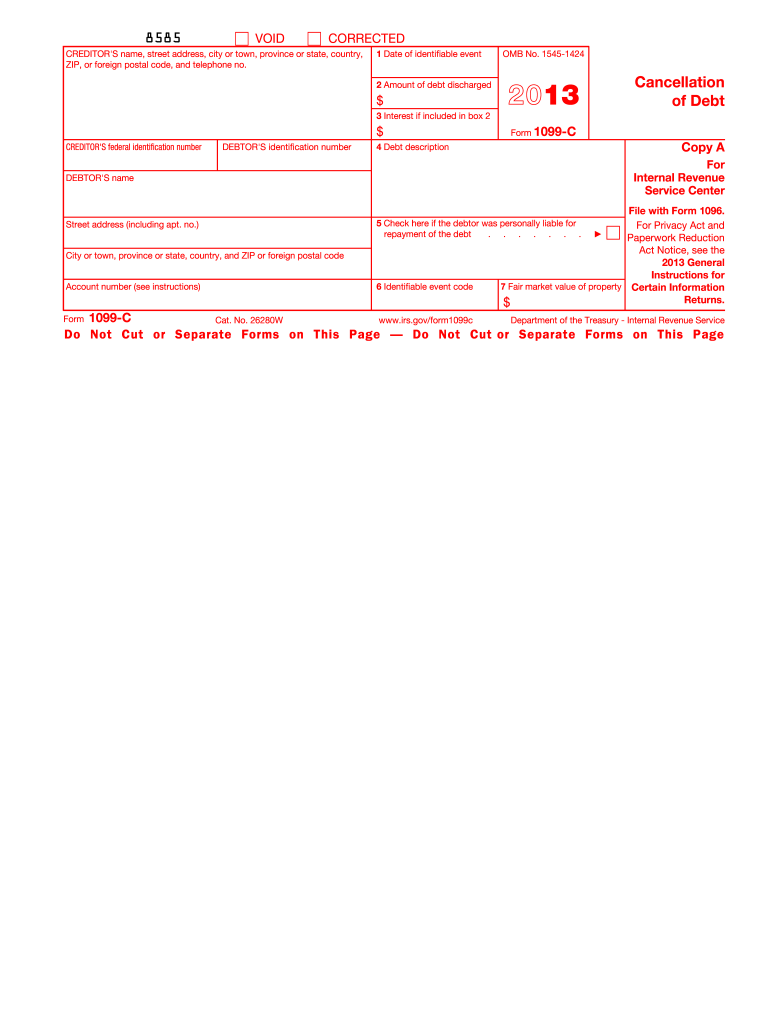

1099 C Form 2013

What is the 1099 C Form

The 1099 C Form, officially known as the Cancellation of Debt form, is used by lenders to report the cancellation of a debt owed by an individual or business. This form is crucial for tax purposes, as the IRS considers canceled debt as taxable income. It is typically issued when a debt of $600 or more is forgiven, such as in cases of foreclosure, repossession, or debt settlement. Understanding the implications of receiving a 1099 C Form is essential for accurate tax reporting and compliance.

How to use the 1099 C Form

Using the 1099 C Form involves several key steps. First, the debtor must receive the form from the lender, which outlines the amount of debt canceled and any other relevant information. The recipient must then report this amount on their tax return, typically on Form 1040. It is important to accurately include this income, as failing to do so may result in penalties from the IRS. Additionally, taxpayers may need to consider any exceptions or exclusions that could apply, such as insolvency or bankruptcy, which might allow them to exclude the canceled debt from taxable income.

Steps to complete the 1099 C Form

Completing the 1099 C Form requires careful attention to detail. Here are the steps involved:

- Obtain the form from the IRS website or through tax software.

- Fill in the lender's information, including name, address, and taxpayer identification number.

- Enter the debtor's information, ensuring accuracy in the name and Social Security number.

- Report the amount of debt canceled in the appropriate box.

- Indicate the date of cancellation and any applicable codes that describe the nature of the debt.

- Review the completed form for accuracy before submission.

Legal use of the 1099 C Form

The legal use of the 1099 C Form is governed by IRS regulations. Lenders are required to issue this form when they cancel a debt of $600 or more. The recipient must accurately report the canceled debt as income on their tax return. Failure to comply with these requirements can lead to legal consequences, including fines or penalties. It is essential for both lenders and debtors to understand their responsibilities regarding this form to ensure compliance with tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the 1099 C Form are critical for both issuers and recipients. Lenders must provide the form to the debtor by January 31 of the year following the debt cancellation. Additionally, they must file the form with the IRS by February 28 if filing by paper, or by March 31 if filing electronically. Recipients should be aware of these dates to ensure timely reporting of canceled debt on their tax returns, which are typically due on April 15.

Who Issues the Form

The 1099 C Form is issued by creditors who have canceled a debt. This includes banks, credit unions, credit card companies, and other financial institutions. In some cases, businesses that have forgiven debts may also issue this form. It is important for debtors to keep track of any 1099 C Forms they receive, as they serve as official documentation for tax reporting purposes.

Quick guide on how to complete 1099 c 2013 form

Complete 1099 C Form effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It serves as an ideal eco-conscious substitute for traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly and without delays. Manage 1099 C Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-focused tasks today.

The simplest way to edit and electronically sign 1099 C Form with ease

- Locate 1099 C Form and click Get Form to begin.

- Utilize the tools at your disposal to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information using the tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing additional copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign 1099 C Form to ensure exceptional communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1099 c 2013 form

Create this form in 5 minutes!

How to create an eSignature for the 1099 c 2013 form

The best way to generate an eSignature for a PDF file online

The best way to generate an eSignature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

How to create an eSignature right from your mobile device

How to create an eSignature for a PDF file on iOS

How to create an eSignature for a PDF on Android devices

People also ask

-

What is a 1099 C Form and when do I need it?

The 1099 C Form is a tax document used to report cancellation of debt to the IRS. You typically need to file a 1099 C Form if a lender cancels a debt of $600 or more. Understanding when to use this form is crucial for tax compliance, especially if you have received debt forgiveness.

-

How can airSlate SignNow help me with my 1099 C Form?

airSlate SignNow streamlines the process of sending and eSigning your 1099 C Form. With our easy-to-use platform, you can quickly prepare, send, and securely collect signatures on your tax documents, ensuring you stay compliant and organized.

-

Is there a cost associated with using airSlate SignNow for 1099 C Forms?

Yes, airSlate SignNow offers a variety of pricing plans designed to fit different business needs. Our plans are cost-effective, allowing you to manage your 1099 C Form and other documents without breaking the bank, with features that scale as your business grows.

-

What features does airSlate SignNow offer for managing 1099 C Forms?

airSlate SignNow provides features such as customizable templates for the 1099 C Form, secure cloud storage, and automated workflows. These tools help you efficiently manage your documents, reduce errors, and ensure timely filing.

-

Can I integrate airSlate SignNow with other accounting software for 1099 C Forms?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, allowing you to directly manage your 1099 C Form alongside other financial documents. This integration simplifies your workflow and enhances your overall productivity.

-

How secure is the eSigning process for my 1099 C Form?

The security of your documents is our top priority at airSlate SignNow. We use advanced encryption and secure servers to protect your 1099 C Form during transmission and storage, ensuring that your sensitive information remains confidential.

-

Can I track the status of my 1099 C Form once sent for eSignature?

Yes, airSlate SignNow provides real-time tracking of your sent 1099 C Form. You can easily monitor the status of your document to ensure that it has been received and signed, giving you peace of mind throughout the process.

Get more for 1099 C Form

- Student handbook san jacinto college form

- Application for readmission trinity university web trinity form

- Corporate training ampamp consulting servicessan jacinto college form

- Exercise caution when using free wifi or public computers as these are not secure form

- Work study employer information form

- Confidential travel history form all university of st

- Form ithaca college

- Food stamps eligibility snap program eligibility help form

Find out other 1099 C Form

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself