out other Form 8689

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple