1040 Schedule a Form 2015

What is the 1040 Schedule A Form

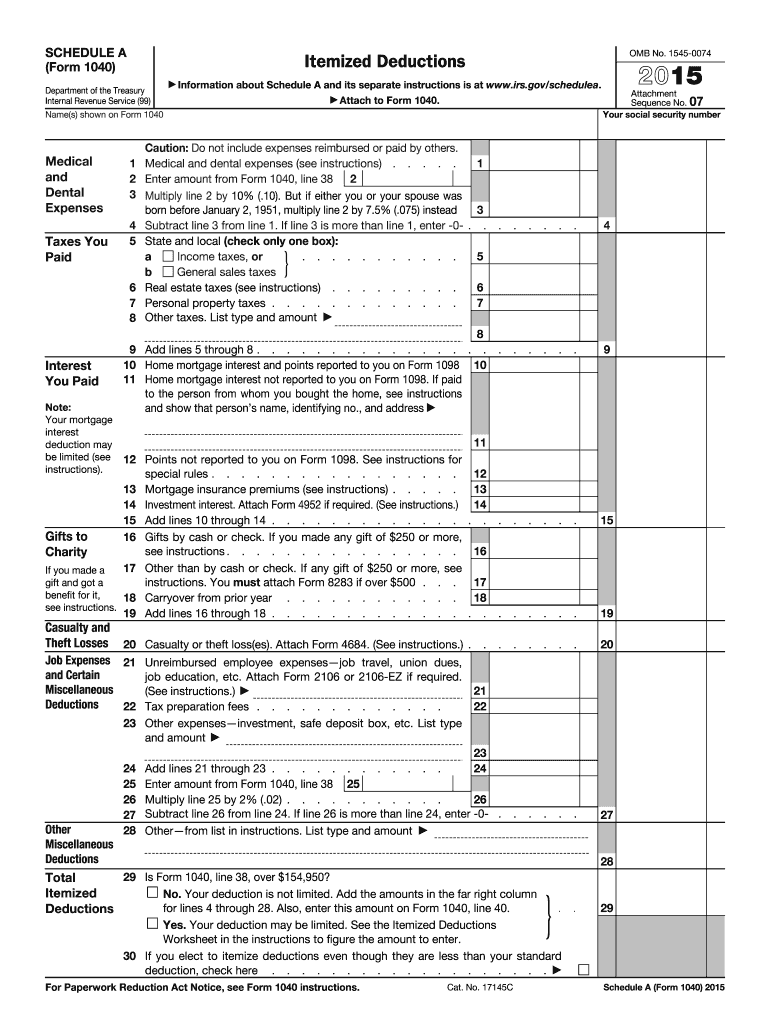

The 1040 Schedule A Form is a tax form used by taxpayers in the United States to report itemized deductions. By completing this form, individuals can potentially reduce their taxable income, which may lead to a lower tax liability. The form allows taxpayers to detail various expenses, such as medical costs, state and local taxes, mortgage interest, and charitable contributions. This form is attached to the standard Form 1040 during the tax filing process.

How to use the 1040 Schedule A Form

Using the 1040 Schedule A Form involves several steps. First, taxpayers must determine if itemizing deductions is more beneficial than taking the standard deduction. If itemizing is advantageous, the taxpayer should gather all relevant documentation for deductible expenses. Next, fill out the form by entering the amounts for each category of deduction, ensuring accuracy to avoid issues with the IRS. Finally, attach the completed Schedule A to Form 1040 and submit it according to IRS guidelines.

Steps to complete the 1040 Schedule A Form

Completing the 1040 Schedule A Form requires careful attention to detail. Here are the steps involved:

- Gather Documentation: Collect receipts and records for all deductible expenses.

- Determine Eligibility: Ensure that the expenses qualify for itemization under IRS rules.

- Fill Out the Form: Enter the amounts in the appropriate sections, including medical expenses, taxes paid, and charitable contributions.

- Calculate Total Deductions: Sum all the deductions to find the total amount to report on Form 1040.

- Review for Accuracy: Double-check all entries for correctness before submission.

Key elements of the 1040 Schedule A Form

The 1040 Schedule A Form consists of several key sections that taxpayers must complete. These include:

- Medical and Dental Expenses: Report qualifying medical costs exceeding a certain percentage of adjusted gross income.

- Taxes You Paid: Include state and local income taxes, real estate taxes, and personal property taxes.

- Interest You Paid: Deduct mortgage interest and points paid on a mortgage.

- Gifts to Charity: Report contributions made to qualified charitable organizations.

- Other Itemized Deductions: Include miscellaneous deductions such as unreimbursed business expenses or certain unreimbursed employee expenses.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the 1040 Schedule A Form. Taxpayers must adhere to these rules to ensure compliance and avoid penalties. Key guidelines include:

- Understanding which expenses are eligible for deduction.

- Maintaining accurate records and documentation of all claimed deductions.

- Filing the form by the tax deadline to avoid late fees.

- Using the most current version of the form, as updates may occur annually.

Form Submission Methods

Taxpayers can submit the 1040 Schedule A Form through various methods. The most common submission methods include:

- Online Filing: Many taxpayers choose to file electronically using tax software, which often simplifies the process.

- Mail: Taxpayers can print the completed form and mail it to the appropriate IRS address based on their location.

- In-Person: Some individuals may opt to file in person at designated IRS offices or through a tax professional.

Quick guide on how to complete 2015 1040 schedule a form

Effortlessly prepare 1040 Schedule A Form on any device

Managing documents online has gained popularity among businesses and individuals. It offers a superb eco-friendly substitute to traditional printed and signed papers, as you can obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and electronically sign your documents quickly without delays. Handle 1040 Schedule A Form on any platform using airSlate SignNow’s Android or iOS applications and improve any document-related operation today.

The easiest way to edit and electronically sign 1040 Schedule A Form with ease

- Find 1040 Schedule A Form and click Get Form to begin.

- Use the tools we supply to fill out your document.

- Mark essential sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and electronically sign 1040 Schedule A Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 1040 schedule a form

Create this form in 5 minutes!

How to create an eSignature for the 2015 1040 schedule a form

The way to make an electronic signature for a PDF document online

The way to make an electronic signature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

The best way to generate an electronic signature straight from your smart phone

The way to generate an eSignature for a PDF document on iOS

The best way to generate an electronic signature for a PDF document on Android OS

People also ask

-

What is the 1040 Schedule A Form and why do I need it?

The 1040 Schedule A Form is used to report itemized deductions on your federal tax return. This form allows taxpayers to list eligible expenses, such as medical expenses, mortgage interest, and charitable contributions, which can lower your taxable income. Understanding how to effectively use the 1040 Schedule A Form can help you maximize your deductions and potentially increase your tax refund.

-

How can airSlate SignNow help me with my 1040 Schedule A Form?

AirSlate SignNow simplifies the process of filling out and eSigning your 1040 Schedule A Form. With our user-friendly platform, you can easily upload your tax documents, fill in the necessary information, and send the form for signature. This streamlines the process, ensuring you meet deadlines without the hassle of paper forms.

-

Is there a cost associated with using airSlate SignNow for the 1040 Schedule A Form?

Yes, airSlate SignNow offers affordable pricing plans that cater to individual users and businesses. While the cost varies depending on the plan you choose, the investment is signNowly lower than traditional methods of document management. We provide a cost-effective solution to help you manage your 1040 Schedule A Form and other documents efficiently.

-

What features does airSlate SignNow offer for managing the 1040 Schedule A Form?

AirSlate SignNow offers a range of features for managing your 1040 Schedule A Form, including customizable templates, secure document sharing, and in-app collaboration tools. Our platform also provides electronic signature capabilities, ensuring that your forms are signed quickly and securely. These features help streamline your tax preparation process.

-

Can I integrate airSlate SignNow with other tax software for my 1040 Schedule A Form?

Absolutely! AirSlate SignNow integrates seamlessly with various accounting and tax software, making it easy to manage your 1040 Schedule A Form alongside other financial documents. This integration allows you to sync data and streamline your workflow, saving you time and reducing the risk of errors.

-

What are the benefits of using airSlate SignNow for electronic signatures on my 1040 Schedule A Form?

Using airSlate SignNow for electronic signatures on your 1040 Schedule A Form provides several benefits, including faster turnaround times and enhanced security. Electronic signatures are legally binding and reduce the need for physical paperwork, making the process more efficient. Additionally, our platform offers tracking features, so you can monitor the status of your signed documents.

-

Is airSlate SignNow secure for handling my 1040 Schedule A Form?

Yes, airSlate SignNow prioritizes the security of your documents, including the 1040 Schedule A Form. We implement industry-standard security measures such as encryption, secure cloud storage, and multi-factor authentication to protect your sensitive information. You can use our platform with confidence, knowing your data is safe.

Get more for 1040 Schedule A Form

- Form unregistered vehicle permit

- A67 dot forms

- Form 451 exemption application nebraska revenue

- Ro 1062 form fill out and sign printable pdf templatesignnow

- Objection and request for departmental review nc 242 form

- Pdf a guide for organizing domestic limited liability companies in illinois form

- 2019 form 540nr california nonresident or part year resident income tax return form 2019 form 540nr california nonresident or

- Purpose quotinheritancequot is the practice of passing on vehicles upon the death of an individual form

Find out other 1040 Schedule A Form

- eSignature Nebraska Limited Power of Attorney Free

- eSignature Indiana Unlimited Power of Attorney Safe

- Electronic signature Maine Lease agreement template Later

- Electronic signature Arizona Month to month lease agreement Easy

- Can I Electronic signature Hawaii Loan agreement

- Electronic signature Idaho Loan agreement Now

- Electronic signature South Carolina Loan agreement Online

- Electronic signature Colorado Non disclosure agreement sample Computer

- Can I Electronic signature Illinois Non disclosure agreement sample

- Electronic signature Kentucky Non disclosure agreement sample Myself

- Help Me With Electronic signature Louisiana Non disclosure agreement sample

- How To Electronic signature North Carolina Non disclosure agreement sample

- Electronic signature Ohio Non disclosure agreement sample Online

- How Can I Electronic signature Oklahoma Non disclosure agreement sample

- How To Electronic signature Tennessee Non disclosure agreement sample

- Can I Electronic signature Minnesota Mutual non-disclosure agreement

- Electronic signature Alabama Non-disclosure agreement PDF Safe

- Electronic signature Missouri Non-disclosure agreement PDF Myself

- How To Electronic signature New York Non-disclosure agreement PDF

- Electronic signature South Carolina Partnership agreements Online