Form 1099 INT Rev January 2022 Interest Income 2022

What is the Form 1099 INT Rev January 2022 Interest Income

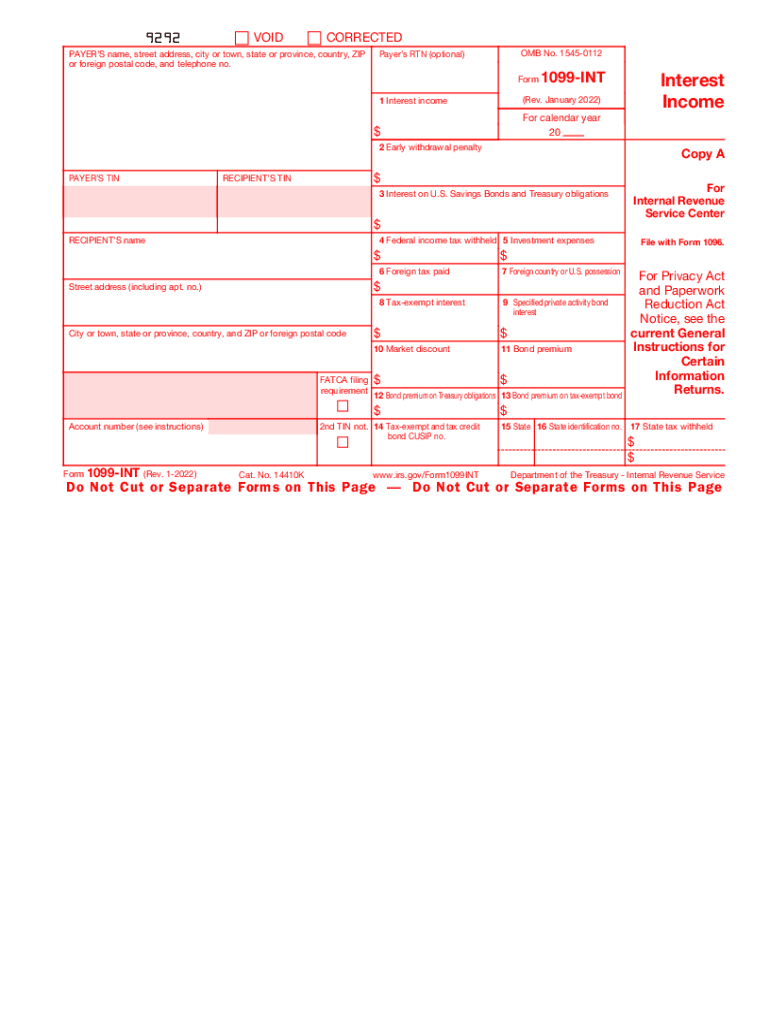

The Form 1099 INT Rev January 2022 is a tax document used to report interest income earned by individuals and entities. It is issued by banks, financial institutions, and other payers to individuals who have received interest payments of ten dollars or more during the tax year. This form is essential for taxpayers to accurately report their income to the Internal Revenue Service (IRS) and ensure compliance with tax regulations. The information provided on the form includes the payer's details, the recipient's information, and the total interest paid.

How to use the Form 1099 INT Rev January 2022 Interest Income

To use the Form 1099 INT Rev January 2022, taxpayers should first receive the form from the financial institution that paid them interest. Once received, it is important to review the information for accuracy. Taxpayers must then report the interest income on their federal tax return, typically on Schedule B, which is used to report interest and ordinary dividends. It is crucial to keep this form for personal records and to ensure that all reported income matches the amounts reported to the IRS.

Steps to complete the Form 1099 INT Rev January 2022 Interest Income

Completing the Form 1099 INT Rev January 2022 involves several key steps:

- Obtain the form from the IRS website or your financial institution.

- Fill in the payer's information, including name, address, and taxpayer identification number (TIN).

- Provide the recipient's information, including name, address, and TIN.

- Report the total interest income received in the appropriate box.

- Include any federal income tax withheld, if applicable.

- Submit the completed form to the IRS and provide a copy to the recipient by the required deadlines.

Legal use of the Form 1099 INT Rev January 2022 Interest Income

The legal use of the Form 1099 INT Rev January 2022 is governed by IRS regulations. This form must be filed by payers who have made interest payments to individuals or entities. It serves as a formal record of interest income and is necessary for both the payer and recipient to maintain accurate tax records. Failure to issue or accurately report this form can result in penalties for the payer and discrepancies in the recipient's tax filings.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1099 INT Rev January 2022 are critical to ensure compliance with IRS regulations. Payers must furnish the form to recipients by January thirty-first of the year following the tax year in which the interest was paid. Additionally, the form must be submitted to the IRS by the end of February if filing by paper, or by the end of March if filing electronically. Adhering to these deadlines helps avoid potential penalties and ensures that all parties are in compliance with tax laws.

Penalties for Non-Compliance

Non-compliance with the requirements related to the Form 1099 INT Rev January 2022 can result in significant penalties. If a payer fails to issue the form or submits incorrect information, they may face fines imposed by the IRS. The penalties vary based on how late the form is filed and can range from fifty dollars to several hundred dollars per form, depending on the severity of the violation. It is essential for payers to understand their responsibilities to avoid these penalties.

Quick guide on how to complete form 1099 int rev january 2022 interest income

Complete Form 1099 INT Rev January 2022 Interest Income effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, as you can easily find the right form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Form 1099 INT Rev January 2022 Interest Income on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to edit and eSign Form 1099 INT Rev January 2022 Interest Income with ease

- Obtain Form 1099 INT Rev January 2022 Interest Income and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional handwritten signature.

- Verify all the details and click on the Done button to save your changes.

- Select your preferred method for sharing your form, whether via email, SMS, or an invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign Form 1099 INT Rev January 2022 Interest Income and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1099 int rev january 2022 interest income

Create this form in 5 minutes!

How to create an eSignature for the form 1099 int rev january 2022 interest income

How to create an electronic signature for a PDF in the online mode

How to create an electronic signature for a PDF in Chrome

How to create an e-signature for putting it on PDFs in Gmail

The best way to create an e-signature right from your smart phone

How to create an e-signature for a PDF on iOS devices

The best way to create an e-signature for a PDF on Android OS

People also ask

-

What features does airSlate SignNow offer for int gov irs users?

airSlate SignNow provides a variety of features tailored for int gov irs users, including secure eSigning, document templates, and cloud storage. These features ensure that your documents remain compliant with IRS regulations while being easy to manage. Additionally, team collaboration tools facilitate seamless workflow integration.

-

How does airSlate SignNow ensure compliance with int gov irs regulations?

airSlate SignNow adheres to established eSignature laws and guidelines, ensuring that all documents signed through the platform meet int gov irs requirements. The platform also offers audit trails and timestamps to provide verifiable proof of compliance. This gives businesses peace of mind when handling sensitive documents.

-

What is the pricing structure for airSlate SignNow aimed at int gov irs users?

The pricing for airSlate SignNow is designed to be cost-effective for int gov irs users, with various plans available depending on the size of your business and specific needs. Each plan includes a range of features, ensuring that you only pay for what you need. Free trials are also available, allowing users to explore the platform before committing.

-

Can airSlate SignNow integrate with other software I use for int gov irs processes?

Yes, airSlate SignNow offers integration capabilities with popular software used by int gov irs operations, including document management systems and CRM tools. This ensures that you can streamline your workflows and maintain a cohesive system. Integration can enhance productivity by automating multiple tasks within your existing setups.

-

What are the benefits of using airSlate SignNow for my int gov irs documentation?

Using airSlate SignNow for your int gov irs documentation simplifies the signing process, making it quicker and more efficient. The platform's user-friendly interface allows for easy navigation and operation, which can save time and reduce errors. Additionally, its secure infrastructure safeguards your documents against unauthorized access.

-

Is airSlate SignNow suitable for large organizations dealing with int gov irs?

Absolutely, airSlate SignNow is suitable for large organizations engaging with int gov irs due to its scalable solutions. It supports multiple users and permissions, ensuring that team members can collaborate securely. The ability to manage numerous documents at scale makes it an ideal choice for enterprises.

-

What support services are provided by airSlate SignNow for int gov irs clients?

airSlate SignNow offers comprehensive support services for int gov irs clients, including live chat, email support, and extensive online resources. Should any issues arise, the support team is readily available to assist. This commitment to customer support helps ensure that your experience with the platform is smooth and efficient.

Get more for Form 1099 INT Rev January 2022 Interest Income

- Revocation of anatomical gift donation colorado form

- Employment or job termination package colorado form

- Newly widowed individuals package colorado form

- Colorado dnr form

- Employment interview package colorado form

- Employment employee personnel file package colorado form

- Assignment of mortgage package colorado form

- Assignment of lease package colorado form

Find out other Form 1099 INT Rev January 2022 Interest Income

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast