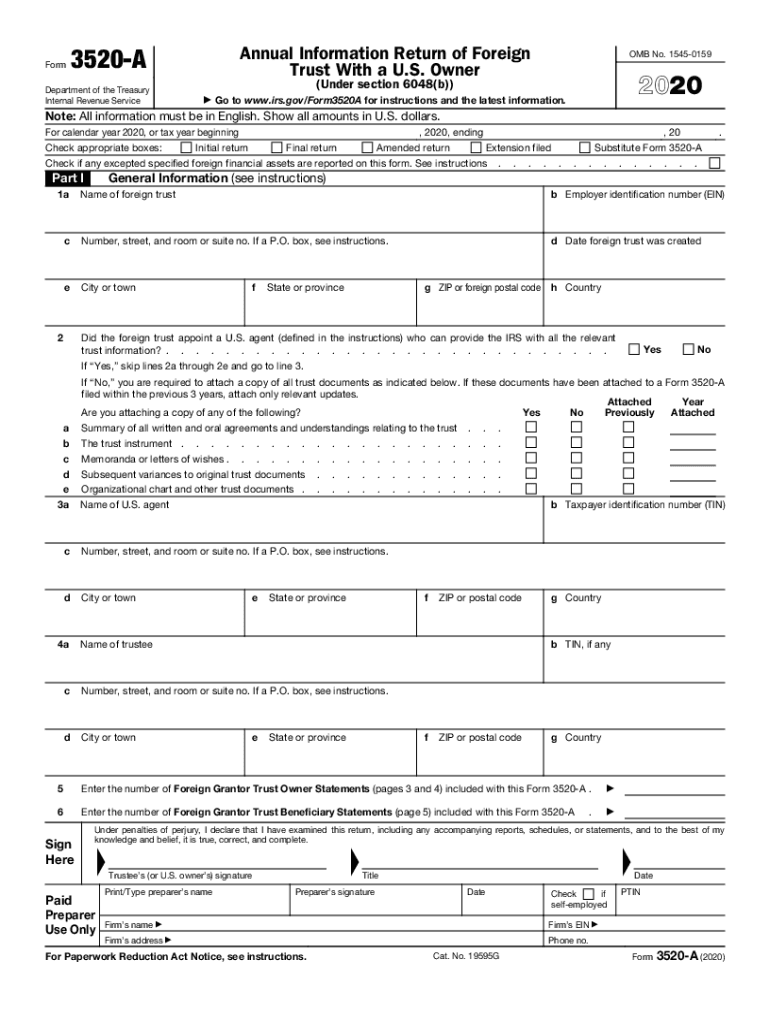

Form 3520 a Annual Information Return of Foreign Trust with a U S Owner under Section 6048b 2020

What is the Form 3520-A Annual Information Return of Foreign Trust with a U.S. Owner Under Section 6048(b)

The Form 3520-A serves as an annual information return for foreign trusts that have a U.S. owner, specifically under Section 6048(b) of the Internal Revenue Code. This form is crucial for U.S. taxpayers who are beneficiaries of foreign trusts or who have created such trusts. It provides the IRS with necessary details about the trust's income, distributions, and other pertinent information that ensures compliance with U.S. tax laws. Understanding the purpose of this form is vital for avoiding potential penalties associated with non-compliance.

Steps to Complete the Form 3520-A

Completing the Form 3520-A involves several key steps to ensure accuracy and compliance. First, gather all relevant information about the foreign trust, including its name, address, and taxpayer identification number. Next, detail the trust's financial activities, including income earned and distributions made to U.S. beneficiaries. It is essential to provide accurate information to avoid complications. Finally, review the completed form for errors before submission, as any inaccuracies can lead to penalties.

Filing Deadlines / Important Dates

The Form 3520-A has specific filing deadlines that must be adhered to in order to avoid penalties. Generally, the form is due on the fifteenth day of the third month following the end of the trust's tax year. For example, if the trust operates on a calendar year, the form would be due by March 15 of the following year. If the deadline falls on a weekend or holiday, it is typically extended to the next business day. Staying aware of these deadlines is crucial for compliance.

Penalties for Non-Compliance

Failure to file the Form 3520-A or inaccuracies in the information provided can result in significant penalties. The IRS may impose a penalty of five percent of the trust's gross value for each month the form is late, up to a maximum of 25 percent. Additionally, if the IRS deems that the failure to file was intentional, the penalties can be even more severe. Understanding these consequences highlights the importance of timely and accurate filing.

Digital vs. Paper Version

When completing the Form 3520-A, taxpayers have the option to file either a digital or paper version. The digital version is often preferred for its convenience and efficiency, allowing for quicker processing times. However, some individuals may choose to submit a paper form for various reasons, such as personal preference or lack of access to digital tools. Regardless of the method chosen, it is essential to ensure that all information is accurately reported and submitted on time.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Form 3520-A. These guidelines include detailed instructions on what information is required, how to report income, and the necessary disclosures related to foreign trusts. Familiarizing oneself with these guidelines is essential for ensuring compliance and avoiding penalties. Taxpayers should refer to the IRS instructions for the most up-to-date information and requirements related to the form.

Quick guide on how to complete 2020 form 3520 a annual information return of foreign trust with a us owner under section 6048b

Complete Form 3520 A Annual Information Return Of Foreign Trust With A U S Owner Under Section 6048b effortlessly on any device

Online document administration has become increasingly favored by organizations and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can easily find the right template and securely archive it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Manage Form 3520 A Annual Information Return Of Foreign Trust With A U S Owner Under Section 6048b on any platform using airSlate SignNow Android or iOS applications and simplify any document-related process today.

The best way to alter and eSign Form 3520 A Annual Information Return Of Foreign Trust With A U S Owner Under Section 6048b without breaking a sweat

- Find Form 3520 A Annual Information Return Of Foreign Trust With A U S Owner Under Section 6048b and click Get Form to begin.

- Utilize the tools we provide to finish your document.

- Emphasize relevant parts of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal significance as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to share your form, by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets your needs in document management in just a few clicks from a device of your choice. Modify and eSign Form 3520 A Annual Information Return Of Foreign Trust With A U S Owner Under Section 6048b and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form 3520 a annual information return of foreign trust with a us owner under section 6048b

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 3520 a annual information return of foreign trust with a us owner under section 6048b

The way to make an eSignature for a PDF in the online mode

The way to make an eSignature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

The way to make an eSignature straight from your smart phone

The way to make an eSignature for a PDF on iOS devices

The way to make an eSignature for a PDF document on Android OS

People also ask

-

What are the form 3520 instructions?

The form 3520 instructions provide detailed guidance on reporting transactions with foreign trusts and receiving certain foreign gifts. These instructions are essential for ensuring compliance with IRS regulations. Understanding the form 3520 instructions can help avoid penalties for incorrect reporting.

-

How can airSlate SignNow assist with completing form 3520?

airSlate SignNow offers an intuitive platform that allows users to fill out and eSign documents easily, including form 3520. Utilizing our features streamlines the process of managing complex tax forms. With airSlate SignNow, you can ensure that your form 3520 is completed accurately and efficiently.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow has flexible pricing plans tailored to your business needs, whether you are an individual or a large organization. Each plan provides access to key features such as document templates and eSign functionality, which can be beneficial when handling form 3520 instructions. You can explore our pricing page for detailed information.

-

Does airSlate SignNow integrate with other software for tax purposes?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software solutions. This feature enables users to manage form 3520 instructions in conjunction with their existing workflows. Integrations help streamline data transfer, making it easier to handle all tax-related documentation.

-

What features does airSlate SignNow offer for document management?

AirSlate SignNow offers features such as document templates, secure eSigning, and real-time collaboration. These tools are particularly useful when working with complex forms like the form 3520 instructions. This functionality helps teams ensure compliance while enhancing productivity.

-

How can I ensure compliance when using form 3520 instructions in airSlate SignNow?

To ensure compliance while using form 3520 instructions in airSlate SignNow, utilize our template features and collaborate with your team for review. It's essential to double-check the filled form against the official instructions to avoid mistakes. Our user-friendly interface aids in maintaining precision during the process.

-

Is airSlate SignNow suitable for businesses of all sizes?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, from freelancers to large enterprises. Regardless of the complexity of handling documents like form 3520 instructions, our platform provides the tools necessary for efficient document management. Its scalability makes it an ideal choice for diverse business needs.

Get more for Form 3520 A Annual Information Return Of Foreign Trust With A U S Owner Under Section 6048b

- Wwwcaustelotfarmscomdocfilessummercamp19marciak performance horse camp registration form

- Cityoflakewoodusitlakewood community gardenlakewood community garden city of lakewood form

- Voter registration 611906602 form

- Wwwredwoodfallsbaseballcomwp contentuploads10u aa redwood area youth msf invitational tournament june 9 form

- Appdedyniomassachusetts mail in votermassachusetts mail in voter registration form quick and easy

- Static11sqspcdncomstaticfcatv underground rebar registration form for local 55 out of

- Pdf texas medical center cancer center referral form

- Counselling contract template form

Find out other Form 3520 A Annual Information Return Of Foreign Trust With A U S Owner Under Section 6048b

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent