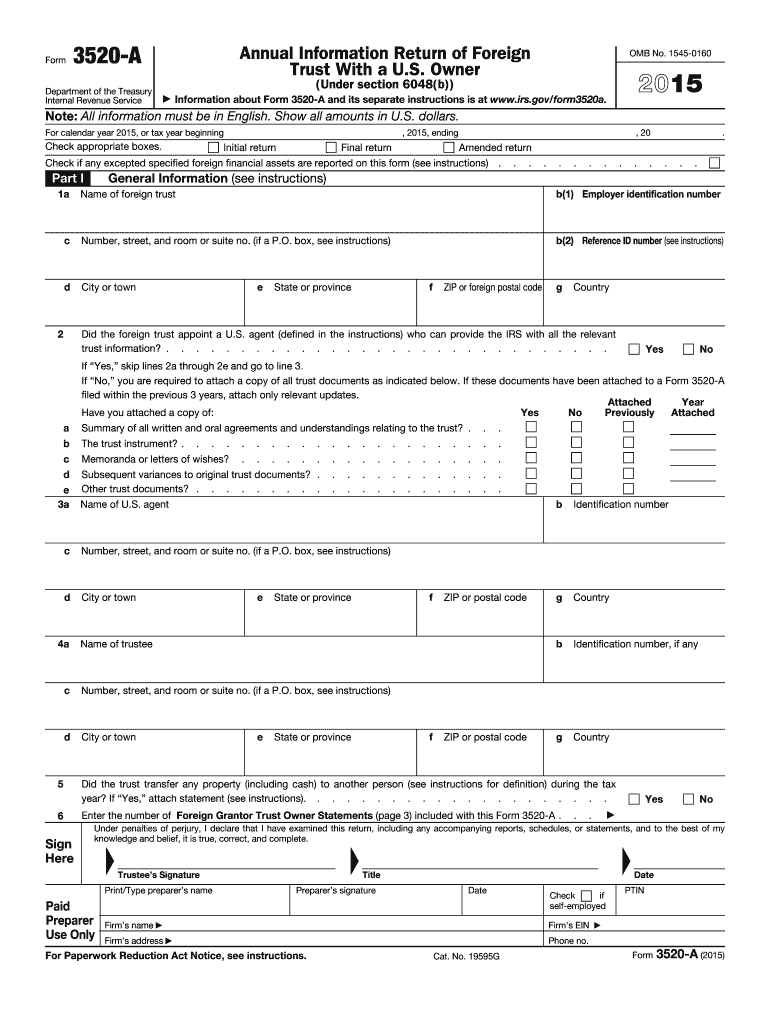

Irs Form 3520 2015

What is the IRS Form 3520

The IRS Form 3520 is a crucial document used by U.S. taxpayers to report certain transactions with foreign trusts, as well as the receipt of foreign gifts. This form is primarily designed for individuals who have established or received funds from foreign trusts or who have received large gifts from foreign entities. The IRS requires this form to ensure compliance with U.S. tax laws regarding foreign financial interests.

How to Use the IRS Form 3520

To effectively use the IRS Form 3520, taxpayers must first determine if they meet the reporting requirements. If you are a U.S. person who has created or received funds from a foreign trust, or if you have received gifts exceeding a certain threshold from foreign individuals or entities, you are required to file this form. The form must be filled out accurately, detailing the nature of the transactions and any necessary identification information about the foreign trust or donor.

Steps to Complete the IRS Form 3520

Completing the IRS Form 3520 involves several key steps:

- Gather necessary information, including details about the foreign trust or the donor of the gift.

- Fill out the form, ensuring that all required fields are completed accurately.

- Attach any necessary documentation that supports your claims, such as trust agreements or gift letters.

- Review the completed form for accuracy before submission.

Legal Use of the IRS Form 3520

The legal use of the IRS Form 3520 is essential for compliance with U.S. tax regulations. Filing this form is not optional; failure to do so can result in significant penalties. The form must be filed by the due date, which typically aligns with the annual tax return deadline. Understanding the legal implications of this form helps taxpayers avoid potential issues with the IRS.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines for the IRS Form 3520. Generally, the form is due on the same date as your federal income tax return, which is typically April 15. However, if you file for an extension for your tax return, the due date for Form 3520 may also be extended. Taxpayers should keep track of these dates to ensure timely compliance.

Penalties for Non-Compliance

Non-compliance with IRS Form 3520 requirements can lead to severe penalties. The IRS imposes fines for failing to file the form, which can be substantial, especially if the taxpayer has significant foreign trust transactions or gifts. Understanding these penalties emphasizes the importance of timely and accurate filing to avoid unnecessary financial burdens.

Quick guide on how to complete 2015 irs form 3520

Prepare Irs Form 3520 effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers a perfect eco-friendly substitute to conventional printed and signed paperwork, allowing you to access the necessary form and securely save it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents promptly without delays. Manage Irs Form 3520 on any platform using airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

The easiest way to edit and eSign Irs Form 3520 seamlessly

- Find Irs Form 3520 and then click Get Form to begin.

- Use the tools we offer to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and then click on the Done button to save your modifications.

- Choose your delivery method for the form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Edit and eSign Irs Form 3520 and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 irs form 3520

Create this form in 5 minutes!

How to create an eSignature for the 2015 irs form 3520

The best way to make an electronic signature for your PDF online

The best way to make an electronic signature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The best way to generate an eSignature right from your smartphone

How to generate an electronic signature for a PDF on iOS

The best way to generate an eSignature for a PDF on Android

People also ask

-

What is IRS Form 3520 and why is it important?

IRS Form 3520 is used to report certain transactions with foreign trusts and the receipt of certain foreign gifts. It is important because failing to file this form can result in signNow penalties by the IRS. Ensuring compliance with Form 3520 is essential for individuals or businesses involved in international transactions.

-

How can airSlate SignNow help with IRS Form 3520?

airSlate SignNow provides a streamlined process to send and eSign IRS Form 3520 quickly and securely. Our platform ensures that all information is captured accurately, and users can track the status of their documents in real time. With our solution, you can make the filing process more efficient and compliant.

-

What features does airSlate SignNow offer for IRS Form 3520?

airSlate SignNow offers essential features for completing IRS Form 3520, including document templates, eSigning, and secure document storage. You can easily customize forms and utilize our intuitive dashboard to manage all your forms. This automation reduces the risk of errors and speeds up the completion process.

-

Is there a cost associated with using airSlate SignNow for IRS Form 3520?

Yes, there is a cost associated with using airSlate SignNow, but we offer competitively priced plans tailored to businesses of all sizes. Pricing depends on your specific needs and the number of users. We also provide a free trial so prospective customers can explore the platform before committing.

-

Can I integrate airSlate SignNow with other software for submitting IRS Form 3520?

Absolutely! airSlate SignNow integrates seamlessly with various popular software applications, enabling users to streamline the submission of IRS Form 3520. These integrations can help improve your overall workflow, making compliance easier and more efficient.

-

What are the benefits of using airSlate SignNow for IRS Form 3520?

Using airSlate SignNow for IRS Form 3520 offers numerous benefits, including increased efficiency in document handling and enhanced security features. Our platform allows for easy tracking of document progress, reducing the chances of delays or miscommunication. Additionally, the user-friendly interface ensures that anyone can navigate and use the tool effectively.

-

How secure is the information submitted via airSlate SignNow for IRS Form 3520?

Security is paramount at airSlate SignNow. The platform uses advanced encryption methods to protect all sensitive information submitted, including IRS Form 3520 data. Additionally, we comply with industry standards and regulations to ensure the safety of your documents throughout the signing process.

Get more for Irs Form 3520

- Notification of change of ownership vehicle licence transfer form mr9 notification of change of ownership vehicle licence

- After completing an installation modification or addition of a system or single station detector excluding a one or form

- Illinois 2021 ticket sale and resale registration form

- Publication 5412 g sp 5 2020 internal revenue service form

- Form 1040 sr department of the treasuryinternal revenue

- Register rules avoidthescam net fill out and sign form

- 2020 schedule h form 1040 internal revenue service

- 2020 instructions for form 6251 instructions for form 6251 alternative minimum taxindividuals

Find out other Irs Form 3520

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself