Annual Information Return of Foreign Trust with a US Owner IRS Gov 2014

What is the Annual Information Return Of Foreign Trust With A US Owner IRS gov

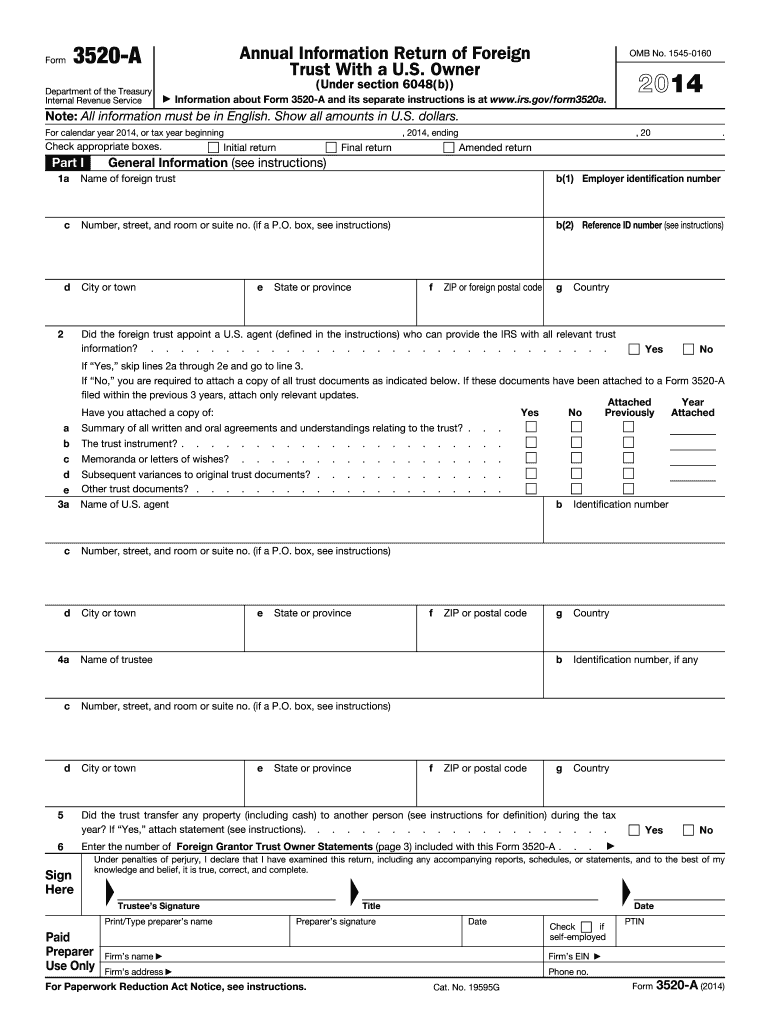

The Annual Information Return of Foreign Trust with a US Owner, commonly referred to as Form 3520-A, is a tax document required by the Internal Revenue Service (IRS). This form is specifically designed for foreign trusts that have a US owner. It provides the IRS with essential information regarding the trust's activities, assets, and distributions. The purpose of this form is to ensure compliance with U.S. tax laws and to prevent tax evasion through foreign entities.

Steps to complete the Annual Information Return Of Foreign Trust With A US Owner IRS gov

Completing the Annual Information Return involves several key steps. First, gather all necessary documentation related to the foreign trust, including financial statements and details of any distributions made during the year. Next, accurately fill out Form 3520-A, ensuring that all information is complete and correct. Pay special attention to sections that require detailed descriptions of the trust's activities. Once the form is completed, review it for accuracy before submitting it to the IRS.

Filing Deadlines / Important Dates

The filing deadline for the Annual Information Return of Foreign Trust with a US Owner aligns with the tax return due date for the US owner. Typically, this means the form must be filed by April fifteenth of the following year, unless an extension has been granted. It is crucial to adhere to these deadlines to avoid penalties and ensure compliance with IRS regulations.

Penalties for Non-Compliance

Failure to file the Annual Information Return can result in significant penalties. The IRS imposes a penalty of up to ten thousand dollars for each failure to file, and additional penalties may apply for inaccuracies or late submissions. It is essential for US owners of foreign trusts to understand these consequences and ensure timely and accurate filing to avoid financial repercussions.

Required Documents

To successfully complete the Annual Information Return, several documents are necessary. These include the trust's financial statements, records of distributions made to US beneficiaries, and any correspondence with the IRS regarding the trust. Having these documents readily available will streamline the completion process and help ensure compliance with IRS requirements.

Legal use of the Annual Information Return Of Foreign Trust With A US Owner IRS gov

The legal use of the Annual Information Return is critical for US owners of foreign trusts. This form not only fulfills IRS requirements but also provides legal protection by documenting the trust's activities and compliance with tax laws. Properly filing this form can mitigate risks associated with tax evasion allegations and ensure that the trust operates within the legal framework established by the IRS.

How to use the Annual Information Return Of Foreign Trust With A US Owner IRS gov

The Annual Information Return serves as a key tool for US owners of foreign trusts to report trust activities to the IRS. To use this form effectively, it is important to understand the specific information required, including details about the trust's income, assets, and distributions. By accurately completing and submitting this form, US owners can maintain compliance and avoid potential tax issues.

Quick guide on how to complete annual information return of foreign trust with a us owner irsgov

Easily Prepare Annual Information Return Of Foreign Trust With A US Owner IRS gov on Any Device

Digital document management has gained traction among companies and individuals alike. It serves as a perfect environmentally friendly alternative to conventional printed and signed documents, allowing you to find the right template and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly without waiting. Manage Annual Information Return Of Foreign Trust With A US Owner IRS gov on any device using airSlate SignNow apps for Android or iOS and streamline any document-related process today.

The Easiest Way to Edit and Electronically Sign Annual Information Return Of Foreign Trust With A US Owner IRS gov

- Locate Annual Information Return Of Foreign Trust With A US Owner IRS gov and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of the documents or obscure sensitive details with tools specifically offered by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes only seconds and holds the same legal authority as a traditional ink signature.

- Review the information and click the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, exhausting form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Annual Information Return Of Foreign Trust With A US Owner IRS gov to ensure effective communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct annual information return of foreign trust with a us owner irsgov

Create this form in 5 minutes!

How to create an eSignature for the annual information return of foreign trust with a us owner irsgov

How to generate an electronic signature for your PDF document in the online mode

How to generate an electronic signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature straight from your mobile device

How to make an electronic signature for a PDF document on iOS devices

The way to generate an electronic signature for a PDF document on Android devices

People also ask

-

What is the Annual Information Return Of Foreign Trust With A US Owner IRS gov?

The Annual Information Return Of Foreign Trust With A US Owner IRS gov is a tax form that U.S. owners of foreign trusts must file annually. This form helps the IRS track foreign trusts and ensures compliance with U.S. tax laws, preventing potential penalties or issues. Understanding this form is essential for maintaining transparency and fulfilling tax obligations.

-

How can airSlate SignNow assist with the Annual Information Return Of Foreign Trust With A US Owner IRS gov?

airSlate SignNow provides an easy-to-use platform for managing documents required for the Annual Information Return Of Foreign Trust With A US Owner IRS gov. With streamlined eSigning and document sending features, businesses can efficiently gather necessary signatures and maintain compliance. This enhances productivity and reduces the time spent on document management.

-

Is airSlate SignNow cost-effective for filing the Annual Information Return Of Foreign Trust With A US Owner IRS gov?

Yes, airSlate SignNow offers a cost-effective solution for managing your documents related to the Annual Information Return Of Foreign Trust With A US Owner IRS gov. Pricing plans are designed to fit various business needs, ensuring accessibility. By reducing paperwork and facilitating eSigning, it can lower overall operational costs.

-

What features of airSlate SignNow support the filing process for the Annual Information Return Of Foreign Trust With A US Owner IRS gov?

AirSlate SignNow includes features such as secure eSigning, document templates, and automated workflows that simplify the process for the Annual Information Return Of Foreign Trust With A US Owner IRS gov. These tools ensure that you can compile, sign, and send your documents efficiently. Additionally, real-time tracking keeps you updated on document status.

-

Can I integrate airSlate SignNow with other software for the Annual Information Return Of Foreign Trust With A US Owner IRS gov?

Yes, airSlate SignNow offers integrations with various software applications, making it easier to manage the overall process of your Annual Information Return Of Foreign Trust With A US Owner IRS gov. Whether you use accounting software or customer relationship management (CRM) tools, integrations can streamline your document workflows. This flexibility helps maintain consistency across platforms.

-

What are the benefits of using airSlate SignNow for the Annual Information Return Of Foreign Trust With A US Owner IRS gov?

Using airSlate SignNow for the Annual Information Return Of Foreign Trust With A US Owner IRS gov increases efficiency and accuracy within your business operations. The platform's user-friendly interface allows for quick eSigning and document sharing, reducing delays in submission. This leads to improved compliance and better management of time-sensitive tax forms.

-

Is my data secure when using airSlate SignNow for the Annual Information Return Of Foreign Trust With A US Owner IRS gov?

Absolutely, data security is a top priority for airSlate SignNow. The platform employs advanced encryption and various security protocols to safeguard your information, especially when dealing with sensitive documents like the Annual Information Return Of Foreign Trust With A US Owner IRS gov. You can confidently manage and sign your documents without worrying about data bsignNowes.

Get more for Annual Information Return Of Foreign Trust With A US Owner IRS gov

Find out other Annual Information Return Of Foreign Trust With A US Owner IRS gov

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors