IRS Form 3520 a Annual Information Return of ForeignIRS Form 3520 a Annual Information Return of ForeignAbout Form 3520 A, Annua 2022-2026

Understanding IRS Form 3520

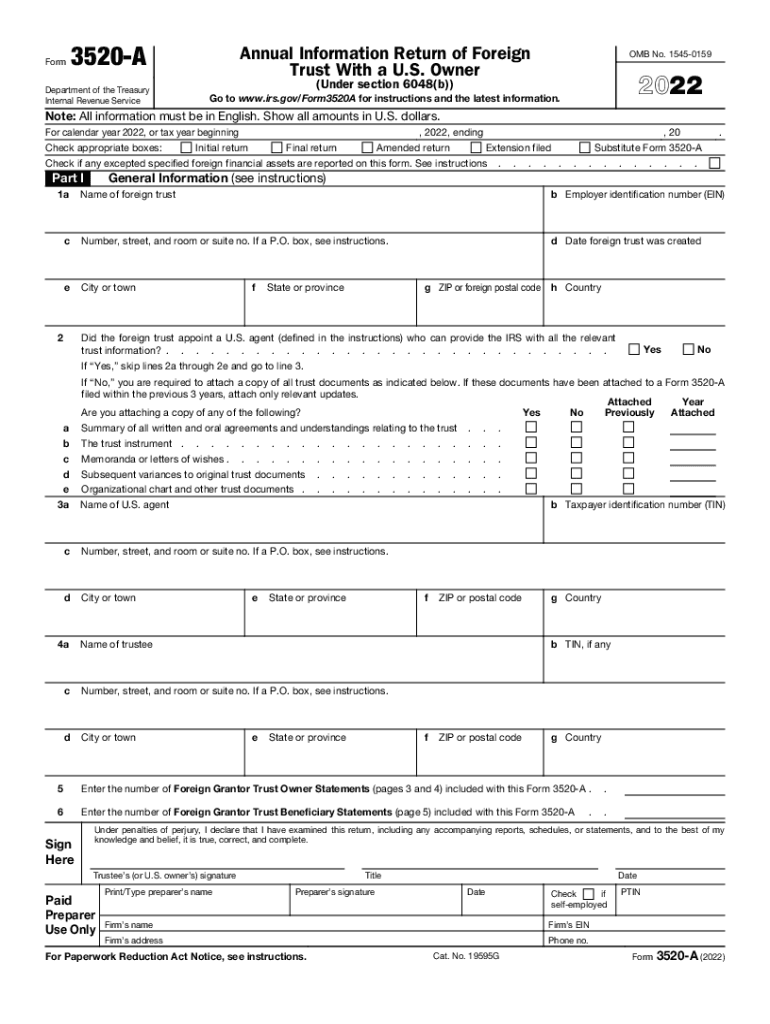

IRS Form 3520 is an essential document for U.S. taxpayers who receive foreign gifts or inheritances exceeding a specific threshold. This form serves as an annual information return, reporting transactions with foreign trusts and the receipt of certain foreign gifts. It is crucial for compliance with IRS regulations and helps in avoiding potential penalties. The IRS requires this form to ensure that taxpayers disclose their foreign financial interests and comply with U.S. tax laws.

Steps to Complete IRS Form 3520

Completing IRS Form 3520 involves several steps to ensure accuracy and compliance. First, gather all necessary information regarding the foreign gift or inheritance, including the name and address of the foreign donor, the amount received, and the date of the transaction. Next, fill out the form accurately, ensuring that all sections are completed, particularly those pertaining to the nature of the gift or inheritance. After completing the form, review it for any errors or omissions before submission.

Filing Deadlines for IRS Form 3520

The filing deadline for IRS Form 3520 typically aligns with the due date for your income tax return, which is usually April 15. However, if you require an extension, you may file for an extension using IRS Form 4868, which extends your deadline by six months. It is important to note that while an extension provides additional time to file your tax return, it does not extend the time to pay any taxes owed. Late filing of Form 3520 can result in significant penalties, so timely submission is essential.

Penalties for Non-Compliance with IRS Form 3520

Failure to file IRS Form 3520 on time or inaccuracies in the information provided can lead to substantial penalties. The IRS imposes a penalty of five percent of the amount of the foreign gift or inheritance for each month the form is late, up to a maximum of 25 percent. Additionally, if the form is not filed at all, the IRS may impose a flat penalty of $10,000. Understanding these penalties underscores the importance of timely and accurate filing.

Digital Submission Methods for IRS Form 3520

Taxpayers can file IRS Form 3520 electronically or by mail. While the IRS does not currently allow electronic filing of Form 3520 directly, many tax preparation software programs offer the option to complete and print the form for mailing. When submitting by mail, ensure that you send the form to the correct IRS address, which varies depending on whether you are enclosing a payment. Always keep a copy of the submitted form for your records.

Key Elements of IRS Form 3520

IRS Form 3520 includes several key elements that require careful attention. These elements include personal identification information, details about the foreign gift or inheritance, and any relevant trusts. Additionally, the form may require disclosures regarding foreign accounts or assets. Accurate reporting of these elements is critical for compliance and to avoid penalties.

Quick guide on how to complete irs form 3520 a annual information return of foreignirs form 3520 a annual information return of foreignabout form 3520 a

Complete IRS Form 3520 A Annual Information Return Of ForeignIRS Form 3520 A Annual Information Return Of ForeignAbout Form 3520 A, Annua effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents promptly without holdups. Manage IRS Form 3520 A Annual Information Return Of ForeignIRS Form 3520 A Annual Information Return Of ForeignAbout Form 3520 A, Annua on any device with airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

How to modify and electronically sign IRS Form 3520 A Annual Information Return Of ForeignIRS Form 3520 A Annual Information Return Of ForeignAbout Form 3520 A, Annua with ease

- Locate IRS Form 3520 A Annual Information Return Of ForeignIRS Form 3520 A Annual Information Return Of ForeignAbout Form 3520 A, Annua and then click Get Form to proceed.

- Use the tools we provide to fill out your form.

- Highlight important sections of the documents or conceal sensitive information with tools that airSlate SignNow exclusively provides for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in a few clicks from any device you prefer. Alter and electronically sign IRS Form 3520 A Annual Information Return Of ForeignIRS Form 3520 A Annual Information Return Of ForeignAbout Form 3520 A, Annua to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 3520 a annual information return of foreignirs form 3520 a annual information return of foreignabout form 3520 a

Create this form in 5 minutes!

How to create an eSignature for the irs form 3520 a annual information return of foreignirs form 3520 a annual information return of foreignabout form 3520 a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 3520 IRS?

Form 3520 IRS is a tax form used to report certain transactions with foreign trusts, the receipt of foreign gifts, and the creation of foreign trusts. This form is crucial for U.S. taxpayers who have financial interests in foreign entities and need to comply with IRS regulations. Ensuring accurate completion of Form 3520 IRS can help avoid potential penalties.

-

How can airSlate SignNow assist with Form 3520 IRS preparation?

AirSlate SignNow streamlines the process of signing and submitting Form 3520 IRS by offering a user-friendly electronic signature platform. With our service, you can easily gather signatures from multiple parties, ensuring that your forms are completed quickly and efficiently. This reduces the hassle associated with traditional paperwork when dealing with Form 3520 IRS.

-

Is there a cost to use airSlate SignNow for Form 3520 IRS transactions?

Yes, there is a pricing structure for using airSlate SignNow, which varies depending on the features and the number of users. However, compared to other solutions, our service is cost-effective and offers great value for businesses needing to manage Form 3520 IRS submissions. You can explore our pricing plans on our website to find the right fit.

-

Are there templates available for Form 3520 IRS on airSlate SignNow?

While airSlate SignNow does not provide a specific template for Form 3520 IRS, our platform allows you to upload and customize any document, including IRS forms. You can easily create a streamlined process for managing your Form 3520 IRS submissions. Our solution ensures all necessary signatures are collected efficiently.

-

What are the benefits of using airSlate SignNow for IRS forms?

Using airSlate SignNow for IRS forms like Form 3520 comes with multiple benefits, such as legal compliance and improved workflow. Our platform speeds up the signing process, allowing for quicker turnaround times. Additionally, the ability to track document status enhances your ability to stay organized with Form 3520 IRS submissions.

-

Can airSlate SignNow integrate with accounting software for Form 3520 IRS?

Yes, airSlate SignNow offers integration capabilities with various accounting and financial management software. This allows for seamless data transfer and better management of your Form 3520 IRS-related activities. Integrating with your existing systems improves efficiency and ensures that you stay on top of your tax obligations.

-

Does airSlate SignNow provide support for international transactions related to Form 3520 IRS?

Absolutely! airSlate SignNow is designed to facilitate international transactions, making it easier to handle documents related to Form 3520 IRS. We provide customer support to help navigate any challenges that may arise during the process of signing and submitting international forms, ensuring compliance with IRS regulations.

Get more for IRS Form 3520 A Annual Information Return Of ForeignIRS Form 3520 A Annual Information Return Of ForeignAbout Form 3520 A, Annua

- Express employment pay card form

- Ohio waiver application pdf form

- Cara cek saldo asuransi astra life form

- Skin assessment form

- Artistry products catalogue form

- San bernardino family court forms

- Tipps application form in tamil pdf download

- Sample child support enforcement order qdro garnishment of monthly pension payments form

Find out other IRS Form 3520 A Annual Information Return Of ForeignIRS Form 3520 A Annual Information Return Of ForeignAbout Form 3520 A, Annua

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe