Form 8840 2016

What is the Form 8840

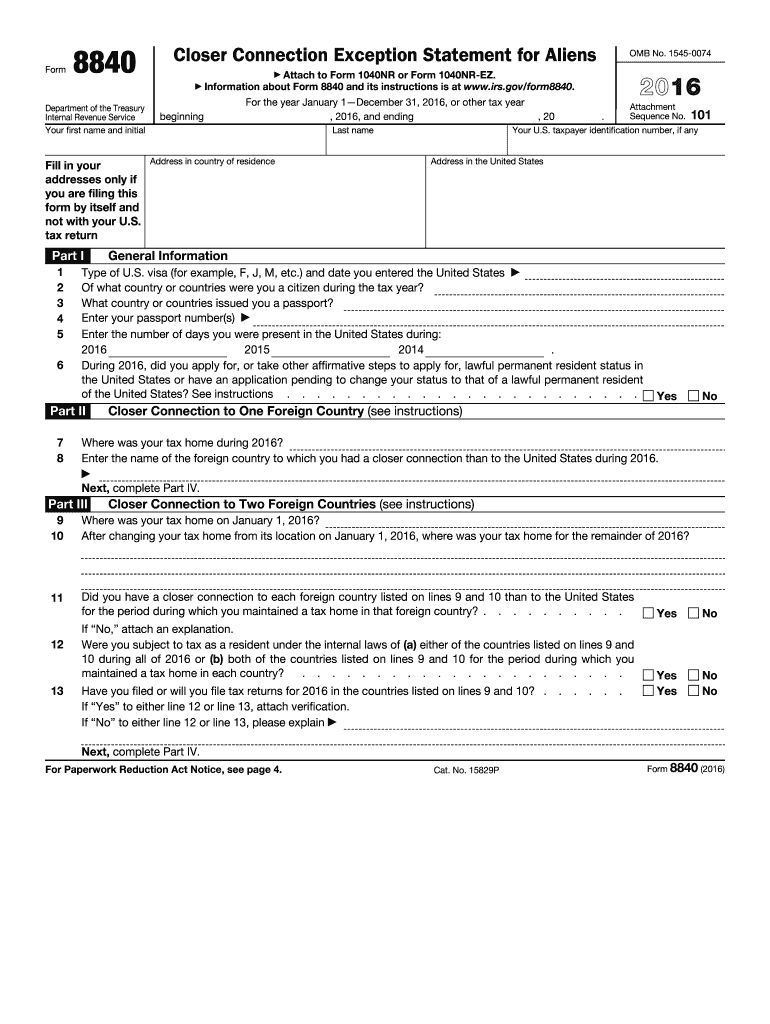

The Form 8840, officially known as the "Closer Connection Exception Statement for Aliens," is a tax document used by individuals who are not U.S. citizens but may be considered U.S. residents for tax purposes. This form is specifically designed for those who meet the substantial presence test but can demonstrate a closer connection to a foreign country. By filing this form, individuals can claim an exception from being classified as a U.S. resident for tax purposes, thereby potentially avoiding U.S. taxation on foreign income.

How to use the Form 8840

Using the Form 8840 involves several steps to ensure accurate completion. First, individuals must determine their eligibility by assessing their time spent in the U.S. and their ties to a foreign country. Next, they need to gather necessary documentation that supports their claim of a closer connection, such as proof of residency in the foreign country. Once the form is completed, it should be submitted to the IRS by the specified deadline. It is important to keep a copy of the form for personal records and future reference.

Steps to complete the Form 8840

Completing the Form 8840 requires careful attention to detail. Here are the essential steps:

- Review the eligibility criteria to ensure you qualify for the closer connection exception.

- Gather supporting documents, including proof of foreign residency and ties.

- Fill out the form accurately, providing all required information, such as your name, address, and tax identification number.

- Specify the foreign country to which you have a closer connection.

- Sign and date the form to certify its accuracy.

- Submit the completed form to the IRS by the appropriate deadline.

Legal use of the Form 8840

The legal use of the Form 8840 hinges on its compliance with IRS regulations. It serves as a formal declaration of an individual's intent to claim a closer connection to a foreign country, which can affect their tax obligations. To be legally binding, the form must be filled out completely and accurately, and it must be submitted on time. Failure to comply with these requirements may result in penalties or the loss of the exception claim.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8840 are crucial for compliance. Typically, the form must be submitted by June fifteenth of the year following the tax year in question. If an individual is unable to meet this deadline, they may request an extension. However, it is important to note that extensions do not apply to the payment of any taxes owed. Keeping track of these dates ensures that individuals maintain their eligibility for the closer connection exception.

Required Documents

To successfully complete the Form 8840, individuals must provide several supporting documents. These may include:

- Proof of residency in the foreign country, such as utility bills or lease agreements.

- Documentation of ties to the foreign country, including bank statements or tax returns.

- Any previous correspondence with the IRS regarding residency status.

Having these documents ready can facilitate a smoother filing process and strengthen the case for claiming the closer connection exception.

Quick guide on how to complete form 8840 2016

Complete Form 8840 seamlessly on any device

Managing documents online has gained traction among companies and individuals. It offers an excellent environmentally friendly substitute for conventional printed and signed paperwork, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the resources you require to create, modify, and eSign your documents promptly without delays. Manage Form 8840 on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related process today.

How to modify and eSign Form 8840 effortlessly

- Locate Form 8840 and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools specifically designed for that by airSlate SignNow.

- Create your signature using the Sign tool, which only takes a few seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, time-consuming form searches, or errors that necessitate new printed copies. airSlate SignNow satisfies your document management needs in just a few clicks from any device you choose. Modify and eSign Form 8840 and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8840 2016

Create this form in 5 minutes!

How to create an eSignature for the form 8840 2016

How to make an electronic signature for your Form 8840 2016 online

How to generate an eSignature for the Form 8840 2016 in Chrome

How to generate an electronic signature for putting it on the Form 8840 2016 in Gmail

How to generate an eSignature for the Form 8840 2016 straight from your smartphone

How to create an eSignature for the Form 8840 2016 on iOS

How to make an eSignature for the Form 8840 2016 on Android devices

People also ask

-

What is Form 8840 and who needs to fill it out?

Form 8840, also known as the 'Closer Connection Exception Statement for Aliens,' is a tax form used by individuals who are considered non-resident aliens but claim a closer connection to a foreign country. This form helps establish that individuals do not meet the substantial presence test for U.S. tax purposes. It's essential for non-residents who want to clarify their tax obligations to the IRS.

-

How can airSlate SignNow assist with completing Form 8840?

airSlate SignNow simplifies the process of completing Form 8840 by allowing users to securely eSign and send the document electronically. With an intuitive interface, users can easily fill out the necessary fields and ensure that all required signatures are captured. This ensures compliance with IRS regulations while saving time and effort.

-

Is there a cost associated with using airSlate SignNow for Form 8840?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan includes features that facilitate the eSigning and document management process, making it a cost-effective solution for completing Form 8840 and other important documents. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow provide for managing Form 8840?

airSlate SignNow offers several features that enhance the management of Form 8840, including real-time tracking of document status, customizable templates, and secure cloud storage. These features ensure that your Form 8840 is handled efficiently and securely, helping you stay organized and compliant with tax regulations.

-

Can I integrate airSlate SignNow with other applications when filing Form 8840?

Absolutely! airSlate SignNow seamlessly integrates with various applications such as Google Drive, Dropbox, and Microsoft Office. This allows users to easily import data for Form 8840 and manage their documents across different platforms, streamlining the filing process.

-

What are the benefits of using airSlate SignNow for eSigning Form 8840?

Using airSlate SignNow for eSigning Form 8840 provides numerous benefits, including enhanced security, time savings, and improved efficiency. Users can complete the form from anywhere, on any device, ensuring that they can meet deadlines without the hassle of printing and mailing documents.

-

How secure is airSlate SignNow when handling Form 8840?

airSlate SignNow prioritizes security by employing advanced encryption and compliance protocols to protect your data when handling Form 8840. With features like two-factor authentication and secure cloud storage, users can trust that their sensitive tax information is safe and secure.

Get more for Form 8840

- Tdlr contractors license form

- Thsteps dental provider enrollment application 2012 form

- Fresno unified school district fingerprinting form

- Request for modification and affidavit fillable form

- Lic9108 form

- Sc 105 request for court order and answer form

- Volunteer registration packet peoria public schools form

- How to write an election campaign lettersynonym form

Find out other Form 8840

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy