SCHEDULE G Supplemental Information Regarding Form 990 or 2020

Understanding Schedule G for Form 990

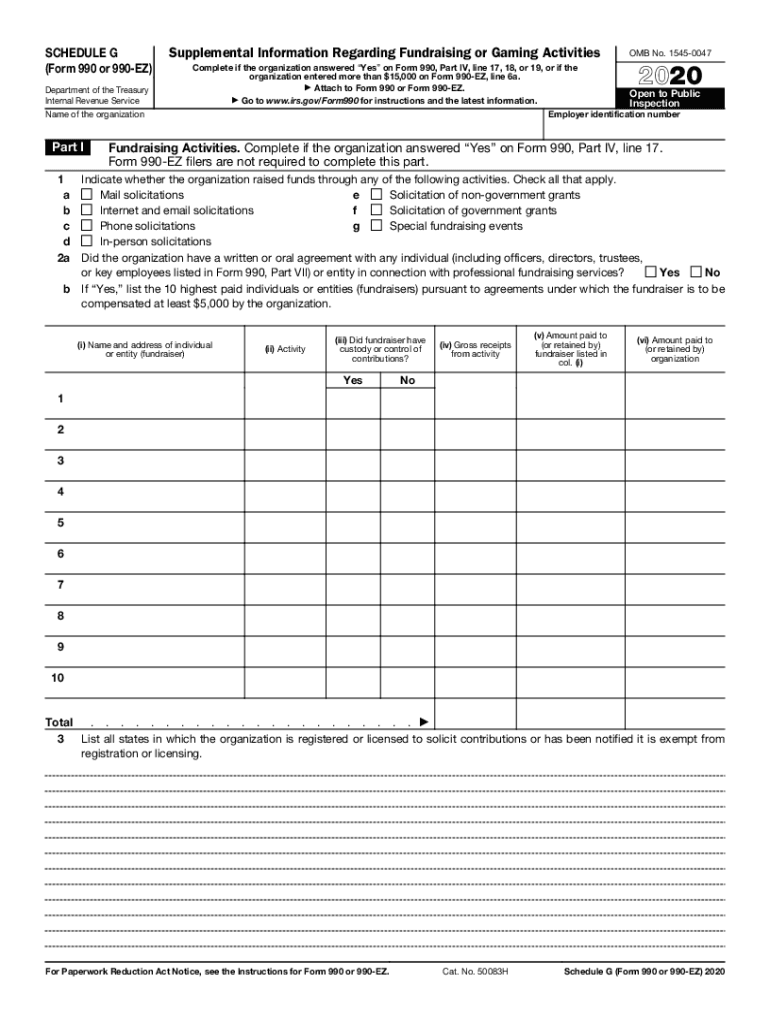

Schedule G is a supplemental form required by the IRS for organizations that file Form 990. This form provides detailed information about professional fundraising services and the organization’s fundraising activities. It is essential for transparency and accountability, ensuring that the IRS and the public can assess how organizations raise and spend funds. Organizations must accurately report their fundraising expenses and revenue sources to comply with federal regulations.

Steps to Complete Schedule G

Completing Schedule G involves several key steps:

- Gather all relevant financial documents, including fundraising contracts and expense records.

- Fill out Part I, which requires information about the organization’s fundraising activities, including the types of fundraising methods used.

- Complete Part II, detailing any professional fundraising services used, including their names and the fees paid.

- Review the information for accuracy, ensuring all figures match your financial statements.

- Submit Schedule G along with Form 990 by the filing deadline to avoid penalties.

Filing Deadlines for Schedule G

The filing deadline for Schedule G coincides with the due date for Form 990, which is typically the 15th day of the fifth month after the end of the organization’s fiscal year. For organizations with a fiscal year ending December 31, the deadline would be May 15 of the following year. If additional time is needed, organizations can file for an extension, but they must ensure that Schedule G is included with the extended Form 990 submission.

IRS Guidelines for Schedule G

The IRS provides specific guidelines for completing Schedule G, emphasizing the importance of accuracy and transparency. Organizations must adhere to the instructions provided in the IRS Form 990 instructions, which outline how to report fundraising activities and professional services. It is crucial to ensure that all reported figures are consistent with the organization’s financial records to avoid discrepancies that could lead to audits or penalties.

Penalties for Non-Compliance

Failure to file Schedule G or inaccuracies in the information provided can lead to significant penalties. The IRS may impose fines on organizations that do not comply with the filing requirements, which can range from $20 per day for each day the form is late, up to a maximum of $10,000. Additionally, non-compliance may result in increased scrutiny from the IRS and potential audits, which can further complicate an organization’s financial standing.

Digital vs. Paper Version of Schedule G

Organizations have the option to submit Schedule G electronically or via paper forms. Filing electronically is often more efficient and reduces the risk of errors, as e-filing systems typically include built-in checks for common mistakes. However, some organizations may prefer paper submissions for various reasons, including familiarity with physical forms. Regardless of the method chosen, it is essential to ensure that all information is complete and accurate to comply with IRS regulations.

Quick guide on how to complete schedule g supplemental information regarding form 990 or

Finalize SCHEDULE G Supplemental Information Regarding Form 990 Or effortlessly on any device

Digital document handling has become increasingly favored by companies and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents promptly without interruptions. Manage SCHEDULE G Supplemental Information Regarding Form 990 Or on any platform using airSlate SignNow's Android or iOS applications and enhance any documentation process today.

The easiest method to modify and electronically sign SCHEDULE G Supplemental Information Regarding Form 990 Or with ease

- Find SCHEDULE G Supplemental Information Regarding Form 990 Or and click Get Form to commence.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or conceal sensitive information using tools specifically offered by airSlate SignNow for that purpose.

- Generate your signature with the Sign tool, which requires seconds and holds the same legal authority as a conventional wet ink signature.

- Review all the details and click on the Done button to preserve your modifications.

- Choose your preferred method to submit your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate the concerns of lost or misfiled documents, tedious form searching, or mistakes that necessitate the printing of additional document copies. airSlate SignNow fulfills your document management needs in just a few clicks from the device of your choice. Modify and electronically sign SCHEDULE G Supplemental Information Regarding Form 990 Or and ensure excellent communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule g supplemental information regarding form 990 or

Create this form in 5 minutes!

How to create an eSignature for the schedule g supplemental information regarding form 990 or

How to make an eSignature for a PDF file in the online mode

How to make an eSignature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The best way to create an electronic signature right from your smartphone

The best way to make an eSignature for a PDF file on iOS devices

The best way to create an electronic signature for a PDF on Android

People also ask

-

What is schedule g and how can it help my business?

Schedule g is a feature offered by airSlate SignNow that allows businesses to organize and manage their document signing processes efficiently. By using schedule g, you can streamline workflows, improve document turnaround times, and enhance overall productivity. This solution is particularly beneficial for businesses that frequently deal with contracts or agreements.

-

How does airSlate SignNow's pricing structure work for schedule g?

The pricing structure for schedule g on airSlate SignNow varies based on the plan you choose. Each plan offers different features, and you can select one that fits your business needs and budget. Additionally, you have the option to try schedule g features through a free trial before committing.

-

What features are included with schedule g?

With schedule g, airSlate SignNow includes features like customizable templates, real-time tracking, and reminders for document signing. These features help ensure that important deadlines are met and that the signing process is as seamless as possible. You can also easily integrate schedule g with other tools your team uses for optimal efficiency.

-

Can I integrate schedule g with other applications?

Yes, schedule g can be integrated with various applications to enhance your document management workflow. Popular integrations include CRM systems, project management tools, and cloud storage services. This flexibility allows you to maintain a smooth workflow and access all your documents in one place.

-

What are the benefits of using schedule g for document management?

Using schedule g simplifies document management by automating the signing process and reducing the need for physical paperwork. This not only saves time but also minimizes errors and ensures a secure signing environment. As a result, your business can focus on growth rather than getting bogged down by administrative tasks.

-

How secure is the signing process with schedule g?

The signing process with schedule g is highly secure, utilizing encryption technology to protect your documents. airSlate SignNow adheres to industry standards to ensure that your data is safe during transmission and storage. You can have peace of mind knowing that your sensitive information is handled with the utmost care.

-

Is support available when using schedule g?

Yes, airSlate SignNow provides comprehensive support for users of schedule g. You can access help through various channels, including live chat, email, and a detailed knowledge base. The support team is dedicated to ensuring you get the most out of your experience with schedule g.

Get more for SCHEDULE G Supplemental Information Regarding Form 990 Or

- Get fillable online pptc 042 e child abroad general passport form

- Wwwcourseherocomfile65662251pptc482pdf save reset form protected when completed b

- Guide 5269 applying for a study permit outside canada2019 2021 form canada imm 1294 fill online printable fillable blankstudy

- Fillable online application to change conditions extend my stay or form

- Document checklist permanent residence provincial nominee class and form

- Wwwcanadacaenimmigration refugeesguide 5466 atlantic immigration pilot program atlantic form

- Application for employment solicitud de empleo mc janitorial llc form

- Wwwsignnowcomfill and sign pdf form108976employment and social development canada canada signnow

Find out other SCHEDULE G Supplemental Information Regarding Form 990 Or

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors