1099 Int Form 2016

What is the 1099 Int Form

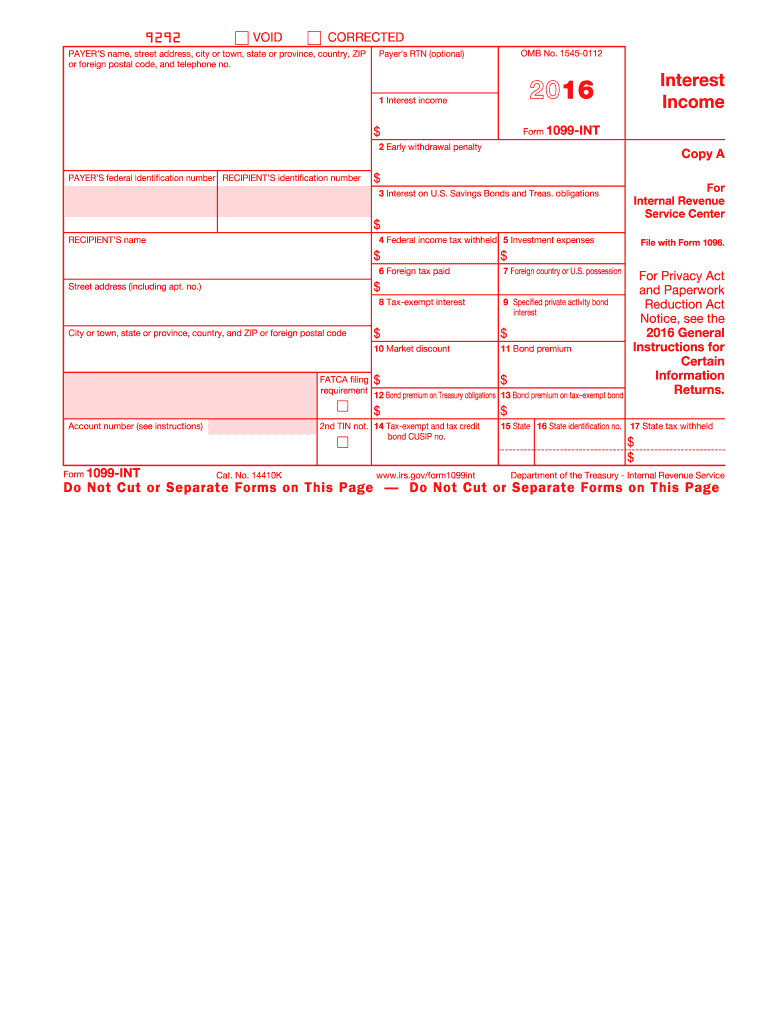

The 1099 Int Form is a tax document used in the United States to report interest income earned by individuals or entities. This form is essential for taxpayers who have received interest payments from banks, financial institutions, or other entities throughout the tax year. It is crucial for accurately reporting income to the Internal Revenue Service (IRS) and ensuring compliance with tax regulations. The 1099 Int Form includes details such as the payer's information, the recipient's information, and the total interest income received during the tax year.

How to obtain the 1099 Int Form

Taxpayers can obtain the 1099 Int Form through several methods. Most commonly, financial institutions will automatically send this form to individuals who have earned interest income. If you do not receive a form, you can request it directly from the institution that paid you interest. Additionally, the IRS provides a downloadable version of the 1099 Int Form on its website, which can be printed and filled out if necessary. It is important to ensure that you have the correct form for the tax year you are filing.

Steps to complete the 1099 Int Form

Completing the 1099 Int Form involves several key steps:

- Gather necessary information, including your personal details and the payer's information.

- Enter the total amount of interest income received in the appropriate box on the form.

- Include any federal income tax withheld, if applicable.

- Review the form for accuracy and completeness before submission.

- Submit the completed form to the IRS and provide a copy to the entity that issued the interest payments.

Legal use of the 1099 Int Form

The 1099 Int Form is legally required for reporting interest income to the IRS. Failing to report this income can result in penalties and interest charges. It is important for taxpayers to ensure that all interest income is reported accurately to maintain compliance with tax laws. The form must be filed by the deadline set by the IRS, typically by January thirty-first of the following year, to avoid any potential legal issues.

Key elements of the 1099 Int Form

Several key elements are essential for the 1099 Int Form:

- Payer's Information: This includes the name, address, and taxpayer identification number (TIN) of the entity that paid the interest.

- Recipient's Information: This includes the name, address, and TIN of the individual or entity receiving the interest.

- Interest Income Amount: The total amount of interest earned during the tax year must be clearly stated.

- Federal Income Tax Withheld: Any amounts withheld for federal taxes should be reported on the form.

Filing Deadlines / Important Dates

It is crucial to adhere to filing deadlines for the 1099 Int Form to avoid penalties. The form must be submitted to the IRS by January thirty-first of the year following the tax year in which the interest was earned. If the form is filed electronically, the deadline may extend to March thirty-first. Recipients should also receive their copies by the same deadline to ensure timely reporting of income on their tax returns.

Quick guide on how to complete 1099 int 2016 form

Complete 1099 Int Form effortlessly on any gadget

Online document management has gained popularity among businesses and individuals alike. It offers a fantastic environmentally friendly substitute for traditional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, edit, and eSign your documents swiftly without unnecessary delays. Manage 1099 Int Form on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest method to modify and eSign 1099 Int Form with minimal effort

- Find 1099 Int Form and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal authority as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Modify and eSign 1099 Int Form and ensure exceptional communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1099 int 2016 form

Create this form in 5 minutes!

How to create an eSignature for the 1099 int 2016 form

How to create an eSignature for the 1099 Int 2016 Form in the online mode

How to make an electronic signature for the 1099 Int 2016 Form in Google Chrome

How to create an electronic signature for signing the 1099 Int 2016 Form in Gmail

How to generate an electronic signature for the 1099 Int 2016 Form right from your smart phone

How to make an eSignature for the 1099 Int 2016 Form on iOS devices

How to make an eSignature for the 1099 Int 2016 Form on Android devices

People also ask

-

What is a 1099 Int Form and why is it important?

The 1099 Int Form is a tax document used to report interest income earned by individuals or entities. It's important because it helps taxpayers report their earnings accurately to the IRS, ensuring compliance and avoiding penalties. With airSlate SignNow, you can easily eSign and manage your 1099 Int Form electronically, streamlining your tax preparation process.

-

How can airSlate SignNow help with 1099 Int Form management?

airSlate SignNow simplifies the management of your 1099 Int Form by allowing you to send, sign, and store documents securely online. With our user-friendly interface, you can quickly create and customize your forms, ensuring that all necessary information is included. Plus, our platform helps you keep track of document status in real-time, making tax season less stressful.

-

Is there a cost associated with using airSlate SignNow for the 1099 Int Form?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs. Our cost-effective solutions provide access to essential features for handling your 1099 Int Form, ensuring you get the best value for your investment. You can choose a plan that fits your budget and requirements, whether you're a freelancer or a large business.

-

What features does airSlate SignNow offer for eSigning the 1099 Int Form?

airSlate SignNow includes robust features for eSigning your 1099 Int Form, such as customizable templates, in-person signing options, and secure cloud storage. Additionally, our platform supports multiple file formats, making it easy to upload and manage your tax documents. With airSlate SignNow, you can ensure your forms are signed efficiently and securely.

-

Can I integrate airSlate SignNow with other software for 1099 Int Form processing?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, allowing you to enhance your workflow when processing your 1099 Int Form. By connecting with popular tools like accounting software and CRM systems, you can automate data entry and improve efficiency across your operations.

-

What benefits does airSlate SignNow provide for filing the 1099 Int Form?

Using airSlate SignNow to file your 1099 Int Form provides numerous benefits, including time savings, increased accuracy, and enhanced security. Our platform ensures your documents are signed electronically and stored securely, reducing the risk of lost paperwork. Additionally, you can easily track signatures and manage multiple forms, making the filing process more efficient.

-

Is airSlate SignNow compliant with IRS regulations for the 1099 Int Form?

Yes, airSlate SignNow is designed to comply with IRS regulations for electronic signatures on the 1099 Int Form. Our platform meets the necessary security standards and provides a legally binding eSignature, ensuring that your forms comply with federal requirements. You can trust airSlate SignNow to help you meet your tax obligations with confidence.

Get more for 1099 Int Form

Find out other 1099 Int Form

- Sign Pennsylvania Pet Addendum to Lease Agreement Computer

- Sign Rhode Island Vacation Rental Short Term Lease Agreement Safe

- Sign South Carolina Vacation Rental Short Term Lease Agreement Now

- How Do I Sign Georgia Escrow Agreement

- Can I Sign Georgia Assignment of Mortgage

- Sign Kentucky Escrow Agreement Simple

- How To Sign New Jersey Non-Disturbance Agreement

- How To Sign Illinois Sales Invoice Template

- How Do I Sign Indiana Sales Invoice Template

- Sign North Carolina Equipment Sales Agreement Online

- Sign South Dakota Sales Invoice Template Free

- How Can I Sign Nevada Sales Proposal Template

- Can I Sign Texas Confirmation Of Reservation Or Order

- How To Sign Illinois Product Defect Notice

- Sign New Mexico Refund Request Form Mobile

- Sign Alaska Sponsorship Agreement Safe

- How To Sign Massachusetts Copyright License Agreement

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy