1099 Int Form 2017

What is the 1099 Int Form

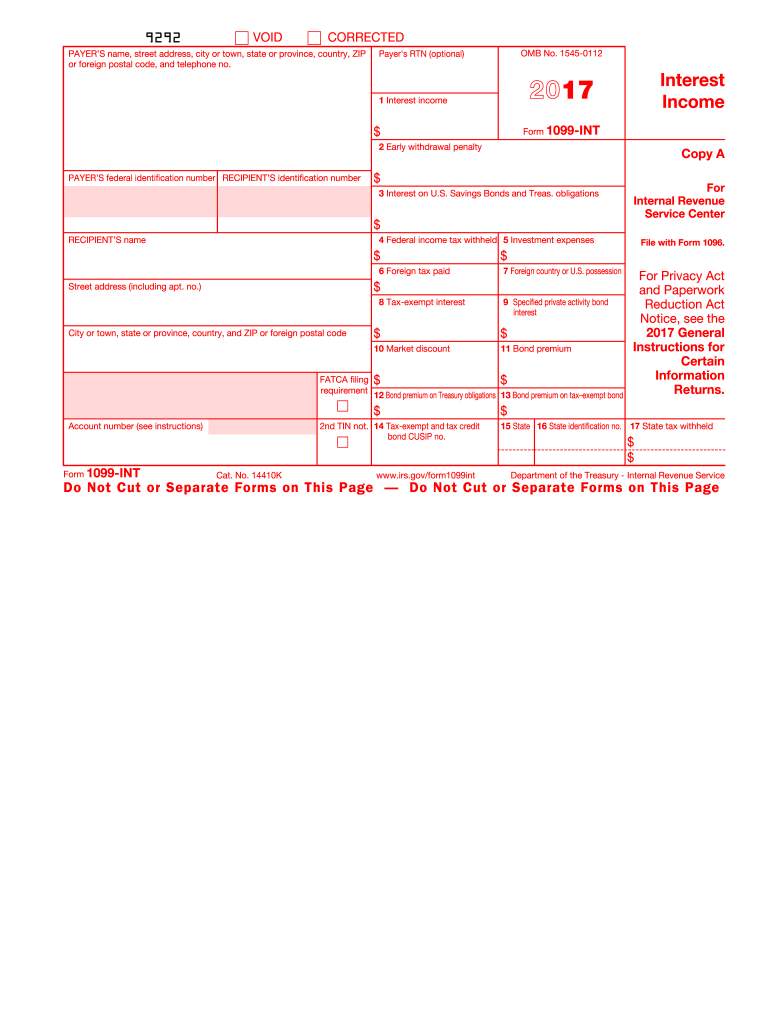

The 1099 Int Form is a tax document used in the United States to report interest income. Financial institutions, such as banks and credit unions, issue this form to individuals and businesses that have earned interest over a specified threshold during the tax year. The information reported on the 1099 Int Form is essential for taxpayers to accurately report their income on their federal tax returns. This form typically includes details such as the payer's information, the recipient's information, and the total interest earned.

How to use the 1099 Int Form

Using the 1099 Int Form involves several steps. First, recipients should review the form for accuracy, ensuring that all personal information and reported interest amounts are correct. Next, taxpayers should report the interest income on their tax return, typically on Schedule B of Form 1040. It is important to keep a copy of the 1099 Int Form for personal records and to ensure compliance with IRS regulations. If there are discrepancies, recipients should contact the issuer to resolve any issues before filing their taxes.

Steps to complete the 1099 Int Form

Completing the 1099 Int Form requires careful attention to detail. Follow these steps:

- Gather necessary information, including the payer's name, address, and taxpayer identification number (TIN).

- Enter your name, address, and TIN as the recipient.

- Report the total interest income earned in the designated box.

- Include any applicable federal tax withheld, if applicable.

- Review the form for accuracy before submitting it to the IRS.

Legal use of the 1099 Int Form

The legal use of the 1099 Int Form is crucial for compliance with IRS regulations. This form serves as a record of interest income that must be reported on federal tax returns. Failure to report income from the 1099 Int Form can lead to penalties, including fines and interest on unpaid taxes. It is essential for both payers and recipients to understand their responsibilities regarding this form to avoid legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the 1099 Int Form are important to ensure timely compliance with IRS requirements. Generally, financial institutions must send out the 1099 Int Form to recipients by January 31 of the year following the tax year in which the interest was earned. Additionally, the form must be filed with the IRS by February 28 if submitted by mail or by March 31 if filed electronically. It is essential to adhere to these deadlines to avoid penalties.

Who Issues the Form

The 1099 Int Form is typically issued by banks, credit unions, and other financial institutions that pay interest to individuals or businesses. These entities are responsible for reporting the interest payments made during the tax year. It is important for recipients to keep track of all 1099 Int Forms received to ensure accurate reporting of income on their tax returns.

Quick guide on how to complete 1099 int 2017 form

Complete 1099 Int Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage 1099 Int Form on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest method to modify and eSign 1099 Int Form seamlessly

- Locate 1099 Int Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize signNow sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Verify the details and click on the Done button to preserve your changes.

- Select your preferred delivery method for your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Remove the hassle of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs within a few clicks from any device of your choice. Modify and eSign 1099 Int Form and ensure exceptional communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1099 int 2017 form

Create this form in 5 minutes!

How to create an eSignature for the 1099 int 2017 form

How to make an electronic signature for the 1099 Int 2017 Form in the online mode

How to generate an eSignature for the 1099 Int 2017 Form in Chrome

How to make an electronic signature for signing the 1099 Int 2017 Form in Gmail

How to make an eSignature for the 1099 Int 2017 Form straight from your smart phone

How to create an eSignature for the 1099 Int 2017 Form on iOS

How to generate an electronic signature for the 1099 Int 2017 Form on Android OS

People also ask

-

What is the 1099 Int Form and why is it important?

The 1099 Int Form is a tax document used to report interest income earned by individuals and businesses. It is essential for accurate tax reporting and ensures compliance with IRS regulations. By using airSlate SignNow, you can easily manage and eSign your 1099 Int Forms, streamlining your tax preparation process.

-

How can airSlate SignNow help me with my 1099 Int Form?

airSlate SignNow simplifies the process of preparing and signing your 1099 Int Form. Our platform allows you to create, send, and electronically sign documents securely, ensuring that your tax forms are handled efficiently and accurately. This can save you time and reduce the likelihood of errors in your tax submissions.

-

Is there a cost associated with using airSlate SignNow for the 1099 Int Form?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of different users, including businesses that frequently handle 1099 Int Forms. Our pricing is competitive and designed to provide you with an affordable solution for document management. Explore our plans to find the best fit for your budget.

-

What features does airSlate SignNow offer for managing the 1099 Int Form?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking specifically for managing your 1099 Int Form. With our intuitive interface, you can easily fill out and send forms while keeping track of their status in real time, enhancing your overall productivity.

-

Can I integrate airSlate SignNow with other software for my 1099 Int Form needs?

Absolutely! airSlate SignNow offers seamless integrations with popular accounting and tax software, making it easy to incorporate your 1099 Int Form processing into your existing workflows. This integration capability ensures that you can manage all aspects of your financial documents in one place.

-

Is airSlate SignNow secure for handling sensitive information on the 1099 Int Form?

Yes, security is a top priority at airSlate SignNow. Our platform utilizes advanced encryption and compliance measures to protect sensitive information on your 1099 Int Form and other documents. You can trust that your data is safe while eSigning and sharing important tax documents.

-

How does airSlate SignNow improve the efficiency of processing the 1099 Int Form?

By using airSlate SignNow, you can streamline the entire process of preparing, signing, and submitting your 1099 Int Form. Our user-friendly platform reduces the time spent on manual paperwork, minimizes errors, and accelerates the turnaround time for document approval, allowing you to focus on your core business activities.

Get more for 1099 Int Form

Find out other 1099 Int Form

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter