Form 3520 2013

What is the Form 3520

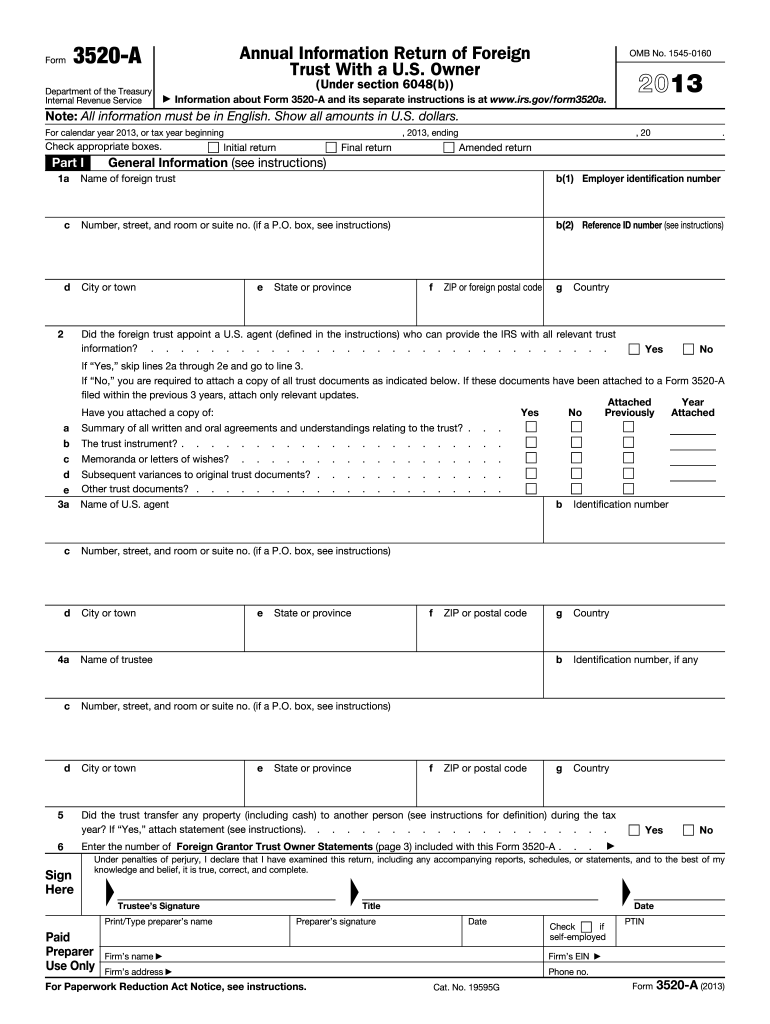

The Form 3520 is a U.S. Internal Revenue Service (IRS) document used to report certain transactions with foreign trusts, ownership of foreign trusts, and receipts of foreign gifts. This form is essential for U.S. taxpayers who have foreign financial interests, ensuring compliance with U.S. tax laws. Failing to file this form when required can lead to significant penalties. Understanding the purpose of Form 3520 is crucial for maintaining proper tax compliance and avoiding legal repercussions.

How to use the Form 3520

Using Form 3520 involves several steps to ensure accurate reporting. Taxpayers must first determine if they are required to file based on their foreign financial activities. If required, they can obtain the form from the IRS website or through tax preparation software. Once the form is acquired, individuals need to carefully fill it out, providing detailed information about foreign trusts, gifts, or inheritances received. After completing the form, it must be submitted to the IRS by the specified deadline to avoid penalties.

Steps to complete the Form 3520

Completing Form 3520 requires careful attention to detail. Here are the essential steps:

- Determine if you need to file based on your foreign financial interests.

- Obtain the latest version of Form 3520 from the IRS website.

- Fill out the form accurately, providing necessary details about foreign gifts or trusts.

- Review the completed form for accuracy and completeness.

- Submit the form to the IRS by the due date, either electronically or by mail.

Filing Deadlines / Important Dates

Filing deadlines for Form 3520 are critical to avoid penalties. Generally, the form is due on the same date as your income tax return, typically April 15 for most taxpayers. If you require an extension for your income tax return, this extension also applies to Form 3520. However, it is essential to check for any specific updates from the IRS regarding deadlines, as they can vary based on individual circumstances.

Penalties for Non-Compliance

Failing to file Form 3520 when required can lead to substantial penalties. The IRS imposes a penalty of five percent of the amount of the foreign gift or trust for each month the form is late, up to a maximum of 25 percent. Additionally, if the failure to file is deemed willful, the penalties can be much higher. Understanding these consequences underscores the importance of timely and accurate filing of Form 3520.

Legal use of the Form 3520

Form 3520 serves a legal purpose in the context of U.S. tax law. It is required under the Internal Revenue Code to ensure that U.S. taxpayers report their foreign financial interests accurately. The form helps the IRS track foreign transactions and prevent tax evasion. Legal compliance with Form 3520 is essential for taxpayers with foreign trusts or gifts, as it protects them from potential legal issues and penalties associated with non-disclosure.

Quick guide on how to complete 2013 form 3520

Complete Form 3520 effortlessly on any device

Web-based document management has become widely adopted by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the features necessary to create, modify, and electronically sign your documents promptly without any hold-ups. Manage Form 3520 on any platform using the airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

The easiest way to edit and electronically sign Form 3520 seamlessly

- Locate Form 3520 and click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize important sections of your documents or obscure private information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information and click the Done button to apply your changes.

- Select your preferred method of delivering your form, whether via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about missing or lost files, cumbersome form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Edit and electronically sign Form 3520 to ensure outstanding communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 form 3520

Create this form in 5 minutes!

How to create an eSignature for the 2013 form 3520

The best way to make an eSignature for a PDF online

The best way to make an eSignature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

The way to generate an eSignature straight from your smartphone

How to make an eSignature for a PDF on iOS

The way to generate an eSignature for a PDF document on Android

People also ask

-

What is Form 3520 and why do I need it?

Form 3520 is a required IRS form for U.S. taxpayers to report certain transactions with foreign trusts and to report the receipt of certain foreign gifts. Understanding and filing Form 3520 is essential to comply with federal tax regulations and avoid penalties.

-

How can airSlate SignNow help me manage Form 3520?

airSlate SignNow streamlines the process of preparing and managing Form 3520 by offering an intuitive eSigning and document management solution. With our platform, you can easily fill out, sign, and send your Form 3520, reducing paperwork and enhancing accuracy.

-

Is airSlate SignNow suitable for filing Form 3520?

Absolutely! airSlate SignNow is designed for efficient document management, making it an ideal choice for individuals and businesses needing to file Form 3520. Our secure platform ensures that your sensitive information is protected while you complete essential tax forms swiftly.

-

What are the pricing options for using airSlate SignNow with Form 3520?

airSlate SignNow offers a variety of pricing plans to cater to different needs, with options that include unlimited eSigning for a fixed monthly fee. You can choose a plan that fits your requirements, and we provide cost-effective solutions to manage your Form 3520 documents efficiently.

-

Can airSlate SignNow integrate with other accounting software for Form 3520?

Yes, airSlate SignNow seamlessly integrates with various accounting and tax preparation software to assist in managing Form 3520. These integrations help you sync your data easily, making the filing process smoother and more organized.

-

What features of airSlate SignNow are specifically beneficial for Form 3520?

Key features of airSlate SignNow beneficial for Form 3520 include customizable templates, secure eSigning, and automated reminders for important deadlines. These features help ensure that your Form 3520 is completed and submitted on time, enhancing compliance.

-

Is airSlate SignNow secure for filing sensitive documents like Form 3520?

Yes, airSlate SignNow prioritizes your data security, employing strong encryption and compliance with industry standards. When filing sensitive documents like Form 3520, you can trust that your information is safe and securely handled.

Get more for Form 3520

- N 400 khmer translation 2414 form cambodian family

- Mobile coverage claim form security service ssfcu

- Scoutmasters key progress record form

- Do the math order form

- Mood assessment questionnaire form

- Commissioner fieldbook for unit service boy scouts of america form

- 32bj 401k contribution form

- Commissioner award of excellence in unit service progress record 122916 fillable format

Find out other Form 3520

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will