1040 Schedule a Form 2016

What is the 1040 Schedule A Form

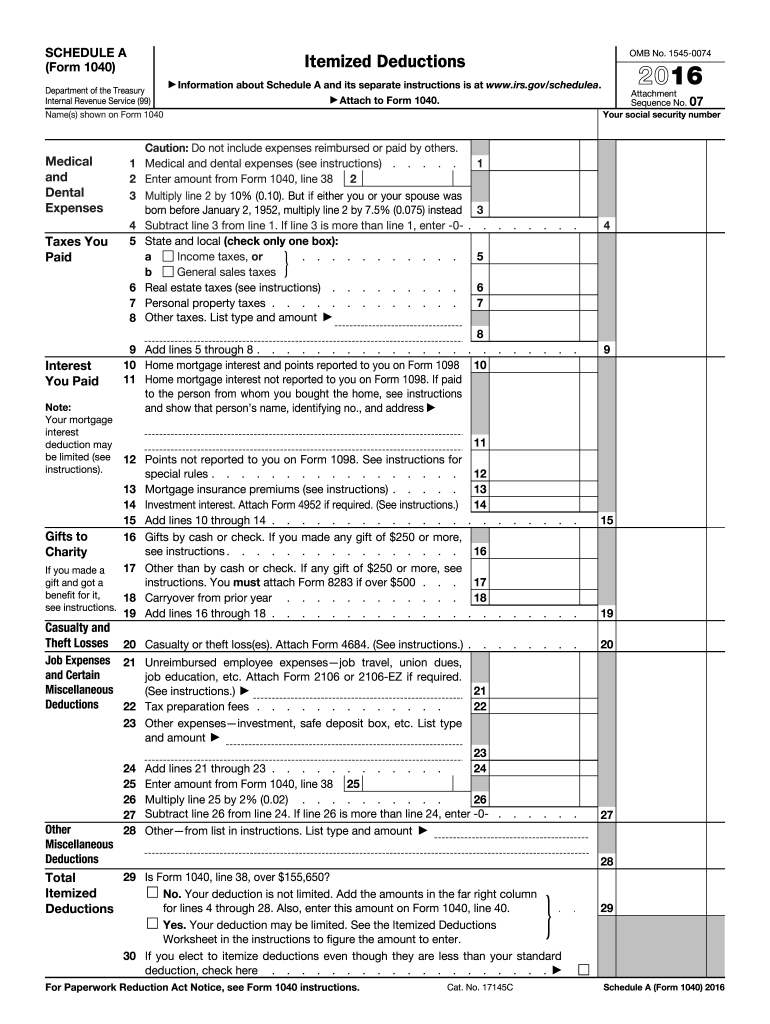

The 1040 Schedule A Form is a crucial component of the U.S. individual income tax return. It allows taxpayers to itemize their deductions rather than taking the standard deduction. This form is particularly beneficial for individuals with significant deductible expenses, such as medical costs, mortgage interest, and charitable contributions. By itemizing deductions, taxpayers may reduce their taxable income, potentially leading to a lower overall tax liability.

How to use the 1040 Schedule A Form

To effectively use the 1040 Schedule A Form, taxpayers should first gather all relevant financial documents that support their itemized deductions. This includes receipts, bank statements, and any other documentation related to deductible expenses. Once the necessary documents are collected, the taxpayer can fill out the form by entering the amounts for each category of deductions. It is essential to accurately report these figures to ensure compliance with IRS regulations and maximize potential tax benefits.

Steps to complete the 1040 Schedule A Form

Completing the 1040 Schedule A Form involves several key steps:

- Gather documentation: Collect all necessary receipts and statements for deductible expenses.

- Fill out personal information: Enter your name, Social Security number, and filing status at the top of the form.

- Report deductions: Carefully input amounts in the corresponding categories, such as medical expenses, state and local taxes, and charitable contributions.

- Calculate total deductions: Sum the amounts from all applicable categories to determine your total itemized deductions.

- Transfer totals: Carry the total from the Schedule A to the appropriate line on your Form 1040.

Key elements of the 1040 Schedule A Form

The 1040 Schedule A Form includes several key elements that taxpayers should understand:

- Medical and dental expenses: This section allows taxpayers to deduct unreimbursed medical expenses exceeding a certain percentage of their adjusted gross income.

- Taxes paid: Taxpayers can deduct state and local income taxes, sales taxes, and property taxes.

- Interest paid: This includes mortgage interest and points paid on a mortgage.

- Gifts to charity: Taxpayers can deduct contributions made to qualified charitable organizations.

- Other deductions: This section may include miscellaneous deductions, subject to certain limitations.

IRS Guidelines

The IRS provides specific guidelines for using the 1040 Schedule A Form. Taxpayers should consult the IRS instructions for the form to understand eligibility requirements and limitations on deductions. The guidelines also detail record-keeping requirements and the importance of maintaining documentation for all claimed deductions. Adhering to these guidelines helps ensure compliance with tax laws and minimizes the risk of audits or penalties.

Form Submission Methods

Taxpayers can submit the 1040 Schedule A Form through various methods:

- Online filing: Many tax preparation software programs allow for electronic submission of the form.

- Mail: Taxpayers can print the completed form and mail it to the IRS, following the address specified in the form instructions.

- In-person: Some individuals may choose to deliver their forms directly to a local IRS office, although this method is less common.

Quick guide on how to complete 1040 schedule a 2016 form

Effectively Prepare 1040 Schedule A Form on Any Device

Web-based document handling has become increasingly popular among companies and individuals alike. It offers a perfect environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the features necessary to create, modify, and electronically sign your documents quickly and efficiently. Manage 1040 Schedule A Form on any device through airSlate SignNow's Android or iOS applications and streamline any document-related task today.

Edit and eSign 1040 Schedule A Form with Ease

- Obtain 1040 Schedule A Form and click Get Form to initiate.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent parts of your documents or redact sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced papers, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from the device of your preference. Edit and eSign 1040 Schedule A Form and ensure outstanding communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1040 schedule a 2016 form

Create this form in 5 minutes!

How to create an eSignature for the 1040 schedule a 2016 form

How to make an eSignature for your 1040 Schedule A 2016 Form online

How to create an electronic signature for your 1040 Schedule A 2016 Form in Chrome

How to create an electronic signature for putting it on the 1040 Schedule A 2016 Form in Gmail

How to create an electronic signature for the 1040 Schedule A 2016 Form straight from your mobile device

How to create an electronic signature for the 1040 Schedule A 2016 Form on iOS devices

How to create an electronic signature for the 1040 Schedule A 2016 Form on Android

People also ask

-

What is the 1040 Schedule A Form used for?

The 1040 Schedule A Form is used by taxpayers to itemize their deductions when filing their federal income tax returns. This allows individuals to potentially reduce their taxable income by listing eligible expenses, such as medical costs, mortgage interest, and charitable contributions.

-

How can I access the 1040 Schedule A Form with airSlate SignNow?

You can easily access the 1040 Schedule A Form through airSlate SignNow's platform, where you can upload, edit, and eSign your tax documents securely. Our user-friendly interface makes it simple to manage all your tax forms, including the 1040 Schedule A Form.

-

What features does airSlate SignNow offer for the 1040 Schedule A Form?

AirSlate SignNow provides a range of features for the 1040 Schedule A Form, including customizable templates, eSignature capabilities, and document sharing options. These features streamline the process of completing and submitting your tax forms, making it more efficient.

-

Is there a cost associated with using airSlate SignNow for the 1040 Schedule A Form?

Yes, there is a subscription fee for using airSlate SignNow, but it is competitively priced, making it a cost-effective solution for managing your 1040 Schedule A Form and other documents. We offer various plans to suit different needs, ensuring you only pay for the features you require.

-

Can I integrate airSlate SignNow with other software for handling the 1040 Schedule A Form?

Absolutely! AirSlate SignNow seamlessly integrates with various applications, allowing you to connect your workflows for the 1040 Schedule A Form with tools like Google Drive, Salesforce, and more. This integration enhances productivity and ensures your tax documents are easily accessible.

-

What are the benefits of using airSlate SignNow for the 1040 Schedule A Form?

Using airSlate SignNow for the 1040 Schedule A Form offers numerous benefits, including faster processing times, enhanced security, and the ability to track document status in real-time. These advantages help you stay organized and ensure your tax filing is completed accurately and on time.

-

Is airSlate SignNow secure for handling the 1040 Schedule A Form?

Yes, airSlate SignNow prioritizes security by employing advanced encryption and compliance standards to protect your sensitive information, including the 1040 Schedule A Form. You can trust that your documents are safe from unauthorized access and bsignNowes.

Get more for 1040 Schedule A Form

- Ma month to month rental agreement form

- Wyoming mutual wills package with last wills and testaments for married couple with adult children form

- Promissory note with full up form

- Family limited partnership agreement and certificate form

- Operating agreement online form

- Quit claim deed tennessee form

- Washington contract for sale and purchase of real estate with no broker for residential home sale agreement form

- Photography llc operating agreement form

Find out other 1040 Schedule A Form

- eSign Missouri Real Estate Affidavit Of Heirship Simple

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy