8840 Form 2014

What is the 8840 Form

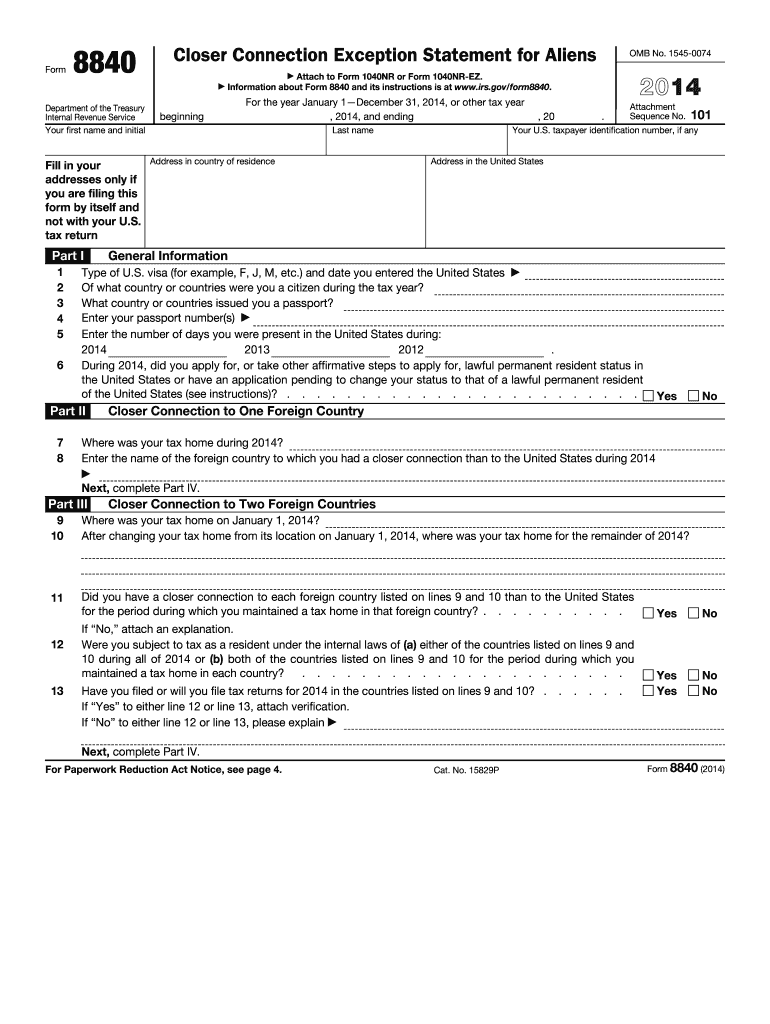

The 8840 Form, officially known as the "Closer Connection Exception Statement for Aliens," is a tax document used by individuals who are not U.S. citizens but claim to have a closer connection to a foreign country. This form is primarily used to establish that a taxpayer does not meet the substantial presence test for U.S. tax purposes, thereby allowing them to avoid being classified as a U.S. resident alien. The form is essential for those who wish to maintain their non-resident status while residing in the United States.

How to use the 8840 Form

To effectively use the 8840 Form, individuals must fill it out accurately and submit it to the Internal Revenue Service (IRS). The form requires detailed information about the taxpayer's residency, including the countries with which they have significant ties. It is crucial to provide accurate dates of presence in the U.S. and the foreign country to support the claim of a closer connection. The completed form can help prevent unnecessary taxation on worldwide income.

Steps to complete the 8840 Form

Completing the 8840 Form involves several key steps:

- Gather necessary information, including personal identification details and residency history.

- Fill out the form with accurate dates and locations of presence in the U.S. and the foreign country.

- Provide explanations for the closer connection to the foreign country, including ties such as family, business, and social connections.

- Review the completed form for accuracy before submission.

- Submit the form to the IRS by the required deadline, typically by June 15 of the year following the tax year in question.

Legal use of the 8840 Form

The 8840 Form is legally recognized as a valid document for establishing non-resident status under U.S. tax law. To ensure its legal use, it must be completed in accordance with IRS guidelines. Providing false information or failing to submit the form when required can lead to penalties and complications with tax obligations. It is important to keep copies of the submitted form and any supporting documentation for personal records.

Filing Deadlines / Important Dates

The filing deadline for the 8840 Form is typically June 15 of the year following the tax year in which the individual was present in the U.S. For example, for the tax year 2022, the form must be filed by June 15, 2023. It is essential to meet this deadline to avoid penalties and maintain non-resident status. If additional time is needed, individuals may file for an extension, but they must ensure that the form is submitted by the extended deadline.

Required Documents

When completing the 8840 Form, certain documents may be necessary to support the claims made within the form. These documents can include:

- Proof of residency in the foreign country, such as utility bills or lease agreements.

- Travel records showing dates of entry and exit from the U.S.

- Documentation of ties to the foreign country, including family connections or business interests.

Having these documents ready can facilitate a smoother filing process and help substantiate the claims made on the form.

Quick guide on how to complete 2014 8840 form

Effortlessly Prepare 8840 Form on Any Device

Digital document management has become increasingly favored by companies and individuals alike. It offers an excellent environmentally friendly substitute for traditional printed and signed papers, allowing you to locate the right form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly and without delays. Manage 8840 Form on any device with airSlate SignNow’s Android or iOS applications and streamline any document-related workflow today.

How to Modify and eSign 8840 Form with Ease

- Obtain 8840 Form and click Get Form to begin.

- Utilize the tools provided to fill out your document.

- Emphasize important sections of your paperwork or obscure sensitive information with specialized tools that airSlate SignNow offers for this purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your adjustments.

- Select your preferred method of sharing your form, whether by email, SMS, or a link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign 8840 Form and ensure effective communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 8840 form

Create this form in 5 minutes!

How to create an eSignature for the 2014 8840 form

How to generate an eSignature for a PDF document online

How to generate an eSignature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

How to make an eSignature from your smart phone

The best way to create an eSignature for a PDF document on iOS

How to make an eSignature for a PDF file on Android OS

People also ask

-

What is the 8840 Form and who needs to file it?

The 8840 Form, also known as the 'Closer Connection Exception Statement for Aliens', is required for certain non-resident aliens who wish to claim a closer connection to a foreign country. Individuals who spend a considerable amount of time in the U.S. but do not qualify as residents must file this form to avoid being taxed as a U.S. resident.

-

How can airSlate SignNow help with completing the 8840 Form?

airSlate SignNow streamlines the process of completing and eSigning the 8840 Form by providing user-friendly templates and tools to guide you through each step. Our platform ensures that you can fill out, review, and sign the form quickly, which simplifies compliance and reduces errors.

-

What are the benefits of using airSlate SignNow for the 8840 Form?

Using airSlate SignNow for the 8840 Form offers several benefits, including faster document turnaround, enhanced security through encryption, and easy sharing with tax professionals. You can also access your forms anywhere and anytime, making it a convenient solution for filing essential paperwork.

-

Is there a cost associated with using airSlate SignNow for the 8840 Form?

Yes, airSlate SignNow offers flexible pricing plans that cater to various business needs. While there is a fee for utilizing premium features, our cost-effective solution ensures that you get great value while simplifying the process of managing your 8840 Form and other documents.

-

Can I integrate airSlate SignNow with other software for the 8840 Form?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, enhancing your ability to manage documents efficiently. Whether you use CRM systems or accounting tools, you can easily connect them to streamline the filing and signing process of the 8840 Form.

-

What security measures does airSlate SignNow implement for the 8840 Form?

airSlate SignNow prioritizes your security by using advanced encryption protocols and secure servers to protect your data. When working with sensitive documents like the 8840 Form, we ensure that all your information remains confidential and secure throughout the entire signing process.

-

How to track the status of my 8840 Form after sending it via airSlate SignNow?

airSlate SignNow provides real-time tracking features that allow you to monitor the status of your 8840 Form after you send it out. You can see when it has been opened, viewed, and signed, offering you peace of mind and ensuring timely submission.

Get more for 8840 Form

- Law office study program registration vermont judiciary form

- Law office study six month report rule 7 of the vermont judiciary form

- Cv 800v respondents statement of possession of firearms form

- W9 r092004 form

- Wy statement form

- Sd non disclosure form

- State of south dakota in circuit court ss form

- State of south dakota in circuit court ss county of form

Find out other 8840 Form

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement