Us 8840 2018

What is the US 8840?

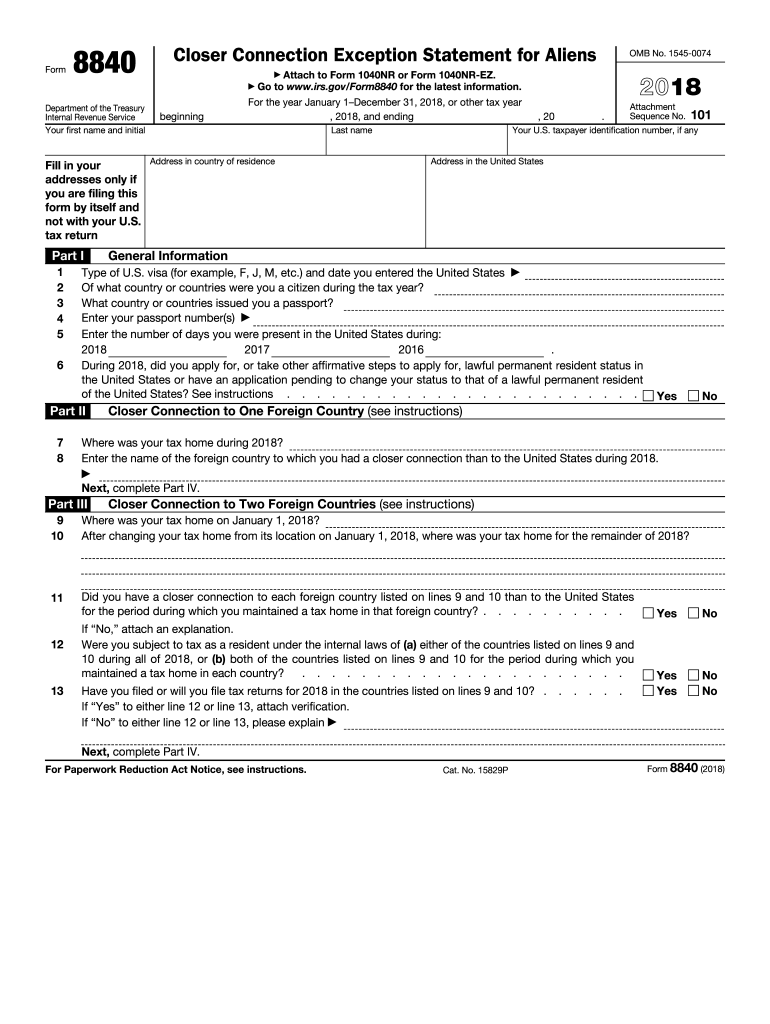

The US 8840, also known as the Form 8840, is a tax form used by individuals to claim the Closer Connection Exception to the substantial presence test. This form is particularly relevant for non-resident aliens who have significant ties to the United States but do not meet the criteria to be considered residents for tax purposes. By filing this form, individuals can avoid being taxed on their worldwide income while still being compliant with US tax laws.

How to obtain the US 8840

To obtain the US 8840 form, individuals can visit the official IRS website, where the form is available for download in PDF format. It is essential to ensure that you are using the correct version for the applicable tax year, such as the formulaire 8840 en francais 2019. Additionally, the form can also be requested by mail from the IRS if preferred. Make sure to have all necessary personal information and documentation ready when obtaining the form.

Steps to complete the US 8840

Completing the US 8840 involves several key steps:

- Begin by entering your personal information, including your name, address, and taxpayer identification number.

- Indicate your residency status and the countries where you have tax obligations.

- Provide details about your connections to the United States, such as the length of stay and ties to family or property.

- Carefully review the form for accuracy and completeness before signing and dating it.

It is crucial to ensure that all information is accurate to avoid any potential issues with the IRS.

Key elements of the US 8840

The US 8840 form includes several key elements that must be addressed:

- Personal Information: This section requires your name, address, and taxpayer identification number.

- Residency Information: You must indicate your residency status and any other countries where you may have tax obligations.

- Closer Connection Statement: This section allows you to explain your closer connection to a foreign country compared to the United States.

- Signature: The form must be signed and dated to be considered valid.

Filing Deadlines / Important Dates

Filing deadlines for the US 8840 are crucial to avoid penalties. Generally, the form must be filed by the due date of your tax return, which is typically April 15 for most individuals. If you are unable to meet this deadline, you may be eligible for an extension. However, it is important to check specific dates for the tax year you are filing, as they can vary.

Form Submission Methods (Online / Mail / In-Person)

The US 8840 can be submitted through various methods:

- By Mail: The completed form can be mailed to the appropriate IRS address based on your location.

- Online: While the IRS does not allow electronic filing of this form directly, you can prepare it using tax software and then print it for submission.

- In-Person: You may also deliver the form in person to your local IRS office, although this method is less common.

Quick guide on how to complete form 8840 2016 2018 2019

Uncover the simplest method to complete and sign your Us 8840

Are you still spending unnecessary time preparing your official documents on paper instead of doing it online? airSlate SignNow presents a superior way to complete and sign your Us 8840 and associated forms for public services. Our intelligent electronic signature solution equips you with everything required to handle documents swiftly and in line with formal standards - robust PDF editing, managing, safeguarding, signing, and sharing tools all accessible within a user-friendly interface.

Just a few steps are needed to complete to fill out and sign your Us 8840:

- Upload the editable template to the editor using the Get Form key.

- Verify what information you need to provide in your Us 8840.

- Navigate through the fields using the Next button to ensure nothing is missed.

- Utilize Text, Check, and Cross tools to complete the fields with your details.

- Enhance the content with Text boxes or Images from the top toolbar.

- Underline what is truly signNow or Cover areas that are no longer relevant.

- Click on Sign to create a legally binding electronic signature using any option you prefer.

- Insert the Date next to your signature and conclude your work with the Done button.

Store your completed Us 8840 in the Documents folder within your profile, download it, or export it to your preferred cloud storage. Our solution also facilitates flexible file sharing. There’s no need to print your templates when you need to send them to the relevant public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Give it a try today!

Create this form in 5 minutes or less

Find and fill out the correct form 8840 2016 2018 2019

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

How can I fill out the FY 2015-16 and 2016-17 ITR forms after the 31st of March 2018?

As you know the last date of filling income tax retruns has been gone for the financial year 2015–16 and 2016–17. and if you haven’t done it before 31–03–2018. then i don’t think it is possible according to the current guidlines of IT Department. it may possible that they can send you the notice to answer for not filling the retrun and they may charge penalty alsoif your income was less than taxable limit then its ok it is a valid reson but you don’t need file ITR for those years but if your income was more than the limit then, i think you have to write the lette to your assessing officer with a genuine reason that why didn’t you file the ITR.This was only suggestion not adviceyou can also go through the professional chartered accountant

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

How do I fill out 2016 ITR form?

First of all you must know about all of your sources of income. In Indian Income Tax Act there are multiple forms for different types of sources of Income. If you have only salary & other source of income you can fill ITR-1 by registering your PAN on e-Filing Home Page, Income Tax Department, Government of India after registration you have to login & select option fill ITR online in this case you have to select ITR-1 for salary, house property & other source income.if you have income from business & profession and not maintaining books & also not mandatory to prepare books & total turnover in business less than 1 Crores & want to show profit more than 8% & if you are a professional and not required to make books want to show profit more than 50% of receipts than you can use online quick e-filling form ITR-4S i.s. for presumptive business income.for other source of income there are several forms according to source of income download Excel utility or JAVA utility form e-Filing Home Page, Income Tax Department, Government of India fill & upload after login to your account.Prerequisite before E-filling.Last year return copy (if available)Bank Account number with IFSC Code.Form 16/16A (if Available)Saving Details / Deduction Slips LIC,PPF, etc.Interest Statement from Banks or OthersProfit & Loss Account, Balance Sheet, Tax Audit Report only if filling ITR-4, ITR-5, ITR-6, ITR-7.hope this will help you in case any query please let me know.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

Create this form in 5 minutes!

How to create an eSignature for the form 8840 2016 2018 2019

How to create an eSignature for your Form 8840 2016 2018 2019 online

How to generate an electronic signature for your Form 8840 2016 2018 2019 in Google Chrome

How to make an electronic signature for signing the Form 8840 2016 2018 2019 in Gmail

How to generate an electronic signature for the Form 8840 2016 2018 2019 from your smart phone

How to make an electronic signature for the Form 8840 2016 2018 2019 on iOS devices

How to create an eSignature for the Form 8840 2016 2018 2019 on Android devices

People also ask

-

Qu'est-ce que le formulaire 8840 en francais 2019 ?

Le formulaire 8840 en francais 2019 est un document fiscal utilisé par les résidents étrangers pour établir leur statut de résident aux États-Unis. Il permet de déclarer les jours passés aux États-Unis et est crucial pour éviter une double imposition. Remplir ce formulaire avec précision est essentiel pour respecter les exigences fiscales.

-

Comment utiliser le formulaire 8840 en francais 2019 avec airSlate SignNow ?

Avec airSlate SignNow, vous pouvez facilement télécharger et envoyer le formulaire 8840 en francais 2019 pour signature électronique. Notre plateforme simplifie le processus en rendant la gestion des documents fluide et rapide. Profitez de notre interface intuitive pour remplir et envoyer votre formulaire sans tracas.

-

Quels sont les tarifs d'utilisation d'airSlate SignNow pour le formulaire 8840 en francais 2019 ?

Les tarifs d'airSlate SignNow varient selon le plan choisi, mais nous offrons des options abordables adaptées à différents budgets. Vous pouvez commencer avec une période d'essai gratuite pour tester l'envoi et la signature de documents comme le formulaire 8840 en francais 2019. Consultez notre site web pour les tarifs spécifiques.

-

Quelles fonctionnalités sont disponibles pour le formulaire 8840 en francais 2019 sur airSlate SignNow ?

airSlate SignNow offre plusieurs fonctionnalités pour faciliter la gestion du formulaire 8840 en francais 2019, notamment l'eSignature, le stockage sécurisé des documents et les notifications automatiques. Ces outils permettent de garder une trace de l'état des signatures et d'assurer que votre formulaire est traité rapidement. Profitez également de la possibilité de collaborer avec d'autres utilisateurs.

-

AirSlate SignNow supporte-t-il l'intégration avec d'autres outils pour le formulaire 8840 en francais 2019 ?

Oui, airSlate SignNow offre des intégrations avec divers outils et applications, facilitant ainsi l'envoi et la gestion du formulaire 8840 en francais 2019. Que vous utilisiez des systèmes de gestion de documents ou des applications de productivité, vous pouvez facilement intégrer notre service. Cela permet de rationaliser votre flux de travail et d'augmenter votre efficacité.

-

Quels avantages airSlate SignNow offre-t-il pour le remplissage du formulaire 8840 en francais 2019 ?

L'utilisation d'airSlate SignNow pour le formulaire 8840 en francais 2019 présente de nombreux avantages, notamment la facilité d'utilisation, la sécurité et la rapidité. Vous pouvez remplir, signer et envoyer le formulaire en quelques clics, ce qui vous fait gagner du temps. De plus, la plateforme garantit la protection de vos informations personnelles.

-

Est-ce que le formulaires peuvent être envoyés à plusieurs destinataires grâce à airSlate SignNow ?

Oui, avec airSlate SignNow, vous pouvez envoyer le formulaire 8840 en francais 2019 à plusieurs destinataires simultanément. Cette fonctionnalité facilite la gestion de documents lorsqu'il y a plusieurs parties impliquées. Vous pouvez également suivre le statut des signatures en temps réel pour une meilleure organisation.

Get more for Us 8840

Find out other Us 8840

- Send Sign PDF Free

- How To Send Sign PDF

- Send Sign Word Online

- Send Sign Word Now

- Send Sign Word Free

- Send Sign Word Android

- Send Sign Word iOS

- Send Sign Word iPad

- How To Send Sign Word

- Can I Send Sign Word

- How Can I Send Sign Word

- Send Sign Document Online

- Send Sign Document Computer

- Send Sign Document Myself

- Send Sign Document Secure

- Send Sign Document iOS

- Send Sign Document iPad

- How To Send Sign Document

- Fax Sign PDF Online

- How To Fax Sign PDF