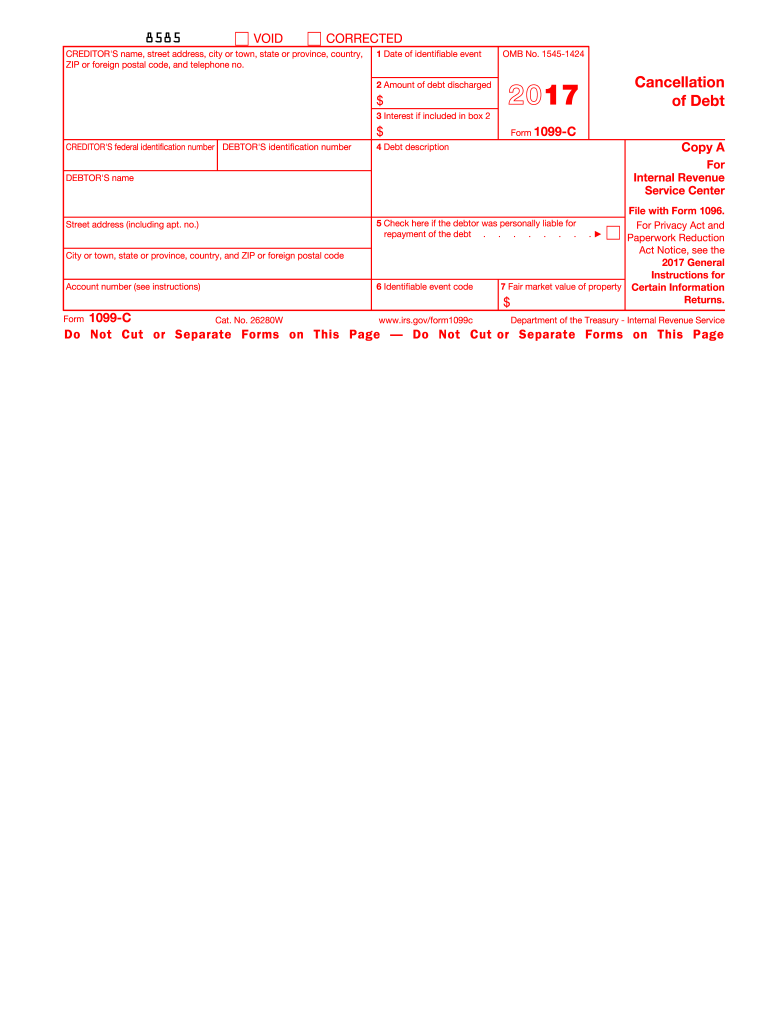

1099c Form 2017

What is the 1099C Form

The 1099C Form, officially known as the Cancellation of Debt form, is a tax document used in the United States to report the cancellation of a debt of $600 or more. This form is typically issued by lenders or creditors when they forgive or cancel a debt, which can include loans, credit card balances, or other financial obligations. The IRS considers canceled debt as taxable income, meaning that individuals may need to report this amount on their tax returns. Understanding the implications of receiving a 1099C Form is crucial for accurate tax reporting and compliance.

How to Use the 1099C Form

Using the 1099C Form involves a few key steps to ensure proper reporting of canceled debt. First, individuals should receive the form from their creditor by January 31 of the year following the cancellation. Once received, it is essential to review the form for accuracy, particularly the amount of debt canceled and the creditor's information. When filing taxes, the amount reported on the 1099C must be included as income on the tax return. Taxpayers may also need to complete additional forms, such as Form 982, to claim any exclusions or adjustments related to the canceled debt.

Steps to Complete the 1099C Form

Completing the 1099C Form requires careful attention to detail. Here are the steps to follow:

- Gather necessary information, including the creditor's name, address, and taxpayer identification number.

- Enter the debtor's information accurately, including name, address, and taxpayer identification number.

- Report the amount of debt canceled in the appropriate box.

- Indicate the date of cancellation in the specified field.

- Provide any additional information as required, such as the reason for cancellation.

Once completed, the form must be submitted to the IRS and a copy sent to the debtor.

Legal Use of the 1099C Form

The legal use of the 1099C Form is governed by IRS regulations, which stipulate that any cancellation of debt over $600 must be reported. Failure to issue a 1099C when required can lead to penalties for the creditor. For the debtor, receiving a 1099C Form signifies a potential tax liability, as the IRS treats canceled debt as taxable income. It is important for both parties to maintain accurate records and ensure compliance with tax laws to avoid legal complications.

Filing Deadlines / Important Dates

Filing deadlines for the 1099C Form are crucial for both creditors and debtors. Creditors must issue the form to the debtor by January 31 of the year following the debt cancellation. Additionally, the form must be filed with the IRS by February 28 if submitted by mail, or by March 31 if filed electronically. Debtors should be aware of these dates to ensure they report the canceled debt accurately on their tax returns, typically due on April 15.

Who Issues the Form

The 1099C Form is issued by creditors who have canceled a debt of $600 or more. This can include banks, credit card companies, mortgage lenders, and other financial institutions. In some cases, debt collectors may also issue a 1099C if they have acquired the debt and subsequently canceled it. It is essential for creditors to comply with IRS regulations regarding the issuance of this form to avoid penalties.

Quick guide on how to complete 1099c 2017 form

Complete 1099c Form effortlessly on any device

Digital document management has gained popularity among organizations and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents quickly and efficiently. Manage 1099c Form on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to edit and electronically sign 1099c Form with ease

- Locate 1099c Form and click on Get Form to begin.

- Utilize the tools provided to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive information with the tools specially designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method of submitting your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign 1099c Form to ensure exceptional communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1099c 2017 form

Create this form in 5 minutes!

How to create an eSignature for the 1099c 2017 form

How to create an eSignature for your 1099c 2017 Form online

How to make an electronic signature for your 1099c 2017 Form in Chrome

How to generate an electronic signature for putting it on the 1099c 2017 Form in Gmail

How to make an electronic signature for the 1099c 2017 Form straight from your smart phone

How to make an electronic signature for the 1099c 2017 Form on iOS

How to create an eSignature for the 1099c 2017 Form on Android

People also ask

-

What is a 1099C Form and when is it used?

The 1099C Form is used to report the cancellation of debt by a creditor to the IRS. This form is important for individuals who have had debts forgiven or canceled, as it can affect their tax obligations. Understanding the implications of a 1099C Form is crucial for accurate tax filing.

-

How does airSlate SignNow help with the 1099C Form process?

airSlate SignNow simplifies the process of sending and signing the 1099C Form electronically. Our platform allows businesses to quickly prepare, send, and obtain signatures on the form, ensuring compliance and efficiency. With our user-friendly interface, managing your 1099C Form is hassle-free.

-

What features does airSlate SignNow offer for handling the 1099C Form?

With airSlate SignNow, you can easily create, edit, and send the 1099C Form while ensuring secure electronic signatures. Our platform includes templates, workflow automation, and document tracking, making it easier to manage all your tax-related documents. This streamlines your operations and minimizes the chances of errors.

-

Is airSlate SignNow a cost-effective solution for managing the 1099C Form?

Yes, airSlate SignNow offers affordable pricing plans that cater to businesses of all sizes looking to manage their 1099C Form efficiently. By reducing paper usage and streamlining document workflows, our solution can save you both time and money. Explore our pricing options to find a plan that fits your needs.

-

Can I integrate airSlate SignNow with other accounting software for 1099C Forms?

Absolutely! airSlate SignNow seamlessly integrates with popular accounting software, allowing you to manage your 1099C Form alongside your financial records. This integration enhances your workflow by connecting document signing and financial management, ensuring that your tax processes are synchronized.

-

What are the benefits of using airSlate SignNow for the 1099C Form?

Using airSlate SignNow for your 1099C Form offers numerous benefits including improved efficiency, enhanced security, and ease of use. Our electronic signature solution ensures that your documents are signed quickly and legally, while also providing a record of completion for your peace of mind. Experience a faster and more reliable way to handle your tax documentation.

-

How secure is the information shared on the 1099C Form with airSlate SignNow?

airSlate SignNow prioritizes the security of your documents, including the sensitive information on the 1099C Form. We utilize advanced encryption and secure data handling practices to protect your information from unauthorized access. Trust us to keep your documents safe while you streamline your signing processes.

Get more for 1099c Form

- Pistons custom form

- Class registration form community scholar university of virginia scps virginia

- Transcript request form owens community college owens

- Fl 683 form

- This renewal is due on or before december 1 illinois form

- Il app card form

- Bir form 1800

- Development and implementation of dashboard ltaq 005 2122 form

Find out other 1099c Form

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe