Form 8840 Closer Connection Exception Statement for Aliens 2020

What is the Form 8840 Closer Connection Exception Statement For Aliens

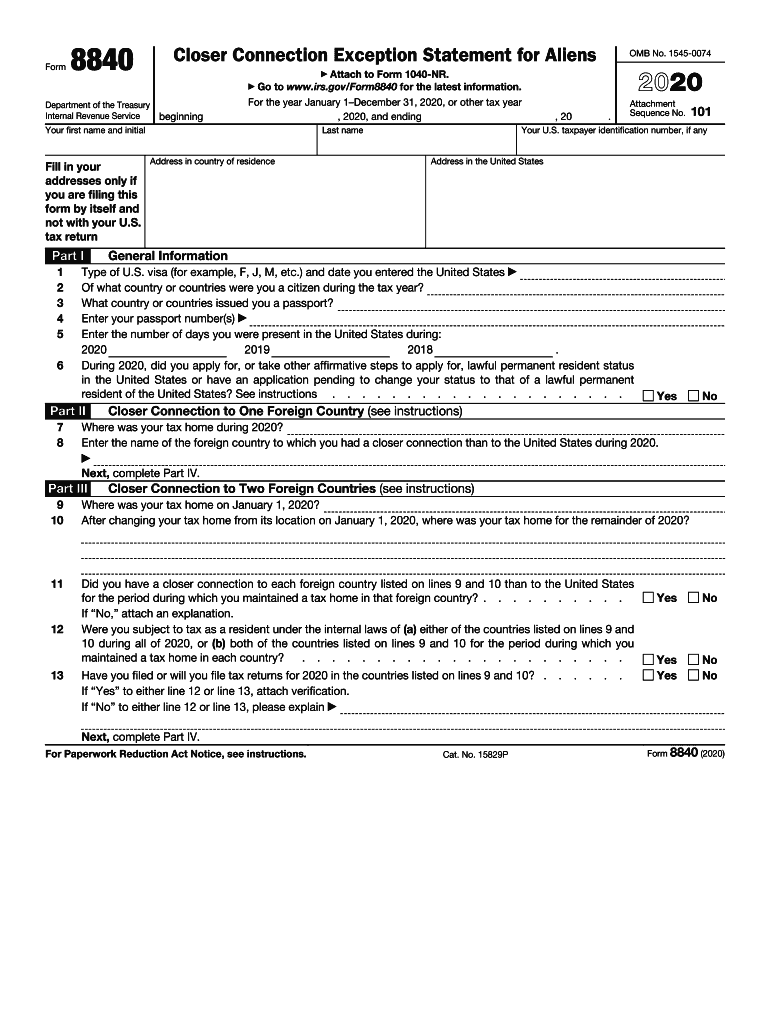

The Form 8840, also known as the Closer Connection Exception Statement for Aliens, is a crucial document for non-resident aliens who wish to claim a closer connection to a foreign country than to the United States. This form is primarily used to establish eligibility for certain tax benefits and exemptions under U.S. tax law. By submitting this form, individuals can demonstrate that they meet specific criteria, which allows them to avoid being classified as U.S. residents for tax purposes, despite spending significant time in the country.

How to use the Form 8840 Closer Connection Exception Statement For Aliens

Using the Form 8840 involves several steps to ensure proper completion and submission. First, individuals must gather relevant information about their residency status, including the number of days spent in the U.S. and their ties to other countries. Next, the form must be filled out accurately, providing details about the individual's closer connection to a foreign country, such as family, business, and social ties. Once completed, the form can be submitted to the IRS as part of the annual tax return process or separately, depending on the individual's circumstances.

Steps to complete the Form 8840 Closer Connection Exception Statement For Aliens

Completing the Form 8840 requires careful attention to detail. Here are the essential steps:

- Gather necessary information, including personal details and residency history.

- Fill out the form, ensuring all sections are completed accurately.

- Provide supporting documentation that demonstrates your closer connection to a foreign country.

- Review the form for any errors or omissions before submission.

- Submit the form to the IRS by the appropriate deadline.

Eligibility Criteria

To qualify for the benefits of the Form 8840, individuals must meet specific eligibility criteria. Primarily, they must be non-resident aliens who have spent a limited amount of time in the U.S. during the tax year. Additionally, they must demonstrate that they have a closer connection to a foreign country, which can include factors such as maintaining a permanent home, family ties, and economic interests outside the U.S. Meeting these criteria is essential for successfully claiming the closer connection exception.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8840 are critical to ensure compliance with IRS regulations. Typically, the form must be submitted by the due date of the individual's tax return, which is usually April 15 for most taxpayers. However, if an extension is filed, the deadline may be extended to October 15. It is important to be aware of these dates to avoid penalties and ensure that the form is processed in a timely manner.

Required Documents

When completing the Form 8840, individuals may need to provide several supporting documents to substantiate their claims. These documents can include:

- Proof of residency in a foreign country, such as utility bills or rental agreements.

- Documentation of family ties, like birth certificates or marriage licenses.

- Financial records demonstrating economic connections outside the U.S.

- Any prior tax returns that may support the claim for a closer connection.

Quick guide on how to complete 2020 form 8840 closer connection exception statement for aliens

Complete Form 8840 Closer Connection Exception Statement For Aliens effortlessly on any device

Digital document management has gained traction among companies and individuals. It offers an ideal environmentally-friendly substitute for conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly and efficiently. Handle Form 8840 Closer Connection Exception Statement For Aliens on any platform with airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to edit and eSign Form 8840 Closer Connection Exception Statement For Aliens with minimal effort

- Locate Form 8840 Closer Connection Exception Statement For Aliens and then click Get Form to commence.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow offers for that specific purpose.

- Generate your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select your preferred delivery method for your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign Form 8840 Closer Connection Exception Statement For Aliens and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form 8840 closer connection exception statement for aliens

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 8840 closer connection exception statement for aliens

The best way to create an electronic signature for a PDF in the online mode

The best way to create an electronic signature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The best way to generate an eSignature right from your smart phone

The way to create an eSignature for a PDF on iOS devices

The best way to generate an eSignature for a PDF on Android OS

People also ask

-

What is the form 8840 form used for?

The form 8840 form, also known as the Statement for Exempt Individuals and Individuals with a Medical Condition, is used by non-resident aliens to establish their residency status in the U.S. It helps individuals claim exemption from the substantial presence test for U.S. tax purposes. Understanding the form 8840 form is vital for those navigating tax implications.

-

How can airSlate SignNow assist with the form 8840 form?

airSlate SignNow simplifies sending and eSigning the form 8840 form through a user-friendly platform. Our solution allows you to prepare and send your form securely and efficiently, ensuring all your documents are handled in compliance with legal standards. This streamlines the process for users needing to manage their tax forms remotely.

-

Is there a cost associated with using airSlate SignNow for the form 8840 form?

Yes, airSlate SignNow offers various pricing plans to cater to different organizational needs, even for processing documents like the form 8840 form. Our services are designed to be cost-effective while providing robust features for document management. Pricing is transparent, allowing users to choose the plan that best fits their requirements.

-

What features does airSlate SignNow provide for managing the form 8840 form?

With airSlate SignNow, users can electronically sign the form 8840 form, track document status, and store completed forms securely in the cloud. Additionally, our platform offers templates and custom fields to expedite the form completion process. These features ensure a hassle-free experience when handling essential tax documents.

-

Are there any integrations available for the form 8840 form?

Yes, airSlate SignNow integrates seamlessly with various applications, allowing users to send the form 8840 form from their preferred platforms. Integrations with tools like Google Drive, Dropbox, and CRM systems enhance workflow efficiency. This ensures you can manage paperwork effectively without switching between different software.

-

Can airSlate SignNow help with submitting the form 8840 form?

While airSlate SignNow facilitates the signing and preparation of the form 8840 form, users must submit it through the appropriate IRS channels. Our platform ensures that you have all necessary signatures and documentation ready for submission. This streamlines the submission process signNowly.

-

Is my information secure when using airSlate SignNow for the form 8840 form?

Absolutely! airSlate SignNow employs industry-leading security measures to protect all your data, including the form 8840 form. We utilize advanced encryption and secure storage to ensure that your sensitive information remains confidential and protected. You can use our platform with confidence.

Get more for Form 8840 Closer Connection Exception Statement For Aliens

- Salary verification form for potential lease wisconsin

- Landlord agreement to allow tenant alterations to premises wisconsin form

- Notice of default on residential lease wisconsin form

- Landlord tenant lease co signer agreement wisconsin form

- Application for sublease wisconsin form

- Inventory and condition of leased premises for pre lease and post lease wisconsin form

- Letter from landlord to tenant with directions regarding cleaning and procedures for move out wisconsin form

- Property manager agreement wisconsin form

Find out other Form 8840 Closer Connection Exception Statement For Aliens

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself