Form 1040 Schedule a 2020

What is the Form 1040 Schedule A

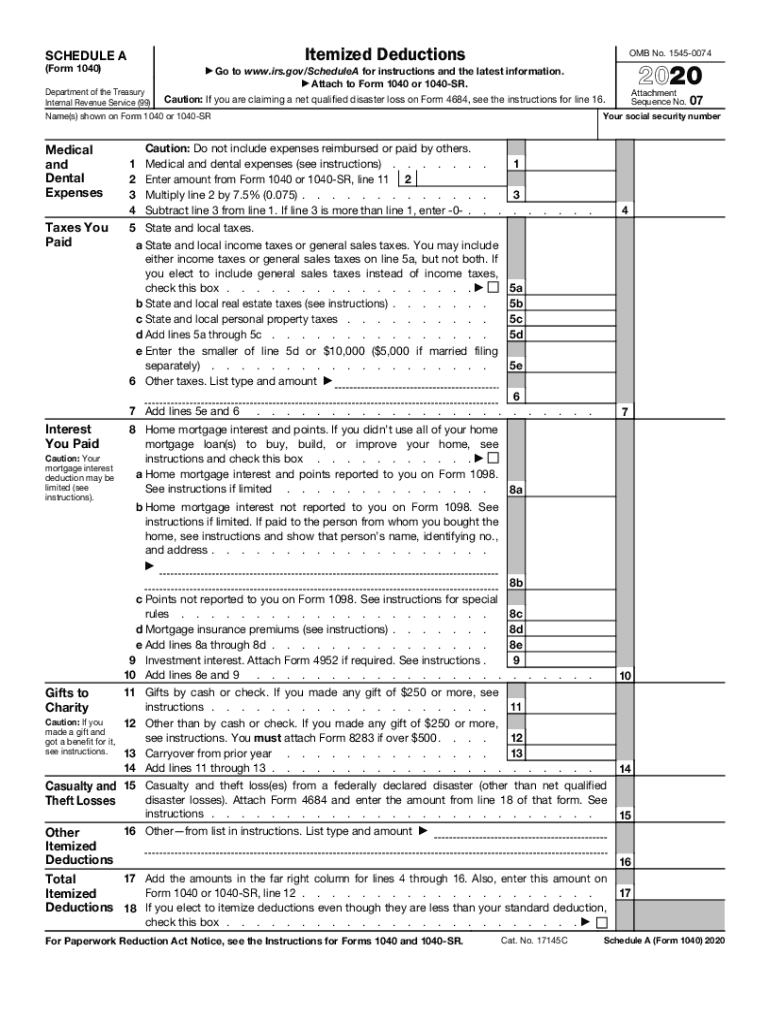

The Form 1040 Schedule A is a crucial document used by taxpayers in the United States to report itemized deductions. This form allows individuals to detail various expenses that may reduce their taxable income, ultimately lowering their tax liability. Common deductions reported on Schedule A include medical expenses, state and local taxes, mortgage interest, and charitable contributions. By utilizing this form, taxpayers can choose to itemize deductions instead of taking the standard deduction, which may be more beneficial depending on their financial situation.

Steps to complete the Form 1040 Schedule A

Completing the Form 1040 Schedule A involves several key steps to ensure accuracy and compliance. Begin by gathering all relevant documentation, such as receipts and statements that support your deductions. Next, follow these steps:

- Fill in your personal information at the top of the form, including your name and Social Security number.

- List your medical and dental expenses in the appropriate section, ensuring you only include qualifying expenses.

- Detail your state and local taxes paid, including property taxes and any other applicable taxes.

- Report mortgage interest paid and any points you may have paid on your mortgage.

- Include any charitable contributions made during the tax year.

- Calculate your total itemized deductions and transfer this amount to your Form 1040.

Legal use of the Form 1040 Schedule A

The legal use of the Form 1040 Schedule A is governed by IRS regulations, which require that all deductions claimed must be legitimate and substantiated. Taxpayers must maintain accurate records and receipts for all expenses reported on the form. The IRS may request documentation to verify the deductions claimed, so it is essential to keep these records organized and accessible. Filing the Schedule A incorrectly or claiming ineligible deductions can result in penalties or audits, emphasizing the importance of compliance with tax laws.

IRS Guidelines

The IRS provides specific guidelines for completing the Form 1040 Schedule A, which taxpayers should carefully review. These guidelines outline which expenses qualify as itemized deductions, the necessary documentation required, and how to calculate the total deductions accurately. It is important to stay updated on any changes to tax laws or IRS regulations that may affect the deductions available for the current tax year. Consulting the IRS website or a tax professional can provide additional clarity and ensure compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1040 Schedule A align with the overall tax filing deadlines set by the IRS. Typically, individual taxpayers must submit their federal tax returns by April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions they may apply for, which can provide additional time to file. It is crucial to adhere to these deadlines to avoid penalties and interest on any taxes owed.

Required Documents

To complete the Form 1040 Schedule A accurately, taxpayers need to gather several key documents. These may include:

- Receipts for medical and dental expenses.

- Property tax statements.

- Mortgage interest statements (Form 1098).

- Documentation for charitable contributions, such as receipts or bank statements.

- Any other relevant financial records that support the deductions claimed.

Having these documents organized and readily available can streamline the process of filling out the Schedule A and ensure compliance with IRS requirements.

Quick guide on how to complete form 1040 schedule a

Complete Form 1040 Schedule A effortlessly on any device

Digital document management has gained traction among organizations and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed papers, as you can locate the correct form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents promptly without delays. Handle Form 1040 Schedule A on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest method to modify and eSign Form 1040 Schedule A with little effort

- Obtain Form 1040 Schedule A and click on Get Form to get started.

- Utilize the tools we provide to fill out your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes moments and holds the same legal significance as a traditional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your PC.

Eliminate the hassle of lost or misplaced documents, exhausting form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choosing. Edit and eSign Form 1040 Schedule A and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1040 schedule a

Create this form in 5 minutes!

How to create an eSignature for the form 1040 schedule a

How to make an electronic signature for a PDF online

How to make an electronic signature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

How to make an electronic signature from your smartphone

The best way to generate an eSignature for a PDF on iOS

How to make an electronic signature for a PDF file on Android

People also ask

-

How can I schedule a demo of airSlate SignNow?

You can easily schedule a demo of airSlate SignNow by visiting our website and clicking on the 'Schedule a Demo' button. Filling out the brief form allows our team to connect with you at a convenient time to showcase the features and benefits of our eSigning solution.

-

What pricing options are available if I want to schedule a plan?

airSlate SignNow offers several pricing options tailored to fit various business needs. To schedule a plan, simply visit our pricing page, where you can compare plans and select the one that aligns with your requirements before proceeding to schedule a subscription.

-

Can I schedule a trial period before committing?

Yes, potential users can schedule a trial period to experience airSlate SignNow firsthand. Going through the sign-up process on our website allows you to schedule a 7-day free trial, giving you the opportunity to explore all features without any costs.

-

How do I schedule a document to be signed with airSlate SignNow?

To schedule a document for signing, upload it to the airSlate SignNow platform and add signers with their email addresses. You can specify the signing order and schedule the document to be sent at a later time, making it easier to manage multiple signatures efficiently.

-

What features should I know about when I schedule a usage plan?

AirSlate SignNow includes essential features such as customizable templates, in-person signing, and real-time status tracking. When you schedule a usage plan, you will gain access to these powerful tools designed to streamline your document management and eSigning processes.

-

How can I schedule a meeting to discuss integrations with my current software?

If you're looking to integrate airSlate SignNow with your existing tools, you can schedule a meeting with our integration specialists. Simply fill out the contact form indicating your interest in integrations, and we will get back to you to arrange a suitable time to discuss your needs.

-

Is there a way to schedule a recurring task using airSlate SignNow?

Yes, airSlate SignNow enables you to schedule recurring tasks such as sending documents for signatures at specified intervals. Just set up your document template and choose the recurring option, making it easier to manage periodic agreements effectively.

Get more for Form 1040 Schedule A

- Twam application form 2022

- Toeic reading test with answers pdf 2021 form

- 50 hour driving log sheet ohio form

- Data structures and algorithms using c by r s salaria pdf download form

- Stat dec form

- Kpop audition form

- Msjhs schedule change form

- Www pdffiller com58761668 agedivision waiver form fillable online agedivision waiver form fax email print

Find out other Form 1040 Schedule A

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online