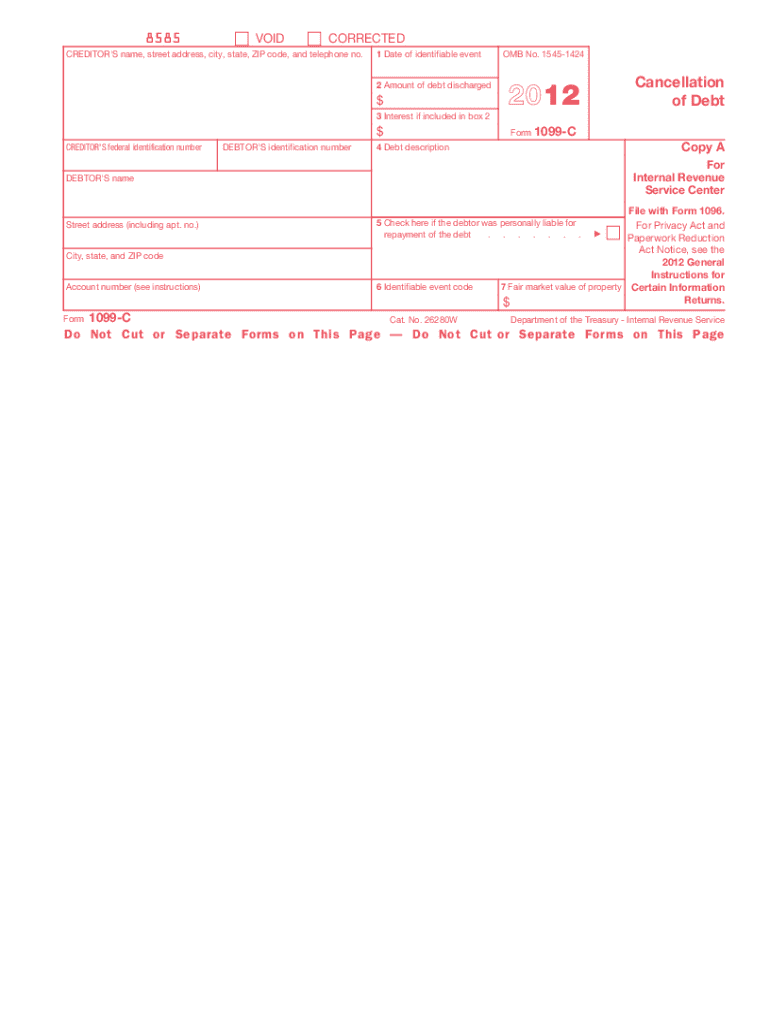

1099 C Form 2012

What is the 1099 C Form

The 1099 C Form, officially known as the Cancellation of Debt, is a tax document used in the United States. It is issued by lenders to report the cancellation of a debt that exceeds six hundred dollars. This form is important for both the lender and the borrower, as it indicates that a debt has been forgiven, which may have tax implications for the borrower. When a debt is canceled, the IRS generally considers the canceled amount as taxable income, which the borrower must report on their tax return.

How to use the 1099 C Form

To use the 1099 C Form effectively, borrowers must first receive it from their lender, which should be done by January thirty-first of the year following the debt cancellation. Once received, the borrower should review the form for accuracy, ensuring that the amount of canceled debt and other details are correct. The borrower must then report this amount as income when filing their federal tax return. It is advisable to consult a tax professional if there are any questions regarding the implications of the canceled debt.

Steps to complete the 1099 C Form

Completing the 1099 C Form involves several key steps:

- Gather necessary information, including the borrower’s name, address, and taxpayer identification number.

- Input the lender’s information, including their name, address, and taxpayer identification number.

- Fill in the amount of debt canceled in the appropriate box, ensuring accuracy.

- Indicate the date of cancellation and any applicable codes that describe the nature of the debt.

- Review the completed form for errors before submission.

Legal use of the 1099 C Form

The legal use of the 1099 C Form is governed by IRS regulations. It is crucial for lenders to issue this form when they cancel a debt to comply with tax reporting requirements. Borrowers must also use the information on this form correctly when filing their taxes. Failure to report canceled debt as income can lead to penalties and additional taxes owed. Therefore, both parties must understand their obligations regarding this form to ensure compliance with federal tax laws.

IRS Guidelines

The IRS provides specific guidelines regarding the issuance and reporting of the 1099 C Form. Lenders must issue this form when they cancel a debt of six hundred dollars or more. The IRS requires that the form be filed by the lender and provided to the borrower by January thirty-first. Borrowers must report the canceled debt on their tax returns, typically on Form 1040, and may need to complete additional forms depending on their tax situation. It is essential to follow these guidelines closely to avoid complications with the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the 1099 C Form are critical for both lenders and borrowers. Lenders must provide the form to borrowers by January thirty-first of the year following the debt cancellation. Additionally, lenders must file the form with the IRS by the end of February if filing on paper, or by March thirty-first if filing electronically. Borrowers should ensure they include the reported canceled debt on their tax returns, which are generally due on April fifteenth. Being aware of these deadlines helps avoid penalties and ensures compliance with tax regulations.

Quick guide on how to complete 2012 1099 c form

Manage 1099 C Form effortlessly on any device

Digital document handling has become increasingly favored by companies and individuals alike. It serves as an excellent environmentally friendly alternative to conventional printed and signed documents, as you can access the necessary form and securely archive it online. airSlate SignNow equips you with all the features required to create, edit, and electronically sign your papers swiftly without delays. Handle 1099 C Form on any device using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

The simplest way to modify and eSign 1099 C Form with ease

- Locate 1099 C Form and click on Get Form to initiate the process.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for these tasks.

- Create your eSignature with the Sign feature, which takes moments and holds the same legal standing as a traditional handwritten signature.

- Review the details and click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, cumbersome form navigation, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign 1099 C Form and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 1099 c form

Create this form in 5 minutes!

How to create an eSignature for the 2012 1099 c form

The best way to make an electronic signature for your PDF in the online mode

The best way to make an electronic signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The way to generate an eSignature right from your smart phone

How to generate an electronic signature for a PDF on iOS devices

The way to generate an eSignature for a PDF on Android OS

People also ask

-

What is a 1099 C Form and why is it important?

A 1099 C Form is a tax document used by lenders to report cancellation of debt to the IRS. It is important because it informs the taxpayer about any forgiven debts, which may be taxable income. Understanding how the 1099 C Form impacts your taxes can help you avoid unexpected liabilities.

-

How can airSlate SignNow help with the 1099 C Form?

airSlate SignNow simplifies the process of signing and sending the 1099 C Form electronically. Our platform offers secure e-signature capabilities, ensuring that your documents are legally binding. Additionally, you can efficiently manage and track the status of your 1099 C Form submissions.

-

Is airSlate SignNow a cost-effective solution for managing 1099 C Forms?

Yes, airSlate SignNow provides a cost-effective solution for handling 1099 C Forms. With our competitive pricing plans, you gain access to a feature-rich platform without breaking the bank. You can streamline your document management processes while saving money.

-

What features does airSlate SignNow offer for the 1099 C Form?

airSlate SignNow offers multiple features for managing the 1099 C Form, such as customizable templates, automated reminders, and secure storage options. You can easily create, send, and track your 1099 C Forms all in one place. Our user-friendly interface ensures that the process is quick and efficient.

-

Can I integrate airSlate SignNow with other accounting software for the 1099 C Form?

Absolutely, airSlate SignNow can be integrated with various accounting software solutions. This integration simplifies the process of preparing and filing the 1099 C Form while maintaining data accuracy. You can sync information seamlessly between platforms, enhancing workflow efficiency.

-

How secure is the information on my 1099 C Form with airSlate SignNow?

Security is a top priority at airSlate SignNow. We use advanced encryption technology to protect all information, including your 1099 C Form. Your personal and financial details are safeguarded from unauthorized access, ensuring compliance with privacy regulations.

-

What support is available for users dealing with the 1099 C Form?

airSlate SignNow offers robust customer support for users managing their 1099 C Forms. Our team is ready to assist with any inquiries you may have about the signing process or specific features. You can access help via chat, email, or phone for timely support.

Get more for 1099 C Form

- Transfer reinstatement request phi beta sigma fraternity inc form

- Planet earth pole to pole worksheet form

- Release of body authorization form

- Roomcommissionsheetdocx form

- Camping health consent and release form young life

- Gaann program us department of education form

- Eleventh report to congress on the implementation of the ncvhs form

- Attachment internship questionnaire questionnaire internship students form

Find out other 1099 C Form

- Can I Sign Georgia Assignment of Mortgage

- Sign Kentucky Escrow Agreement Simple

- How To Sign New Jersey Non-Disturbance Agreement

- How To Sign Illinois Sales Invoice Template

- How Do I Sign Indiana Sales Invoice Template

- Sign North Carolina Equipment Sales Agreement Online

- Sign South Dakota Sales Invoice Template Free

- How Can I Sign Nevada Sales Proposal Template

- Can I Sign Texas Confirmation Of Reservation Or Order

- How To Sign Illinois Product Defect Notice

- Sign New Mexico Refund Request Form Mobile

- Sign Alaska Sponsorship Agreement Safe

- How To Sign Massachusetts Copyright License Agreement

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy

- Sign Indiana Domain Name Registration Agreement Myself

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe