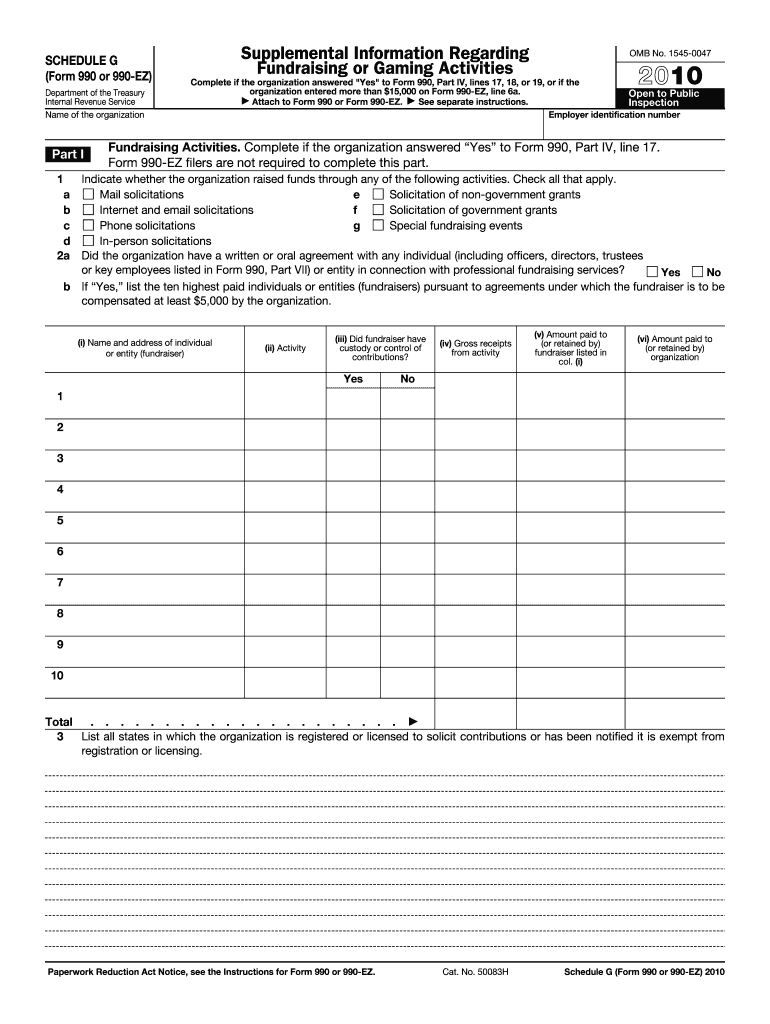

Form 990 Ez Schedule G 2010

What is the Form 990 Ez Schedule G

The Form 990 Ez Schedule G is a crucial document used by certain tax-exempt organizations in the United States to report compensation paid to their highest-paid employees and contractors. This schedule is a part of the larger Form 990, which is an annual information return that provides the IRS and the public with financial information about the organization. The Schedule G specifically focuses on the compensation details, ensuring transparency and accountability in how these organizations manage their funds.

How to use the Form 990 Ez Schedule G

Using the Form 990 Ez Schedule G involves accurately reporting compensation information. Organizations must fill out this schedule if they meet specific criteria, including having total revenue of less than $200,000 and total assets of less than $500,000. The form requires detailed entries about the highest-paid individuals, including their names, titles, and the amounts they were compensated. This information should be cross-referenced with the organization's financial records to ensure accuracy.

Steps to complete the Form 990 Ez Schedule G

Completing the Form 990 Ez Schedule G involves several steps:

- Gather necessary financial records, including compensation data for employees and contractors.

- Identify the highest-paid individuals within the organization, ensuring that you include all required details.

- Fill out the schedule, providing accurate information about each individual’s compensation, including salary, bonuses, and other forms of payment.

- Review the completed schedule for accuracy and compliance with IRS guidelines.

- Attach the completed Schedule G to the main Form 990 before submission.

Legal use of the Form 990 Ez Schedule G

The legal use of the Form 990 Ez Schedule G is governed by IRS regulations. Organizations must ensure that the information provided is truthful and complete, as inaccuracies can lead to penalties. The form is considered a public document, meaning it can be accessed by the public, which emphasizes the need for transparency. Compliance with the legal requirements surrounding this form is essential to maintain the organization’s tax-exempt status.

Filing Deadlines / Important Dates

Filing deadlines for the Form 990 Ez Schedule G typically align with the organization’s fiscal year-end. Most organizations must file their Form 990, including Schedule G, by the 15th day of the fifth month after the end of their fiscal year. For example, if an organization’s fiscal year ends on December 31, the form would be due by May 15 of the following year. It is advisable to check for any changes in deadlines or extensions that may apply.

Form Submission Methods (Online / Mail / In-Person)

The Form 990 Ez Schedule G can be submitted using several methods. Organizations can file electronically through the IRS e-file system, which is often the quickest and most efficient method. Alternatively, organizations may choose to mail a paper copy of the form to the appropriate IRS address. In-person submission is generally not an option for this form. It is important to retain a copy of the submitted form for the organization’s records.

Quick guide on how to complete 2010 form 990 ez schedule g

Complete Form 990 Ez Schedule G effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily find the right form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without any delays. Manage Form 990 Ez Schedule G on any device with airSlate SignNow apps for Android or iOS and enhance any document-centered process today.

The easiest way to edit and eSign Form 990 Ez Schedule G seamlessly

- Find Form 990 Ez Schedule G and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information using tools that airSlate SignNow specifically provides for this purpose.

- Create your signature with the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to send your form—via email, SMS, invitation link, or download it to your computer.

Eliminate the hassles of lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign Form 990 Ez Schedule G and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2010 form 990 ez schedule g

Create this form in 5 minutes!

How to create an eSignature for the 2010 form 990 ez schedule g

The way to generate an electronic signature for your PDF document online

The way to generate an electronic signature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

The way to create an electronic signature straight from your smart phone

The best way to make an electronic signature for a PDF document on iOS

The way to create an electronic signature for a PDF document on Android OS

People also ask

-

What is the Form 990 Ez Schedule G?

The Form 990 Ez Schedule G is a component of the IRS Form 990 series used by organizations to report professional fundraising services. This schedule details the fundraising events and provides transparency about the fees paid to professional fundraisers. Understanding how to fill this form correctly is crucial for compliance.

-

How can airSlate SignNow assist with Form 990 Ez Schedule G?

airSlate SignNow simplifies the process of preparing and signing Form 990 Ez Schedule G with its user-friendly interface. Our platform allows you to quickly upload your completed forms and obtain eSignatures from required parties, ensuring a smooth filing process. This time-saving solution enhances efficiency and accuracy.

-

Is airSlate SignNow cost-effective for managing Form 990 Ez Schedule G?

Yes, airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes, making it an affordable choice for managing Form 990 Ez Schedule G. You get access to a range of features without breaking the bank, ensuring that your document management is both efficient and budget-friendly.

-

What features does airSlate SignNow offer for tax documents like Form 990 Ez Schedule G?

airSlate SignNow provides a suite of features tailored for managing tax documents, including customizable templates for Form 990 Ez Schedule G, automated workflows, and secure eSigning options. These features help you streamline document handling, reducing the risk of errors and ensuring compliance with IRS requirements.

-

Can I integrate airSlate SignNow with my existing accounting software for Form 990 Ez Schedule G?

Absolutely! airSlate SignNow seamlessly integrates with various accounting software, allowing you to manage Form 990 Ez Schedule G alongside your financial data. This integration means you can easily access required documents, maintain organized records, and ensure accuracy in your filings.

-

How does airSlate SignNow enhance the security of Form 990 Ez Schedule G interactions?

Security is a top priority for airSlate SignNow, which employs advanced encryption protocols to protect your Form 990 Ez Schedule G and other sensitive documents. Our platform also offers audit trails and secure authentication methods to ensure that only authorized individuals can access and sign your documents.

-

What are the benefits of using airSlate SignNow for filing Form 990 Ez Schedule G?

Using airSlate SignNow for filing Form 990 Ez Schedule G provides numerous benefits, including faster processing times, improved compliance, and reduced administrative workload. The ease of eSigning and document management allows organizations to focus on their mission rather than paperwork, enhancing overall efficiency.

Get more for Form 990 Ez Schedule G

- Girl health history annual permission f 57 girl scouts of form

- Part i illness and injuries check all that apply form

- Buckeye provider adjustment request form

- Columbus orthopaedic clinic medication log form

- Section a enrollee information all fields are required

- Liability release form university of cincinnati

- Acute pa form

- Ownership and control disclosure form amerihealth caritas

Find out other Form 990 Ez Schedule G

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online