8840 Form 2011

What is the 8840 Form

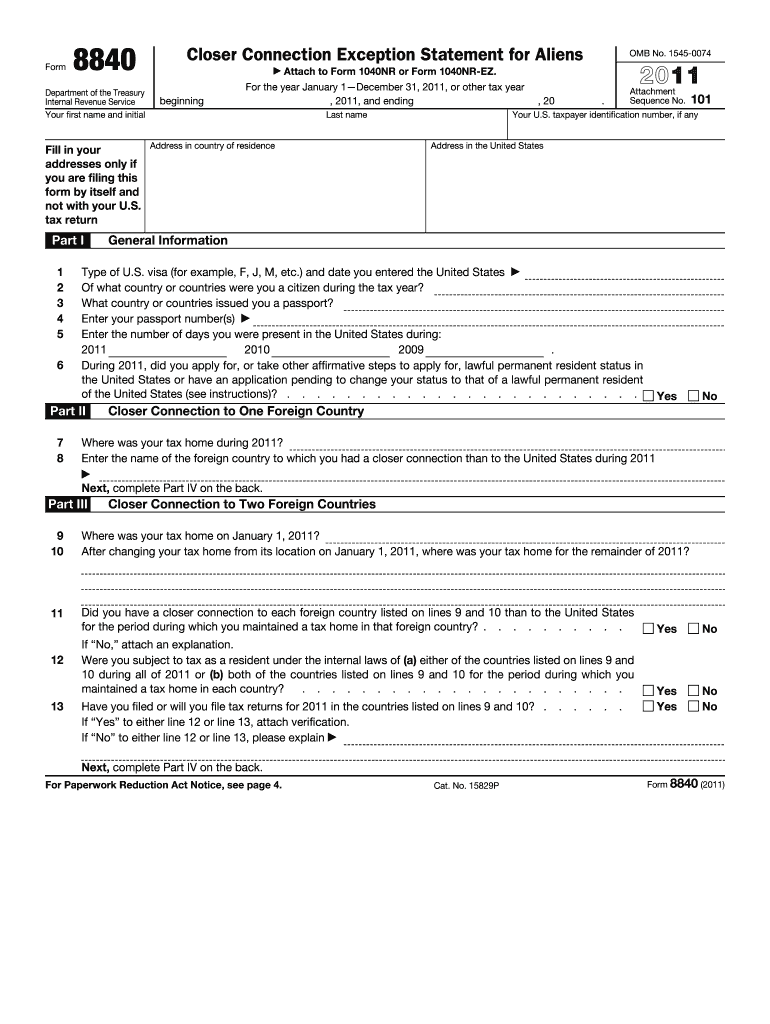

The 8840 Form, also known as the "Closer Connection Exception Statement for Aliens," is a document used by certain non-U.S. citizens to claim a closer connection to a foreign country for tax purposes. This form is primarily utilized by individuals who reside in the United States but maintain significant ties to another country. By filing this form, individuals can avoid being classified as U.S. residents for tax purposes under the substantial presence test.

How to use the 8840 Form

To effectively use the 8840 Form, individuals must first determine their eligibility based on their residency status and connections to other countries. The form requires detailed information about the individual’s residency, including the number of days spent in the United States and the foreign country. It is crucial to provide accurate and complete information to ensure compliance with IRS regulations. Once completed, the form should be submitted to the IRS by the specified deadline.

Steps to complete the 8840 Form

Completing the 8840 Form involves several key steps:

- Gather necessary personal information, including your name, address, and taxpayer identification number.

- Document your physical presence in the United States and your foreign country for the relevant tax year.

- Complete the form by accurately filling in all required fields, ensuring all information aligns with your records.

- Review the form for accuracy and completeness before submission.

- Submit the form to the IRS by the appropriate deadline, typically on or before the tax filing deadline.

Legal use of the 8840 Form

The legal use of the 8840 Form hinges on its compliance with IRS guidelines. This form must be filed by individuals who meet specific criteria to avoid being classified as U.S. residents for tax purposes. Failure to file the form correctly or on time can lead to penalties and complications with tax obligations. It is important to ensure that the information provided is truthful and substantiated by relevant documentation.

Filing Deadlines / Important Dates

Filing deadlines for the 8840 Form align with the annual tax filing season. Typically, the form must be submitted by April fifteenth of the year following the tax year in question. If additional time is needed, individuals may request an extension, but it is essential to ensure that the form is filed within the extended period to avoid penalties. Keeping track of these deadlines is crucial for maintaining compliance with IRS requirements.

Required Documents

When completing the 8840 Form, individuals should have several documents on hand to support their claims:

- Proof of residency in the foreign country, such as utility bills or lease agreements.

- Records of physical presence in the United States, including travel itineraries or entry/exit stamps.

- Tax identification numbers for both the U.S. and the foreign country, if applicable.

Penalties for Non-Compliance

Non-compliance with the requirements for the 8840 Form can result in significant penalties. If the form is not filed on time or contains inaccuracies, individuals may face fines and may be classified as U.S. residents for tax purposes, leading to a higher tax liability. Understanding the implications of non-compliance is essential for individuals who wish to maintain their tax status and avoid unnecessary penalties.

Quick guide on how to complete 2011 8840 form

Complete 8840 Form smoothly on any device

Online document management has become increasingly common among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and eSign your documents quickly without delays. Handle 8840 Form on any device with airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

How to adjust and eSign 8840 Form effortlessly

- Obtain 8840 Form and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark relevant sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to store your changes.

- Choose how you wish to send your form, either via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that require the printing of new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign 8840 Form and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2011 8840 form

Create this form in 5 minutes!

How to create an eSignature for the 2011 8840 form

The way to generate an electronic signature for a PDF document online

The way to generate an electronic signature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

How to create an electronic signature right from your smart phone

The best way to make an eSignature for a PDF document on iOS

How to create an electronic signature for a PDF on Android OS

People also ask

-

What is the 8840 Form?

The 8840 Form, also known as the 'Closer Connection Exception Statement for Aliens,' is a form required by the IRS for individuals who need to claim closer connection to a foreign country. By completing the 8840 Form, you can avoid being classified as a U.S. resident for tax purposes.

-

How can airSlate SignNow help with the 8840 Form?

airSlate SignNow streamlines the process of completing and submitting the 8840 Form by providing an easy-to-use platform for eSigning and document management. With our solution, you can quickly fill out the form, send it for signatures, and securely store it for future reference.

-

What are the pricing plans for using airSlate SignNow for the 8840 Form?

airSlate SignNow offers several pricing plans to suit different needs, whether you're a freelancer or a large organization. Our plans are cost-effective, allowing you to eSign the 8840 Form efficiently without breaking the bank.

-

Are there any features specifically for the 8840 Form in airSlate SignNow?

Yes, airSlate SignNow includes features like document templates, automatic reminders for signers, and secure storage, which are especially useful for completing the 8840 Form. These tools simplify the completion process and ensure you never miss a submission deadline.

-

Can I integrate airSlate SignNow with other software when working on the 8840 Form?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, allowing you to streamline your workflow when completing the 8840 Form. Whether it's CRM systems or cloud storage platforms, our integrations enhance productivity and efficiency.

-

What benefits does using airSlate SignNow provide for the 8840 Form?

Using airSlate SignNow for the 8840 Form offers numerous benefits, including faster processing times, reduced paperwork, and improved accuracy. Our platform minimizes the hassle associated with traditional paper-based processes, making it easier for you to manage your tax responsibilities.

-

Is it secure to eSign the 8840 Form with airSlate SignNow?

Yes, airSlate SignNow prioritizes security with bank-level encryption, ensuring that your 8840 Form and all personal data remain secure. You can eSign and share your documents with confidence, knowing that your information is well protected.

Get more for 8840 Form

- Dekalb county water application form

- Gwinnett county public schools board district assignments form

- Military out of area extension application form

- Fillable online aua2015 request for internet amp network form

- Electrical services international workboat show form

- 633 n saint clair st floor 23 chicago il 60611 312 202 form

- Maryland state board of nursing wccm verification of practice form

- Xl career school form

Find out other 8840 Form

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement