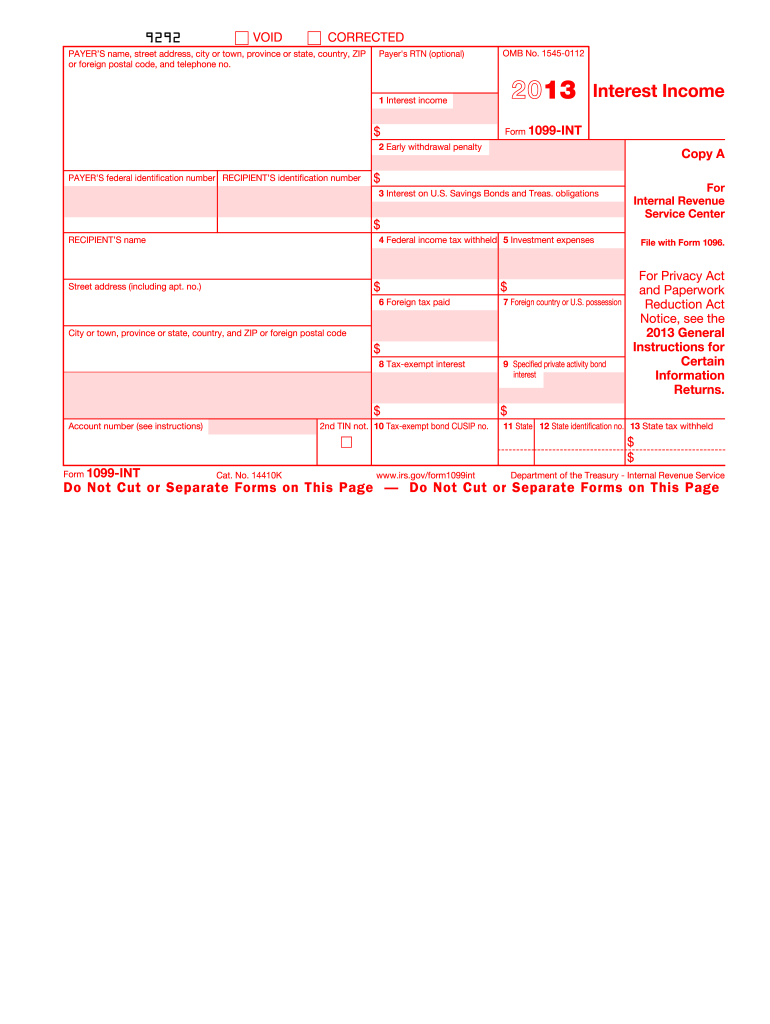

1099 Int Form 2013

What is the 1099 Int Form

The 1099 Int Form is a tax document used in the United States to report interest income earned by individuals and entities. This form is essential for taxpayers who have received interest payments from banks, financial institutions, or other sources. It ensures that the Internal Revenue Service (IRS) is aware of the income received, which must be reported on the taxpayer's annual tax return. The form includes details such as the amount of interest paid, the payer's information, and the recipient's details. Understanding this form is crucial for accurate tax reporting and compliance.

How to obtain the 1099 Int Form

Taxpayers can obtain the 1099 Int Form from several sources. Typically, financial institutions and banks issue this form to their customers by January 31 of each year, reflecting the interest earned in the previous year. If you do not receive your form, you can request it directly from the institution that paid you interest. Additionally, the IRS provides the 1099 Int Form on its website, allowing taxpayers to download and print it if needed. It is important to ensure that you have the correct version of the form for the tax year you are filing.

Steps to complete the 1099 Int Form

Completing the 1099 Int Form involves several straightforward steps. First, gather all necessary information, including your taxpayer identification number (TIN) and the TIN of the payer. Next, enter the payer's name, address, and TIN in the appropriate sections of the form. Then, record the total amount of interest income received in the designated box. Ensure that all information is accurate to avoid issues with the IRS. After filling out the form, review it for any errors before submitting it to the IRS and providing copies to the recipients.

Legal use of the 1099 Int Form

The legal use of the 1099 Int Form is governed by IRS regulations. This form must be filed for any interest payments totaling $10 or more made during the tax year. It is crucial for both the payer and the recipient to retain copies of the form for their records. Failure to file the 1099 Int Form accurately and on time can result in penalties for the payer. Additionally, recipients must report the interest income on their tax returns, as it is subject to federal income tax. Compliance with these regulations ensures legal protection and adherence to tax laws.

Filing Deadlines / Important Dates

The deadlines for filing the 1099 Int Form are critical for compliance. Payers must send out the forms to recipients by January 31 of the year following the tax year in which the interest was paid. Additionally, the form must be submitted to the IRS by February 28 if filed by paper, or by March 31 if filed electronically. It is essential to adhere to these deadlines to avoid penalties and ensure accurate reporting of interest income. Keeping track of these dates can help streamline the filing process and maintain compliance with IRS regulations.

Penalties for Non-Compliance

Non-compliance with the requirements for the 1099 Int Form can lead to significant penalties. If a payer fails to file the form or submits it late, they may incur fines ranging from $50 to $270 per form, depending on how late the form is filed. Additionally, if a payer intentionally disregards the requirement to file, the penalties can be even more severe. Recipients who fail to report the interest income may also face penalties, including additional taxes and interest on unpaid amounts. Understanding these consequences underscores the importance of timely and accurate filing.

Quick guide on how to complete 2013 1099 int form

Easily Prepare 1099 Int Form on Any Device

Managing documents online has gained popularity among both businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, as you can easily find the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle 1099 Int Form on any device with airSlate SignNow's applications for Android or iOS and streamline any document-related task today.

Effortlessly Alter and eSign 1099 Int Form

- Find 1099 Int Form and click Get Form to begin.

- Utilize the tools available to fill out your form.

- Highlight important sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Choose how you want to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that require new copies to be printed. airSlate SignNow takes care of all your document management requirements in just a few clicks from any device you prefer. Modify and eSign 1099 Int Form to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 1099 int form

Create this form in 5 minutes!

How to create an eSignature for the 2013 1099 int form

The best way to create an electronic signature for your PDF document online

The best way to create an electronic signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The way to generate an electronic signature right from your smart phone

The way to create an electronic signature for a PDF document on iOS

The way to generate an electronic signature for a PDF on Android OS

People also ask

-

What is a 1099 Int Form and who needs it?

The 1099 Int Form is used to report interest income earned from bank accounts, investments, and other sources. Individuals and businesses that receive $10 or more in interest during the tax year are required to file this form. Using airSlate SignNow simplifies the process of collecting and sending these forms securely.

-

How can airSlate SignNow help me manage 1099 Int Forms?

airSlate SignNow provides a user-friendly platform for businesses to send, receive, and eSign 1099 Int Forms efficiently. With our solution, you can easily track document status, ensuring that your forms are signed and submitted on time. This not only streamlines your workflow but also helps maintain compliance.

-

Is airSlate SignNow suitable for small businesses handling 1099 Int Forms?

Yes, airSlate SignNow is an ideal choice for small businesses managing 1099 Int Forms. Our cost-effective solution allows small teams to efficiently handle document signing without the need for expensive software or extensive training. Plus, our intuitive interface makes it easy for anyone to use.

-

What features does airSlate SignNow offer for 1099 Int Form management?

airSlate SignNow offers several features tailored for managing 1099 Int Forms, including customizable templates, automated reminders for signatures, and secure storage options. These features ensure that your document handling process is not only efficient but also secure, protecting sensitive information.

-

Can I integrate airSlate SignNow with my accounting software for 1099 Int Forms?

Yes, airSlate SignNow integrates seamlessly with various accounting software, allowing for streamlined handling of 1099 Int Forms. This integration helps to automate the transfer of data and documents, reducing manual entry and the risk of errors. Check our integration options to see how we can work together with your tools.

-

What are the pricing options for using airSlate SignNow for 1099 Int Forms?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses handling 1099 Int Forms. Our pricing is competitive, ensuring you get a cost-effective solution without compromising on features. You can choose from monthly or annual subscriptions to best fit your budget.

-

How secure is airSlate SignNow for handling 1099 Int Forms?

Security is a top priority for airSlate SignNow when handling 1099 Int Forms. We employ advanced encryption standards and secure cloud storage to protect your sensitive information. Additionally, our platform is compliant with industry regulations, ensuring your documents are safe and secure.

Get more for 1099 Int Form

- Office of human resources ms 118 x64467 form

- International eli application packet for readmission form

- Accountability form

- Formsbowie state university

- Check request form drexel university drexel

- Questionnaire for sports participation form

- The performance appraisal form follows the basic principles of effectively evaluating employee performance and is intended to

- Full text of ampquotarmstrong state college catalogampquot form

Find out other 1099 Int Form

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading