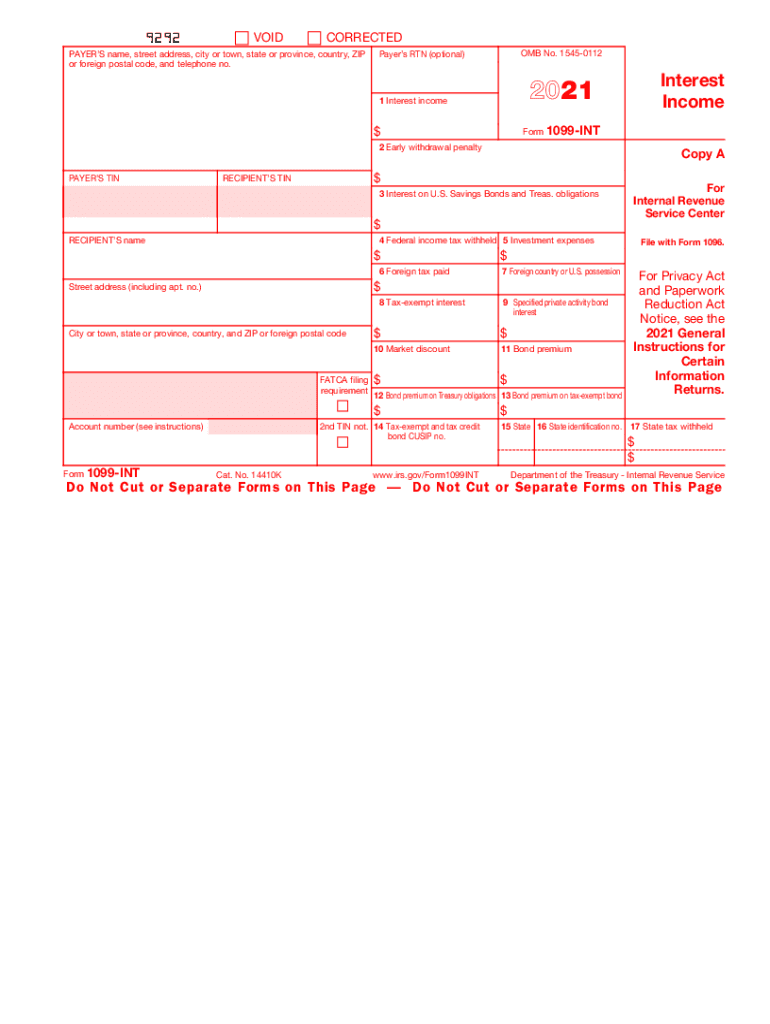

2021 Form 1099 INT Interest Income 2021

What is the 2019 Form 1099 INT Interest Income?

The 2019 Form 1099 INT is an IRS document used to report interest income earned by individuals and entities. This form is essential for taxpayers who have received interest payments from banks, financial institutions, or other entities during the tax year. It serves as a record of the interest income that must be reported on your federal tax return. Understanding this form is crucial for ensuring compliance with tax regulations and accurately reporting income to the IRS.

Key elements of the 2019 Form 1099 INT Interest Income

The 2019 Form 1099 INT includes several key elements that taxpayers should be aware of:

- Payer's Information: This section contains the name, address, and taxpayer identification number (TIN) of the entity that paid the interest.

- Recipient's Information: This includes the name, address, and TIN of the person or entity receiving the interest.

- Interest Income Amount: The total amount of interest paid during the tax year is reported in Box 1.

- Federal Income Tax Withheld: If applicable, any federal income tax withheld is reported in Box 4.

- Other Information: Additional boxes may report specific types of interest or other relevant details.

Steps to complete the 2019 Form 1099 INT Interest Income

Completing the 2019 Form 1099 INT involves several steps:

- Gather all relevant information, including your TIN and the TIN of the payer.

- Fill out the payer's and recipient's information accurately.

- Report the total interest income received in Box 1.

- If applicable, enter any federal income tax withheld in Box 4.

- Review the completed form for accuracy before submission.

Legal use of the 2019 Form 1099 INT Interest Income

The 2019 Form 1099 INT is legally binding when filled out correctly and submitted to the IRS. It is essential to ensure that all information is accurate to avoid penalties or issues with the IRS. This form must be issued to recipients by January 31 of the year following the tax year in which the interest was paid. Recipients must report the income on their tax returns, making the proper completion of this form vital for compliance.

Filing Deadlines / Important Dates

For the 2019 Form 1099 INT, the following deadlines are important:

- Recipient Copy Deadline: January 31, 2020 - The form must be provided to the recipient by this date.

- IRS Filing Deadline: February 28, 2020 (if filing by mail) or March 31, 2020 (if filing electronically).

Who Issues the Form

The 2019 Form 1099 INT is typically issued by banks, credit unions, and other financial institutions that pay interest to individuals or entities. It is the responsibility of the payer to ensure that the form is accurately completed and submitted to both the IRS and the recipient. Taxpayers should keep an eye out for this form if they have earned interest income during the tax year.

Quick guide on how to complete 2021 form 1099 int interest income

Effortlessly Prepare 2021 Form 1099 INT Interest Income on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents since you can easily locate the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Handle 2021 Form 1099 INT Interest Income on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related processes today.

The Easiest Way to Edit and Electronically Sign 2021 Form 1099 INT Interest Income

- Obtain 2021 Form 1099 INT Interest Income and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your electronic signature with the Sign tool, which only takes seconds and carries the same legal significance as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign 2021 Form 1099 INT Interest Income and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 form 1099 int interest income

Create this form in 5 minutes!

How to create an eSignature for the 2021 form 1099 int interest income

The way to make an eSignature for a PDF file in the online mode

The way to make an eSignature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The way to make an electronic signature right from your smartphone

The way to make an eSignature for a PDF file on iOS devices

The way to make an electronic signature for a PDF on Android

People also ask

-

What is a 2019 1099 int form?

A 2019 1099 int form is used to report interest income that you received throughout the year. This form is crucial for accurately filing your taxes, as it details the total interest earned on investments or savings accounts. Understanding your 2019 1099 int is essential for compliance with the IRS.

-

How do I get my 2019 1099 int form?

You can obtain your 2019 1099 int form from the financial institution that paid you interest. Typically, these institutions send out the forms by January 31 of the following year. If you haven’t received your form, check your online banking portal or contact your bank for assistance.

-

Does airSlate SignNow support electronic signing of the 2019 1099 int forms?

Yes, airSlate SignNow allows you to eSign your 2019 1099 int forms easily. Our platform ensures that all signatures meet legal requirements, providing a secure and efficient way to manage your documents. Not only does this save time, but it also enhances overall productivity.

-

What are the pricing options for airSlate SignNow?

AirSlate SignNow offers flexible pricing plans that cater to different business needs, including a plan that is perfect for handling documents like the 2019 1099 int. Pricing is competitive, and you can choose from monthly or annual subscriptions based on your usage. You also have the option for a free trial to explore our features.

-

Can I integrate airSlate SignNow with my accounting software?

Absolutely! AirSlate SignNow offers integrations with various accounting software solutions. This allows you to seamlessly process documents such as the 2019 1099 int and keep track of financial records all in one place, enhancing your workflow efficiency.

-

What features does airSlate SignNow provide for managing tax forms?

AirSlate SignNow provides robust features for managing tax forms, including templates, automated workflows, and eSigning capabilities. With our solution, you can easily create, send, and track your 2019 1099 int forms. These features enhance efficiency and minimize errors in your tax documentation process.

-

Is there customer support available for assistance with the 2019 1099 int form?

Yes, airSlate SignNow offers excellent customer support to help you with any questions regarding the 2019 1099 int form. Our team is available via chat, email, or phone to provide guidance on the signing process and any technical issues you may encounter. We are dedicated to ensuring a smooth user experience.

Get more for 2021 Form 1099 INT Interest Income

Find out other 2021 Form 1099 INT Interest Income

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now