990 Form 2011

What is the 990 Form

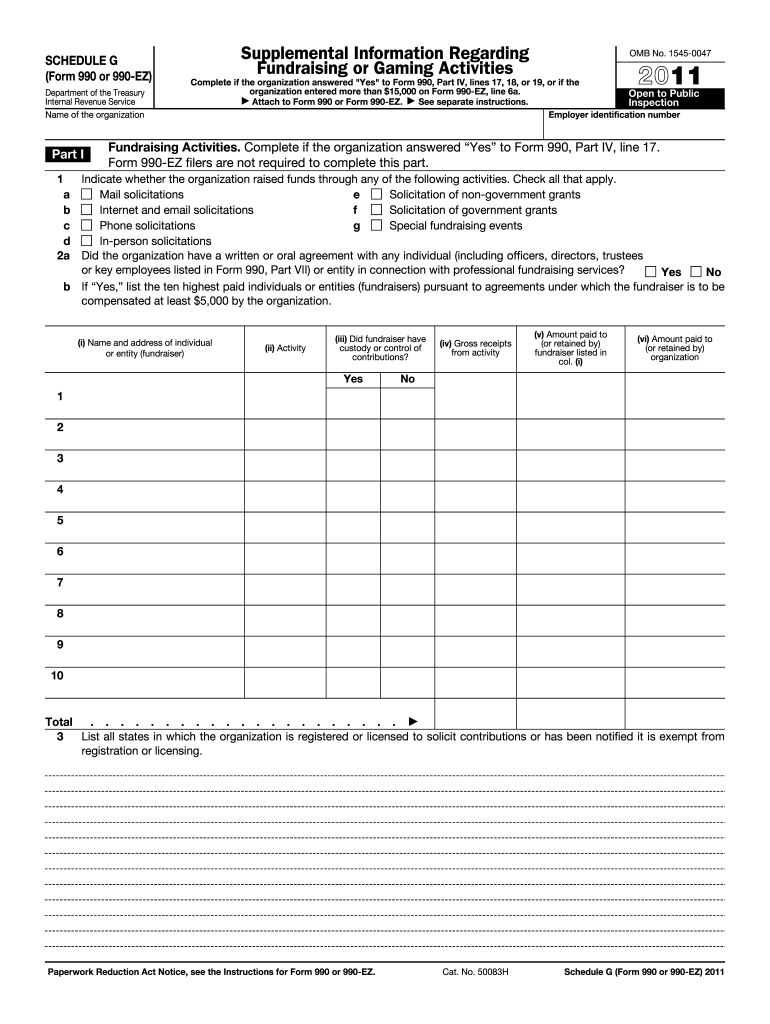

The 990 Form is an essential tax document used by tax-exempt organizations in the United States to provide the Internal Revenue Service (IRS) with information about their financial activities. This form is crucial for maintaining transparency and accountability in the nonprofit sector. It includes details about the organization’s revenue, expenses, and overall financial health, helping the IRS ensure compliance with tax regulations. The 990 Form is typically filed annually and is publicly accessible, allowing donors and the public to evaluate the financial status of nonprofit organizations.

How to use the 990 Form

Using the 990 Form involves several steps that ensure accurate reporting of financial information. Organizations must first gather all necessary financial records, including income statements, balance sheets, and details on program services. Once the required information is compiled, the organization can fill out the form, ensuring that all sections are completed accurately. After completing the form, it should be reviewed for accuracy before submission. Organizations can file the 990 Form electronically using approved e-filing systems, which simplifies the process and helps ensure compliance with IRS requirements.

Steps to complete the 990 Form

Completing the 990 Form requires careful attention to detail. Here are the steps to follow:

- Gather financial records, including income, expenses, and assets.

- Review the specific sections of the 990 Form that need to be filled out based on the organization’s activities.

- Input accurate data into the form, ensuring all figures align with financial statements.

- Double-check all entries for accuracy and completeness.

- Submit the completed form electronically or by mail, adhering to the filing deadlines set by the IRS.

Legal use of the 990 Form

The 990 Form serves as a legally binding document that demonstrates an organization’s compliance with federal tax laws. It is important for organizations to ensure that the information reported is truthful and accurate, as any discrepancies can lead to penalties or loss of tax-exempt status. The form must be filed annually, and failure to do so may result in fines or other legal consequences. Organizations should maintain thorough records to support the information provided in the 990 Form, as these records may be requested during audits or reviews by the IRS.

Filing Deadlines / Important Dates

Organizations must adhere to specific filing deadlines for the 990 Form to remain compliant with IRS regulations. Generally, the form is due on the fifteenth day of the fifth month after the end of the organization’s fiscal year. For organizations operating on a calendar year, this means the form is typically due by May fifteenth. If necessary, organizations can file for an automatic six-month extension, allowing additional time to prepare the form. It is crucial to be aware of these deadlines to avoid penalties and ensure timely compliance.

Examples of using the 990 Form

The 990 Form is utilized by various types of tax-exempt organizations, including charities, educational institutions, and religious organizations. For example, a nonprofit focused on environmental conservation would use the 990 Form to report its fundraising activities, grant distributions, and operational expenses. Similarly, a private foundation would detail its charitable contributions and investment income. These examples illustrate how diverse organizations leverage the 990 Form to maintain transparency and accountability in their financial operations.

Key elements of the 990 Form

The 990 Form consists of several key elements that organizations must complete. These include:

- Basic information about the organization, including its name, address, and mission.

- Financial statements detailing revenue, expenses, and net assets.

- Information on the organization’s programs and activities.

- Governance details, including the board of directors and key staff members.

- Disclosure of compensation for highest-paid employees and contractors.

Each of these elements plays a vital role in providing a comprehensive overview of the organization’s financial health and operational effectiveness.

Quick guide on how to complete 2011 990 form

Complete 990 Form effortlessly on any device

Online document management has become increasingly popular with businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents promptly without delays. Manage 990 Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign 990 Form without effort

- Locate 990 Form and click Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Emphasize key sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Produce your signature with the Sign feature, which takes seconds and holds the same legal significance as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you would like to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Leave behind the concerns of lost or misplaced files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills your needs in document management in just a few clicks from any device you prefer. Modify and eSign 990 Form and guarantee effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2011 990 form

Create this form in 5 minutes!

How to create an eSignature for the 2011 990 form

How to generate an eSignature for a PDF document online

How to generate an eSignature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The best way to make an eSignature from your smart phone

The best way to create an eSignature for a PDF document on iOS

The best way to make an eSignature for a PDF file on Android OS

People also ask

-

What is a 990 Form and why is it important?

The 990 Form is an essential document filed by tax-exempt organizations in the United States to report their financial information to the IRS. It provides transparency about an organization's income, expenses, and operations, helping to maintain public trust. Understanding the 990 Form is crucial for non-profits to ensure compliance and inform donors about their financial status.

-

How does airSlate SignNow facilitate the completion of a 990 Form?

airSlate SignNow offers a streamlined digital platform that simplifies the signing and submission of the 990 Form. With its user-friendly interface, organizations can easily prepare, eSign, and send their forms without the hassle of printing and mailing. This efficiency saves time and helps ensure that your 990 Form is filed promptly.

-

Is there a cost associated with using airSlate SignNow for the 990 Form?

Yes, airSlate SignNow offers various pricing plans that cater to different organizational needs, including features specifically for handling the 990 Form. These cost-effective solutions allow organizations of any size to manage their documents efficiently while staying budget-friendly. You can choose the plan that best fits your business requirements.

-

What features does airSlate SignNow provide for managing the 990 Form?

airSlate SignNow includes features like customizable templates, secure eSigning, and automated reminders for submission deadlines related to the 990 Form. Additionally, users can collaborate with team members in real-time, enhancing the workflow around the preparation of the form. These features simplify the process and ensure accuracy.

-

Can I integrate airSlate SignNow with other software for my 990 Form?

Absolutely! airSlate SignNow provides seamless integrations with popular accounting and document management software, helping you streamline the process of managing your 990 Form. This integration ensures that your financial data is easily accessible and up-to-date, simplifying the reporting process for non-profits.

-

How can using airSlate SignNow benefit my organization regarding the 990 Form?

Using airSlate SignNow for the 990 Form enhances efficiency by reducing paperwork and speeding up the review and approval process. Its secure eSigning capabilities protect sensitive information while ensuring compliance with IRS regulations. Ultimately, it helps non-profits focus on their mission rather than getting bogged down by administrative tasks.

-

How secure is the information I share when completing the 990 Form with airSlate SignNow?

airSlate SignNow prioritizes data security, employing advanced encryption measures to protect all information related to the 990 Form. The platform adheres to strict compliance standards to ensure that your organizational data remains confidential and secure. You can confidently complete and submit your documents knowing your information is safe.

Get more for 990 Form

- Sheetrock drywall contractor package idaho form

- Flooring contractor package idaho form

- Trim carpentry contractor package idaho form

- Fencing contractor package idaho form

- Hvac contractor package idaho form

- Landscaping contractor package idaho form

- Commercial contractor package idaho form

- Excavation contractor package idaho form

Find out other 990 Form

- How Do I Sign Texas Banking Memorandum Of Understanding

- Sign Virginia Banking Profit And Loss Statement Mobile

- Sign Alabama Business Operations LLC Operating Agreement Now

- Sign Colorado Business Operations LLC Operating Agreement Online

- Sign Colorado Business Operations LLC Operating Agreement Myself

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now