Schedules for Form 1040 and Form 1040 SRInternal Revenue Service 2022-2026

Understanding the Schedules for Form 1040

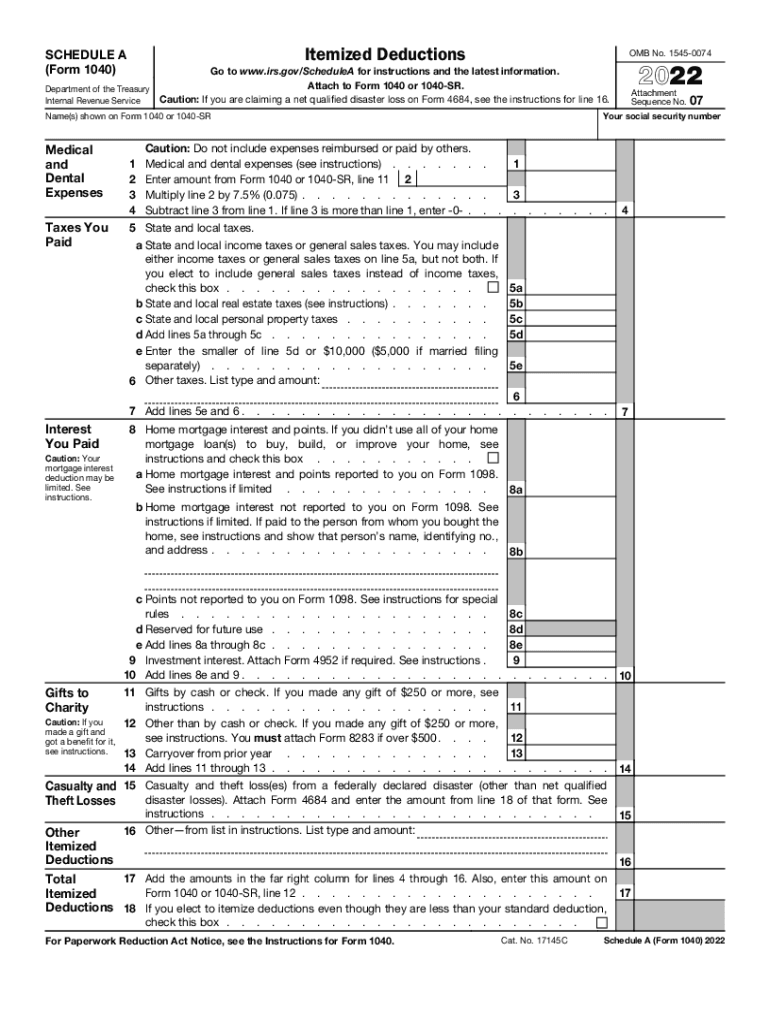

The Schedules for Form 1040 and Form 1040 SR are essential documents used by taxpayers in the United States to report various types of income, deductions, and credits. These schedules allow individuals to provide detailed information that supplements their main tax return. The most common schedules include Schedule A for itemized deductions, Schedule B for interest and ordinary dividends, and Schedule C for business income. Each schedule serves a specific purpose, helping taxpayers accurately report their financial situation to the IRS.

Steps to Complete the Schedules for Form 1040

Completing the Schedules for Form 1040 involves several key steps:

- Gather all necessary financial documents, including W-2s, 1099s, and receipts for deductible expenses.

- Determine which schedules apply to your tax situation. For example, if you plan to itemize deductions, you will need Schedule A.

- Carefully fill out each schedule, ensuring that all information is accurate and complete.

- Transfer the totals from the schedules to the main Form 1040.

- Review all forms for accuracy before submitting them to the IRS.

Legal Use of the Schedules for Form 1040

The Schedules for Form 1040 must be completed and submitted in accordance with IRS regulations to ensure their legal validity. Each schedule must accurately reflect your financial activities for the tax year. Using electronic tools, such as eSignature solutions, can help ensure that your documents are signed and submitted securely. Compliance with the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA) is crucial for the legal acceptance of electronically signed tax documents.

Filing Deadlines and Important Dates

Timely filing of the Schedules for Form 1040 is crucial to avoid penalties. The standard deadline for filing individual tax returns is April 15 of each year. If this date falls on a weekend or holiday, the deadline is extended to the next business day. Taxpayers can request an extension to file, but any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Required Documents for Completing the Schedules

To accurately complete the Schedules for Form 1040, taxpayers should gather the following documents:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Receipts for deductible expenses, such as medical bills or charitable donations

- Statements for interest and dividends

- Records of any other income sources

Examples of Using the Schedules for Form 1040

Here are a few examples of how different taxpayers might use the Schedules for Form 1040:

- A self-employed individual would use Schedule C to report business income and expenses.

- A homeowner might use Schedule A to itemize deductions related to mortgage interest and property taxes.

- Taxpayers with significant investment income would use Schedule B to report interest and dividends received.

Quick guide on how to complete schedules for form 1040 and form 1040 srinternal revenue service

Effortlessly Prepare Schedules For Form 1040 And Form 1040 SRInternal Revenue Service on Any Device

Web-based document management has become increasingly favored by companies and individuals alike. It offers an excellent environmentally friendly substitute for traditional printed and signed documentation, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to swiftly create, modify, and eSign your documents without any delays. Manage Schedules For Form 1040 And Form 1040 SRInternal Revenue Service on any device with the airSlate SignNow applications for Android or iOS and enhance any document-driven process today.

The easiest way to modify and eSign Schedules For Form 1040 And Form 1040 SRInternal Revenue Service effortlessly

- Find Schedules For Form 1040 And Form 1040 SRInternal Revenue Service and select Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information using the features that airSlate SignNow specifically provides for that intention.

- Generate your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Verify all details and click on the Done button to retain your modifications.

- Select your preferred method to deliver your form, whether via email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or errors that necessitate printing new copies of documents. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and eSign Schedules For Form 1040 And Form 1040 SRInternal Revenue Service and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedules for form 1040 and form 1040 srinternal revenue service

Create this form in 5 minutes!

People also ask

-

What is the 2013 1040 schedule and why is it important?

The 2013 1040 schedule is a tax form that individuals use to report their income, deductions, and credits to the IRS. Understanding this schedule is crucial as it affects your overall tax liability and potential refund. Accurate filing of the 2013 1040 schedule can save you money and ensure compliance with tax regulations.

-

How can airSlate SignNow streamline the signing process for the 2013 1040 schedule?

airSlate SignNow simplifies the signing process for the 2013 1040 schedule by allowing users to eSign documents securely and quickly. With its intuitive interface, you can easily send the schedule for signatures, making tax season less stressful. This efficient process saves time and helps ensure that your forms are submitted on time.

-

What features does airSlate SignNow offer for managing the 2013 1040 schedule?

airSlate SignNow provides features such as electronic signatures, document templates, and secure cloud storage specifically for forms like the 2013 1040 schedule. These tools help users maintain organization and streamline their tax filing process. Additionally, you can track the status of your signed documents in real-time.

-

Is airSlate SignNow cost-effective for handling my 2013 1040 schedule?

Yes, airSlate SignNow offers a cost-effective solution for managing your 2013 1040 schedule and other documents. With various pricing plans available, you can choose the option that best fits your needs. The savings in time and resources spent on manual processes make it a valuable investment for individuals and businesses alike.

-

Can I integrate airSlate SignNow with my accounting software for the 2013 1040 schedule?

Absolutely! airSlate SignNow can be integrated with numerous accounting software solutions, making it easier to manage your 2013 1040 schedule. This integration allows for seamless data transfer and simplifies your filing process by keeping everything in one place. You can focus more on your finances rather than paperwork.

-

What are the benefits of eSigning my 2013 1040 schedule with airSlate SignNow?

eSigning your 2013 1040 schedule with airSlate SignNow offers numerous benefits such as increased security and reduced turnaround time. You can sign documents from anywhere, on any device, which means greater flexibility. Additionally, the secure signing process ensures that your sensitive information remains protected.

-

How does airSlate SignNow ensure the security of my 2013 1040 schedule?

airSlate SignNow employs advanced security measures, including encryption and secure data storage, to protect your 2013 1040 schedule. This commitment to security ensures that your sensitive information is safe from unauthorized access. You can confidently eSign and share your tax documents knowing they are well-protected.

Get more for Schedules For Form 1040 And Form 1040 SRInternal Revenue Service

Find out other Schedules For Form 1040 And Form 1040 SRInternal Revenue Service

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors