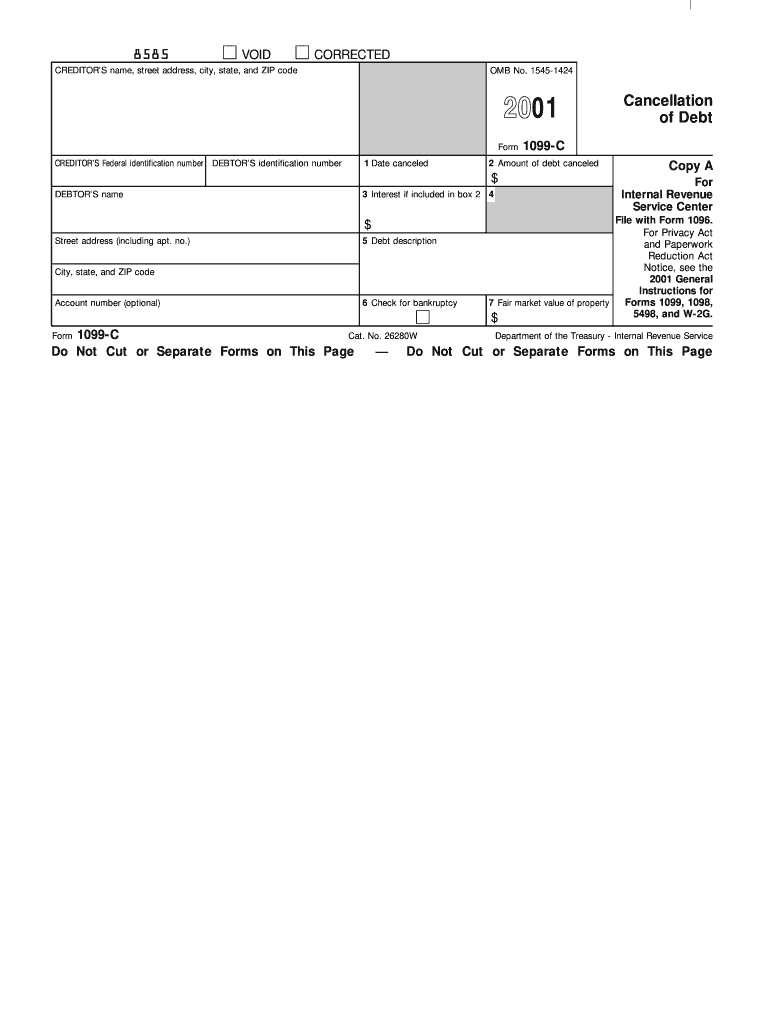

Form 1099C Cancellation of Debt Irs 2001

What is the Form 1099C Cancellation Of Debt Irs

The Form 1099C Cancellation Of Debt is a tax form used by the Internal Revenue Service (IRS) to report the cancellation of debt by a lender. When a creditor forgives or cancels a debt of $600 or more, they are required to issue this form to the debtor and the IRS. The cancellation of debt can be considered taxable income, which means it may affect the taxpayer's overall income tax liability. Understanding this form is crucial for individuals who have had debts forgiven, as it helps them accurately report their income on their tax returns.

How to use the Form 1099C Cancellation Of Debt Irs

Using the Form 1099C Cancellation Of Debt involves a few key steps. First, the lender must complete the form, providing details such as the debtor's information, the amount of debt canceled, and the date of cancellation. Once the form is completed, it is sent to the debtor and filed with the IRS. The debtor should keep this form for their records and use it when preparing their tax return. It is essential to report the canceled debt as income unless an exclusion applies, such as insolvency or bankruptcy.

Steps to complete the Form 1099C Cancellation Of Debt Irs

Completing the Form 1099C requires careful attention to detail. Here are the steps involved:

- Gather necessary information, including the debtor's name, address, and taxpayer identification number (TIN).

- Input the creditor's information, including their name, address, and TIN.

- Indicate the amount of debt canceled in the appropriate box.

- Provide the date of cancellation.

- Check any applicable boxes, such as if the debt was discharged in bankruptcy.

- Review the completed form for accuracy before submission.

Key elements of the Form 1099C Cancellation Of Debt Irs

The Form 1099C includes several key elements that are important for both creditors and debtors. These elements include:

- Debtor Information: Name, address, and TIN of the individual whose debt was canceled.

- Creditor Information: Name, address, and TIN of the entity that canceled the debt.

- Amount of Debt Canceled: The total amount of debt that has been forgiven.

- Date of Cancellation: The date when the debt was officially canceled.

- Box for Bankruptcy Discharge: Indicates if the debt was discharged in bankruptcy, which may affect tax implications.

IRS Guidelines

The IRS provides specific guidelines regarding the Form 1099C. Creditors are required to issue this form if they cancel a debt of $600 or more. The form must be filed with the IRS by the end of February if filed on paper or by the end of March if filed electronically. Additionally, debtors should receive their copy of the form by January 31 of the following year. It is crucial for both parties to adhere to these guidelines to ensure compliance and avoid penalties.

Penalties for Non-Compliance

Failure to comply with the requirements related to the Form 1099C can result in penalties for both creditors and debtors. Creditors who do not issue the form when required may face fines imposed by the IRS. Debtors who fail to report canceled debt as income may also incur penalties, including interest on unpaid taxes. It is essential for both parties to understand their responsibilities to avoid these potential consequences.

Quick guide on how to complete 2001 form 1099c cancellation of debt irs

Complete Form 1099C Cancellation Of Debt Irs effortlessly on any device

Digital document management has gained popularity among enterprises and individuals alike. It offers an ideal environmentally-friendly substitute for traditional printed and signed papers, as you can obtain the correct form and securely archive it online. airSlate SignNow equips you with all the tools you need to generate, modify, and eSign your documents swiftly without any hold-ups. Handle Form 1099C Cancellation Of Debt Irs on any device using the airSlate SignNow Android or iOS apps and simplify any document-related task today.

How to modify and eSign Form 1099C Cancellation Of Debt Irs without hassle

- Find Form 1099C Cancellation Of Debt Irs and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize signNow sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to preserve your changes.

- Select how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 1099C Cancellation Of Debt Irs and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2001 form 1099c cancellation of debt irs

Create this form in 5 minutes!

How to create an eSignature for the 2001 form 1099c cancellation of debt irs

How to create an eSignature for your PDF file in the online mode

How to create an eSignature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

The best way to generate an eSignature from your smartphone

How to generate an electronic signature for a PDF file on iOS devices

The best way to generate an eSignature for a PDF file on Android

People also ask

-

What is Form 1099C Cancellation Of Debt Irs?

Form 1099C Cancellation Of Debt Irs is a tax form used by the IRS to report canceled debt. When a lender forgives or cancels at least $600 of your debt, they are required to file this form. Understanding this form is crucial for tax reporting and financial management.

-

How can airSlate SignNow help with Form 1099C Cancellation Of Debt Irs?

airSlate SignNow provides a seamless way to eSign and send Form 1099C Cancellation Of Debt Irs quickly and securely. Our platform ensures that your tax documentation is handled efficiently, saving you time and ensuring compliance with IRS regulations.

-

Is there a cost associated with using airSlate SignNow for Form 1099C Cancellation Of Debt Irs?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our cost-effective solutions allow you to manage Form 1099C Cancellation Of Debt Irs without breaking the bank, ensuring you have the tools necessary for professional document handling.

-

What features does airSlate SignNow offer for handling tax documents like Form 1099C Cancellation Of Debt Irs?

airSlate SignNow offers features like secure eSignature, document storage, and customizable templates specifically for forms like Form 1099C Cancellation Of Debt Irs. These features streamline the process, making it easier to manage your tax documentation efficiently.

-

How secure is airSlate SignNow when sending Form 1099C Cancellation Of Debt Irs?

Security is our top priority at airSlate SignNow. When sending Form 1099C Cancellation Of Debt Irs, your data is protected through end-to-end encryption, ensuring that your sensitive tax information remains safe and secure.

-

Can airSlate SignNow integrate with other software for handling Form 1099C Cancellation Of Debt Irs?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, allowing you to streamline your workflow for handling Form 1099C Cancellation Of Debt Irs. This integration ensures that your document management and financial processes are optimized and efficient.

-

What are the benefits of using airSlate SignNow for Form 1099C Cancellation Of Debt Irs?

Using airSlate SignNow for Form 1099C Cancellation Of Debt Irs offers several benefits, including enhanced efficiency, improved accuracy, and cost savings. Our platform simplifies the process of signing and managing tax documents, enabling you to focus on more critical business operations.

Get more for Form 1099C Cancellation Of Debt Irs

- Employment interview package idaho form

- Employment employee personnel file package idaho form

- Assignment of mortgage package idaho form

- Assignment of lease package idaho form

- Lease purchase agreements package idaho form

- Satisfaction cancellation or release of mortgage package idaho form

- Premarital agreements package idaho form

- Painting contractor package idaho form

Find out other Form 1099C Cancellation Of Debt Irs

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement