Form 1040 Schedule a 2010

What is the Form 1040 Schedule A

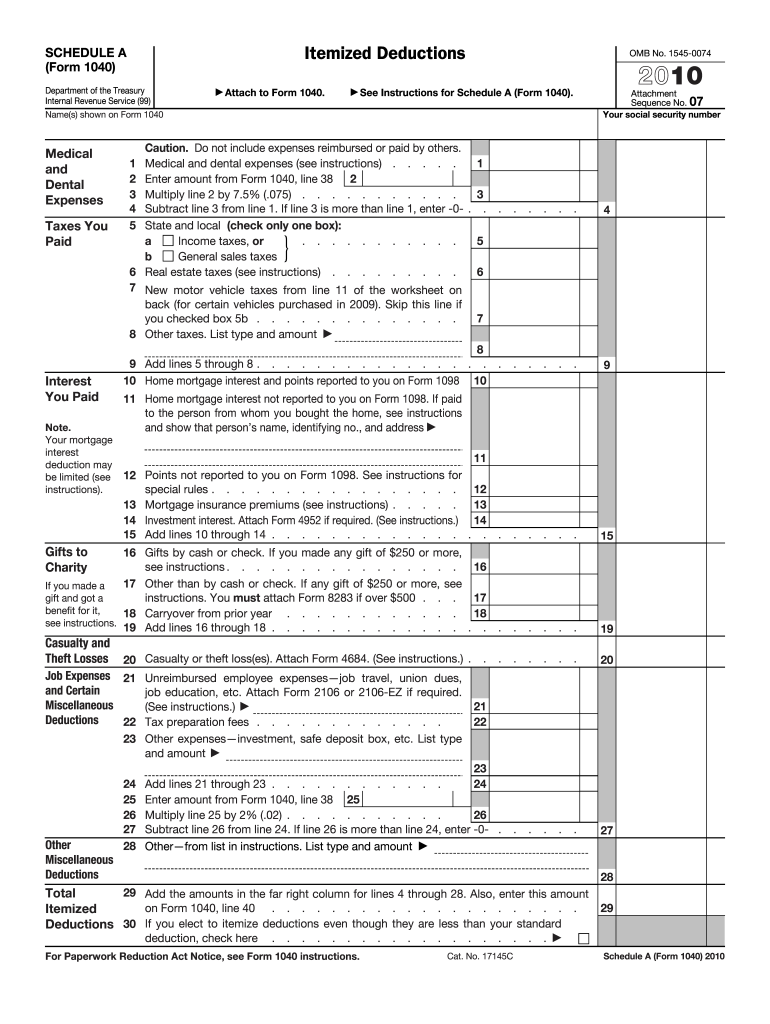

The Form 1040 Schedule A is a crucial tax document used by individual taxpayers in the United States to report itemized deductions. This form allows taxpayers to detail specific expenses that can reduce their taxable income, potentially leading to a lower tax liability. Common deductions include medical expenses, mortgage interest, and charitable contributions. By using Schedule A, taxpayers can opt for itemizing their deductions instead of taking the standard deduction, which may be more beneficial depending on their financial situation.

How to use the Form 1040 Schedule A

Using the Form 1040 Schedule A involves several steps to ensure accurate reporting of itemized deductions. Taxpayers should first gather all necessary documentation, such as receipts and statements for deductible expenses. Next, they should complete the form by entering the total amounts for each category of deduction. It is essential to follow the instructions provided by the IRS to avoid errors. After filling out the form, taxpayers will attach it to their Form 1040 when filing their federal income tax return.

Steps to complete the Form 1040 Schedule A

Completing the Form 1040 Schedule A requires careful attention to detail. Here are the steps involved:

- Gather all relevant documents, including receipts for medical expenses, mortgage interest statements, and charitable donation receipts.

- Begin filling out the form by entering personal information, such as your name and Social Security number.

- Complete each section of the form, including medical and dental expenses, taxes you paid, interest you paid, gifts to charity, and other itemized deductions.

- Calculate the total itemized deductions and ensure they are accurately reflected on your Form 1040.

- Review the completed Schedule A for any errors before submission.

Legal use of the Form 1040 Schedule A

The Form 1040 Schedule A must be completed in compliance with IRS regulations to be considered legally binding. This means that all information provided must be accurate and truthful. Misrepresentation of deductions can lead to penalties and legal issues. It is advisable to keep all supporting documents for at least three years after filing, as the IRS may request them for verification purposes. Utilizing a reliable eSignature solution can further enhance the legal standing of your completed forms.

Key elements of the Form 1040 Schedule A

Several key elements define the Form 1040 Schedule A. These include:

- Medical and Dental Expenses: Total expenses incurred for medical care that exceed a certain percentage of your adjusted gross income.

- Taxes Paid: State and local taxes, real estate taxes, and personal property taxes that are deductible.

- Interest Paid: Mortgage interest and points paid on a primary or secondary residence.

- Gifts to Charity: Contributions made to qualified charitable organizations.

- Other Miscellaneous Deductions: Includes unreimbursed employee expenses and other qualifying deductions.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1040 Schedule A align with the general tax return deadlines. Typically, individual taxpayers must file their federal tax returns by April 15 of each year. If this date falls on a weekend or holiday, the deadline is extended to the next business day. Taxpayers may also request an extension, allowing them to file by October 15, but any taxes owed must still be paid by the original deadline to avoid penalties.

Quick guide on how to complete 2010 form 1040 schedule a

Achieve Form 1040 Schedule A effortlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the necessary form and securely preserve it online. airSlate SignNow equips you with all the tools required to create, adjust, and eSign your documents promptly and without delays. Manage Form 1040 Schedule A on any device with airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to adjust and eSign Form 1040 Schedule A smoothly

- Find Form 1040 Schedule A and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you want to deliver your form, via email, SMS, or invitation link, or download it to your computer.

No more concerns about lost or misplaced documents, tedious form hunting, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 1040 Schedule A to ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2010 form 1040 schedule a

Create this form in 5 minutes!

How to create an eSignature for the 2010 form 1040 schedule a

How to create an eSignature for your PDF online

How to create an eSignature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The best way to generate an eSignature right from your smartphone

How to generate an electronic signature for a PDF on iOS

The best way to generate an eSignature for a PDF on Android

People also ask

-

What is Form 1040 Schedule A and how does it relate to airSlate SignNow?

Form 1040 Schedule A is used to report itemized deductions on your federal income tax return. With airSlate SignNow, you can easily prepare, eSign, and manage your Form 1040 Schedule A documents online, streamlining your tax filing process.

-

How can airSlate SignNow help me fill out Form 1040 Schedule A?

airSlate SignNow offers templates and intuitive tools that guide you through filling out Form 1040 Schedule A. Our platform simplifies the process, allowing you to add necessary details, eSign, and save your document securely in one place.

-

Is airSlate SignNow a cost-effective solution for managing Form 1040 Schedule A?

Yes, airSlate SignNow provides a cost-effective solution for handling Form 1040 Schedule A and other documents. With flexible pricing plans that cater to individual and business needs, you can eSign and manage all your essential tax documents without breaking the bank.

-

What features does airSlate SignNow offer for Form 1040 Schedule A?

airSlate SignNow includes features like customizable templates, secure eSigning, and document sharing specifically designed for Form 1040 Schedule A. These features enhance productivity and ensure that your tax documents are completed efficiently and securely.

-

Can I integrate airSlate SignNow with other applications for my Form 1040 Schedule A?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to streamline your workflow when working on Form 1040 Schedule A. Whether you use accounting software or cloud storage solutions, our platform enhances collaboration and accessibility.

-

How does eSigning my Form 1040 Schedule A with airSlate SignNow benefit me?

eSigning your Form 1040 Schedule A with airSlate SignNow is not only quick and easy, but it also enhances the security and validity of your document. Our legally compliant eSignature process ensures that your tax documents are officially recognized, providing peace of mind during tax season.

-

What support does airSlate SignNow offer for users working with Form 1040 Schedule A?

airSlate SignNow provides comprehensive support for all users dealing with Form 1040 Schedule A. Our dedicated customer service team is available to assist you with any questions or concerns, ensuring that you can confidently manage your tax documents.

Get more for Form 1040 Schedule A

- Flu shots coverage medicare form

- Inpatient medicare prior authorization fax form

- P o box 2998 tacoma washington 98401 form

- 2018 regence bluecross blueshield of oregon pre authorization request form 2018 regence bluecross blueshield of oregon pre

- Snf ipr ltac authorization request form ohp and medicare

- Medicare outpatient prior authorization fax form health net

- Dental hospitalization authorization form ohp and medicare

- Snf ipr ltac authorization request form ohp and medicare 507402172

Find out other Form 1040 Schedule A

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure