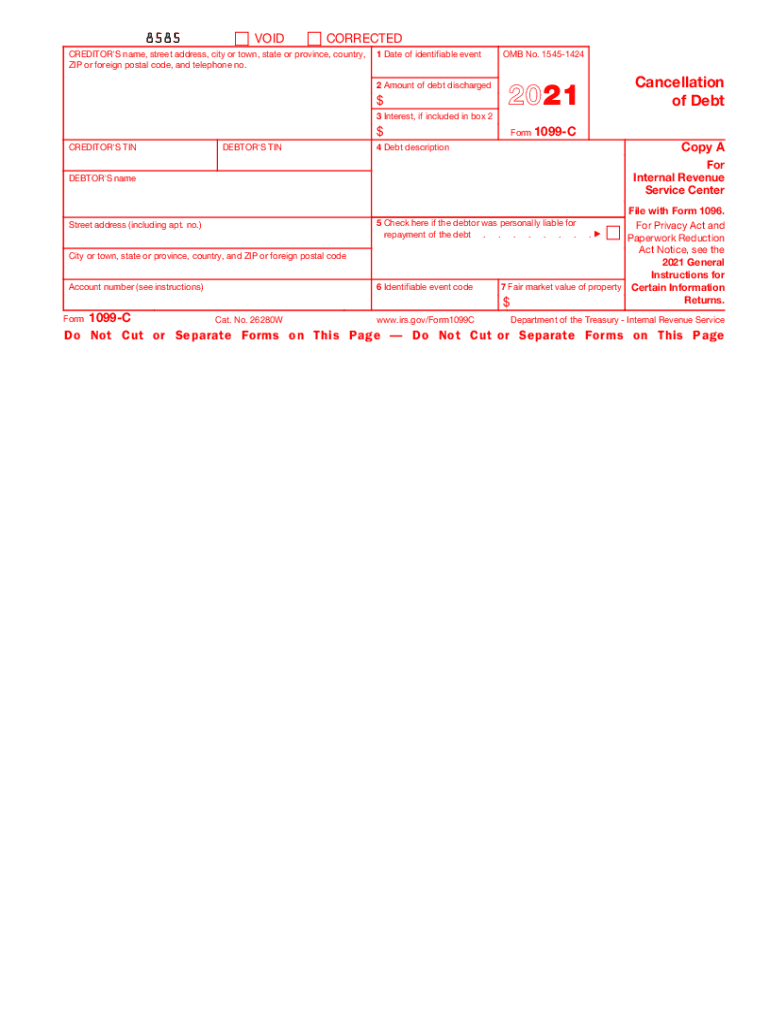

Form 1099 C Cancellation of Debt 2021

What is the Form 1099 C Cancellation of Debt

The Form 1099 C is a tax document used by the Internal Revenue Service (IRS) to report the cancellation of debt. When a lender forgives or cancels a debt of $600 or more, they are required to issue this form to the borrower and the IRS. The cancellation of debt can have significant tax implications, as the IRS typically considers forgiven debt as taxable income. Therefore, it is essential for taxpayers to understand how this form impacts their financial situation and tax obligations.

Steps to Complete the Form 1099 C Cancellation of Debt

Completing the Form 1099 C involves several key steps:

- Gather necessary information, including the debtor's name, address, and taxpayer identification number.

- Provide details about the creditor, including their name, address, and taxpayer identification number.

- Indicate the amount of debt that has been canceled and the date of cancellation.

- Fill in the relevant boxes on the form, ensuring accuracy to avoid issues with the IRS.

- Submit the completed form to the IRS and provide a copy to the debtor.

Legal Use of the Form 1099 C Cancellation of Debt

The legal use of Form 1099 C is crucial for both creditors and debtors. For creditors, issuing this form is a compliance requirement when canceling a debt. For debtors, receiving a 1099 C can affect their tax filings, as they may need to report the canceled debt as income. Understanding the legal implications ensures that both parties adhere to IRS regulations and avoid potential penalties.

IRS Guidelines for Form 1099 C Cancellation of Debt

The IRS provides specific guidelines for completing and submitting the Form 1099 C. These guidelines include:

- Filing deadlines, which typically align with the end of the tax year.

- Requirements for providing copies to the debtor and the IRS.

- Instructions for reporting the canceled debt accurately on tax returns.

Following these guidelines helps ensure compliance and minimizes the risk of audits or penalties.

Who Issues the Form 1099 C Cancellation of Debt

The Form 1099 C is typically issued by financial institutions, credit unions, and other lenders that have canceled a debt. This includes credit card companies, mortgage lenders, and any entity that has forgiven a debt of $600 or more. It is important for borrowers to be aware of who issues the form, as they will need to reference it when filing their taxes.

Filing Deadlines for Form 1099 C Cancellation of Debt

Filing deadlines for the Form 1099 C are crucial for compliance. Generally, creditors must file the form with the IRS by the last day of February if filing on paper, or by March 31 if filing electronically. Additionally, creditors must provide a copy to the debtor by January 31 of the following tax year. Meeting these deadlines helps avoid penalties and ensures that all parties have the necessary documentation for tax purposes.

Quick guide on how to complete 2021 form 1099 c cancellation of debt

Complete Form 1099 C Cancellation Of Debt effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to access the right form and securely store it online. airSlate SignNow provides all the necessary tools to create, edit, and electronically sign your documents promptly without any holdups. Manage Form 1099 C Cancellation Of Debt on any platform with the airSlate SignNow Android or iOS applications and enhance your document-related processes today.

How to edit and electronically sign Form 1099 C Cancellation Of Debt with ease

- Find Form 1099 C Cancellation Of Debt and click Get Form to commence.

- Utilize the features we offer to fill out your document.

- Emphasize important parts of the documents or redact sensitive information using the tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to submit your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searching, or errors that require printing new document versions. airSlate SignNow meets all your document management requirements in just a few clicks from any device you choose. Alter and electronically sign Form 1099 C Cancellation Of Debt to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 form 1099 c cancellation of debt

Create this form in 5 minutes!

How to create an eSignature for the 2021 form 1099 c cancellation of debt

The way to generate an e-signature for a PDF document online

The way to generate an e-signature for a PDF document in Google Chrome

How to generate an e-signature for signing PDFs in Gmail

How to generate an e-signature from your smart phone

The way to create an e-signature for a PDF document on iOS

How to generate an e-signature for a PDF file on Android OS

People also ask

-

What is a 1099 c form and why is it important?

A 1099 c form is used to report cancellation of debt to the IRS. It's important because receiving this form can affect your tax liabilities, as cancelled debt may be viewed as taxable income. Understanding how to manage your 1099 c obligations is crucial for accurate tax reporting.

-

How can airSlate SignNow help with the 1099 c form process?

airSlate SignNow simplifies the process of sending and eSigning your 1099 c forms. With its user-friendly interface, you can quickly prepare these documents and ensure that they are securely signed by all parties involved. This streamlines your workflow and saves valuable time during tax season.

-

Is airSlate SignNow cost-effective for handling 1099 c forms?

Yes, airSlate SignNow offers a cost-effective solution for handling 1099 c forms. With competitive pricing plans, you will have access to essential features without breaking your budget. The affordability allows businesses of all sizes to efficiently manage their tax documents.

-

What features does airSlate SignNow provide for 1099 c management?

airSlate SignNow offers robust features for managing your 1099 c forms, including automated workflows, document tracking, and secure eSignature options. These features ensure that your documents are handled efficiently and securely, leading to a more organized tax filing process.

-

Can I integrate airSlate SignNow with other accounting software for 1099 c management?

Absolutely! airSlate SignNow seamlessly integrates with various accounting software, making it easy to manage your 1099 c forms alongside your financial records. This integration enables a smooth data flow, minimizing errors and duplications in your invoicing and tax submissions.

-

What are the benefits of using airSlate SignNow for 1099 c forms?

Using airSlate SignNow for your 1099 c forms comes with numerous benefits, including enhanced security, efficiency, and compliance. The electronic signature process is both quick and legally binding, helping you stay organized while ensuring all documentation is properly handled in line with IRS guidelines.

-

How secure is airSlate SignNow for transmitting 1099 c forms?

airSlate SignNow uses advanced security protocols to protect your 1099 c forms during transmission. Data encryption and secure servers keep your sensitive information safe, ensuring compliance with privacy regulations. You can confidently send and receive your tax documents without concerns about security bsignNowes.

Get more for Form 1099 C Cancellation Of Debt

- Appearance bond 497300397 form

- Colorado consent surety form

- Colorado show cause 497300399 form

- Verbal emergency protection order issued pursuant to section 13 14 103 crs colorado form

- Colorado protection order form

- Instructions for protected person motion to modify dismiss protection order colorado form

- Motion dismiss order form

- Protection order application form

Find out other Form 1099 C Cancellation Of Debt

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online

- Electronic signature Iowa Business Operations Resignation Letter Online

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple