Schedule a Form 8804 Penalty for Underpayment of Estimated Section 1446 Tax by Partnerships 2018

What is the Schedule A Form 8804 Penalty For Underpayment Of Estimated Section 1446 Tax By Partnerships

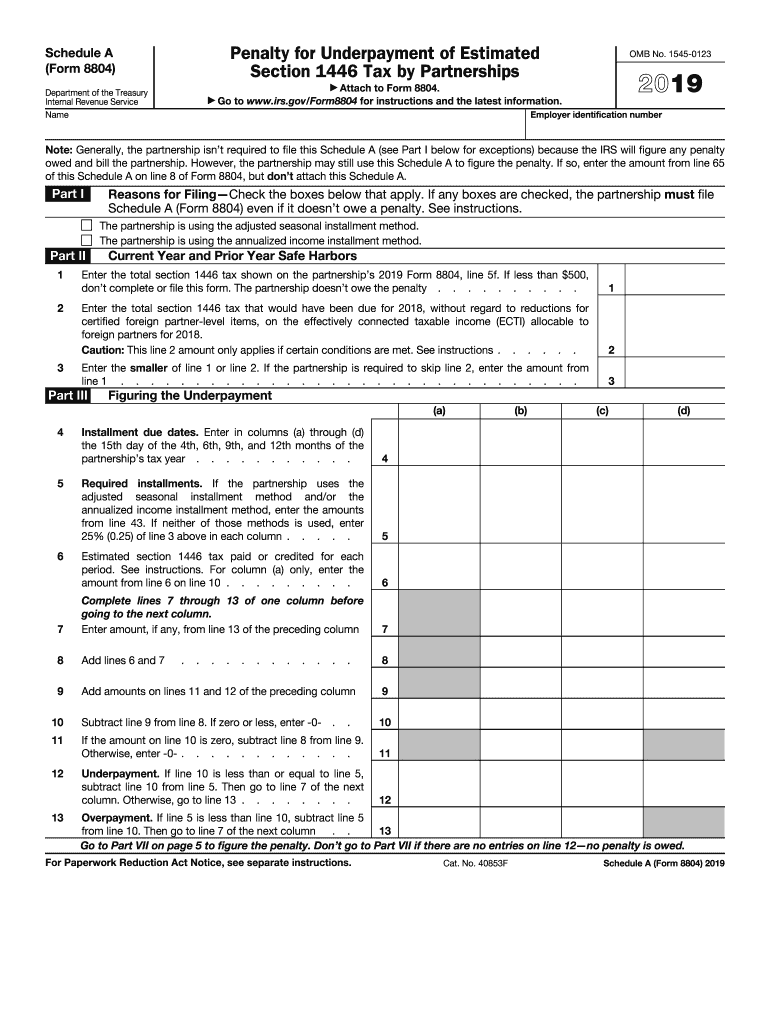

The Schedule A Form 8804 penalty pertains to the underpayment of estimated Section 1446 tax by partnerships. This form is used by partnerships that have foreign partners and are required to withhold tax on effectively connected income. If a partnership fails to pay the required estimated tax, it may face penalties. The penalty is calculated based on the amount of underpayment and the duration of the underpayment period. Understanding this penalty is crucial for partnerships to maintain compliance and avoid unnecessary financial burdens.

Steps to complete the Schedule A Form 8804 Penalty For Underpayment Of Estimated Section 1446 Tax By Partnerships

Completing the Schedule A Form 8804 requires several steps to ensure accuracy and compliance. First, gather all necessary financial information related to the partnership's income and deductions. Next, calculate the total amount of tax owed under Section 1446, considering any prior payments made. Determine the amount of any underpayment by comparing the required estimated tax with what has been paid. Finally, accurately fill out the form, ensuring all calculations are correct and that the form is signed by an authorized individual. It is advisable to review the completed form for any errors before submission.

Legal use of the Schedule A Form 8804 Penalty For Underpayment Of Estimated Section 1446 Tax By Partnerships

The legal use of the Schedule A Form 8804 is governed by IRS regulations. Partnerships must use this form to report any penalties incurred for underpayment of estimated Section 1446 tax. It is essential that the form is completed in accordance with IRS guidelines to ensure its validity. This includes providing accurate information and adhering to filing deadlines. Failure to comply with these legal requirements can result in additional penalties or interest charges.

Filing Deadlines / Important Dates

Partnerships must be aware of specific filing deadlines related to the Schedule A Form 8804. Typically, the form is due on the same date as the partnership's tax return. Partnerships should also be mindful of quarterly estimated tax payment deadlines, as these are crucial for avoiding underpayment penalties. Keeping track of these important dates helps ensure timely compliance and reduces the risk of incurring penalties.

Penalties for Non-Compliance

Non-compliance with the requirements of the Schedule A Form 8804 can lead to significant penalties. If a partnership underpays its estimated Section 1446 tax, it may incur a penalty based on the amount of underpayment and the length of time the payment is overdue. Additionally, failing to file the form on time can result in further penalties. Partnerships should take these potential consequences seriously and ensure they meet all obligations to avoid financial repercussions.

Who Issues the Form

The Schedule A Form 8804 is issued by the Internal Revenue Service (IRS). Partnerships must obtain this form directly from the IRS to ensure they are using the most current version. It is important for partnerships to stay updated on any changes to the form or related regulations to maintain compliance with federal tax laws.

Quick guide on how to complete 2019 schedule a form 8804 penalty for underpayment of estimated section 1446 tax by partnerships

Easily Prepare Schedule A Form 8804 Penalty For Underpayment Of Estimated Section 1446 Tax By Partnerships on Any Device

Digital document management has become increasingly favored by both businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, alter, and electronically sign your documents swiftly without delays. Handle Schedule A Form 8804 Penalty For Underpayment Of Estimated Section 1446 Tax By Partnerships on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Modify and eSign Schedule A Form 8804 Penalty For Underpayment Of Estimated Section 1446 Tax By Partnerships with Ease

- Obtain Schedule A Form 8804 Penalty For Underpayment Of Estimated Section 1446 Tax By Partnerships and click Get Form to begin.

- Utilize the tools we offer to fill in your form.

- Emphasize important sections of the documents or redact sensitive information with tools provided by airSlate SignNow specifically for this purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you prefer to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow fulfills your document management needs with just a few clicks from your chosen device. Alter and eSign Schedule A Form 8804 Penalty For Underpayment Of Estimated Section 1446 Tax By Partnerships and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2019 schedule a form 8804 penalty for underpayment of estimated section 1446 tax by partnerships

Create this form in 5 minutes!

How to create an eSignature for the 2019 schedule a form 8804 penalty for underpayment of estimated section 1446 tax by partnerships

How to create an eSignature for your 2019 Schedule A Form 8804 Penalty For Underpayment Of Estimated Section 1446 Tax By Partnerships online

How to make an electronic signature for your 2019 Schedule A Form 8804 Penalty For Underpayment Of Estimated Section 1446 Tax By Partnerships in Chrome

How to make an eSignature for putting it on the 2019 Schedule A Form 8804 Penalty For Underpayment Of Estimated Section 1446 Tax By Partnerships in Gmail

How to create an electronic signature for the 2019 Schedule A Form 8804 Penalty For Underpayment Of Estimated Section 1446 Tax By Partnerships from your smart phone

How to generate an eSignature for the 2019 Schedule A Form 8804 Penalty For Underpayment Of Estimated Section 1446 Tax By Partnerships on iOS devices

How to make an electronic signature for the 2019 Schedule A Form 8804 Penalty For Underpayment Of Estimated Section 1446 Tax By Partnerships on Android devices

People also ask

-

What is the Schedule A Form 8804 Penalty For Underpayment Of Estimated Section 1446 Tax By Partnerships?

The Schedule A Form 8804 penalty for underpayment of estimated Section 1446 tax by partnerships refers to the fines incurred when a partnership fails to pay the correct estimated tax amount. This form helps calculate the penalties and ensures compliance. Using tools like airSlate SignNow can streamline documentation associated with these tax requirements.

-

How can airSlate SignNow help with the Schedule A Form 8804 process?

AirSlate SignNow offers a user-friendly platform to easily prepare and eSign your Schedule A Form 8804. With its efficient features, users can manage documents, ensuring that all submissions related to the underpayment of estimated Section 1446 tax are submitted on time, reducing the risk of penalties.

-

What are the costs associated with using airSlate SignNow for handling tax forms?

AirSlate SignNow provides various pricing plans suitable for businesses of all sizes. These plans are cost-effective and designed to simplify the process of managing documents related to the Schedule A Form 8804 penalty for underpayment of estimated Section 1446 tax by partnerships. You can choose a plan based on your document handling needs.

-

Can I integrate airSlate SignNow with other accounting software for tax purposes?

Yes, airSlate SignNow seamlessly integrates with popular accounting software, making it easier to manage your tax-related documents. This integration is particularly useful when dealing with the Schedule A Form 8804 penalty for underpayment of estimated Section 1446 tax by partnerships, as it allows for streamlined data transfer and document management.

-

What are the key benefits of using airSlate SignNow for tax compliance?

Using airSlate SignNow improves tax compliance by providing efficient document handling and eSigning capabilities. It signNowly reduces the chances of incurring the Schedule A Form 8804 penalty for underpayment of estimated Section 1446 tax by partnerships due to missed deadlines or incorrect forms. Its features enhance collaboration and tracking of all necessary tax documents.

-

How secure is my information when using airSlate SignNow for tax documents?

AirSlate SignNow prioritizes data security, implementing advanced encryption and compliance measures to safeguard your information. This is crucial when dealing with sensitive documents like the Schedule A Form 8804 relating to penalties for underpayment of estimated Section 1446 tax by partnerships. You can confidently manage your tax documents knowing they are protected.

-

Is it easy to update my documents for Schedule A Form 8804 using airSlate SignNow?

Absolutely! AirSlate SignNow makes it simple to update documents related to the Schedule A Form 8804 penalty for underpayment of estimated Section 1446 tax by partnerships. Its intuitive interface allows users to easily make changes and send documents for eSigning without hassle.

Get more for Schedule A Form 8804 Penalty For Underpayment Of Estimated Section 1446 Tax By Partnerships

- Oil gas operations report form

- Form tsp 76 financial hardship in service withdrawal request

- B25b official form 25b 1208 do it yourself bankruptcy

- Da 4651 r form

- Mentor program mentor application form new hampshire bar nhbar

- Center of hope project deserve form

- Form 70d

- Differentiated instruction classroom observation form

Find out other Schedule A Form 8804 Penalty For Underpayment Of Estimated Section 1446 Tax By Partnerships

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer